The Role of Forensic Accountants in Measuring and Detecting Fraud in Employee Loss Claims

With Examples From Asset Misappropriation to Financial Statement Fraud (Part I of II)

This two-part article focuses on the two significant, but different, roles forensic accountants play in quantifying employee losses and how—in the normal course of the analysis—they may find instances of fraud that require further investigation. The authors first provide detailed guidance for forensic accountants in how to quantify employee losses and later offer insights into behavior that may indicate fraud stemming from such claims. They also explain the factors considered by carriers when hiring external accountants. The second part of the article features two cases studies involving Bribery and Corruption and Financial Statement Fraud.

Introduction

Insurance claims for employee losses are generally examined by insurance carriers. The carrier will often retain a forensic accountant who can measure employee losses. Employee losses are typically categorized as either asset misappropriation, bribery and corruption, or financial statement fraud. Insurance carriers often seek the assistance of forensic accountants to quantify such claims. Initially, the forensic accountant will be retained to calculate the employee loss. During the analysis, should a forensic accountant detect the possibility of fraud in a claim, it may prompt further investigation by the carrier.

A recent example of both asset misappropriation and bribery/corruption occurred at Apple, Inc. A former Apple employee was indicted on federal charges for allegedly defrauding the tech company out of more than $10 million spanning several years. According to prosecutors, the defendant engaged in a multitude of schemes to defraud Apple, including taking kickbacks, stealing parts, and causing Apple to pay for inventory and services it never received.

Another recent example of financial statement fraud occurred at the Kraft Heinz Company. The Securities and Exchange Commission (SEC) charged the company along with the Chief Operating and Procurement officers with engaging in a long-running expense management scheme that resulted in the restatement of several years of financial reporting. According to the SEC, from 2015 through 2018, the multinational food giant engaged in various types of financial misconduct, including recognizing unearned discounts from suppliers, and maintaining false and misleading contracts, which improperly reduced the company’s cost of goods sold and allegedly received “cost savings.” The accounting improprieties resulted in Kraft reporting inflated earnings before interest, taxes, depreciation, and amortization (EBITDA). In June 2019, after the SEC investigation commenced, Kraft restated its financials by correcting more than $200 million of improperly recognized cost savings.[1]

This paper focuses on the two significant, but different, roles forensic accountants play in quantifying employee losses and how—in the normal course of the analysis—they may find instances of fraud that require further investigation. The authors first provide detailed guidance for forensic accountants in how to quantify employee losses and later offer insights into behavior that may indicate fraud stemming from such claims. They also explain the factors considered by carriers when hiring external accountants.

This discussion begins by defining some of the terms and potential players in employee loss claims that are examined for possible fraud. First, what is an employee loss? Generally, an employee loss is the loss of money, securities, or other property caused by employee dishonesty.

Second, what does a forensic accountant do? The AICPA (the governing body of professional accountancy in the United States) defines forensic accounting as “… the application of specialized knowledge and investigative skills possessed by CPAs to collect, analyze, and evaluate evidential matter, and to interpret and communicate findings in the courtroom, boardroom or other legal or administrative venue.”[2] Therefore, professional accountants, mostly CPAs, conduct forensic accounting engagements. A subcategory of forensic accounting is fraud examination, which may be conducted by either accountants or nonaccountants.

Third, according to Black’s Law Dictionary, fraud is “a knowing misrepresentation of the truth or concealment of a material fact to induce another to act to his or her detriment.” The four major elements of fraud are: (1) false statement of a (2) material fact which is (3) willfully made with an (4) intent to deceive.

Fraud is a global problem affecting all organizations worldwide. The Association of Certified Fraud Examiners (ACFE) stated in its 2022 Global Study on Occupational Fraud and Abuse, Report to the Nations, that fraud caused total losses exceeding $3.6 billion USD.[3] The same study estimated that organizations lose 5% of their revenue each year to fraud.[4]

Overview of Employee Loss Claims

An employee loss may trigger coverage through various policies with the business entity’s insurance carrier. The complexities for employee loss claims arise when attempting to measure the potential loss, and whether the loss is related to either asset misappropriation, bribery and corruption, or financial statement fraud. This paper addresses each of these employee loss types.

