Business Valuation

Of a Real Estate Centered Entity

As business valuation analysts, how many of us have ever agreed to value an equity interest in a gas station, or a hotel, or some other business that operates with real estate as an operating asset? For me, that answer is “frequently.” Yet, over the years my view of how to undertake this type of assignment has changed. These types of businesses deserve more care and understanding than a simple net cash flow divided by some cap rate.

As business valuation analysts, how many of us have ever agreed to value an equity interest in a gas station, or a hotel, or some other business that operates with real estate as an operating asset? For me, that answer is “frequently.” Yet, over the years my view of how to undertake this type of assignment has changed. These types of businesses deserve more care and understanding than a simple net cash flow divided by some cap rate.

What is a Real Estate Centered Entity (RECE)?

A true real estate centered entity (RECE), can be described by a variety of business definitions, such as real estate with a business deriving customer patronage from a locational advantage , or a business with active real estate, or a “going-concern” property. These types of properties can include, but are not limited to:

- Gas stations/C-stores

- Car washes

- Senior housing

- Vineyards/wineries

- Marina/ski resorts

- Hotels/motels

- Amusement parks

- Grain mills/farms/livestock companies (agricultural properties)

- Family restaurants

- Bowling alleys, casinos

- Airports, golf courses

- Funeral homes, cemeteries

- Recycling centers, landfills

- Nurseries, greenhouses

Usually, our typical valuation assignment is to conclude value of the whole company or a fractional part. In either assignment, the basic conclusion has to do with the value of the whole enterprise, operations, cash flow, balance sheet components, and the myriad of other steps we perform. These RECE businesses are usually small and often called “Main Street” businesses that make up the typical smaller companies that are the bread and butter of most CPAs. Factors that are likely seen in RECE businesses are:

- Real estate offers locational competitive advantage

- Smaller revenue, probably under $5M

- Likely family-owned; real property[i] may be inside the business records

- Probably long-term history of operations

- May have non-operating assets and liabilities

- Draws customers from local area to sell products or provide services

- Usually walk-in, consumer-based customers

- CPAs do tax work, maybe just write-up and tax filings

- Vulnerable to changing economics and demographics

- Often poor quality of internal financial records at a given valuation date

One key aspect of going-concern real estate interests was acknowledged recently by the U.S. Small Business Administration in their Standard Operating Procedure 50. This normally affects real property appraisers who value the real estate for collateral loans offered by banking institutions. As such, it is now a common assignment for real property appraisers to examine the land, buildings, and embedded equipment plus an intangible value for a going-concern business entity. This recent development is something business value analysts must understand when a real estate appraisal is supplied to us.

Real property appraisers see that some or all of the customer patronage inures to physical location in an operating entity. The methods of analysis vary,[ii] but as an example, valuing a hotel property as an operating entity, the real property appraiser may deduct management fees to calculate net operating income, then consider a multiple of the management fees as the “intangible.”

Economics of Real Property

Business valuation analysts know that the economic environment can be a large influencer on equity value. The COVID-19 recessionary period influenced real property values just like we saw business equity markets plunge with rises in volatility. Keep in mind that recent hikes in the Federal Funds rate, akin to interest rates the leveraged buyers use to acquire property, affect real estate values.

