Cost Approach to Intellectual Property Valuation

Part IV: Illustrative Examples

Part I of this series discussed the conceptual foundations of the cost approach to intellectual property valuation. Part II described the generally accepted valuation methods within the cost approach to intellectual property valuation. Part III presented the practical measurement procedures in the application of the cost approach. In this final installment of this series, Part IV presents several illustrative examples of the application of the cost approach in several intellectual property valuation scenarios.

[su_pullquote align=”right”]

Cost Approach to Intellectual Property Valuation Part I: Conceptual Principles

Cost Approach to Intellectual Property Valuation Part II: Valuation Methods

Cost Approach to Intellectual Property Valuation Part III: Practical Procedures[/su_pullquote]

Introduction

This four-part discussion series summarizes the application of the cost approach to value patents, copyrights, trademarks, and trade secrets—that is, the four categories of intellectual property.

Part I of this series discussed the conceptual foundations of the cost approach to intellectual property valuation. Part II described the generally accepted valuation methods within the cost approach to intellectual property valuation. Part III presented the practical measurement procedures in the application of the cost approach. In this final installment of this series, Part IV presents several illustrative examples of the application of the cost approach in several intellectual property valuation scenarios.

Illustrative Cost Approach Valuation Examples

The following two examples illustrate the application of the cost approach to develop an intellectual property valuation in typical client situations.

Example 1: Valuation of Internally Developed Computer Software Copyrights and Trade Secrets

This first example involves the valuation of internally developed computer software copyrights and trade secrets intellectual property. This example illustrates the application of the cost approach replacement cost new less depreciation (RCNLD) method. This RCNLD method illustrative analysis includes consideration of developer’s profit, entrepreneurial incentive, and economic obsolescence.

This illustrative valuation example is based on the following assumed fact set:

- Beta, LLC (Beta) is the owner/operator of the software-related copyrights and trade secrets.

- Beta is a public utility that is assessed, for state and local property tax purposes, based on the unit principle of property valuation. That is, the property tax assessor values all of the Beta tangible property and intangible property collectively, as a single “unit” of operating assets. The property tax assessor valued the total Beta unit of operating assets at $900 million.

- The property tax valuation date in the subject taxing jurisdiction is January 1, 2021.

- Intangible personal property (including intellectual property) is excluded from property taxation in the subject taxing jurisdiction where Beta is located.

- The statutory property tax standard of value in the subject taxing jurisdiction is fair market value.

Beta management wants to estimate the fair market value of the software-related intellectual property. Based on that valuation, Beta management wants to subtract that intellectual property value from the assessor’s $900 million total unit valuation. Assuming that Beta owns and operates no other intangible property, the residual amount (i.e., the total unit value less the intellectual property value) will represent the value of the Beta tangible property that is subject to property tax in the local taxing jurisdiction.

Beta management retained an analyst to estimate the fair market value of the software-related intellectual property for property tax compliance and appeal purposes.

The Beta internal information technology (IT) staff has developed many computer software programs over the years. The Beta IT staff groups all of that internally developed software into the seven major software systems listed in Exhibit 1.

