Legal Update

July 2022

This article focuses on Partner Reinsurance Co. v. RPM Mortgage, Inc., 2022 U.S. Dist. LEXIS 94244 (S.D.N.Y. May 25, 2022). This is a case of buyer’s remorse. The target’s financial condition changed dramatically after the LOI and buyer attempted to renegotiate the acquisition terms. This case illustrates how damages were calculated.

Buyer’s remorse: everybody’s experienced it at one point or another. For me, it was a very ugly Hawaiian shirt; for Elon Musk, it appears to be Twitter. Partner Reinsurance Co. v. RPM Mortgage, Inc., 2022 U.S. Dist. LEXIS 94244 (S.D.N.Y. May 25, 2022) was a case of buyer’s remorse much grander than the Hawaiian shirt. This opinion is the result of an eight-day bench trial of a claim against RPM Mortgage, Inc. (RPM) for its breach of a contract to buy Entitle Direct Group, Inc. (“Entitle”). Spoiler alert: Judge Engelmayer awarded Partner Reinsurance (PartnerRe), which was, during the relevant time, Entitle’s indirect parent company and was the plaintiff in this litigation, nearly $11 million.

Background

PartnerRe acquired Entitle, an Ohio-based title insurance company, in 2012. In 2015, PartnerRe decided that Entitle was “experiencing financial setbacks” because its strategy of marketing directly to customers was not generating sufficient volume. Since Entitle’s results were inconsistent with PartnerRe’s portfolio, it began exploring a sale of the company. PartnerRe was looking for $30 million for Entitle.

By December 2015, Entitle was exploring a deal with RPM, a California-based, family-owned mortgage bank. RPM believed that being able to offer title insurance to its mortgage customers would enhance its business model, and the RPM referrals would provide Entitle with the volume it needed to be profitable.

In June 2016, RPM executed a nonbinding letter of intent (LOI) to buy 100% of Entitle with Entitle’s shareholder retaining a profit interest in the company. During RPM’s due diligence, Entitle’s financial performance worsened. Negotiations continued with multiple revisions leading to a second LOI in September 2016, that ultimately formed the basis of the deal. Under the September LOI, RPM would acquire 67% of Entitle for $13 million, adjusted to the extent Entitle’s actual losses through closing exceeded projected losses. PartnerRe would retain the 33% minority interest.

While RPM was negotiating, people in and affiliated with the organization were already questioning the wisdom of the deal. In a June 16, 2016, e-mail, an executive at one of RPM’s lenders called Entitle a “turd.” Later in 2016, RPM’s CFO questioned whether they had sufficient resources for all the company’s planned acquisitions, and RPM’s CEO acknowledged that unless they came up with $25 million in additional capital, they would have to “exit” the Entitle deal. Despite these doubts, RPM continued pursuing the deal with Entitle.

During the months of due diligence, RPM was constantly attempting to renegotiate the terms of the September LOI. Finally, in February 2017, RPM’s CFO issued his due diligence report noting that Entitle was, at the time, losing up to $352,000 per month. Entitle was forthright about its financial woes. In February 2017, RPM’s CFO notified the CEO that Entitle expected its loss from August 2016 through June 2017 had increased from $208,000 to $1,500,000. Entitle also informed RPM that it had been under greater regulatory scrutiny due to its losses. The Ohio Department of Insurance (ODI) was looking for additional capital investment into Entitle.

Despite knowing all of this, RPM proceeded with a definitive Merger Agreement on February 16, 2017. The final deal provided that RPM would acquire Entitle for $13,125,000 adjusted to the extent that Entitle’s losses from August 1, 2016, through closing exceeded $208,000 (despite the fact that Entitle had already advised RPM that its anticipated loss would be approximately $1,500,000 for that period). Approximately one third of the shares of the new RPM subsidiary would be transferred to PartnerRe as an equity kicker. PartnerRe was also required to issue a loan to Entitle when the Merger Agreement was executed to satisfy the ODI’s concerns. After closing, PartnerRe could convert the loan into additional equity based on the purchase price. Closing of the deal, while dependent on several details (like ODI approval) was expected to be on May 31, 2017. Due to delays getting ODI approval, the closing date was extended to June 9, 2017.

During the two weeks from May 25, when Entitle notified RPM of the ODI delay, and June 9, 2017, there was a flurry of communications back and forth between the companies with RPM imposing new demands on Entitle. Among other things, RPM sought revised proforma financial statements and raised concerns that ODI would demand RPM make an additional, post-closing capital contribution. Entitle executives suspected that the demands were an excuse for RPM to delay closing or terminate the deal altogether.

