2021 Healthcare M&A in Review

Indications for 2022

After an understandable slowdown in 2020, due to the onset of the COVID-19 pandemic, merger and acquisition (M&A) activity in the healthcare industry accelerated in 2021, and the industry is expected to continue the high number of deals and high deal volume in 2022. This article will review the U.S. healthcare industry’s M&A activity in 2021 and discuss what these trends may mean for 2022.

After an understandable slowdown in 2020, due to the onset of the COVID-19 pandemic,[1] merger and acquisition (M&A) activity in the healthcare industry accelerated in 2021, and the industry is expected to continue the high number of deals and high deal volume in 2022. This article will review the U.S. healthcare industry’s M&A activity in 2021 and discuss what these trends may mean for 2022.

2021 M&A Activity

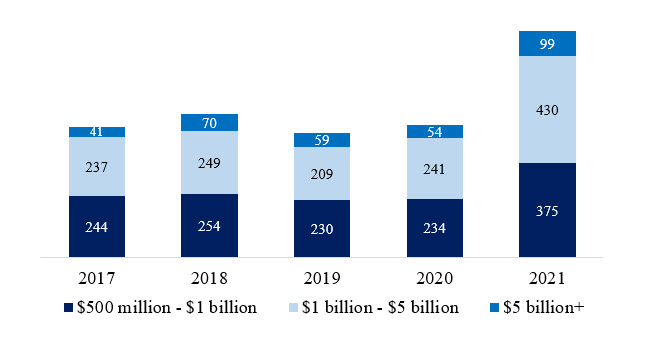

As set forth in the below exhibit, the overall number of healthcare deals were up significantly in 2021 (56% for the 12 months ending November 15, 2021) compared to 2020.[2]

Healthcare M&A Deals, 2017–November 15, 2021[3]

Deal value also increased 46%, with the healthcare sector-wide mean enterprise value to earnings before interest, taxes, income, depreciation, and amortization (EBITDA) multiple reaching 15.2x in 2021.[1] Overall deal value increases were driven by increases in managed care EBITDA multiples (up 2.9 to 16.6x) and in senior care (up 2.1 to 14.0x).[2] EBITDA multiples also decreased in the acute care, ambulatory care-rehab-dental, and lab-imaging-pharmacy subsectors, between 0.5 and 1.0x.[3] Despite the increases in these sectors, multiples were down in four of the seven subsectors tracked by global consulting firm PwC, although the multiples in many of the sectors were still quite high; for example, home health/hospice subsector EBITDA multiples decreased 5.0, to 21.0x (a higher multiple than either the managed care or long-term care subsectors).[4]

2021 also saw significant growth in the number of healthcare megadeals (defined as deals valued at $5 billion or greater).[5] Several of those megadeals occurred in the contract research and manufacturing space, which was unsurprising based on the increase in products spurred by the COVID-19 pandemic (e.g., vaccinations, testing).[6] Some of the other notable megadeals included:

(1) Humana’s acquisition of the remainder of Kindred at Home. Humana previously had a 40% stake and purchased the other 60% in 2021; and[7]

(2) Two deals involving Walgreens Boots Alliance: a divestiture of Alliance HealthCare Services, a “comprehensive provider of outpatient radiology and oncology solutions for hospitals, health systems and physician groups,”[8] and an increased stake in VillageMD, a primary care business.[9]

Regarding publicly-traded companies, there were eight pure health services initial public offerings (IPOs) in 2021, an increase from 2020 (which saw only two IPOs), as well as previous years, which had no health services IPOs.[10] Additionally, 2021 continued 2020’s trend of more and more deals backed by special purpose acquisition companies (SPACs).[11]