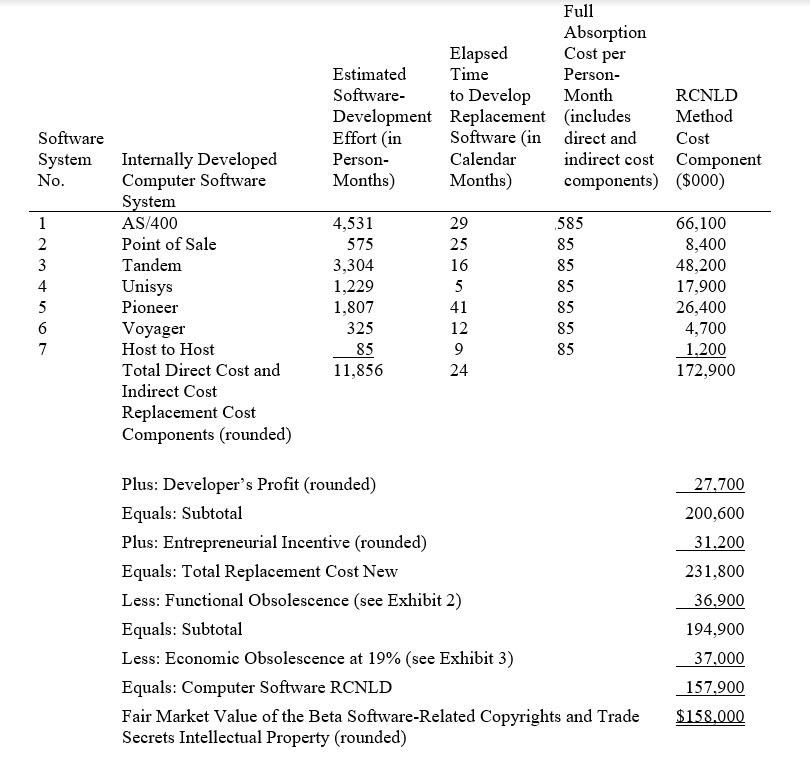

Exhibit 1: Beta, LLC Software-Related Intellectual Property

Cost Approach—RCNLD Method Valuation Summary As of January 1, 2021

The analyst worked with the Beta IT management to estimate the amount of effort required to replace the functional equivalent (as in, the economic utility) of the internally developed software as of the valuation date. The estimates for the number of development effort person-months required to replace the utility of each software system are listed in Exhibit 1. A person-month is equal to 40 hours per week for four weeks.

The analyst concluded that it would require 11,856 person-months to replace the functionality of the Beta software-related intellectual property.

The analyst examined the actual software development costs incurred at Beta during 2020. Based on this due diligence examination, the analyst concluded that the average cost per person-month for the Beta software development effort was $14,585. That total cost includes all direct costs and all indirect costs related to the Beta actual software development efforts. Therefore, that cost per IT person-month is a full absorption software development cost estimate.

The analyst estimated the developer’s profit component related to the Beta software replacement cost new (RCN). The analyst surveyed several custom software development companies of the type that would accept a contract to replace the Beta systems. These software development companies indicated that they would charge a 16 percent operating profit margin over their actual development costs to develop the replacement software. The analyst added this developer’s profit cost component to the RCN estimate.

As indicated in the “Elapsed Time to Develop” column in Exhibit 1, it would take 24 elapsed months, on average, to develop and to implement all the hypothetical replacement software.

The analyst decided to estimate the entrepreneurial cost component as the opportunity cost related to Beta operating profit for a 24-month software replacement period.

The analyst estimated the Beta normalized operating profits (measured here as earnings before interest and taxes) for a 24-month software replacement period. Working with the Beta financial management, the analyst concluded that this 24-month opportunity cost (as in, the Beta operating profits that would be lost without the computer software in place) is $31.2 million. The analyst included this opportunity cost amount as the entrepreneurial incentive cost component.

Including all four cost components, the analyst estimated the Beta software-related intellectual property RCN to be $231.8 million.

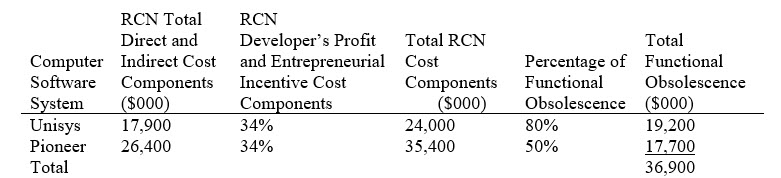

During the due diligence examination, the analyst learned that both the Unisys and the Pioneer systems are currently in the process of being replaced. The Beta IT department is in the process of developing replacement application software for both systems. The Unisys system is expected to be replaced in one year, and the Pioneer system is expected to be replaced within three years.

Based on these estimated times, and working with Beta IT management, the analyst estimated that (1) the Unisys system is 80 percent functionally obsolete and (2) the Pioneer system is 50 percent functionally obsolete. The analyst estimated the Beta software functional obsolescence by applying the excess capital cost method to measure functional obsolescence. This excess capital cost method analysis is summarized in Exhibit 2.

