The Future of the Business Valuation Profession

(Part II)

To look to the future of the BV profession, we must explore the relevant dynamics within the industry. That starts with looking to our past to see what events and milestones brought us to where we are today, followed by ascertaining the economic and demographic trends leading us into the future, and culminating with identifying those trends which will have the greatest impact upon the profession. NACVA set upon drafting a white paper that would provide valuable insight to the future of the business valuation profession, with Chris Mercer taking the lead who is known by nearly every person in the valuation industry.

Â

Business Valuation Credentialing Organizations

With the evolution of the business valuation profession beginning in the 1970s, credentialing and education have continually grown in importance. The American Society of Appraisers (ASA) was the first organization to provide credentials for business appraisers (synonymous with valuators). It was soon followed by the Institute of Business Appraisers (IBA). The National Association of Certified Valuators and Analysts (NACVA) entered the picture in 1991.

The development of the valuation profession has been integrally tied to its credentialing organizations, and the future of the profession will continue to be influenced by trends in the evolution of these organizations.

The primary U.S. based business valuation credentialling organizations are:

- American Society of Appraisers (ASA), a multi-discipline credentialling organization

- National Association of Certified Valuators and Analysts (NACVA)

- American Institute of Certified Public Accountants (AICPA)

Statistics from the credentialling organizations are not always available or complete. The data shown in this paper is the best available and most current as of this writing. The opinions and forecasts expressed are those of the author.

The American Society of Appraisers (ASA)

Overview

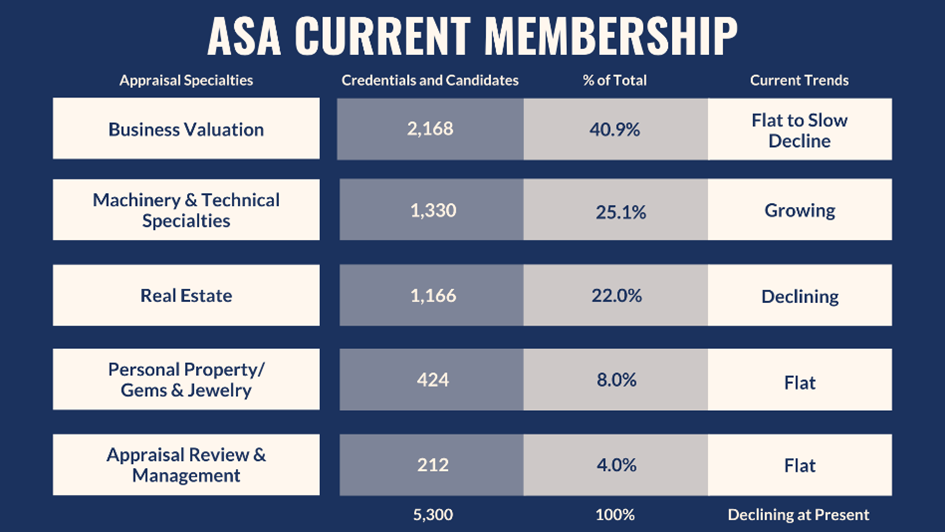

The American Society of Appraisers started in 1939 when two technical societies merged to create one organization. The ASA provides credentialing and education programs to its members in the following disciplines: Appraisal Review and Management, Gems and Jewelry, Machinery and Technical Specialties, Personal Property, Real Estate, and Business Valuation. Our focus, of course, is on business valuation, which is the largest discipline within the ASA. The current composition (as of 2nd quarter, 2021) of the ASA credentialed members and candidates is shown in the following figure:

The multi-disciplinary nature of the ASA may have been a strength at one time. When the author joined in 1987, the largest discipline was real estate. Consequently, real estate members dominated its leadership. At that time, their business valuation membership was in second place, and the machinery and technical specialties membership was a distant third.

Business valuation became the largest discipline within the ASA membership in the 1990s. Steady growth in the machinery and technical specialties has pushed it to the number two spot.