Asset Misappropriation

Asset misappropriations are most often thefts of cash, but they may also include theft of a company’s securities, inventory, time, or intellectual property. Common examples of asset misappropriations include the following:

- Employee removes cash from the register in a retail business

- Employee forges company checks to himself or to entities he controls

- Employee deliberately overstates amounts for reimbursement from the company

- Employee creates fictitious expense reports

- Employee diverts corporate receipts to herself or entities she controls

- Employee removes or diverts inventory from the business

- Employee utilized business time or resources for personal gain

- Employee sells proprietary computer code to competitors

- Employee utilizes customer lists or other trade secrets for personal gain

The first step in measuring an asset misappropriation employee loss event is the determination of what calculations must be done. Generally, the potential loss is assessed through analysis of the amounts withdrawn and returned to the company as follows:

The documents required to complete this analysis will vary based on the type of business and complexity of the asset misappropriations. The following documents are typically requested in order to analyze asset misappropriation claims:

- Bank statements/bank reconciliations

- Copies of cancelled checks (original documents are preferable)

- Details of deposits and Wire/ACH transfers

- General ledger (for relevant periods)

- Income/profit and loss statements

- Insured’s claim

- Police report (if applicable)

It also may be suitable to conduct interviews of relevant company personnel to gain additional information about the claim or the alleged losses.

The second step in measuring the employee loss is performing the correct analysis. This process may be as simple as looking at a bank account for a forged check, or in more complicated situations, utilizing formulas to determine the amount of money that should have been deposited and comparing those amounts to actual deposits.

The forensic accountant will also analyze which transactions are potentially legitimate versus personal in nature by examining bank statements for transactions that relate to relevant business activities. It is important that the forensic accountant have a thorough understanding of the company’s business so that she will better be able to determine questionable transactions. As an example, for a manufacturing concern, payments to a boutique clothing store or adult content websites would certainly rise to the level of questionable transactions. Payments to fast food restaurants and office supply companies are more difficult to ascertain.

Asset Misappropriation Case Examples

Case Study 1

QBurgers, Inc., a business that specialized in gourmet burgers and French fries, submitted an employee loss claim to XYZ Insurance Company alleging that, during the past five days, one of the shift managers was stealing cash from the nightly deposits.

Upon receipt of the assignment, the forensic accountant will generally research the business, market environment, competitors, trends, and the general economy of the region where the business is located. Below are examples of the documentation and information from the carrier and business that the forensic accountant may request:

- Cash register reports

- Bank statements/bank reconciliations

- Deposit slips

- Police report (if applicable)

- Accounting deposit and payment ledgers

The next steps are to evaluate and analyze the documentation and related claims. The forensic accountant may perform such analysis as follows:

- First, an analysis of QBurger’s cash register reports, for the relevant period, show an average of $10,000 per day in cash sales. Company policy is that all cash sales are deposited each night.

- Second, an analysis of QBurger’s bank statement, for the relevant period, show an average of $9,000 per day in deposits.

- What is the amount of potential loss?

Therefore, the employee loss (i.e., value of the potential claim) may be calculated as follows:

As a final check, the forensic accountant should ascertain whether either cash remained at the facility (in a vault or other location), or deposits were delayed in posting or misapplied by the bank.

Case Study 2

KBeauty, Inc., a high-end nail salon, submitted an employee loss claim to XYZ Insurance Company alleging that $10,000 was taken from the business on or about December 10, 2021. The insured claims the source of cash was accumulated sales from the previous months.

