The Appraisal Process

An Outline for Making Awards Useful and Final (Part II of III)

Appraisal is a frequently used and often maligned method to adjudicate disputes in the property insurance world. Typically, appraisal is used for the purposes of evaluation only and will not bring finality to a claim in which coverage, or, in certain jurisdictions, causation is also being disputed. Although the perceived advantages of appraisal versus litigation are that it is considered fast, inexpensive, and relatively final, the appraisal process is often criticized because of unpredictable awards that are not helpful in settling a disputed claim and, in some cases, can lead to further protracted litigation. If, however, an appraisal is conducted with appropriate guidelines, the process can be valuable in bringing finality to valuation disputes. This second of three-part article is intended to outline a process which will result in unambiguous appraisal awards. Regardless of the size or complexity of a disputed claim, the appraisal process should always be approached in a thoughtful manner by the policyholder and insurer.

Introduction

This is the second of a three-part article on The Appraisal Process. In this second part, the author discusses the importance of understanding what is being appraised and establish protocols regarding the various values that may be included in the appraisal.

1. Understanding and Reaching an Agreement on What is Being Appraised

Understanding what to appraise and how to go about communicating the issues to the appraisers and umpire who will make the award is vital in making the process useful. Failure to clearly and unambiguously define the scope of an appraisal can often serve to compound the problem. Therefore, it is crucial, reducing this to writing that the scope of the appraisal be clearly defined in a written agreement that does not leave what will be awarded and how it will be awarded to chance. In non-complex matters, experienced appraisers and umpires can often determine what should be decided in the appraisal process; however, the parties need to understand that the scope of appraisal cannot and should not be determined by the appraisers and umpire.

Agreements to Appraise Disputes in Non-Complex Matters

The importance of making an unambiguous demand for appraisal was noted previously herein. The following is a brief discussion of how to construct an agreement to appraise a loss.

The scope of coverage and appraisal is determined in the first instance by the applicable policy language. Where the policy is silent (and most policies are silent on this issue), the following is a typical, but by no means complete, list of values that can be determined by appraisal:

- Replacement Cost Loss—scope and value

- Replacement Cost Loss—value only, where scope is agreed

- Limited Replacement Cost Loss—where a single item or finite set of items needs to be determined

- Actual Cash Value Loss

- Period of Restoration

- Demolition Cost

- Code Upgrades/Law and Ordinance Loss

- Extra Expense Loss

- Expediting Expense Loss

- Rental Loss

- Business Interruption Loss

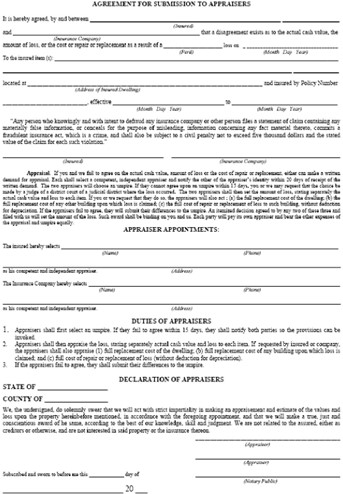

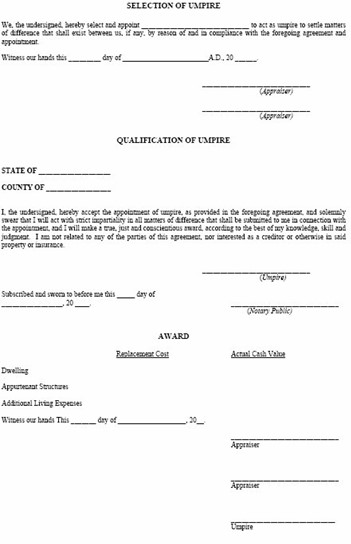

After a demand for appraisal has been made, it is recommended that the parties enter into a written agreement to appraise the loss. Ideally this can happen after the parties have named their appraisers, regardless of whether the umpire has already been chosen. If there is any ambiguity in the scope of the appraisal, it is essential to reach an agreement, in writing, on what disputed values will need to be awarded by the appraisal panel, in addition to other issues which are pertinent to the appraisal. As previously noted, neither the insurance policy nor case law is likely to provide guidance in this area. A simple “Agreement for Submission to Appraisers” like the one presented below is often used in non-complex matters.[1]