Across the healthcare sector, the most popular subsector in 2021 was long-term care.[12] There was also high growth in deals among physician practices, with over 400 deals in 2021 compared to 200–250 deals per year previously,[13] as well as in the managed care and rehabilitation subsectors.[14] Notably, the only subsector to decrease in deal volume in 2021 was hospitals and health systems,[15] with only 49 announced transactions; however, the size of these transactions increased from 2020 levels.[16] This is not altogether surprising as hospitals and health systems were largely distracted in 2021 by the ongoing COVID-19 pandemic and associated issues such as labor shortages and cost increases.[17] Consequently, it is also not surprising that nearly one-third of these transactions involved a rural or urban/rural seller (i.e., those hospitals and health systems that have been most acutely affected by the pandemic).[18]

Some of the major 2021 deals involving hospitals, health systems, and physicians included:

(1) Oak Street Health’s $130 million acquisition of RubiconMD, a specialist network covering specialties such as cardiology, nephrology, and pulmonology;[19]

(2) Tenet Healthcare’s $1.1 billion acquisition of SurgCenter Development’s ambulatory business;[20]

(3) Steward Health Care’s $1.1 billion acquisition of five hospitals and associated physician practices in South Florida from Tenant Healthcare; [21]

(4) The merger of Jefferson Health and Einstein Healthcare (which was finalized after the Federal Trade Commission [FTC] failed attempt to block the deal), resulting in an 18-hospital system in the Philadelphia area;[22] and

(5) The merger of LifePoint Health and Kindred Healthcare. Among other moves, the merged parties broke off a new company called ScionHealth, which will be comprised of 79 hospitals in 25 states, including 61 of Kindred’s long-term acute care hospitals (LTACHs) and 18 of LifePoint’s community hospitals.[23]

2021 Value Drivers

The M&A trends observed in 2021 indicated several value drivers, which may be useful in predicting the healthcare M&A landscape for 2022. First, as is often the case in healthcare, regulatory oversight may serve to slow down or outright prevent some deals. Overall deal timeframes have been expanding, due to the backlog of regulatory reviews by federal and state regulatory agencies.[24] Further, it is expected that the federal government may contest a greater number of mergers going forward, as a result of President Joe Biden’s July 2021 executive order related to increasing competition across industries, including healthcare.[25] One section of that executive order encouraged the Department of Justice (DOJ) and the FTC to increase focus on antitrust issues related to hospital consolidation.[26] Similarly, the relatively new price transparency regulations established by the Centers for Medicare & Medicaid Services (CMS) may serve to shake up the competitive landscape with payors and providers, as reimbursement information that was previously private is now publicly available.[27]

Second, as noted above, the COVID-19 pandemic continues to wreak havoc on the U.S. healthcare delivery system. One of the corollaries of the pandemic has been labor and supply chain shortages. These issues, which have had a significant, negative impact on healthcare in particular, may drive investment up and down the supply chain as providers seek to ensure continuity of services.[28] Additionally, the ongoing pandemic makes it harder to anticipate the future. Uncertainty as to when the public health emergency will end lends to uncertainty as to when the myriad regulatory relaxations and waivers that have been in place for nearly two years will also end.[29] Further, federal funds that have provided economic relief over the past nearly two years will likely dry up in 2022, potentially motivating some sellers who have been able to continue operations as a result of government funding.[30]

Third, the economic downturn likely contributed to the increase in the number of deals in 2021, and is expected to continue in 2022.[31] It has been previously established that deals tend to surge after an economic downturn.[32] Especially in an industry such as healthcare, which has historically been seen as largely “recession proof,”[33] an overall economic downturn will motivate both buyers (who may see opportunities to grow and/or invest) and sellers (who may see a need to sell or otherwise divest).[34]

Fourth, the continuing emergence of non-traditional healthcare providers such as Best Buy, Amazon, and Wal-Mart, may serve to shake up the healthcare sector.[35] These non-traditional healthcare players have made numerous large, strategic moves over the past several years to make a place for themselves in healthcare, and do not appear to be slowing down. Many of these companies first developed their own entities to address their and their employees’ own healthcare needs, but then expanded their offerings to other companies and individuals in hopes of being an agent of change in the wider U.S. healthcare system. With wide brand name recognition, these retail giants are poised to make a large impact in the healthcare sector.

