Unimpeachable Scope

A Synopsis of Valuation Brief 1 “Understanding the Differences: Conclusion of Value vs. Value Calculations”

Valuation Brief 1, “Understanding the Differences: Conclusion of Value vs. Value Calculations” attempts to unpack the differences between that which is a conclusion of value and that which is not. In this 14th article of the unimpeachable neutrality series, the author provides a synopsis of the key takeaways from the inaugural valuation brief for which he had the pleasure of being a co-author.

Society has evolved and perhaps devolved such that labels are becoming increasingly more important. From preferred pronouns to politically correct labels that offend some and confuse others, how something is categorized or characterized is a purely human prerogative that often dictates not only how something is viewed, but more importantly, how something is treated. In the world of estimating value, the way said estimate is derived dictates what the appraiser, analyst, or valuator can effectively label the engagement and report the estimate of value Valuation Brief 1, “Understanding the Differences: Conclusion of Value vs. Value Calculations” attempts to unpack the differences between that which is a conclusion of value and that which is not. I posted the first brief on my LinkedIn page and saw that it received over 6,500 impressions, which is at least some indication that this topic is, at a minimum, of some interest to the public. Valuation Brief 1, “Understanding the Differences: Conclusion of Value vs. Value Calculations” was a team effort developed under the leadership of the Business Valuation Resource Panel (BVRP), which is a panel of leading business valuation experts, professionals, and academics appointed to provide input, recommendations, and updates from the business valuation discipline to the Appraisal Foundation’s boards. While on this subcommittee, I had the privilege of working with some of the best and brightest the valuation industry has to offer, including Andrew S. Pike, CFA, ASA, RV, Elaine Young, ABV, ASA, and Sarah von Helfenstein, MBA, CVA. Ironically, each of these brilliant professionals are current or former Chairpersons of the BVRP. In this 14th article of the unimpeachable neutrality series, I will provide a synopsis of the key takeaways from the inaugural valuation brief for which I had the pleasure of being a co-author.

Substantially All Valuation Standards Delineate by Level of Scope

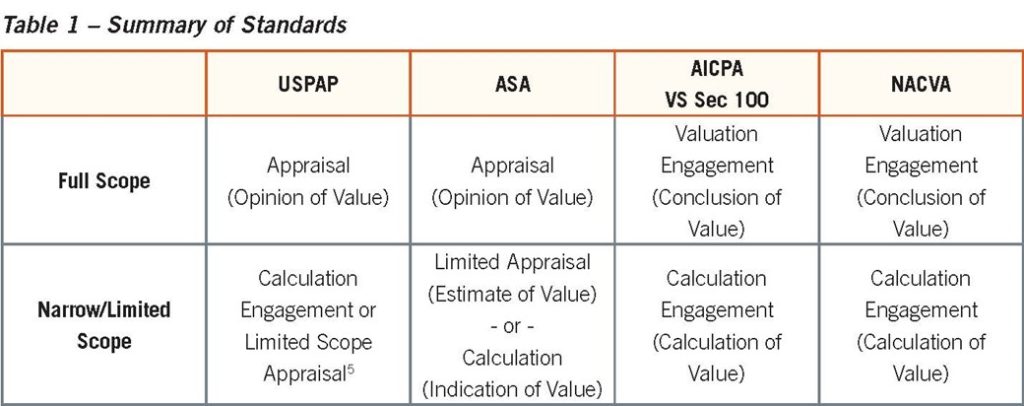

The first critical takeaway from the valuation brief is that substantially all the business valuation standards in the United States delineate the types of engagements one may perform to estimate value by level of scope, as shown within the table found on page 5 of the valuation brief reproduced below

As can be seen in the table, NACVA, AICPA, and ASA effectively bifurcate the classification of engagement by level of scope, with the distinction being that the scope of an engagement to estimate value is either (1) full scope or (2) narrow/limited in scope.

The NACVA has established professional standards that define two types of engagements used to estimate value: (1) valuation engagement and (2) calculation engagement.

- NACVA Full Scope = Valuation Engagement. This engagement requires the valuation professional to apply appropriate valuation approaches and methods, determined at their discretion, to arrive at a conclusion of value. The resulting value conclusion is presented in a summary or detailed report.

- NACVA Limited Scope = Calculation Engagement. In this type of engagement, the client and valuation professional agree on specific valuation approaches, methods, and the extent of selected procedures, resulting in a calculated value. The calculated value is presented in a calculation report, which should include a statement acknowledging that the engagement did not include all the procedures required for a conclusion of value. It should also state that the results may have been different if a conclusion of value had been determined.

According to the Statement on Standards for Valuation Services (SSVS) VS Section 100 issued by the American Institute of CPAs (AICPA), there are two types of engagements to estimate value: (1) valuation engagement, which results in a conclusion of value and (2) calculation engagement, which results in a calculated value.

- AICPA Full Scope = Valuation Engagement. The valuation professional has the flexibility to use appropriate valuation approaches and methods to arrive at the value conclusion in a valuation engagement. However, all three valuation approaches should be considered, and the results should be reconciled and assessed for reliability. The conclusion of value is communicated in a summary or detailed report.

