Economic Obsolescence Measurement Best Practices

(Part II of IV)

The first of this four-part series considered the differences between the unit principle of property appraisal and the summation principle of property appraisal. This second part describes and illustrates the generally accepted economic obsolescence measurement methods (with particular emphasis on the capitalization of income loss method).

Introduction

Valuation analysis (‚Äúanalysts‚ÄĚ) are often called on to value complex, special-purpose industrial and commercial property operating collectively as a single ‚Äúunit‚ÄĚ of property. Analysts typically apply the cost approach to value such special-purpose property. This discussion focuses on the identification and measurement of economic obsolescence within the application of the cost approach. This topic is particularly relevant to the unit principle appraisal of public utility and utility-type property for state and local ad valorem tax appeal purposes.

The first of this four-part series considered the differences between the unit principle of property appraisal and the summation principle of property appraisal. This second part describes and illustrates the generally accepted economic obsolescence measurement methods (with particular emphasis on the capitalization of income loss method).

Analysts who develop unit principle appraisals have to be able to (1) identify and distinguish (qualitatively and quantitatively) the various elements (or types) of obsolescence in a cost approach analysis of special-purpose industrial and commercial property, (2) explain and apply the generally accepted economic obsolescence measurements methods, (3) report and defend the economic obsolescence measurement analysis in a property tax appraisal, and (4) respond to typical taxing authority objections related to the proposed economic obsolescence adjustment. Parts three and four of this series will focus on best practices responses to the typical assessment authority objections related to the economic obsolescence measurement.

Economic Obsolescence Measurement Methods

There are several generally accepted economic obsolescence measurement methods, including the following:

- Market extraction method

- Matched pair sales comparison method

- Capitalization of income loss method (CILM)

- Inutility method

The market extraction method involves the following procedures:

- The analyst first identifies the sales of comparable properties

- The analyst second compares each property sale price to the cost less physical depreciation for each comparable property

- If the sale price exceeds the cost less depreciation, then there is no economic obsolescence

- If the sale price is less than the cost less depreciation, then the deficiency is considered to indicate economic obsolescence

- The economic obsolescence can be divided by the comparable property’s cost (or by the comparable property’s cost less depreciation) metric in order to calculate an economic obsolescence percent

- This economic obsolescence measurement percentage can be applied to the cost metric for the taxpayer’s unit property

- The analyst quantifies one or more property-specific income (profit margin or rate of return) metrics

- The analyst selects corresponding benchmark (e.g., historical, projected, industry, comparable property) income metrics

- The analyst calculates the difference between the property-specific actual income (margin or rate of return) metric and the benchmark income (margin or rate of return) metric

- The analyst applies this difference in the income metrics (i.e., actual vs. benchmark) to the taxpayer’s unit property (either as a percentage measure or as a capitalization of the income deficiency)

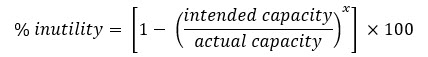

The inutility method of obsolescence measurement typically involves same version of the following formula:

where:

Intended capacity = the property’s design or rated production or utilization

Actual capacity = the property’s actual production or utilization

x = scale factor exponent of the cost increase compared to the volume increase

This inutility obsolescence measurement method assumes that economic obsolescence is directly proportional to inutility (or to underutilization). This obsolescence measurement method assumes that all of the taxpayer’s production/utilization costs are variable. That is, there are no unit-level fixed costs. Therefore, the unit-level profit margin is assumed to remain constant (and adequate) at all property utilization levels.

The first two economic obsolescence measurement methods are more applicable to summation principle appraisals. The CILM measurement method is applicable to both summation principle appraisals and unit principle appraisals. The inutility measurement method typically understates economic obsolescence. The inutility method measures the unit’s deficiency in volume (production) but not the unit’s deficiency in profit margins or rates of return. Exhibit 3 summarizes and compares the relative strengths and weaknesses of these economic obsolescence measurement methods.

