Understanding Complex Compensation in Marital Divorce

VPS StraightTalk Webinar, June 22, 2022

On June 22, 2022, VPS StraightTalk Webinar held a webinar that featured Marc Bello. This article summarizes the issues presented in the webinar, “Understanding Complex Compensation in Marital Divorce.”

“Understanding Complex Compensation in Marital Divorce” by Marc Bello, CPA, ABV, CVA, MST, Partner with Edelstein & Company, LLP, was broadcast by VPS StraightTalk Webinar, June 22, 2022. The type of compensation discussed consisted of equity-based compensation plans, such as non-qualified deferred compensation plans, stock options, restricted stocks, supplemental executive retirement plans (SERPs), and performance awards. The program was ideally suited to business valuation professionals seeking to understand how compensation is calculated and what are the tax ramifications of these plans. This article summarizes the topics covered.

Introduction: Equity-Based Compensation Plans

Equity-based compensation plans are established to attract and retain employees. These plans are not limited to established and stabilized C corporations. Equity-based compensation plans are used by start-ups, public and private entities that are S corporations, LLCs, and partnerships.

In the context of a marital dissolution, valuation professionals need to understand what type of equity award(s) is/are in place, the percentage of ownership in the company, understand what constitutes marital property, when and how to determine the division of equity-based compensation, the impact of the proposed division on the separating spouses, and whether the award may be considered for alimony, child support, and/or property division.

While there are many differences between the awards, equity-based plans have common features. Those common plan features include vesting periods and terms that set forth when employee can and will take possession of an equity award and liquidate the same.

Obtain Plan Documents

In these engagements, valuation practitioners assisting counsel must obtain the plan document or have it subpoenaed. The purpose for asking is to review the vesting provisions, qualifications to participate, payment terms, and employment termination provisions.

Stock-Based Awards

As previously noted, the equity or stock-based awards include the following plans:

- Stock options (there are two types; these provide the right to purchase company stock at a specific price in the future)

- Incentive stock options

- Non-qualified stock options (this is a plan that does not meet the requirements of an incentive stock option and is taxed when the option is exercised)

- Restricted stock (the right to receive value of company stock at a vesting date)

- Appreciation rights (the right to receive value at the time of vesting)

- Performance stock

Legal Decisions Impacting Whether Options Are Separate or Marital Property

Three legal decisions were briefly discussed where the (state) courts ruled on what options were considered separate or marital property. This article provides more details on three cases cited in the webinar; the summary provides context and serves to illustrate issues that arise in these engagements. Of course, this summary is provided for educational purposes; professionals engaged should consult with qualified legal counsel and obtain decisions that are considered precedent in their jurisdiction and state.

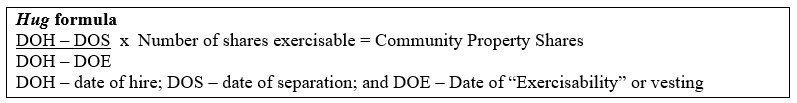

The first case is In Re Marriage of Hug, 154 Cal.App.3d 781 (1984). In this long-term marriage case, the spouses separated on June 19, 1976. On November 6, 1972, husband left a position with IBM to begin employment with Amdahl. While employed at Amdahl, husband was granted options to purchase 3,100 shares of Amdahl stock. Amdahl granted the first of the disputed options on August 9, 1974, an option to purchase 1,000 shares at $1 per share. In August 1974, Amdahl granted a second option for 1,300 shares at $1 per share. On September 15, 1975, Amdahl granted a third option for 800 shares at $5 per share. Each option was exercisable over four years, each in increments of 30 percent, 25 percent, 25 percent, and 20 percent. Since portions of the options were exercisable only after the parties’ separation, the court sought to allocate the options to reflect the relationship between periods of husband’s community contribution in comparison to his overall contribution to earning the option rights. In other words, the trial court attempted to fairly allocate the stock options between compensation for services prior to and after the date of separation.

On appeal, the court held:

It was not an abuse of discretion, under facts of this case, for the trial court to allocate those interests by applying a time rule, finding that the number of options determined to be community property is a product of a fraction in which the numerator is the period in months between the commencement of the spouse’s employment by the employer and the date of separation of the parties, and the denominator is the period of months between commencement of employment and the date each option is first exercisable, multiplied by the number of shares which can be purchased on the date the option is first exercisable. The remaining options are the separate property of the employee. In so holding, we stress that trial court, in the exercise of their discretion, are not limited to this formula in seeking an equitable allocation of separate and community interests in employee stock options.

The following formula is referred to as the Hug formula and is used in cases where the options were primarily intended to attract the employee to the job and reward past services.

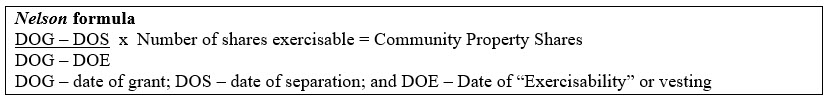

In re Marriage of Nelson, 177 Cal.App.3d 151, (1986) provides a second approach. In Nelson, a large portion of the trial court’s decree involved the characterization and apportionment of stock options issued to husband by his employer, the Ampex Corporation. These fell into three separate categories: those that were granted and became exercisable before the parties separated; those that were granted before the parties separated but were not exercisable until after they separated (hereafter the intermediate options); and those that were granted after the parties separated (hereafter the postseparation options). The first group was characterized by the trial court as wholly community property; the second, partly community property and partly husband’s separate property; and the third, wholly husband’s separate property.