With the emergence of state licensing requirements for real estate appraisers, the perceived value of an ASA real estate credential began to decline. Enrollment in the real estate discipline of the ASA declined as well, pushing it down to the third spot where it has resided for some years.

The ASA was the leading business valuation credentialing organization through the late 1990s, but it did not take advantage of this lead to adapt to the needs and trends of the burgeoning business valuation industry. In the early 1990s, the ASA was the leading provider of educational services to the profession. Courses were taught throughout the United States and around the world. Though the business valuation discipline generated substantial funds through educational activities, those funds were diverted to other disciplines within the ASA and were not reinvested in the business valuation discipline to foster growth.

The structure as a multi-disciplinary society has been detrimental to the growth of the business valuation discipline for the ASA. The leaders within the discipline were essentially left on their own to promote the program without adequate staff support and financial resources.

While initially the leader in the business valuation discipline, competition arose that has diminished the relative importance of the ASA as a provider of business valuation credentials and training. Competition came when the NACVA entered the arena in 1991, and continued as the AICPA began to offer its ABV (Accredited, Business Valuation) credential in 1998.

With emerging competition and marketing lethargy, growth of the ASA’s business valuation discipline has been flat, and more recently in slow decline. The number of credentialed and candidate members peaked at 2,450 in 2017 and stood at 2,168 as of March 2021. The actual number of credentialed valuators has hovered in the range of 1,500 for the last decade.

Predictions for the American Society of Appraisers

- The multi-disciplinary nature of ASA has been and will continue to be a detriment to the future growth of the business valuation discipline.

- The business valuation discipline can hold its own for a few years with 1,400–1,500 credentialed appraisers but outlook for growth is not strong, particularly in light of its aging membership.

- Competition from the larger AICPA and well entrenched NACVA is intense and will inhibit efforts to grow.

- Unless something dramatically changes, the relative importance of the ASA as a credentialing organization will continue to decline.

To learn more about the ASA, click here.

The National Association of Certified Valuators and Analysts (NACVA)

Overview

NACVA was founded in 1991. Its founders recognized that business valuation was a growing field and that the market for credentialing business valuation professionals was underserved. Over the past 30-plus years, NACVA has grown to become the largest business valuation credentialling organization in the country. Co-founder Parnell Black is its current CEO.

At NACVA’s founding, the only two competing credentialling organizations were the ASA and the Institute of Business Appraisers (IBA). The ASA had approximately 1,500 credentialed members at that time, and the IBA had significantly fewer credentialed members, though the IBA had between 2,500–3,000 members.

NACVA initially offered its business valuation credential, Certified Valuation Analyst (CVA), to CPAs who wanted to pursue business valuation work. The field was fertile, and NACVA saw early success with its education and credentialling programs.

NACVA subsequently established a global model for education, training, credentialing, and recertification. Early in its history, NACVA was thought of as irrelevant by many well-known names in the industry and viewed as lacking credibility because NACVA is a for-profit association. With its significant growth, that perception is changing.

During the 1990s, NACVA developed what was considered by many a marketing and educational machine to grow its membership. While the ASA diverted resources from the business valuation discipline to other disciplines, NACVA reinvested heavily in focused efforts to grow its business valuation programs and expand into financial forensics and litigation training, and eventually developed a financial forensics certification, the Master Analyst in Financial Forensics. (MAFF).

The constituency for NACVA started with CPA business advisory practitioners and new entrants to the profession, but approximately seven years later they added financial forensics and litigation support to the mix. Over the last decade, seeing its membership aging, NACVA brought deliberate marketing focus for education and credentialling to the younger generation.

In the late 1990s and early 2000s, NACVA recognized that there was demand for a valuation credential for non-CPA business advisors, thus, the Accredited Valuation Analyst designation (AVA) was created. Prior to that period, NACVA entered into an arrangement to train and certify IRS engineers in business valuation. As part of that program, the Government Valuation Analyst designation (GVA) was created.

The requirements for earning the CVA and the AVA/GVA designations were essentially the same. CPAs could earn the CVA and non-CPAs with two years of valuation experience could earn the AVA certification, and similarly for government employees, the GVA certification. For many years, the ratio of candidate growth for the CVA and AVA/GVA was about 50/50.