Exhibit 3: Economic Obsolescence Measurement Methods Comparison of Application Strengths and Weaknesses

|

|

Measurement Method |

Application Strengths |

Application Weaknesses |

|

|

|

Market extraction |

‚Äʬ†¬†¬†¬† Market-based analysis is based on empirical transaction evidence |

‚Äʬ†¬†¬†¬†¬† For most unit appraisals, it is difficult to identify comparable unit sales ‚Äʬ†¬†¬†¬†¬† For most unit appraisals, it is difficult to measure the cost less depreciation of the comparable units |

|

|

|

Matched pair sales comparison |

‚Äʬ†¬†¬†¬† Market-based analysis is based on empirical transaction evidence |

‚Äʬ†¬†¬†¬†¬† For most unit appraisals, it is difficult to identify matched pair sales (specifically a taxpayer unit matched pair sale) ‚Äʬ†¬†¬†¬†¬† It may be difficult to associate the before and after unit value decrease with economic obsolescence |

|

|

|

CILM |

‚Äʬ†¬†¬†¬† Actual profit margins and actual ROIs are based on empirical evidence ‚Äʬ†¬†¬†¬† Required profit margins and return on investments are based on empirical evidence ‚Äʬ†¬†¬†¬† Comparing the taxpayer ROI to the taxpayer cost of capital utilizes a perfect comparable |

‚Äʬ†¬†¬†¬†¬† It may be difficult to identify benchmarks for comparison ‚Äʬ†¬†¬†¬†¬† It may be difficult to identify benchmark time periods for comparison ‚Äʬ†¬†¬†¬†¬† At least one application of this method should be based on a return on (pre-economic obsolescence adjustment) cost approach value indication |

|

|

|

Inutility |

‚Äʬ†¬†¬†¬† Both actual and benchmark data are generally available at the taxpayer unit ‚Äʬ†¬†¬†¬† This ‚Äútextbook‚ÄĚ formula provides the appearance of precision |

‚Äʬ†¬†¬†¬†¬† The analyst may have to justify the rated or design capacity as an achievable benchmark ‚Äʬ†¬†¬†¬†¬† Scale factor exponent data are not always available ‚Äʬ†¬†¬†¬†¬† This method can be associated with either functional obsolescence or economic obsolescence ‚Äʬ†¬†¬†¬†¬† The 100% variable cost assumption is usually not valid; so this method may understate the measurement of economic obsolescence ‚Äʬ†¬†¬†¬†¬† Unit product/service price decreases usually accompany unit product/service volume decreases; therefore, so profit margins and returns on investment typically decrease at a greater rate than does the utilization decrease. |

|

All Cost Approach Methods Should Conclude about the Same Value

There should be one synthesized value conclusion for the taxpayer unit. There should be one synthesized unit value conclusion developed by the cost approach. All cost approach appraisal methods should conclude mutually supported unit value indications. The different cost approach appraisal methods should not conclude with materially different unit value indications.

While cost metrics may vary between the various cost approach appraisal methods, the depreciation measurement metrics should also vary between the cost approach appraisal methods. In particular, the economic obsolescence measurements should vary between the various cost approach appraisal methods‚ÄĒand bring the various method unit-level value indications in line with each other. This concept of offsetting cost metrics and offsetting depreciation/obsolescence metrics is illustrated in Exhibit 4.

Exhibit 4: Illustrative Example of Depreciation Metric Changes to Offset Cost Metric Changes