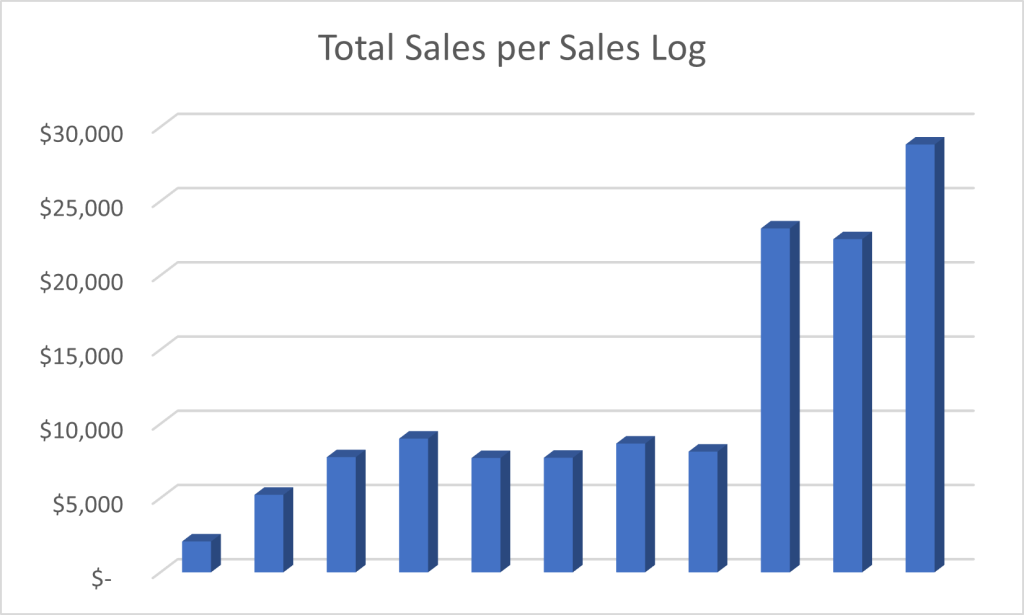

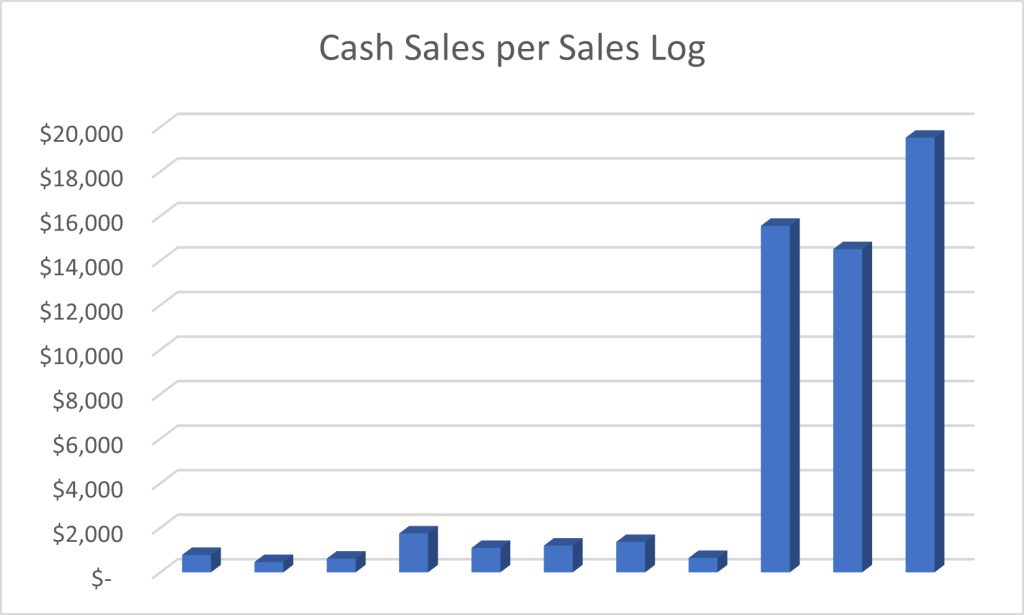

Upon receipt of the assignment, the forensic accountant analyzed the cash, check, and credit card sales for the months February through December 2021 as depicted in the following chart:

The following charts depict KBeauty’s total and cash sales.

The immediate red flags in the charts above are the significant increases in cash and total sales beginning in October 2021. Such increases may be caused by the seasonal nature of the business but might also be caused by fraudulent manipulation of the company’s accounting records. The forensic accountant should further analyze KBeauty’s records to determine whether the increase in cash sales is valid by examining the cash logs and bank deposits.

The second part of this article will continue with a discussions and cases studies of bribery and corruption and financial statement fraud.

We would like to thank F. Dean Driskell III and Peter S. Davis for providing insight and expertise that greatly assisted this research.

This article was previously published by JSHeld in JDSupra, June 07, 2022, and is reprinted here by permission.

Â

[1] https://www.sec.gov/news/press-release/2021-174.

[1] AICPA Practice Aid 10-1, Serving as an Expert Witness or Consultant.Â

[1] ACFE 2022 Global Study on Occupational Fraud and Abuse, Report to the Nations, page 4. Report may be downloaded for free at https://www.acfe.com/report-to-the-nations/2022/.

[1] Ibid.

Dean Driskell III, CPA, ABV, CFF, CFE, MBA, is an Executive Vice President in J.S. Held’s Forensic Accounting / Economics / Corporate Finance practice. He specializes in performing consulting services for clients involved in various types of accounting, economic, and commercial disputes as well as fraud and forensic accounting matters. With more than 30 years of experience in financial analysis, accounting, reporting, and financial management, he has served clients and their counsel in both private and public sectors, providing technical analyses, accounting/restatement assistance, valuation services, and litigation support across a variety of industries, and as an expert witness in litigation.

Mr. Driskell can be contacted at (404) 876-5220 or by e-mail to DDriskell@jsheld.com.

Peter S. Davis, CPA, ABV, CFF, CIRA, CTP, CFE, is a Senior Managing Director in J.S. Held’s Forensic Accounting / Economics / Corporate Finance practice. He has served as Receiver in regulatory matters brought by the SEC, FTC, Arizona Corporation Commission, the Arizona State Board of Education, as well as lenders and shareholders. His areas of expertise include: understanding and interpreting complex financial data, fraud detection and deterrence, and determination of damages. He has provided expert testimony in numerous federal, bankruptcy, and state court matters.

Mr. Davis can be contacted at (602) 295-6068 or by e-mail to PDavis@jsheld.com.