Recognizing there was confusion in the market between the CVA and the AVA/GVA designations, NACVA began a discussion with its membership to consider merging the AVA/GVA designations into the CVA. This matter was fully aired to the membership over a period of years. Approval to merge the designations was ultimately granted by NACVA’s Valuation Credentialing Board in the early 2010s. This merging of the AVA/GVA designations into the CVA designation occurred in 2013 with 95% general approval of the membership.

NACVA adopted a strategy for international growth in the mid-2000s when it helped create the European Association of Certified Valuators and Analysts (EACVA). EACVA offers the CVA designation in Europe, along with various forms of professional development and training. EACVA is NACVA’s strongest chapter among seven international chapters. The international arena will be a source of future growth for NACVA. At present, EACVA has over 800 members.

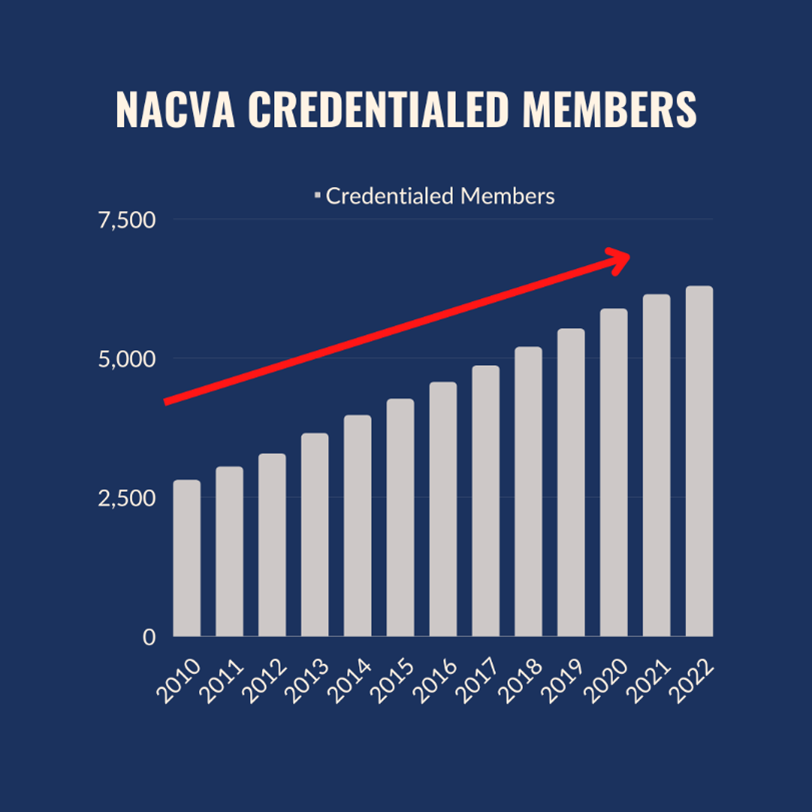

With the global growth of business valuation, the Global Association of Certified Valuators and Analysts (GACVA) was born. The net result of NACVA’s activities and growth initiatives has been a steady growth in credentialed members over many years.

NACVA is focused on meeting the needs of its members through training and a wide variety of programs.

NACVA’s credentialed member base grew from 2,808 in 2010 to 6,297 in 2022. This total includes members of EACVA, NACVA’s European Chapter. Though the newest entrant to the valuation credentialling field, coming about after the ASA and IBA, NACVA now has more credentialed valuators than all the other organizations combined, including the AICPA (see below).

Predictions for the NACVA

- Expect NACVA to continue to grow in membership because it has the programs, people and resources in place to make it happen.

- Recognition for the CVA designation will continue to grow, helped by the fact it is accredited by the NCCA and ANAB.

- Potential for merger with AICPA or RICS, major industry players, or other effective transition of ownership.

- Will continue to be the dominant provider of education/training services among valuation and financial forensics credentialing organizations.