The above sample memorandum of appraisal (also called an appraisal protocol) illustrates that no matter how small or large the dispute, a simple agreement with instructions governing the appraisal is necessary to establish clarity and avoid post-appraisal valuation disputes and/or litigation over the meaning of the award.

Figure 1: Sample Memorandum of Appraisal.

Complex Appraisal Protocols

High value, complex matters which require numerous values to be awarded, will require a detailed agreement prior to proceeding with the appraisal. In this regard, the parties, whether on their own, with help from the umpire, or as ordered by a court, must enter a written protocol that has the effect of an “order”. For an appraisal protocol to be useful, an understanding of the nature of the dispute(s) regarding loss and value, as well as clarity about how the values need to be reported by the panel, is required. At a minimum, the appraisal protocol for a complex matter must include the following:[2]

- The names of the parties and the date and type of loss

- The scope of the appraisal, clearly listing the valuation(s) which are going to be determined by the process[3]

- A list of the legal issues that parties have agreed on which the umpires can decide or a statement that the appraisers and umpire cannot decide questions of law or coverage

- The identity of the appraisers

- The identity of the umpire or a description of the procedure for selecting the umpire

- Statement that any disputes regarding the protocol are to be resolved by the panel

- The manner in which the disputed loss is to be appraised, which may include

a. Timetable and location of appraisal

b. Method of recording the appraisal proceedings

c. Discovery issues which may also include subpoena power of the panel

d. Use of experts

e. Manner in which the loss will be appraised

f. Sample Award Form or instructions on how award will be reported

g. Definitions of terms and coverage - General Items

a. Statement regarding no ex parte communication between parties and appraiser

b. Statement regarding no ex parte communication between appraisers and umpire

c. Confidentiality issues or agreements

d. Hold harmless language protecting the appraisers and umpire[4]

e. Other as may be required

Conclusion

In the third and final article, the author discusses other issues to consider, including, clarifying dispute regarding valuation definitions or coverage, multiple appraisals, umpire expenses, and how to respond if the panel is unable to render an award.

This article was previously published by J.S. Held in JDSupra, August 25, 2022, and is republished here by permission.

[1] This agreement is included in the addendum attached hereto.

[2] A sample complex appraisal protocol is included in the addendum attached hereto.

[3] In large complex claims where there are multiple insurers with non-concurrent policies, or multiple insureds who have various insurable interests, further itemization of an award may be necessary and should be clearly articulated in the protocol.

[4] Appraisers and umpires will often seek to be held harmless by the parties in a similar fashion that arbitration or mediation agreements will seek to hold arbitrators and mediators harmless.

Jonathon C. Held is President and CEO of J.S. Held, LLC, a consulting company with more than 1,500 professionals on five continents. During his tenure of more than 45 years with the company, Mr. Held has been responsible for the growth of the firm from two employees to a multi-disciplinary consulting firm with global reach. Mr. Held has acted as a consultant and expert on numerous high value, high profile cases during his career, including many of the highest valued property claims in history. He has handled assignments in all 50 U.S. states, in more than 20 countries, and on five continents. He has been an expert witness and dispute resolution panelist on numerous matters throughout the United States. Mr. Held has also authored many published papers and spoken at numerous educational conferences including (among others) the PLRB, LEA, ABA, the Wind Network conference, the Lloyds Market Association, and the Property Insurance Coverage Group Conference at Lloyds.

Mr. Held can be contacted at (516) 621-2900 or by e-mail to jheld@jsheld.com.