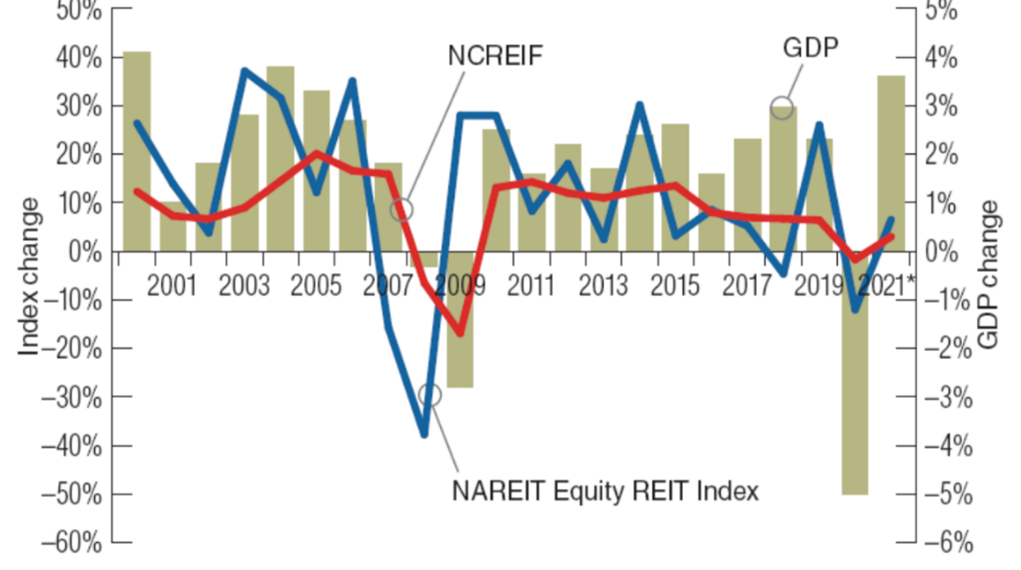

A report from Price Waterhouse Coopers and the Urban Land Institute “2021 emerging trends in real estate” showed the volatility in various real property investments tracking with the quarterly Gross Domestic Product:

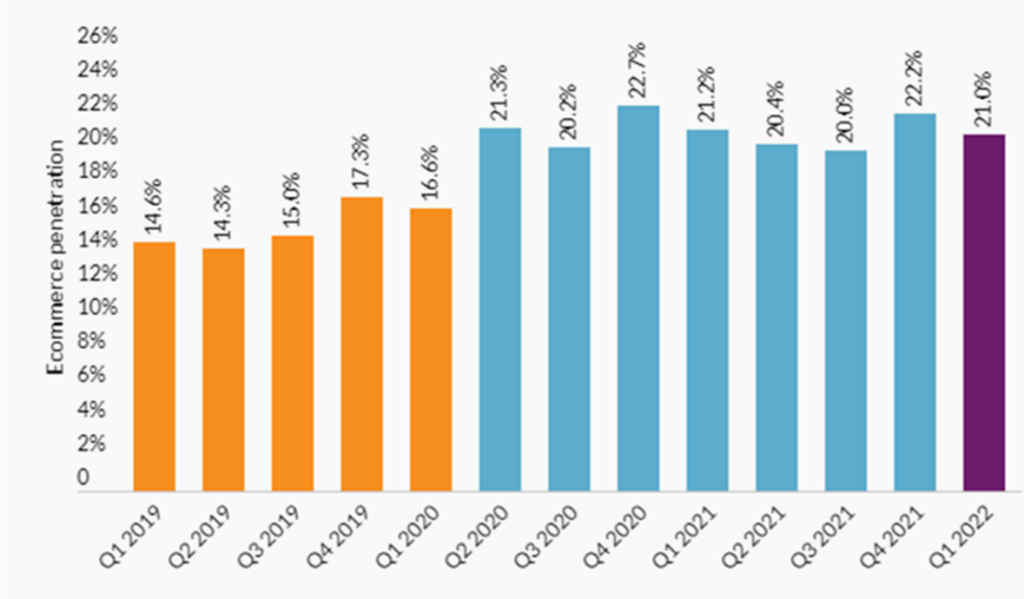

In a similar vein, a U.S. Department of Commerce report in May 2022 showed that E-Commerce is rising as a percentage of retail sales, arguably undermining the future performance of RECEs serving as retail product outlets:

