How Selling a Business is Like Running a Half Marathon

Getting to the Finish Line is Exhausting

In this article, the author analogizes the sale of a business to how one prepares and runs a half marathon. Many business owners may treat an exit as a half marathon, but that is a mistake. Business owners need professional consultants to assist them with their exit plan and negotiations. The author shares his views on the negotiation process and stresses that business owners must prepare and expect changes to successfully conclude a sale.

2021 was a record year for business sale/exit transactions in the lower-middle market (businesses with valuations between $10 million and $100 million). Accordingly, many NACVA members will invariably be in conversations with business owners about the potential exit from their privately held business. So, I thought that a comparison of a business sale process to the first half marathon that I ran last month might be entertaining and educational. I hope that you enjoy the comparisons and that they help you relate to how and why exit planning is such an important part of the process of an owner seeking outside investment in a business.

A Half Marathon is a Distance Run That Requires Preparation

Many ‘amateur’ runners will try running a half marathon. And virtually anyone who is planning to complete a race of this length, particularly someone new to distance running, will likely prepare for the event. The physical and mental demands of such an endeavor mandate a schedule of preparation, working towards ‘race day’ when all that preparation will be put to the test. Whether the goal is to simply complete the race or to achieve a certain time, the novice runner will be wondering, until they stop running that day, whether their preparation was sufficient to achieve their goal. That was certainly the case for my first half marathon run—I had no idea if my preparation was sufficient to make it to the finish line. While I was running, I thought a lot about the similarities between the race and the preparation and process of exiting a business via an external sale transaction.

Like the half marathon, exiting a business can be thought of in two phases: first, is the planning phase and then, second, comes the execution phase—the race itself. Without proper preparation, including an understanding of the resources that will be needed, the distance that needs to be run, or the challenges that lie along the journey, the likelihood of achieving whatever goal is set is questionable. Some business owners go through a multi-year, comprehensive exit planning process, starting with an educational process that results in a written exit plan that outlines the owner’s personal and business goals, overall objectives, and the potential obstacles that could stand in the way of success. The written plan both educates the business owner and charts the course forward, helping that owner see his/her goals articulated in writing, along with details of the journey that lies ahead. The exit plan is the preparation, without which it is hard for an owner to know what to expect and how to ‘train’. Like the half marathon, if I simply woke up on race day and felt like my overall athleticism would help me prevail, I would have been so much worse off than the months of training that prepared me for ‘race day’. That said, even after preparing by closely following a training schedule, there was still a lot of pain, discomfort, and surprises along the way.

Buyers are ‘Full’ Marathon Runners Who Know How to Train; Half Marathon Runners are Significantly Less Prepared and May Only Run Once

Before my half marathon race started at 7:45 a.m. in Newport, RI, the full marathon runners were sent off at 7:30. Interestingly, there appeared to be significantly fewer full marathon runners than the half marathon crowd. And, like business exits, there are significantly fewer business buyers than the millions of potential selling owners. The difference, however, is not in the number of participants, it is in the level of experience. Full marathon runners are typically experienced runners who not only train appropriately for a race but are significantly more prepared for what that lies ahead, often-times having traversed the terrain many times before. Our business owner clients are a lot like first-time, half marathon runners who may only run a race once, not quite knowing what to expect or how to be prepared.

By contrast, professional buyers know how transactions work and how to successfully navigate a business acquisition. Business owners are mostly novices who will commonly only have one business exit experience in their lives. So, in this regard, the professional buyer (like the full marathon runner) is far better prepared for the race than the half marathon runner, or first-time business seller. Like the full marathon runner, the professional buyer has the advantage once the process begins. Owners who have failed to plan enter the ‘race’ of a business exit without experience and will almost certainly be outgunned in the process. While most business owners pride themselves on having business savvy to run a successful business, that is the equivalent of preparing for a long jog instead of a 13.1-mile race. It can be, and often-times is, that owner believing minimal preparation will stand up against a professional group whose primary focus is on acquiring businesses.

The Best Laid Plans Change Once the Race Begins

Before the race began, I had a plan for my running pace and how I would handle the challenge. I was on a 12-week training schedule, during which I gradually increased the distances I was running. I also worked on the pace of my running; for example, in my second month of training I was averaging a pace of 10 minutes per mile. When my training reached distances of eight to 10 miles per practice run, I found that 10½ minute miles allowed me more energy to finish those runs. With an average pace of 10½ minute miles, I would finish the half marathon in about two hours and 18 minutes. Despite the mindset that I would maintain a certain pace on race-day, things changed once the starter’s gun fired.

My pace for the first six miles was significantly faster than what I had planned, averaging nearly nine-minute miles. As a first-time runner, I felt great about halfway through the run, believing that the ‘race day’ pace would sustain through the finish and that additional energy would come to me in the form of ‘running with a pack’ and the adrenaline that was part of the experience.

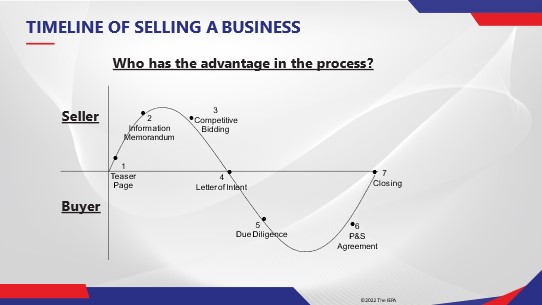

Like a business sale transaction, sellers can feel very empowered at the beginning of the selling process. The chart below shows the emotional process many owners go through. Like the first half of my race, there is a level of excitement when a business is brought to market, particularly when many buyers show interest in the business. When bidding starts—called an indication of interest (IOI) due date—some of the excitement increases. At this stage (again, just like the first half of my race), there is excitement, leverage, and a sense that the process is going very well.