The Entitle executives were right. RPM internal communications between the CEO and CFO showed that it was looking for “reasons to stall” the merger. By forcing Entitle to submit updated forms to ODI, which had not requested any additional data, RPM could seek additional investors or “negotiate” with PartnerRe to loan more money to Entitle. One RPM executive suggested to the CEO that RPM “should also look at getting turned down by the [insurance] commissioner” to get out of the deal altogether. The CEO then sent Entitle a list of new pre-conditions for closing, most of which were unrelated to the terms of the Merger Agreement.

The e-mails between the companies flew back and forth with Entitle arguing that it was not obligated, under the Merger Agreement, to submit revised projections to ODI that would restart the approval process, that RPM’s demands were disingenuous, and RPM’s CEO insisting that the updated information was necessary for him to avoid being accused of filing false information.

On June 2, 2017, ODI unconditionally approved the transaction, and with all of the preconditions in the Merger Agreement satisfied, Entitle notified that it was prepared to proceed with closing on June 9. RPM continued to demand satisfaction with the requests that it had made after the execution of the Merger Agreement. On June 9, 2017, Entitle arrived at the appointed time at the appointed place prepared to close on the transaction. RPM did not. Over the next several weeks, counsel for Entitle attempted without success to salvage the deal. On June 29, 2017, the parties terminated the Merger Agreement.

Following the termination, PartnerRe and Entitle began looking for a new buyer. Ultimately, on December 31, 2017, they accepted an offer from Radian Title Services, Inc. On March 27, 2018, the Radian deal closed with PartnerRe at a purchase price of $7,310,574. After deducting the various setoffs and expenses, PartnerRe realized approximately $1,763,363 from the transaction, plus an assignment of Entitle’s claims against RPM.

Court Findings

The court found that RPM had breached the Merger Agreement by failing to close on the transaction and that RPM’s reasons for not completing the purchase were pretextual and its witnesses, including several of its executives, lacked credibility.

Regarding damages, the court found that the governing Delaware law provided that PartnerRe could recover damages that should be “based upon the reasonable expectations of the parties at the time of the Merger Agreement, to wit, the sum that would put the promisee in the same position as if the promisor had performed the contract.”[1] That number consisted of the amount PartnerRe would have realized from closing the deal plus the value of the minority interest it was to receive in the successor company following the merger. While the parties agreed with this approach in theory, their experts testified to widely different amounts with PartnerRe’s expert, Basil Imburgia, concluding that damages totaled $10,886,955 and RPM’s expert, Bruce Bush, concluding that the number was only $4,886,000.

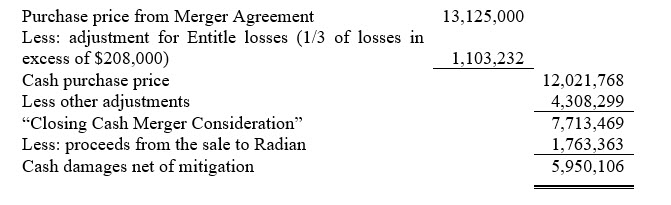

Imburgia calculated the cash at closing component to be $5,950,106, consisting of:

Bush only raised one issue with this calculation. Between the termination of the Merger Agreement and the sale to Radian, PartnerRe loaned Entitle an additional $925,000. Bush contended that had PartnerRe structured those cash infusions as capital investments, they would not have been eliminated in the subsequent sale to Radian, reducing the cash damages component by that amount. The court rejected this argument. Imburgia’s analysis was based on what actually happened, not what might, in hindsight, have been a better approach.

There was nothing improper about the decision by PartnerRe, after RPM breached, to finance Entitle via loans rather than a purchase of an increased equity interest. Bush did not point to any industry custom or legal rule that required either manner of financing. PartnerRe’s decision to proceed as it did was economically rational, hindsight notwithstanding. And there is no evidence that PartnerRe’s decision as to how to go about funding Entitle was intended artificially to boost its eventual damages from RPM.[2]

The real departure between the two experts was in the value of the one-third interest in the merged entity that PartnerRe would have received under the Merger Agreement. Imburgia calculated the value of the minority interest based on the price that RPM had agreed to pay for its majority interest. He reasoned that the cash purchase price for the 67% interest ($12,021,768) implied that RPM had valued the whole entity at $17,942,937. Thus, the indicated value of PartnerRe’s 36.54% interest would be $6,555,799. From that, Imburgia deducted a 25% discount for lack of control, which he chose because the “valuation literature suggests a discount for lack of control within the range of approximately 20 to 30%.”[3]

Bush, on the other hand, insisted that, due to Entitle’s deteriorating financial performance during the second quarter of 2017 and the uncertainties over the potential synergies with RPM following a merger, any value attributable to the minority interest would be speculative. Bush also argued that Imburgia had failed to include a discount for lack of marketability and that the control discount he did use was arbitrary. Bush “viewed any minority interest calculation as too speculative. He therefore valued PartnerRe’s minority equity interest at zero.”[4]