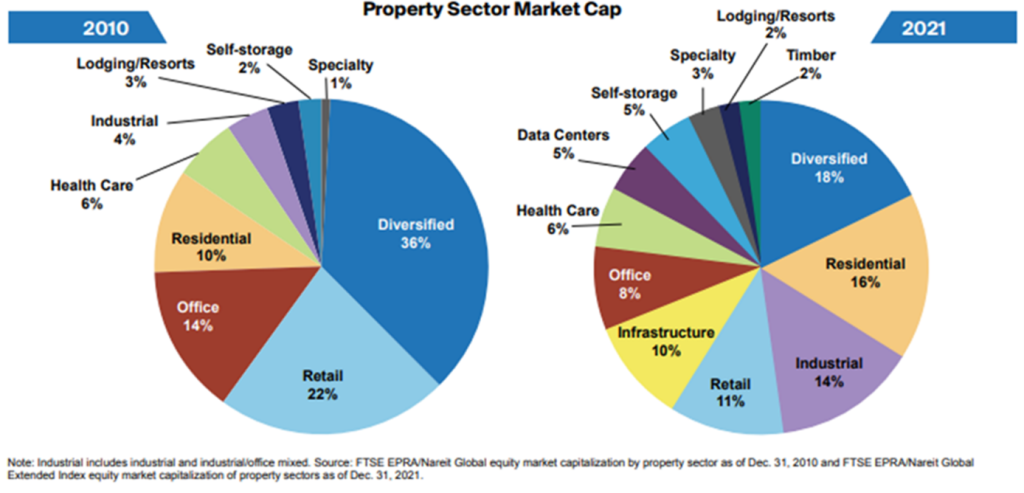

Another way to consider the value of RECE properties is to compare the various market capitalizations of holding companies traded in public exchanges. The relative value of various sectors in 2010 and 2021 was published by the FTSE/National Association of Real Estate Investment Trusts:

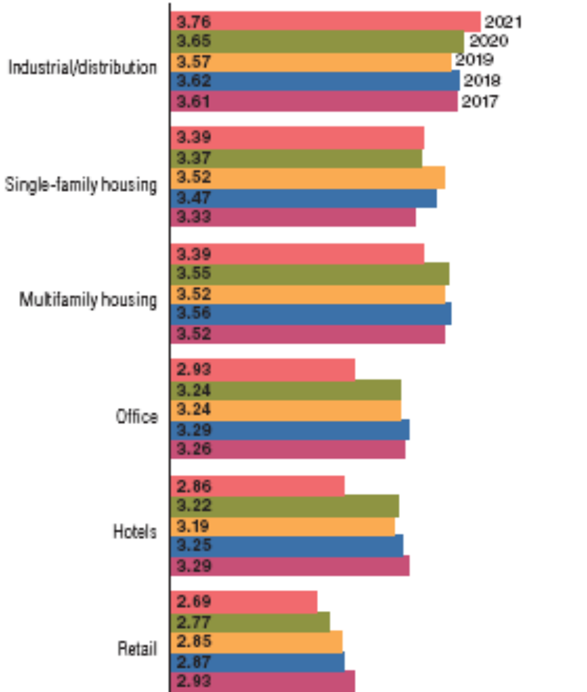

One last study by Price Waterhouse Coopers in 2021 showed the relative investment prospects of current types of RECE properties:

Note the shrinkage in certain types of RECE properties over the five-year period, notably retail, hotels, office holding companies, and multi-family holding companies.

Distinctions between the Business Value Analyst and the Real Property Discipline

In valuing business equity, we must consider the mixing of various assets and liabilities, tangible and intangible assets and liabilities, and gauge the quality of management, staff, procedures, and systems within a competitive environment. Small movements in some elements can have large influences on yield and growth. Our date of value is usually historical and is given to us. We assume facts known, knowable, and reasonably foreseeable. If we are valuing fractional non-controlling interests, we apply discounts for lack of control and/or lack of marketability as our methods require. If land and improved property are held within the business, we may view them as operating assets or rely on a real estate appraisal for “market value” and normalize the cash flow stream for imputed rent.