Succinctly, husband did not attack the court’s apportionment of the value of these options between community and separate property; rather, he argued that they had no community aspect at all. In making this argument, he argued that options are not analogous to nonvested pension benefits. He argued that options had no value before their date of exercisability, so that upon becoming exercisable, they became postseparation earnings within California Civil code section 5118 and in a similar vein, that the price of the Ampex Company stock must increase in value after the date of exercisability for the employee to realize a gain to the options reward only future, rather than past efforts on the employee’s part. The court citing Hug, rejected husband’s argument and stated:

Implicit in this statement (the Hug holding) is a recognition of employee stock option grants as “not an expectancy but a chose in action, a form of property …” susceptible of division in spite of being contingent or not having vested.

The Nelson formula is used where the options were primarily intended as compensation for future performance and as an incentive to stay with the company.

The third case is Toni Baccanti v. George I. Morton, 434 Mass. 787 (2001). Here, wife quit her full-time job and worked part-time to care for the couple’s behaviorally challenged son. Husband kept his full-time job and was given stock options by his employer. The Court looked at MGL c. 208, s.34, to determine if unvested stock options were property that could be included in the marital estate; reasoning that although the law did not expressly address stock options, it did mention both vested and unvested benefits. The Court determined that the only portion of unvested stock that “reflects efforts spent during the union” can be regarded as a divisible marital asset. So, for each unvested stock option award, regardless of how far into the vesting period the employee partner was at the time of the divorce, the portion of the stock option award that can be treated as an asset and undivided between the divorcing spouses is the portion of stock option award that can be treated as an asset and split between the divorcing spouses.

Like the Hug decision, the Massachusetts Court also held that there are no hard and fast rules as to division of property and that the trial judge (in Mass., the Probate Court) has wide discretion determining how best to divide the marital assets.

Another case briefly discussed was Ludwig v. Ludwig, 15-P-1177 (Mass. slip opinion) (2017). The issue on appeal involved double-dipping; the Probate Court included unvested stock options as income that had not been included in the parties’ equitable division after the implementation of the time rule laid out in Baccanti v. Morton. Another issue raised by husband on appeal was the date used under the time rule when determining the value of the unvested stock options; the later the date used to determine the value translated into a greater number of shares available for distribution. The Probate Court ruled that the date to be used was the date closest to when the hearing was scheduled because the court found that neither party had acted in a way to drag out the case; husband argued in favor of using the date closest to the date that the parties separated, which was close to a year and a half prior.

A fifth case briefly discussed was Wooters v. Wooters, 74 Mass.App.Ct. 839 (2009). This decision cites Baccatani and focused on enforcement of alimony provisions included in divorce decrees. The Court in Wooters held that exercised stock options were part of his “gross annual income” and therefore had to be factored in the alimony calculation.

The webinar handouts included several waterfall illustrations to show how practitioners can apply the formulas.

Restricted Stock—RSA, RSUs

Restricted Stock Awards (RSA), also referred to as restricted stock or 1244 stock, is awarded to the employee on the date they are granted. They are usually subject to a vesting schedule and incentivize the employee to stay. If the employee leaves, the company can repurchase the shares. The taxation of awards and impact of a section 83(b) election was discussed in this area.

Restricted Stock Units (RSU) are not issued to the employee or independent contractors until they vest. When a company grants RSUs, they are promising to issue those shares later based on a vesting schedule. In addition to a time-vesting schedule, often RSUs include liquidation conditions that provide that the company must be acquired or be the subject of an IPO for the units to vest.

In these engagements, the speaker suggested that the appraiser ensure that counsel ask or obtain, as part of the discovery, the Custodial Account statement.

The webinar concluded with a tax illustration involving vested RSU, that served to remind participants that the issues discussed often resurface even after the decree of dissolution has long been signed and that 50/50 distributions need to factor the taxation of RSUs.

Conclusion

The use of stock options, SERPs, Appreciation Rights, RSA, and RSUs to retain employees and/or contractors will continue. Retaining qualified employees, at all levels, is critical. Competitive and proactive employers need stable and incentivized customer service staff, staff that understands logistics, a strong and reliable sales force and marketing team, and focused management. Valuation practitioners will benefit from understanding the compensation tools and issues discussed in this webinar. The program here was timely and ideally suited to new and mid-level valuation and litigation support staff.

This webinar was produced by Valuation Products and Services (www.valuationproducts.com). Recordings are available.

Roberto H Castro, JD, MBA, MST, CVA, is a retired attorney now focusing on litigation support. He is also Technical Editor of QuickRead and a member of NACVA’s CUV team.

Mr. Castro can be contacted at (509) 679-3668 or by e-mail to rcastro@rcastrolaw.com.