|

|

|

Cost Approach Valuation Variables |

HCLD Method |

RPCNLD Method |

RCNLD Method |

|

|

|

A |

Taxpayer property cost metric |

$1,200,000 |

$1,800,000 |

$1,500,000 |

|

|

|

B |

Physical depreciation [1] |

500,000 |

600,00 |

600,000 |

|

|

|

C |

Functional obsolescence [2] |

100,000 |

200,000 |

0 |

|

|

|

D |

Cost less PD less FO (A ‚Äď B ‚Äď C = D) |

600,000 |

1,000,000 |

900,000 |

|

|

|

E |

Unit operating income |

50,000 |

50,000 |

50,000 |

|

|

|

F |

Actual unit ROI (E ¬ł D) |

8.3% |

5% |

5.6% |

|

|

|

G |

Required unit ROI (cost of capital) [3] |

10% |

10% |

10% |

|

|

|

H |

Return deficiency (rounded) (G ‚Äď F) |

1.7% |

5% |

4.4% |

|

|

|

I |

Income deficiency (rounded) (H √ó D) |

10,000 |

50,000 |

40,000 |

|

|

|

J |

Capitalization rate [3] (= G) |

10% |

10% |

10% |

|

|

|

K |

Capitalization of income loss (EO = I ¬ł J) |

100,000 |

500,000 |

400,000 |

|

|

|

L |

Value indication (rounded) (D ‚Äď K = value) |

$500,000 |

$500,000 |

$500,000 |

|

|

|

EO = Economic obsolescence [1] Effective age varies based on the benchmark cost metric. |

|

||||

|

|

[2] Functional obsolescence varies compared to the benchmark; the ideal replacement unit may have no functional obsolescence. |

|

||||

|

|

[3] Capitalization rate = the taxpayer’s cost of capital (assumes a 0 percent expected long-term growth rate as a simplifying assumption). |

|

||||

The different cost approach appraisal methods assume different benchmark units of operating property. These different benchmark property units typically manifest different depreciation components. Typically, the changes in the benchmark depreciation components approximately offset the changes in the benchmark cost metrics. Accordingly, alternative cost approach appraisal methods should conclude generally comparable values for the same operating property unit.

Capitalization of Income Loss Method Principles and Procedures

The CILM quantifies the first principle of economic obsolescence measurement. That is, economic obsolescence considers the difference between:

- the actual economic condition of the taxpayer unit and

- the required (or the market participants’ opportunity return) economic condition of the taxpayer unit.

The difference in the taxpayer unit’s actual economic condition versus required (i.e., market participant) economic condition can be measured by the following:

- Profit margins

- Returns on investment

- The individual components of either of these two margin or return financial fundamentals, including the following:

- Price or volume changes for goods and services produced by the unit

- Prices of materials, labor, or overhead consumed

- Changes in capital asset or working capital investments

- Changes in income tax rates

- Changes in cost of capital components

- Regulatory changes affecting the taxpayer unit’s operations

The difference in the taxpayer unit’s profit margin can be measured different ways through various income or cash flow components, including the following:

- Before or after tax

- Before or after debt service

- Before or after nonoperating expense

- Dollar revenue or per unit revenue

- Dollar expense or per unit expense

- Market size, market share, or market demand

The difference in the taxpayer unit’s return on investment can be measured different ways through various income, cash flow, or investment components, including the following:

- Return

- Before or after tax

- Before or after debt service

- Before or after nonoperating expense

- Any revenue or expense metric

- Growth rate for any of the above return components

- The cost of capital

- Investment

- Gross tangible assets

- Net tangible assets

- Current value of tangible assets

- Total assets

- The owners’ equity

- Total invested capital (owners’ equity plus long-term debt)

The benchmark for the taxpayer unit’s economic condition performance can be any benchmark that is not (or is less) influenced by economic obsolescence, including the following:

- Guideline public companies

- Specific competitor companies

- Industry trade association data

- The industry cost of capital metric

- The unit’s cost of capital metric

- The unit’s historical results of operations (before economic obsolescence impact)

- The unit’s prospective results of operations (without economic obsolescence impact)

- Taxpayer management or industry expectations at the time of a taxpayer unit investment

The benchmark level of economic performance can be any benchmark that is not (or is less) influenced by economic obsolescence, including the following:

- Mean, median, or other central tendency measures

- Top 25 percent or top 10 percent of the benchmark data array

- The highest data point in the benchmark data array (e.g., the top performing company or the best performance time period)

If the taxpayer‚Äôs industry is generally impacted by economic obsolescence, then the use of mean or median benchmarks will typically understate the economic obsolescence measurement. This is because the mean or the median benchmark metrics themselves will be impacted by the existence of industry-wide economic obsolescence. When economic obsolescence impacts the benchmark metrics, then it may be appropriate to use the top performing data point (e.g., the top 10 percent or the top individual company) to measure the unit-level economic obsolescence. This is because market participant investors will require the achievable economic metrics produced by the top performer in the taxpayer‚Äôs industry‚ÄĒthat is, the benchmark that is not (or is least) impacted by the industry-wide economic obsolescence.

