The Impact of Inflation

On Business Valuation

The effects of inflation on consumers’ spending and psyche are well-known. The difficulties each causes in day-to-day life are often discussed. Inflation has affected everything from the cost of transportation to the cost of food and housing. What is less discussed, however, is how the current inflationary period is affecting small business owners and their companies. In this article the author shares his impression.

U.S. Inflation

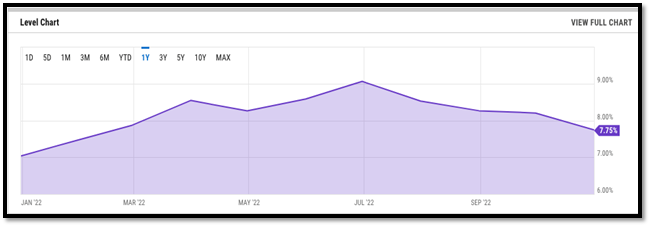

Calculated annually, the U.S. Inflation Rate reflects the average percentage by which the price of a specific basket of goods and services purchased in the United States has increased. The U.S. Federal Reserve uses the inflation rate as a key indicator of economic growth and stability. The Federal Reserve has been monitoring the U.S. economy’s inflation rate since 2012, and if it is higher than 2 percent, it may alter monetary policy. Inflation spiked dramatically in the early 1980s when the economy was in a deep recession. When inflation reached 14.93 percent, the Federal Reserve under Paul Volcker had to take drastic measures.

The current rate of inflation in the United States, as of October 31, 2022, is 7.75 percent. This is a slight decrease from the 8.26 percent rate recorded in September 2022.

[1] Information retrieved December 6, 2022, from https://bit.ly/3NiIFPZ

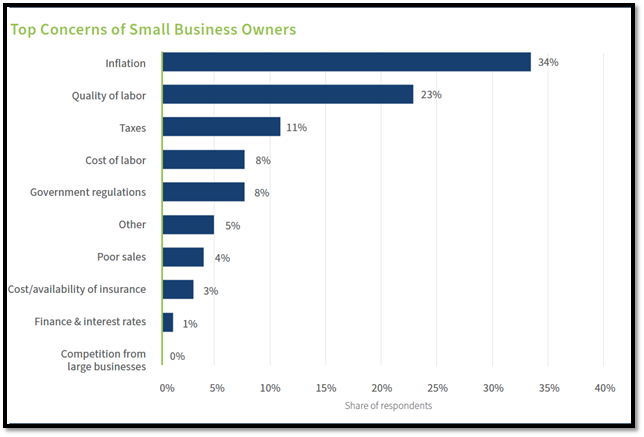

Effect of Inflation on Consumers

The effects of inflation on consumers’ spending and psyche are well-known. The difficulties it causes in day-to-day life are often discussed. Inflation has affected everything from the cost of transportation to the cost of food and housing. What is less discussed, however, is how the current inflationary period is affecting small business owners and their companies. If you have clients who are business owners, you have probably fielded questions from them about how to protect their operations from the current economic climate. More than 1,500 small business owners were surveyed, and an overwhelming majority cited inflation as their primary concern. When asked to choose between inflation, labor quality, regulations, and tax rates, 34 percent voted for inflation.

[2] Information retrieved December 6, 2022, from https://bit.ly/3h5OEfy

The Impact of Inflation on Business Valuation

There are three value-drivers that impact the value of a company: a) the cash flow, b) the growth, and c) the risk. Simply put, Value = Cash Flow(1+g)/Risk. Now, to measure the impact of inflation on business valuation, we need to analyze the impact of inflation on these three value-drivers.

a) Impact of Inflation on Cash Flow

Valuation experts typically use cash flow as their primary metric of economic benefits. So, how does inflation affect cash flow? The general rule is that when inflation is high, businesses will raise prices to consumers. Consumers’ reduced spending has a direct effect on a business’s top line (revenues) and bottom line (profits). Since cash flow is a direct result of income or profits, it stands to reason that high inflation has a negative effect on cash flow. As a result, it is safe to assume that the company’s value will fall as well.

b) Impact of Inflation on Growth

When evaluating whether to invest or purchase ownership stakes in a business, one of the most essential factors investors consider is the firm’s sustainable growth rate. Due to the prospective nature of valuation, knowing the company’s long-term development prospects is essential for any interested party. High inflation dampens corporate expansion potential since it increases both direct and indirect expenses. As costs are passed through, the customers’ desire for non-essential items drops as a result, slowing economic growth.