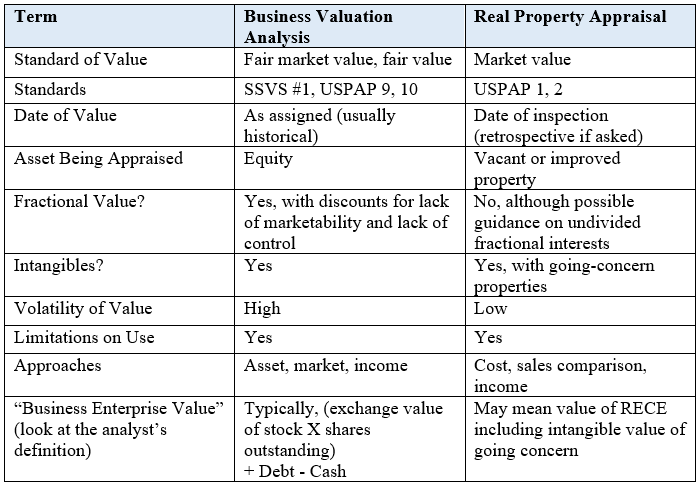

Real property appraisers, in contrast, normally appraise the “bundle of rights” in the property, including any land, improvements, air and mineral assets, and embedded equipment on a “fee simple” basis or value without any encumbrances such as debt. The date of inspection is usually the date of value. Clearly, real property appraisers do not get into the equity structure, although the property value can be influenced by competition. Real property appraisers are obligated to consider the property on the basis of highest and best use (HABU). As an example, if the property being appraised is currently used as an old restaurant but commercial development would establish a higher price in exchange, then the higher value would be reported. Certain key term differences can be summarized as follows:

Real property appraisers normally rely primarily on comparable market transactions of prior sales of “similar” properties within the “neighborhood.” The market value prices per square foot may be adjusted for certain amenities, such as parking lot sizes, or quality of equipment used (e.g., as in a car wash). The cost approach is essentially a reconstructive analysis of the costs, or expenses, necessary to reproduce the improvements and buy similar raw land.

An income approach—which may be a single period capitalization or, rarely, a multi-period model—can be similar to the market analysis of deriving a cap rate (denominator) from the market evidence and applying it to net operating income (NOI), which is similar to EBITDAR, with the “R” being rent.[iii] Another way to consider NOI is to start with gross income land subtract fixed expenses, variable expenses, and a vacancy adjustment. A maintenance reserve may also be considered. Normally the last year of operation is considered, suggesting a potential problem when the operating RECE business has had an unusually good or bad year.

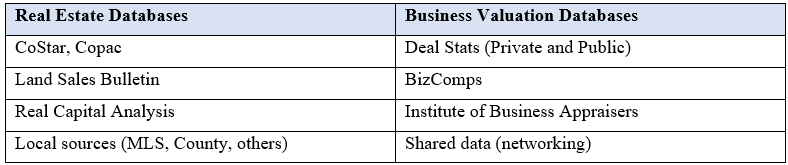

Real estate transaction databases are also different than what is used in business valuation. For the RECE types of property, these are usually an exchange value for the property as a going-concern. Keep in mind that our normal business valuation transaction databases specifically do not include the real estate.

Real Property Appraisal Analytical Methods for Intangibles

Real property appraisers have a variety of “discernment rules” and methods for estimating the intangible component, varying by type of property. Usually, it is “enhanced value” of the operating property because of the business locational advantage.

- Sometimes the intangible asset is calculated by estimating exchange value of (hotel, gas station, etc.) from comparable sales and subtracting value of the “dark” property and embedded machinery.

- Real property intangible calculation should be an overlap customer patronage calculated in a business valuation.

- Analysts must value other “intangibles” such as patents, trademarks, and covenants not-to-compete since these would not likely be reflected in a real property appraisal.

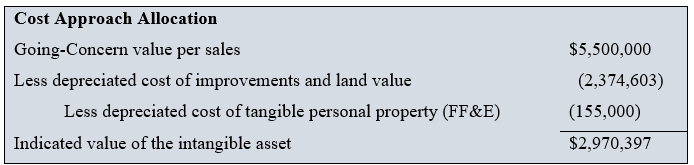

Another example of how a real estate appraiser could report RECE property value[iv] is to deduct the depreciated cost of improvements, land value alone, and any tangible personal property (such as equipment in a car wash) from the “transaction value” of similar properties:

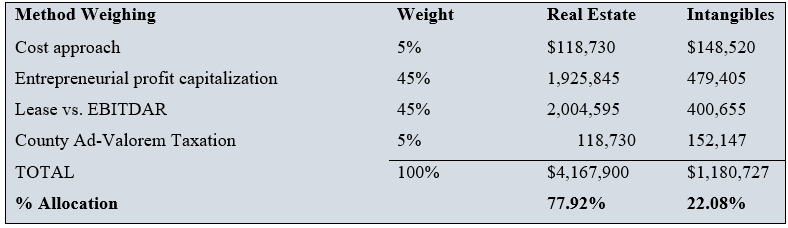

You may find that the real property appraiser considered a variety of methods, weighing the merits of each analysis (much like business value reconciliation) to conclude the value of the property alone and the going-concern value embedded within the operating property:

Without getting into the depth of the real estate analysis, it is important for analysts to understand and review the real estate report.