The court adopted Imburgia’s calculations since “under Delaware law, the deal price negotiated by the parties is considered the ‘best evidence’ of an asset’s value. See Schonfeld v. Hilliard, 218 F.3d 164, 178 (2d Cir. 2000) (collecting cases); see also DFC Glob. Corp. v. Muirfleld Value Partners, L.P., 172 A.3d 346, 366 (Del. 2017) (‘[T]he sale value resulting from a robust market check will often be the most reliable evidence of fair value, and … second-guessing the value arrived upon by the collective views of many sophisticated parties with a real stake in the matter is hazardous.’).”[5]

The purchase price set in the Merger Agreement was the product of extensive negotiations between unrelated parties. All concerned were represented by counsel, and there was substantial due diligence both before the September LOI and after, before those terms were incorporated into the Merger Agreement. The court also dismissed Bush’s contention that Imburgia’s methodology failed to capture the significantly higher than expected losses that Entitle sustained during the first half of 2017. The court recognized that:

- The larger than anticipated losses were a result of a slowing in the market for mortgage refinancing because of a short-term increase in interest rates,

- The evidentiary record showed that Entitle notified RPM that its losses for the first half of 2017 were going to be higher than previously anticipated before the Merger Agreement was executed, and

- The pricing formula in the Merger Agreement itself addressed the potential for higher-than-expected losses before closing the deal.

Conclusion

Partner Reinsurance Co. v. RPM Mortgage, Inc. demonstrates, yet again, that the deal is the deal and failure to complete the deal can lead to substantial damages even if circumstances change after the deal is signed. While not specifically discussed in the opinion, the facts of this case suggest that, as can sometimes happen, the buyer’s management became so invested in doing a deal despite obvious negative factors,[6] that they were unwilling to walk away before executing the agreement.

This case is also a strong reminder that the negotiated terms of the deal will likely provide the basis for valuing any damages arising out of the failure to complete the transaction.

[1] Partner Reinsurance Co. v. RPM Mortg., Inc., 2022 U.S. Dist. LEXIS 94244at *186-187, internal citation and quotation marks omitted.

[2] Ibid. at *190, internal citation and footnote omitted.

[3] Ibid. at *192. In a supplemental affidavit, Imburgia supported this conclusion as “the average discount derived from a data set of all transactions over a period of 23 years.” The court did not provide any information about what data set was used.

[4] Ibid. at *193. In his affidavit submitted as part of the trial, Bush allowed for a potential value of the minority interest at $1,172,000 based on a discounted cash flow model. The court, however, did not include any details of how he reached that number.

[5] Ibid. at 194.

[6] In June 2016, three months before the September LOI, RPM’s lenders recognized this as a bad deal. In November 2016, RPM’s own management team was questioning whether it made sense to commit scarce resources to the deal. In February 2017, the RPM CFO’s due diligence report warned that Entitle was losing up to $352,000 per month and Entitle warned RPM that its losses for the first half of 2017 would be around $1,500,000. Despite all of these warnings, the RPM CEO went forward with the Merger Agreement.

Michael J. Molder, JD, CPA, CFE, CVA, MAFF, applies 30 years of experience as a Certified Public Accountant and litigator to help investigate and analyze cases with complex financial and economic implications. He has acted as both counsel and accounting expert in pending and threatened litigation as well as participating in internal investigations of financial misconduct. As a litigator, Mr. Molder helped co-counsel understand complex financial and accounting issues in dozens of cases. In 2006, Mr. Molder returned to public accounting applying his unique skills to forensic engagements. He has also performed valuations of business interests in a wide variety of industries.

Mr. Molder has served as valuation expert for both plaintiffs and defendants in commercial litigation matters and owner and non-owner spouses in matrimonial dissolutions. He has participated in the valuations of businesses in a wide variety of industries, including: food service, wholesale and retail distribution, literary development and production, healthcare, manufacturing, and real estate development.

Mr. Molder has also investigated and valued damages in a wide variety of litigation contexts ranging from breach of contract claims to personal injury cases, and from employment disputes to civil fraud. He has consulted on many matters which have not involved the issuance of a report for litigation or resulted in deposition or trial testimony. Accordingly, the identity of these matters is protected by attorney client privilege.

Mr. Molder has also lectured widely on a variety of accounting and litigation related topics including business valuation, financial investigations in divorce proceedings, accountant ethics, financial statement manipulation and “earnings management.”

Mr. Molder can be contacted at (610) 208-3169 or by e-mail to Molder@lawandaccounting.com.