For example, long-term leasing agreements with inflation-linked escalation provisions may further increase overhead costs. Inflation may also cause vendors and service providers to raise prices. In a tight labor market, salary increases may help retain competent workers. Rising living costs for low-wage workers might lead to attrition for more costly workers.

The combined effects of the company’s slow growth and low sales hurt its worth.

c) Impact of Inflation on Risk (Discount Rate)

The cost of capital, often known as the discount rate, is the third value driver that may influence the value of a firm. Methods such as the Ibbotson Build-Up technique, the Capital Assets Pricing Method (CAPM), and the Weighted average Cost of Capital (WACC) are examples of some of the approaches that may be used in business valuation when calculating the discount rate that will be applied to a particular firm.

The increase of the risk-free rate, which is the rate that is released every day for the 20-Year Treasury Bond, as well as the rising of the cost of equity and the cost of debt, are where the influence of inflation can be seen to have an effect on the discount rate.

These rates tend to go up whenever inflation does, and as a result, the cost to get funds increases as well. The risk profile of the company is raised and makes it unattractive to investors.

When the discount rate is greater, the value of the firm is negatively impacted, which means that the value of the company is lowered, sometimes by a large amount.

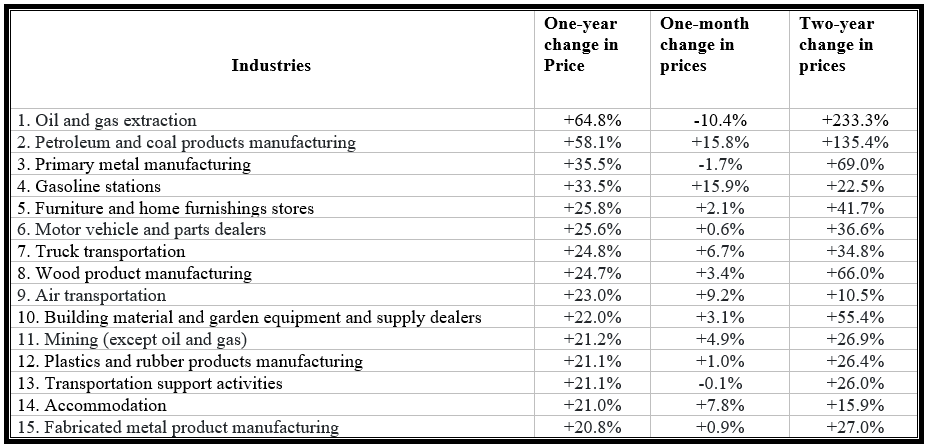

Industries Most Affected by Inflation

Despite the fact that inflation is now pervasive across the economy, not all sectors have been hit equally. Researchers on behalf of Self, calculated the one-year price change from March 2021 to March 2022 in order to identify the industries[3] most affected by inflation.

The table below presents which industries have been the most affected by inflation.

Conclusion

When there is inflation, a company’s actual earnings fall since a dollar can now only buy a lower quantity of products and services. In other words, a million dollars in “earnings” today will not go as far as a million dollars in “profits” two years ago when it came to buying resources (inflation is a hidden tax).

Profit preservation—and growth—are essential for a company’s long-term viability. In times of high inflation (if possible), cash flow is the primary driver of business valuation, and a company is often sold with the hope that it will continue to earn profits in the future. A company’s value increases in proportion to the amount of cash it can earn and maintain.

[3] Moneytalksnews.com: 15 Industries Most Affected by Inflation. Information retrieved on December 6, 2022, from https://bit.ly/3h1e0v9

Achille Ekeu, MBA, CVA, is the President and CEO of the Washington Valuation Group, LLC and a former Board member who served on the Valuation Credentialing Board (VCB) of the National Association of Certified Valuators and Analysts (NACVA). He is also a State Chapter President of NACVA for Maryland and Washington DC. Mr. Ekeu is the Author of a book titled “30 Frequently Asked Questions in Business Valuation”. He focuses on business valuations for tax, transaction and litigation purposes. He was just recently appointed by Court Order on a big litigation case in Baltimore City, Maryland.

Mr. Ekeu can be contacted at (240) 274-9570 or by e-mail to achille.ekeu@washingtonvaluation.com.