Exhibit 2: Beta, LLC Software-Related Intellectual Property

Cost Approach—RCNLD Method Functional Obsolescence Analysis As of January 1, 2021

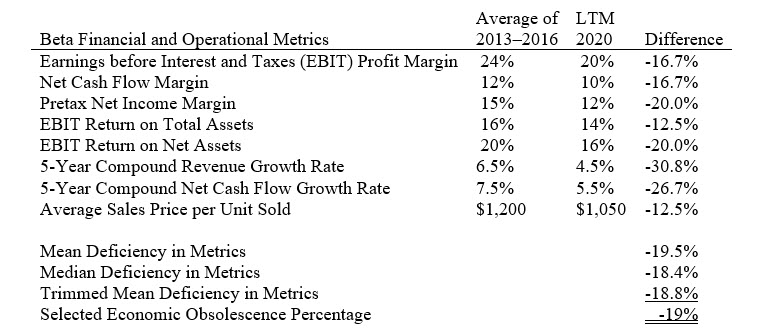

During the due diligence investigation, the analyst learned that most of the Beta software was developed and installed between five and eight years ago. During that earlier time period, Beta was much more profitable than it is now.

Because of intense competition in its industry, the Beta profit margins, growth rates, and return on investment (ROI) all decreased between (1) the time period when the subject software was originally developed (i.e., during 2013 through 2016) and (2) the current time period (all of 2020).

The analyst considered these factors when assessing the economic obsolescence component. The analyst prepared Exhibit 3 to summarize some of the economic obsolescence elements considered in the software-related intellectual property valuation.

Exhibit 3: Beta, LLC Software-Related Intellectual Property

Cost Approach—RCNLD Method Economic Obsolescence Analysis As of January 1, 2021

Based on the analysis of the financial and operational metrics presented in Exhibit 3, the analyst selected 19 percent as the appropriate economic obsolescence measurement. The analyst applied this economic obsolescence measurement to the RCNLD indication presented in Exhibit 1.

Based on the application of the cost approach and the RCNLD method, the analyst concluded that the fair market value of the Beta software-related copyrights and trade secrets intellectual property, as of January 1, 2021, was $158 million.

Example 2: Valuation of a Patent for a Drug Compound

The second illustrative example relates to the Gamma Corporation (Gamma). Gamma is a company that manufactures and distributes pharmaceutical products. Gamma recently acquired Delta, Inc. (Delta) in a taxable asset purchase transaction. Delta owns a recently granted patent on a newly developed drug compound. Delta management calls this drug compound—and the related drug product—Epsilon.

This example illustrates the application of the cost approach and the RCNLD method in the valuation of the acquired intellectual property. This example illustrates the analyst’s consideration of (1) the intellectual property development stages and (2) functional obsolescence measurement.

Gamma management retained the analyst to estimate the fair market value of the Epsilon patent and related intellectual property. The purpose of this fair market value valuation is to allow Gamma management to complete its Internal Revenue Code Section 1060 purchase price allocation related to the purchase of the Delta business enterprise. The valuation (i.e., the acquisition) date is January 1, 2021.

The Epsilon patented drug compound is recently developed. The patent for the Epsilon drug compound was recently awarded to Delta by the United State Patent and Trademark Office (USPTO). The recently patented Epsilon drug product was it not yet commercialized as of the January 1, 2021, valuation date.

Delta recently completed the drug development, patent application and approval, and FDA approval process. Accordingly, Delta management provided the analyst with current and accurate (1) product development activities and (2) product development effort estimates (measured in person-months).

Working with Delta management, the analyst concluded that the average full absorption cost of the Epsilon product development team is $12,000 per person-month. The analyst based this valuation variable on the current costs associated with the actual Epsilon development team. This person-month estimate includes all direct costs and all indirect costs related to the Epsilon compound and product development process.