What Does this Mean for 2022?

The trends and value drivers discussed above help set the scene for what could be a very eventful 2022. Overall, most industry analysts expect to see more deals in 2022, due to a continuance of the 2021 value drivers, as well as a continuation of high multiples.[36] Specifically, behavioral health is poised for a big year, given the well-documented access issues in that subsector; further, behavioral health has been an increasing target for startups looking to enter the market and shake up the status quo.[37] The home care subsector also anticipates more deals, due to increased Medicare payments in 2022.[38] Alternatively, in other subsectors, such as physician services, potential Medicare cuts may drive consolidation and PE roll-ups.[39]

PwC anticipates that 2022 M&A activity could be even bigger than 2021.[40] Per PwC’s U.S. Pharmaceutical & Life Sciences Consulting Solutions Leader, it is anticipated that there will be a continuance of “[b]iotech and smaller medical device deals” in the first half of 2022, and larger deals in the back half of the year, “driven by a need for scale and an expected settling of the regulatory landscape.”[41] Further, Rich Bayman, senior vice president and managing director with H2C Securities, Inc., expects “to see more merger-of-equals-type scenarios.”[42] With the ongoing COVID-19 pandemic, whether these predictions will ultimately pan out remains to be seen.

[1] “Health services: Deals 2022 outlook” PwC, https://www.pwc.com/us/en/industries/health-industries/library/health-services-deals-insights.html (Accessed 2/17/22); “2021 saw a big rebound for M&A activity in health care” By Gabriel Perna, Health Evolution, January 12, 2022, https://www.healthevolution.com/insider/2021-saw-a-big-rebound-for-ma-activity-in-health-care/ (Accessed 2/17/22); “Health services M&A deals surged in 2021. Here are key trends that could impact dealmaking next year, PwC reports” By Heather Landi, Fierce Healthcare, December 10, 2021, https://www.fiercehealthcare.com/finance/health-services-m-a-deals-surged-2021-here-are-some-trends-could-impact-deal-making-next (Accessed 2/17/22).

[2] Long-term care comprised of skilled nursing facilities, assisted living facilities, and long-term acute care hospitals. “Health services: Deals 2022 outlook” PwC, https://www.pwc.com/us/en/industries/health-industries/library/health-services-deals-insights.html (Accessed 2/17/22).

[3] “Health services: Deals 2022 outlook” PwC, https://www.pwc.com/us/en/industries/health-industries/library/health-services-deals-insights.html (Accessed 2/17/22).

[4] Ibid.

[5] Ibid.

[6] Ibid.

[7] Ibid.

[8] “Alliance Healthcare Services” https://www.alliancehealthcareservices-us.com/ (Accessed 2/17/22).

[9] “Health services: Deals 2022 outlook” PwC, https://www.pwc.com/us/en/industries/health-industries/library/health-services-deals-insights.html (Accessed 2/17/22).

[10] Ibid.

[11] For more information on SPACs, see “SPAC Popularity Soaring in Healthcare” Health Capital Topics, Vol. 14, Issue 4 (April 2021) https://www.healthcapital.com/hcc/newsletter/04_21/HTML/SPAC/convert_healthcare_spac_growth_4.22.21.php (Accessed 2/17/22). “Health services: Deals 2022 outlook” PwC, https://www.pwc.com/us/en/industries/health-industries/library/health-services-deals-insights.html (Accessed 2/17/22).

[12] “Health services: Deals 2022 outlook” PwC, https://www.pwc.com/us/en/industries/health-industries/library/health-services-deals-insights.html (Accessed 2/17/22).