- NACVA, through its GACVA, will continue to grow internationally.

To learn more about NACVA, click here.

The American Institute of Certified Public Accountants (AICPA)

Overview

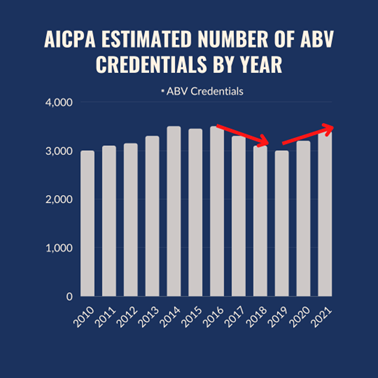

The AICPA developed its business valuation certification program in 1997. The first examinations for CPAs to earn the Accredited in Business Valuation (ABV) credential were held that year with the first credentials awarded in 1998. The new credential was well-received by CPAs who were already business valuators and who desired a credential, as well as by CPAs wanting to enter the field and make this part of their practices.

Historical figures as to the number of ABV credential holders is not available. However, we do know the ABV designation caught on rapidly with CPAs. Unconfirmed estimates in 2010, suggested there were in the range of 2,500–3,000 ABVs. Further, in 2015, a reliable source reported there were 3,274 ABVs, and in 2018, this number had declined to about 3,000 ABVs. Note, consistent with its historical disclosure policies, the AICPA declined to provide any historical or current membership statistics.

By all appearances, the designation was in slow decline when, in June 2018, the AICPA suddenly, and without approval or forewarning from then-existing CPA/ABVs, announced that the ABV credential would be available to non-CPAs going forward. This caused considerable consternation among some established CPA/ABVs, and an unknown number of CPA/ABVs did not renew their credential in 2018 and 2019.

The AICPA has taken steps to assure its members that radical changes like these will not occur in the future and is focused on communication and reconciliation with the CPA/ABV population.

It is assumed that the AICPA wanted to make its ABV credential available to the many business valuators who work for the largest CPA firms who are not CPAs. In addition, there was (and is) a desire to provide an attractive credential to the younger generation of prospective valuators given the aging population of the credentialed base, and a decline in entrants to the CPA profession. Individuals holding the CFA designation and certain other valuation credentials are offered an easier path to the ABV designation than candidates not holding any credentials.

According to Eva Simpson, Director: Valuation Services of the AICPA, the future for the ABV credential is to stay at the forefront of quality for the credential and education, and to maintain relevancy within the ABV community.

Predictions for the AICPA

- The number of ABVs will grow.

- In some respects, the ABV is the easiest credential to obtain, and the credibility of the designation is considered high because of the AICPA brand and its support of the credential.

- Educational and training options will expand.

- AICPA business valuation conferences will be heavily attended, and the quality of programs will continue to improve.

- The AICPA will see the CFA market as a way to build its ranks of ABVs.

To learn more about the AICPA, click here.

Potential Growth of the Profession

Growth of the ASA, NACVA, and AICPA

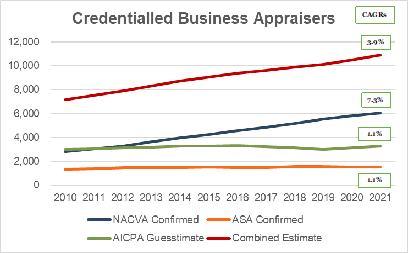

Combining the historical information on the ASA, the AICPA, and the NACVA, we get a picture of combined growth in the number of credentialed business valuators, as seen in the following figure.

This picture does not consider the fact that many business valuators hold multiple credentials, which overstates the total numbers. The CFA designation is not included in the graph because of the lack of any statistics on CFA holders who practice business valuation. Adding CFAs and other non-credentialed valuators would increase the total number of practitioners, perhaps considerably.

The future of the business valuation credentialing organizations in the U.S. will be driven by education and other services these organizations provide to their members, along with their abilities to market and promote the benefits of their credentials and to provide organizational support to existing and new members.

To learn about the predictions for growth of the profession, click here.