When a letter of intent (LOI) is executed, it commonly includes a period of exclusivity for the buyer to do their diligence before consummating the sale. Due diligence is supposed to be a period of time for the buyer to verify what was communicated during the selling process. At this point in time, the advantage in the process shifts, no different than the second half of the race changed for me on my first half marathon. I was ‘halfway home’, but the second half of the race was clearly going to be more difficult than the first half.Â

The Buyer Knows How to Control the Process, the Amateur is Outmatched

The experienced marathon runner can anticipate more challenges and control the process at a higher level than the novice. I realized this in my sixth mile of the race when the ‘pace setter’ who was tasked with running a perfect two-hour half marathon passed me on the course. As this highly experienced runner trotted by, it was clear that the run was nearly effortless for this person. This was a reminder that perhaps my enthusiasm was misplaced, and that I was arguably running too fast. And, just like the inflection point in the chart above signaling the LOI stage where the advantage shifts, I too was about to enter the most difficult part of the race, while the ‘professional runner’ was simply gaining traction.

Professional buyers have the experience just like the pace setter—they have ‘run the race’ many, many times so the first-time seller is significantly outmatched. The professional buyer is better prepared, more experienced, and knows more techniques for gaining advantage in the process. Because most business owners are experienced in business, including some level of intense negotiations, they feel that they can handle a business sale negotiation. However, just like the novice runner who might feel that a half marathon is just an extension of a typical run that they may take on a casual weekend, the reality is often far from the case.

A Re-trade is Equivalent of a Leg Cramp . . . it Could End Your Race, or You Can Work it Out and Continue

One example of where professional buyers can ‘game the process’ is by re-pricing the transaction well into the diligence process. This happens when the buyer explains that what was discovered in diligence is a ‘surprise’ and, accordingly, the buyer needs to reduce the valuation that was agreed upon at the LOI stage. Sometimes the additional risk (or other discovery in diligence) is a legitimate issue that warrants a discussion about a lower valuation. However, often-times the ‘discovery’ is not new at all to the buyer and is being used as a technique to reduce the purchase price.

The running analogy is that of a leg cramp. When an experienced buyer wants to re-price a transaction, it is common for the seller to go ‘pencils down’ and to stop working until the issue is resolved. Like the leg cramp in a race, a re-pricing is either going to end the race, or it is going to be resolved so the running can continue. Business owners who are like the novice runner likely will not know what to do when the leg cramp/re-trade happens. Like the novice runner, the business owner may feel that the best course of action is to stop running. And while ‘walking away from the negotiating table’ is an option (and a common reaction amongst owners), this decision leaves the business owner short of their goal of a business sale. And, while the re-pricing of transactions is an uncomfortable process that requires intense negotiations, it is good advice for the owner to not lose sight of the larger goals that were outlined in the exit plan. With a full exit plan, the business owner can reflect on the written business and personal goals to see if they are met with this transaction, even at a potentially lower valuation. If there is enough buying interest in the first half of the selling process, it is often-times an option to ‘break the LOI’ and re-engage with the ‘back up’ buyers, rather than accept a re-pricing. However, sometimes restructuring the transaction makes more sense for all of the reasons that you originally chose the buyer at the LOI stage. In either event, some level of preparation—and having the advice of an experienced advisor—is invaluable during these moments.

Getting to the Finish Line is Exhausting

According to several industry surveys and research, the average business sale takes approximately 210 days. I ran my half marathon in just over two hours and eight minutes; ahead of the ‘pace time’ during my practice. While my time was better than expected, when I reached the finish line it felt quite a bit like completing a business sale transaction. There was less emotion in terms of celebration than there was relief that the process was complete and that the race was over. I was exhausted, very similar to how I have seen many business owners react as we ‘crossed the finish line’ in a transaction. Whether it is running or a business sale transaction, the process can be grueling.

For my running experience, the dimensions to navigate were limited to my own mental and physical well-being. However, with the sale of a business, owners also have the added elements of managing and anticipating the reaction of employees, customers, vendors, and other stakeholders to the business. In addition, owners need to anticipate the tax implications of the sale transaction, including the structure of the deal and, perhaps, the nature of the relationship with the buyer post-closing (particularly if there is roll-over equity and the deal was re-priced). There is also a risk-sharing component of the deal that, in addition to informing the pricing of the deal, is a material part of the negotiations. And, beyond the parameters of the ‘race’ itself are the considerations for the liquid wealth that the owner will receive, including managing and preserving the liquidity and anticipating the impact it will have on future generations. Again, the exit planning process is designed to address all of these items and help the business owner to not only be more prepared for the sale process, but also to understand the impact to all of these areas of their illiquid wealth that is now converting to liquidity.

Your Exit Consultant and Exit Planning Team are Your Trainers and Your Coaches

Since 2021 broke so many records for M&A transactions, we anticipate that trend will continue into 2022 and beyond, and that business owners will need advice on their business exits. I hope that you enjoyed this article and that it helps to make you a better advisor to your business owners.

John M. Leonetti, Esq., M.S. Finance, CM&AA, and a Certified Business Exit Consultant®, is the founder and CEO of the International Exit Planning Association. He is a nationally recognized leader in the exit planning field and has been interviewed on ABC News Now, NECN, and numerous national radio programs, including being quoted in the Wall Street Journal on a number of occasions. In addition, Mr. Leonetti is the author of the highly publicized book Exiting Your Business, Protecting Your Wealth: A Strategic Guide for Owners and their Advisors. His book has been the hot topic for many national industry and business owner publications. The IEPA also offers the Certified Business Exit Consultant® professional designation program for advisors who want to assist business owners with their exit planning.

Mr. Leonetti may be contacted at (781) 821-2608 or by e-mail to john@theiepa.com.