[13] “Health services: Deals 2022 outlook” PwC, https://www.pwc.com/us/en/industries/health-industries/library/health-services-deals-insights.html (Accessed 2/17/22); “Health services M&A deals surged in 2021. Here are key trends that could impact dealmaking next year, PwC reports” By Heather Landi, Fierce Healthcare, December 10, 2021, https://www.fiercehealthcare.com/finance/health-services-m-a-deals-surged-2021-here-are-some-trends-could-impact-deal-making-next (Accessed 2/17/22).

[14] “Health services M&A deals surged in 2021. Here are key trends that could impact dealmaking next year, PwC reports” By Heather Landi, Fierce Healthcare, December 10, 2021, https://www.fiercehealthcare.com/finance/health-services-m-a-deals-surged-2021-here-are-some-trends-could-impact-deal-making-next (Accessed 2/17/22).

[15] Ibid.

[16] “2021 M&A in Review: A New Phase in Healthcare Partnerships” Kaufman, Hall & Associates, LLC, 2022, available at: https://www.kaufmanhall.com/sites/default/files/2022-01/KHReport-MA-2021-Review.pdf (Accessed 2/17/22), p. 3.

[17] “Healthcare M&A update: A quiet 2021 could give way to strategic shifts in 2022” By Nick Hut, Healthcare Financial Management Association, January 21, 2022, https://www.hfma.org/topics/news/2022/01/healthcare-m-a-update–a-quiet-2021-could-give-way-to-strategic-.html (Accessed 2/17/22).

[18] “2021 M&A in Review: A New Phase in Healthcare Partnerships” Kaufman, Hall & Associates, LLC, 2022, available at: https://www.kaufmanhall.com/sites/default/files/2022-01/KHReport-MA-2021-Review.pdf (Accessed 2/17/22), p. 3.

[19] “2021 saw a big rebound for M&A activity in health care” By Gabriel Perna, Health Evolution, January 12, 2022, https://www.healthevolution.com/insider/2021-saw-a-big-rebound-for-ma-activity-in-health-care/ (Accessed 2/17/22).

[20] Ibid.

[21] “Healthcare M&A update: A quiet 2021 could give way to strategic shifts in 2022” By Nick Hut, Healthcare Financial Management Association, January 21, 2022, https://www.hfma.org/topics/news/2022/01/healthcare-m-a-update–a-quiet-2021-could-give-way-to-strategic-.html (Accessed 2/17/22).

[22] “2021 saw a big rebound for M&A activity in health care” By Gabriel Perna, Health Evolution, January 12, 2022, https://www.healthevolution.com/insider/2021-saw-a-big-rebound-for-ma-activity-in-health-care/ (Accessed 2/17/22); “Jefferson Health, Einstein Healthcare Network ink merger deal after FTC legal challenge falls flat” By Robert King, Fierce Healthcare, October 6, 2021, https://www.fiercehealthcare.com/hospitals/jefferson-health-einstein-health-network-ink-merger-deal-after-ftc-legal-challenge-falls (Accessed 2/17/22).

[23] “2021 saw a big rebound for M&A activity in health care” By Gabriel Perna, Health Evolution, January 12, 2022, https://www.healthevolution.com/insider/2021-saw-a-big-rebound-for-ma-activity-in-health-care/ (Accessed 2/17/22).

[24] “Health services: Deals 2022 outlook” PwC, https://www.pwc.com/us/en/industries/health-industries/library/health-services-deals-insights.html (Accessed 2/17/22).

[25] “FACT SHEET: Executive Order on Promoting Competition in the American Economy” The White House, July 9, 2021, https://www.whitehouse.gov/briefing-room/statements-releases/2021/07/09/fact-sheet-executive-order-on-promoting-competition-in-the-american-economy/ (Accessed 2/17/22).

[26] “Health services: Deals 2022 outlook” PwC, https://www.pwc.com/us/en/industries/health-industries/library/health-services-deals-insights.html (Accessed 2/17/22).

[27] Ibid.

[28] Ibid.

[29] Ibid.