The Capitalization of Income Loss Method Simplified Illustrative Example

This section provides an example of the CILM. There are numerous specific applications of the CILM, but they all involve some quantification of either a profit deficiency, a return deficiency, or some other measure (price decrease, cost increase, volume decrease, etc.) of income deficiency. The CILM is a frequently applied economic obsolescence measurement method in a unit principle appraisal developed for state and local tax planning, compliance, or controversy purposes.

In this example, let’s assume that the cost approach concludes the following results:

Unit cost metric (however defined)       $200 million

¬†‚Äst¬† Physical deterioration¬†¬†¬†¬†¬†¬†¬†¬†¬†¬†¬†¬†¬†¬†¬†¬†¬†¬†¬†¬†¬†¬†¬†¬†¬†¬†¬†¬†¬†¬† 80 million

¬†‚Äst¬† Functional obsolescence¬†¬†¬†¬†¬†¬†¬†¬†¬†¬†¬†¬†¬†¬†¬†¬†¬†¬†¬†¬†¬†¬†¬†¬†¬†¬† 20 million

¬†=¬†¬† Cost less physical depreciation (‚ÄúPD‚ÄĚ)¬† $100 million

¬†¬†¬†¬†¬† less functional obsolescence (‚ÄúFO‚ÄĚ)

In this example, let’s assume the following unit-level operating results:

Representative operating cash flow              $6 million

(may be the unit-level historical average or the unit’s expected next period operating results)

Let’s assume the following actual unit-level economic condition:

Representative operating cash flow           $6 million

÷   Unit cost less PD less FO investment      100 million

=   Actual unit-level return on investment                 6%

Now, let’s assume the following required (or market-participant-derived) unit-level economic condition:

Unit weighted average cost of capital                                                                      12%

¬†‚Äst¬†¬†¬† Expected long-term growth rate in the selected income metric¬†¬†¬†¬†¬†¬†¬†¬†¬†¬†¬†¬†¬†¬†¬†¬†¬†¬†¬†¬†¬†¬†¬†¬†¬†¬†¬†¬†¬†¬†¬†¬†¬†¬†¬† 2%

=     CILM direct capitalization rate (i.e., the required income return on investment)         10%

Based on these hypothetical data, let’s develop the following unit-level economic obsolescence measurement:

Required income return on investment (i.e., direct capitalization rate)                  10%

¬†‚Äst¬† Actual unit-level return on investment¬†¬†¬†¬†¬†¬†¬†¬†¬†¬†¬†¬†¬†¬†¬†¬†¬†¬†¬†¬†¬†¬†¬†¬†¬†¬†¬†¬†¬†¬†¬†¬†¬†¬†¬†¬†¬†¬†¬†¬†¬†¬†¬†¬†¬†¬†¬†¬†¬†¬†¬†¬†¬†¬†¬†¬†¬†¬†¬†¬†¬†¬†¬†¬† 6%

=   Rate of return on investment deficiency (i.e., income loss)                                    4%

Rate of return on investment deficiency                                                               4%

÷   Required income return on investment (i.e., direct capitalization rate)                  10%

=   Economic obsolescence measurement percentage                                               40%

Using the same data, let’s consider an alternative economic obsolescence measurement follows:

Unit cost less PD less FO                                                                      $100 million

×   Required income return on investment (i.e., direct capitalization rate)                  10%

=   Required unit-level income metric                                                          $10 million

Required unit-level income metric                                                          $10 million

¬†‚Äst¬† Actual unit-level representative operating cash flow¬†¬†¬†¬†¬†¬†¬†¬†¬†¬†¬†¬†¬†¬†¬†¬†¬†¬†¬†¬†¬†¬†¬†¬†¬†¬†¬†¬†¬†¬†¬†¬†¬†¬†¬† 6 million