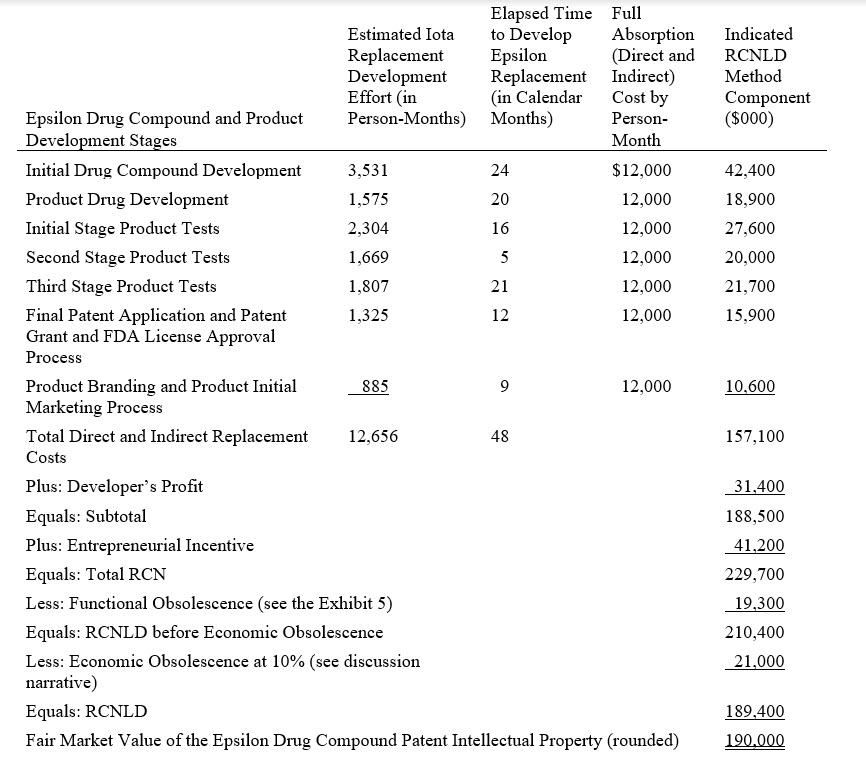

Exhibit 4 presents (1) the drug compound’s development stages, (2) the estimated replacement effort by drug compound development stage, and (3) the estimated total amount of elapsed time required to replace the Epsilon drug compound, test the compound and receive FDA approval, prepare the patent application, receive the patent grant from the USPTO, and begin commercializing the drug product. Based on these data, the analyst can calculate the total direct and indirect RCN.

Exhibit 4: Delta, Inc. Epsilon Patent and Related Intellectual Property

Cost Approach—RCNLD Method Fair Market Value Summary As of January 1, 2021

The analyst estimated the developer’s profit cost component. Like many pharmaceutical companies, Delta sometimes uses contract laboratories to assist in the drug development process. These contract laboratories typically work on a “cost plus” contract pricing basis.

After reviewing the actual contracts that Delta entered into over the years with various contract laboratories, the analyst concluded that 20 percent was a reasonable developer’s profit margin. The analyst included this market-derived developer’s profit margin in the Exhibit 4 RCN cost estimate.

Working with Delta management, the analyst concluded that it would require 48 months of elapsed time to replace the Epsilon drug compound, the patent application and patent grant, and the FDA approval. Management prepared a 10-year business plan for this new drug product. The present value of the expected operating profit (measured here as EBIT) for the first four years in the 10-year business plan is $41.2 million.

With the acquired Epsilon patent in place, the acquirer Gamma is projected to earn (on a present value basis) $41.2 million of operating profit from this new drug product over the next four years. Without the Epsilon patent in place, the acquirer Gamma is projected to earn $0 of operating profit from this new drug product over the next four years. The analyst decided to use this opportunity cost measurement as the drug compound’s entrepreneurial incentive RCN cost component.

As Exhibit 4 demonstrates, the total Epsilon drug compound intellectual property RCN is $229.7 million.

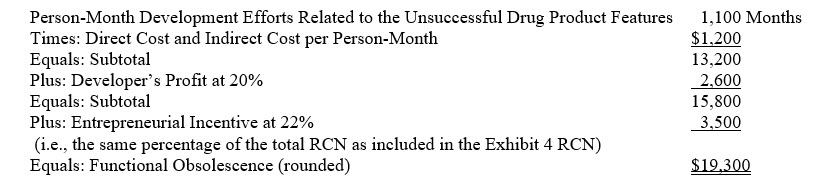

During the due diligence process, the analyst learned that the drug development team actually spent 1,100 person-months related to the development of ultimately unsuccessful product features related to the Epsilon drug compound. These product features were not included in the Epsilon drug compound that finally received (1) the USPTO patent grant and (2) the FDA approval. The analyst concluded that these costs represent functional obsolescence. This is because a willing buyer would not pay a willing seller for the costs associated with the development of these unsuccessful product features.

