Comparing Apples (Enterprise Value) to Oranges (Equity Value) to Pears …?

Communicating Value

“Comparing apples to oranges” refers to contrasting two or more items that are similar, but that have important differences. While apples and oranges are both fruits, they have different flavors, colors, textures, etc. In a business valuation, comparing enterprise value to equity value is like comparing apples to oranges. Both measure the value of a business, but the results can differ significantly, depending on the cash and debt balances on a company’s books as of the valuation date. Not understanding the different types of value utilized in a valuation or transaction analysis may lead to disagreements on the overall company value. As such, it is important to know each value and how they are calculated.

“Comparing apples to oranges” refers to contrasting two or more items that are similar, but that have important differences. While apples and oranges are both fruits, they have different flavors, colors, textures, etc. In a business valuation, comparing enterprise value to equity value is like comparing apples to oranges. Both measure the value of a business, but the results can differ significantly, depending on the cash and debt balances on a company’s books as of the valuation date. Not understanding the different types of value utilized in a valuation or transaction analysis may lead to disagreements on the overall company value. As such, it is important to know each value and how they are calculated.

Equity value is the value attributable to a company’s equity investors, which considers the impact of the value of the company’s cash and debt balances.

Enterprise value, on the other hand, represents a company’s cash-free, debt-free value (a value of the company’s operation regardless of how it might be financed). This value is normally the starting point in a valuation setting and is commonly used for transaction purposes.

Equity value and enterprise are interrelated—if you know one you can calculate the other—as shown below:

Enterprise Value = Equity Value + Debt – Cash

Equity Value = Enterprise Value – Debt + Cash

A good example demonstrating the difference between enterprise value and equity value is the value of a house. Let us say the purchase price of a house is $500,000, for which the buyer makes a down payment of $100,000 and the remaining $400,000 is financed by a lender.

The purchase price of the home ($500,000) represents the enterprise value—the value of the equity and debt combined, excluding any cash. The down payment of $100,000 represents the equity value, or how much the owner would receive if the home were to be sold for the purchase price. In this case, the enterprise value of the home is 5x the equity value.

While we probably agree on all these facts, we may be speaking a different language when it comes to the home’s value.

If we apply the same example to a business, the owner would be selling the company for a $500,000 enterprise value, which would produce only a $100,000 equity value. Based on this gap in value, it is easy to see how signals could get crossed and an owner could expect to net $500,000 in proceeds from a sale when in reality only $100,000 would be received after the $400,000 debt balance was paid off.

Now that we reviewed equity value and enterprise value, it is time to throw a pear into the mix and discuss invested capital value.

Invested capital value is determined based on the sum of a company’s debt and equity (including cash). It is calculated as the combined value of interest-bearing debt and preferred and common equity. This value represents the total amount of capital currently invested in the company, regardless of the source.

Invested Capital = Equity Value + Debt

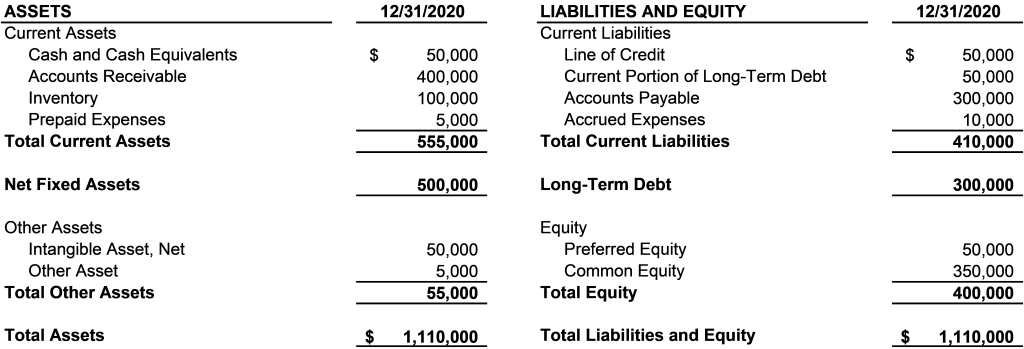

Although the three types of value discussed all measure different components of a company’s capital structure, they are all interrelated. Shown below is a company’s balance sheet, which we will assume is representative of fair value.

Based on the example above, the company’s common equity value is $350,000.

However, the company’s invested capital value is a much higher value of $800,000. Invested capital value is calculated by adding the debt of $400,000 (line of credit, current and long-term portion of debt) to the total equity (preferred and common) value of $400,000.

Based on these facts, the company’s enterprise value is $750,000, which is calculated by taking the invested capital value $800,000 (which combines the equity value and debt) and subtracting the company’s cash of $50,000.

This example illustrates the importance of knowing what value is being considered. A seller can say the business is worth $750,000 and a buyer can say it is worth $350,000 and they both may be correct depending on what value is determined.

Takeaways

In a valuation setting, enterprise value is commonly used as the starting point in determining a company’s value because it lets the valuator reach a conclusion of equity value regardless of the company’s capital structure, which changes by the day depending on the cash and debt balances. For example, if ABC Company has earnings before income taxes, depreciation and amortization (EBITDA) of $1,000,000 and the selected EBITDA multiple is 5.x, the indicated enterprise value would be $5,000,000. To determine the equity value of the company, certain adjustments would need to be made to the enterprise value. If ABC Company has $500,000 cash and $1,000,000 in debt as of the valuation date, there would be a net $500,000 reduction to the enterprise value to reach the company’s equity value.

Enterprise Value $5,000,000 – Debt $1,000,000 + Cash $500,000 = Equity Value $4,500,000

Enterprise value is the most common value used for transaction purposes because it allows the purchase price as of the closing date to consider the actual cash and debt balances at that time. In this case, the seller would likely keep the cash, investments, and any non-operating assets (such as personal vehicles) that are not necessary for the operation of the business. If an equity value were used to set the purchase price, however, it would generally include all these assets (unless they were specifically identified as being excluded).

Whether a value is being determined as an apple (equity value), orange (enterprise value), or a pear (invested capital value) could make a huge difference to both the buyer and the seller. By understanding the differences in these values, it is less likely there will be miscommunications or disputes regarding the applicable value in a transaction.

Ashley DeCress, CPA, ABV, CVA, is a manager in Marcum, LLP’s Advisory Services group with a practice concentrated in the areas of business valuations, litigation services, financial reporting, complex damages analysis and modeling, strategic planning, succession and estate planning, and mergers and acquisitions. Ms. DeCress has been with the firm for over five years and has expanded her professional knowledge across a variety of industries. She is an author and speaker on valuation and litigation advisory topics.

Ms. DeCress can be contacted at (216) 242-0872 or by e-mail to Ashley.DeCress@MarcumLLP.com.