¬†=¬†¬† Income loss (i.e., required income ‚Äď actual income = income loss)¬†¬†¬†¬†¬†¬†¬†¬†¬†¬†¬†¬†¬† $4 million

The following calculation presents one application of the CILM to quantify economic obsolescence:

Unit cost less PD less FO                                                                      $100 million

×   Economic obsolescence percentage                                                                   40%

=   Economic obsolescence dollar measurement                                            $40 million

The following calculation presents an alternative application of the CILM to quantify economic obsolescence:

¬†¬†¬†¬†¬† Income loss (i.e., required income ‚Äď actual income = income loss)¬†¬†¬†¬†¬†¬†¬†¬†¬†¬†¬†¬†¬† $4 million

÷   Direct capitalization rate                                                                                   10%

=   Economic obsolescence dollar measurement                                            $40 million

Based on the cost data and the CILM calculations, we can conclude the cost approach, as follows:

Unit cost less PD less FO                                                                      $100 million

¬†‚Äst¬† Economic obsolescence dollar amount¬†¬†¬†¬†¬†¬†¬†¬†¬†¬†¬†¬†¬†¬†¬†¬†¬†¬†¬†¬†¬†¬†¬†¬†¬†¬†¬†¬†¬†¬†¬†¬†¬†¬†¬†¬†¬†¬†¬†¬†¬†¬†¬†¬†¬†¬†¬†¬†¬†¬†¬†¬†¬† 40 million

=   Cost approach unit-level value indication                                                $60 million

Summary

The first of this four-part series summarized the concepts related to the unit principle of property appraisal. The unit principle is often applied to value a complex unit of special-purpose industrial and commercial property collectively. This unit principle appraisal is often applied for purposes of state and local property tax appeals and litigation.

Analysts often apply the cost approach to value complex, special-purpose property. Economic obsolescence is an important and often disputed issue in the cost approach analyses. This second part describes and illustrates the generally accepted methods of economic obsolescence measurement. The third part of this series will recommend responses to typical assessment authority objections related to economic obsolescence measurements in property tax appeals.

The opinions and materials contained herein do not necessarily reflect the opinions and beliefs of the author’s employer. In authoring this discussion, neither the author nor Willamette Management Associates, a Citizens Company, is undertaking to provide any legal, accounting or tax advice in connection with this discussion. Any party receiving this discussion must rely on its own legal counsel, accountants, and other similar expert advisors for legal, accounting, tax, and other similar advice relating to the subject matter of this discussion.

Robert Reilly, CPA, ASA, ABV, CVA, CFF, CMA, is a Managing Director in the Chicago office of Willamette Management Associates, a Citizens company. His practice includes valuation analysis, damages analysis, and transfer price analysis.

Mr. Reilly has performed the following types of valuation and economic analyses: economic event analyses, merger and acquisition valuations, divestiture and spin-off valuations, solvency and insolvency analyses, fairness and adequacy opinions, reasonably equivalent value analyses, ESOP formation and adequate consideration analyses, private inurement/excess benefit/intermediate sanctions opinions, acquisition purchase accounting allocations, reasonableness of compensation analyses, restructuring and reorganization analyses, tangible property/intangible property intercompany transfer price analyses, and lost profits/reasonable royalty/cost to cure economic damages analyses.

Mr. Reilly has prepared these valuation and economic analyses for the following purposes: transaction pricing and structuring (merger, acquisition, liquidation, and divestiture); taxation planning and compliance (federal income, gift, estate, and generation-skipping tax; state and local property tax; transfer tax); financing securitization and collateralization; employee corporate ownership (ESOP employer stock transaction and compliance valuations); forensic analysis and dispute resolution; strategic planning and management information; bankruptcy and reorganization (recapitalization, reorganization, restructuring); financial accounting and public reporting; and regulatory compliance and corporate governance.

Mr. Reilly can be contacted at (773) 399-4318 or by e-mail to RFReilly@Willamette.com.