- AICPA Limited Scope = Calculation Engagement. In a calculation engagement, the valuation professional and the client agree on the valuation approaches, methods, and procedures to be used to calculate the value. The calculated value is communicated in a calculation report, which should explicitly state that the engagement does not include all the procedures required for a valuation engagement, and that the results may have been different if a valuation engagement had been performed.

The ASA trifurcates by virtue of bifurcating narrow scope engagements further into two separate narrow scope engagement types. The American Society of Appraisers (ASA) has established three types of engagements for valuation professionals: appraisal, limited appraisal, and calculation.

- ASA Full Scope = Appraisal. An appraisal provides an unambiguous opinion of the value of a business, ownership interest, security, or intangible asset, supported by all relevant procedures and conceptual approaches.

- ASA Limited Scope = Limited Scope Appraisal or Calculation. A limited appraisal provides an estimate of value based on a more limited set of procedures and the most appropriate conceptual approach. A calculation provides an approximate indication of value based on limited procedures agreed upon by the valuation professional and client, and may use conceptual approaches agreed upon with the client.

USPAP takes a slightly different approach, as this set of standards does not delineate by scope and instead only distinguishes by report type. USPAP allows for two reporting options for business appraisal reports: an “Appraisal Report” or a “Restricted Appraisal Report.” Each option has its own minimum level of information required and is appropriate for different intended uses. Appraisers must carefully consider the intended use to select the appropriate reporting option. It is important to note that USPAP does not dictate a specific format for the valuation report, but rather requires that the report clearly communicate the scope of work, the data and analysis used in the valuation, and the appraiser’s conclusions and opinions. The report must also comply with any applicable laws or regulations and any specific requirements of the client or intended users.

A Calculation Can Comply with USPAP

The second most critical takeaway is that, at least in theory, a calculation can be performed and reported in compliance with USPAP. Moreover, Advisory Opinion 21 clearly notes that “A calculation engagement or limited scope appraisal are used by appraisers to describe appraisals with a narrow scope of work. These engagements and reports render opinions of value and meet the definition of an appraisal under USPAP.” In other words, an appraisal, as defined by USPAP, can be performed with a narrow or limited scope. There is also a Q&A issued by the Appraisal Foundation that asks and answers, “In the practice of Business Appraisals, does USPAP permit Limited Appraisals or Calculation Engagements?” To which the answer is, “Yes. While these terms have specific meanings and uses, they are both considered appraisals according to the USPAP definition. Limited Appraisals and Calculation Engagements are examples of assignments with a narrow scope of work, which are addressed in the Scope of Work Rule. Under USPAP, it is the appraiser’s responsibility to determine when use of these narrower scopes of work is appropriate. For example, the scope of work must be sufficient to develop assignment results that are credible in the context of the intended use. An appraiser may perform these assignments under USPAP by complying with the RULES and STANDARDS 9 and 10.”

Assessing the Scope of Work is a Continuous Process

The third takeaway within the valuation brief is that the process of evaluating the Scope of Work is an ongoing task. Throughout the duration of the engagement, it is the responsibility of the valuation expert to make appropriate judgments and determine the appropriate scope of work. This is because the required research and analysis to generate reliable assignment outcomes can vary due to a range of factors. For instance, changes in the intended users, intended use, value type and definition, effective date, subject matter, and relevant characteristics, or a condition of the assignment may necessitate the valuation expert to reevaluate the scope of work. In summary, when conducting a business valuation engagement, it is crucial to consider the purpose and intended use of the valuation results and to select the appropriate scope of work and reporting format to meet those requirements. This consideration is an ongoing assessment, as any change in the appraisal elements may make the once appropriate scope not-so-appropriate at any point in the estimation of value process.

Respect my Authority

The information contained within the first valuation brief is not intended to be seen as formal guidance or authoritative standards or commentary. This does not, however, diminish the value and insight set forth under this valuation brief. Supplemental guidance, whether formal or informal, can be combined with standards to make an authoritative point. In fact, combining standards with informal guidance as a means of creating a stronger argument is the very life blood of the Unimpeachable Neutrality series. Additionally, supplemental guidance does not carry the same weight as the standard itself. Professional standards are the authoritative source for requirements, and any guidance provided is intended to assist in interpreting and implementing those standards. It is crucial to recognize that the standard itself carries more weight than supplementary guidance. Therefore, when making authoritative points, it is essential to refer to the standard rather than solely relying on supplemental guidance.

Zachary Meyers, CPA, CVA, has been retained in over 2,600 cases as a testifying, consulting, or joint/court appointed expert. He has testified and been qualified as an expert specific to civil, marital, and criminal litigation. Mr. Meyers was elected to the NACVA Standards Board in 2016, appointed Vice-Chair in 2017, elected Chair in 2018, and in 2019, was re-elected as Chair, which promulgates professional standards for financial professionals, analysts, and experts. Mr. Meyers was appointed as NACVA Standards Board liaison representative for the Global Association of Certified Valuators and Analysts (GACVA) Advisory Council in 2020, which liaises with NACVA’s international chapters in Africa, Canada, Europe, India, Taiwan, and Southeast Asia. In 2021, Mr. Meyers was elected to the Business Valuation Resource Panel of The Appraisal Foundation (TAF), whose purpose is preserving and improving the public trust in valuation.

Mr. Meyers can be contacted at (304) 690-2619 or by e-mail to czmcpacva@CZMeyers.com.