[30] “Healthcare M&A update: A quiet 2021 could give way to strategic shifts in 2022” By Nick Hut, Healthcare Financial Management Association, January 21, 2022, https://www.hfma.org/topics/news/2022/01/healthcare-m-a-update–a-quiet-2021-could-give-way-to-strategic-.html (Accessed 2/17/22).

[31] “Deals 2022 Outlook” PwC, https://www.pwc.com/us/en/services/deals/industry-insights.html (Accessed 2/17/22).

[32] Ibid.

[33] See “Is Healthcare Recession-Proof?” Health Capital Topics, Vol. 13, Issue 5 (May 2020), https://www.healthcapital.com/hcc/newsletter/05_20/HTML/RECESSION/convert_healthcare_recession-proof_hc_topics.php (Accessed 2/17/22).

[34] “Healthcare M&A update: A quiet 2021 could give way to strategic shifts in 2022” By Nick Hut, Healthcare Financial Management Association, January 21, 2022, https://www.hfma.org/topics/news/2022/01/healthcare-m-a-update–a-quiet-2021-could-give-way-to-strategic-.html (Accessed 2/17/22).

[35] “Health services: Deals 2022 outlook” PwC, https://www.pwc.com/us/en/industries/health-industries/library/health-services-deals-insights.html (Accessed 2/17/22).

[36] “Deals 2022 Outlook” PwC, https://www.pwc.com/us/en/services/deals/industry-insights.html (Accessed 2/17/22); “Health services M&A deals surged in 2021. Here are key trends that could impact dealmaking next year, PwC reports” By Heather Landi, Fierce Healthcare, December 10, 2021, https://www.fiercehealthcare.com/finance/health-services-m-a-deals-surged-2021-here-are-some-trends-could-impact-deal-making-next (Accessed 2/17/22).

[37] “Health services M&A deals surged in 2021. Here are key trends that could impact dealmaking next year, PwC reports” By Heather Landi, Fierce Healthcare, December 10, 2021, https://www.fiercehealthcare.com/finance/health-services-m-a-deals-surged-2021-here-are-some-trends-could-impact-deal-making-next (Accessed 2/17/22).

[38] Ibid.

[39] “Health services: Deals 2022 outlook” PwC, https://www.pwc.com/us/en/industries/health-industries/library/health-services-deals-insights.html (Accessed 2/17/22).

[40] “2021 saw a big rebound for M&A activity in health care” By Gabriel Perna, Health Evolution, January 12, 2022, https://www.healthevolution.com/insider/2021-saw-a-big-rebound-for-ma-activity-in-health-care/ (Accessed 2/17/22).

[41] Ibid.

[42] “Healthcare M&A update: A quiet 2021 could give way to strategic shifts in 2022” By Nick Hut, Healthcare Financial Management Association, January 21, 2022, https://www.hfma.org/topics/news/2022/01/healthcare-m-a-update–a-quiet-2021-could-give-way-to-strategic-.html (Accessed 2/17/22).

Todd A. Zigrang, MBA, MHA, ASA, CVA, FACHE, is president of Health Capital Consultants, where he focuses on the areas of valuation and financial analysis for hospitals and other healthcare enterprises. Mr. Zigrang has significant physician-integration and financial analysis experience and has participated in the development of a physician-owned, multispecialty management service organization and networks involving a wide range of specialties, physician owned hospitals as well as several limited liability companies for acquiring acute care and specialty hospitals, ASCs, and other ancillary facilities.

Mr. Zigrang can be contacted at (800) 394-8258 or by e-mail to tzigrang@healthcapital.com.

Jessica Bailey-Wheaton, Esq., is vice president and general counsel for Heath Capital Consultants, where she conducts project management and consulting services related to the impact of both federal and state regulations on healthcare exempt organization transactions, and provides research services necessary to support certified opinions of value related to the fair market value and commercial reasonableness of transactions related to healthcare enterprises, assets, and services.

Ms. Bailey-Wheaton can be contacted at (800) 394-8258 or by e-mail to jbailey@healthcapital.com.