Adopting and Testing a Real Property Conclusion

Our classic intuition tells us that the real estate appraisal we incorporate into our value conclusions would provide a market-based substitute for the recorded value of the land and building improvements. This may have been true many years ago, but for RECE properties in today’s environment, the real estate appraisal likely includes much more in value than just dirt and structures.

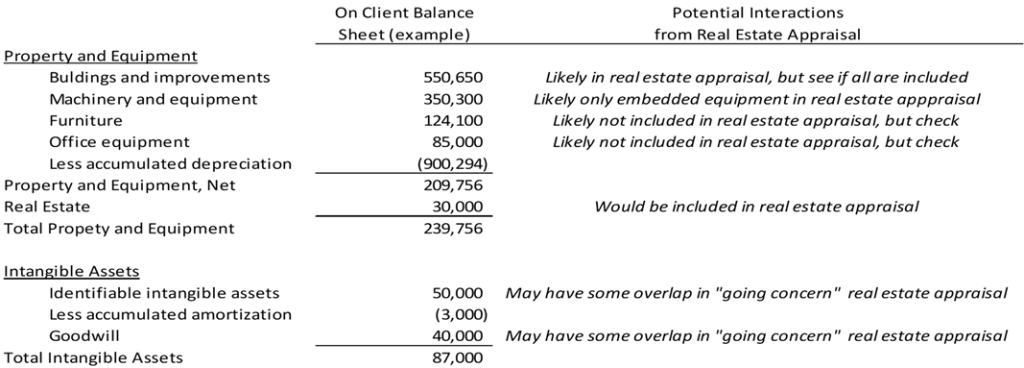

In particular, the valuation analyst must review the real estate appraisal and perhaps discuss the findings with the real property appraiser in order to fully understand what the real property opinion includes. The overlaps in the balance sheet would include not only land (e.g., “real estate”) but also potentially significant portions of property and equipment, and importantly, intangible assets. These potential interactions are illustrated in the structural balance sheet below:

As a result, as analysts we have got to recognize the potential interaction of the real estate appraisal reported values and our adjustments, if any, to the book value of the item.

- Buildings, asphalt driveways, and sheds may be shown as “leasehold improvements” on the firm balance sheet.

- Permanent equipment such as air conditioning, heating, car lifts (as in a gas station), or other forms of equipment that would stay with the hypothetical sale of the property are usually seen as fixed assets on the firm balance sheet.

- The recognition of a going-concern intangible by the real estate appraiser is likely an overlap of any gross intangible asset business valuation analysts recognize.

Concluding Comments

The most important take-away is that real property appraisers, who appraise real estate, are more likely to include an intangible value component in their overall conclusion. Complex RECE properties usually require analysis by business valuation analysts, real property appraisers, and occasionally machinery and equipment appraisers depending on the complexity of the assignment.

Our duty is to ensure adequate delineation of methodology for deriving any goodwill intangible. In working with RECE properties, developing a shared understanding of procedures will help to avoid any overlapping issues. Beware of “double counting” the intangible customer base asset if an RP appraisal contributes to the BV equity conclusion.

This article was based on Mr. Schlegel’s presentation to the NACVA BVFL Super Conference in Salt Lake City, August 18, 2022. https://learn.appraisers.org/products/bv193-appraising-real-estate-centered-entities-by-a-business-appraiser

[i] The term ‘”real property” is used in the real estate appraisal profession meaning not only the value of the land and improvements, but also the surface and other rights that are associated with ownership.

[ii] One of the better books on the subject is L. Deane Wilson’s Going Concern Valuation, 2012.

[iii] For a better description of real property analytics, see Chapter 33 in Valuing a Business, 6th Edition, 2022.

[iv] These examples can be found in Business Valuation Resources Special Report “Allocating Value between Intangibles and Real Estate,” Valuing Companies with Real Estate: Appraisal Experts Untangle the Issues, 2014.

Rob Schlegel, FASA, MCBA, is a Principal with Houlihan Valuation Advisors in Indianapolis, Indiana. He has been practicing business valuation for over 30 years and is a Past International President of the American Society of Appraisers.

Mr. Schlegel can be contacted at (317) 264-1005 or by e-mail to rschelegel@houlihan-hva.com.