The analyst measured the amount of this functional obsolescence as presented in Exhibit 5.

Exhibit 5: Delta, Inc. Epsilon Patent and Related Intellectual Property

Cost Approach Functional Obsolescence Analysis As of January 1, 2020

The analyst considered the existence of economic obsolescence regarding the Epsilon drug-product-related intellectual property. The acquirer Gamma management developed a 10-year business plan for the Epsilon drug product. At the end of 10 years, Gamma management believes that the Epsilon drug product will become obsolete. The Epsilon patent granted by the USPTO will still be legally valid. However, because of industry competition, Gamma management expects that a substitute drug product will replace the Epsilon product in 10 years

Based on this 10-year business plan, the analyst estimated that the acquirer Gamma will earn an internal rate of return (IRR) of approximately 12.5 percent on the commercialization of the Epsilon drug product over 10 years. The analyst learned that the Gamma cost of capital (its weighted average cost of capital or WACC) is 14 percent. Therefore, Gamma management expects to earn an IRR on the commercialization of the Epsilon drug product that is 1.5 percent less than the company’s 14 percent WACC (or required ROI).

Based on this capitalization of income loss method economic obsolescence analysis, the analyst concluded that this Epsilon drug product line will experience approximately 10 percent economic obsolescence (that is, the 1.5 percent IRR deficiency divided by the 14 percent Gamma company WACC). This 10 percent economic obsolescence measurement is included in Exhibit 4.

Based on the cost approach and the RCNLD method, the analyst concluded that the fair market value of the Epsilon drug compound-related intellectual property (acquired as part of Gamma’s acquisition of Delta), as of January 1, 2021, is $190 million (rounded).

Summary and Conclusion

Analysts are often asked to value intellectual property for sale or license transaction, income and property taxation, fair value measurement and other financial accounting, corporate strategic planning, forensic analysis and dispute resolution, and various other client purposes. Most analysts are familiar with the generally accepted income approach and market approach valuation methods that may be applied to value intellectual property. Many analysts (and their clients and their clients’ legal counsel) are less familiar with the generally accepted cost approach valuation methods that may be applied to value intellectual property.

Analysts (and their clients and their clients’ legal counsel) should be aware that if sufficient cost metric data and sufficient depreciation measurement data are available, then the cost approach may be perfectly applicable to the valuation of many types of intellectual property for many different client purposes.

Robert Reilly, CPA, ASA, ABV, CVA, CFF, CMA, is a Managing Director in the Chicago office of Willamette Management Associates, a Citizens company. His practice includes valuation analysis, damages analysis, and transfer price analysis.

Mr. Reilly has performed the following types of valuation and economic analyses: economic event analyses, merger and acquisition valuations, divestiture and spin-off valuations, solvency and insolvency analyses, fairness and adequacy opinions, reasonably equivalent value analyses, ESOP formation and adequate consideration analyses, private inurement/excess benefit/intermediate sanctions opinions, acquisition purchase accounting allocations, reasonableness of compensation analyses, restructuring and reorganization analyses, tangible property/intangible property intercompany transfer price analyses, and lost profits/reasonable royalty/cost to cure economic damages analyses.

Mr. Reilly has prepared these valuation and economic analyses for the following purposes: transaction pricing and structuring (merger, acquisition, liquidation, and divestiture); taxation planning and compliance (federal income, gift, estate, and generation-skipping tax; state and local property tax; transfer tax); financing securitization and collateralization; employee corporate ownership (ESOP employer stock transaction and compliance valuations); forensic analysis and dispute resolution; strategic planning and management information; bankruptcy and reorganization (recapitalization, reorganization, restructuring); financial accounting and public reporting; and regulatory compliance and corporate governance.

Mr. Reilly can be contacted at (773) 399-4318 or by e-mail to RFReilly@Willamette.com.