The Well-Written Business Valuation Report

Structured, Clear, and Well-Researched and Reasoned

In a litigation setting, a well-written business valuation report can position your conclusion of value as credible. When completed for tax purposes, a well-written business valuation report can help avoid an IRS challenge. In any circumstances, a well-written business valuation report can provide the business owner with ways to increase cash flow and reduce risk. After business appraisers learn information about a business, research the economy and applicable industry(ies), analyze the financial statements, and estimate the value of the business, the work is captured in a report. In many cases, it is the business appraiser’s only work product and arguably the most important step in the appraisal process. This article will discuss report writing from three perspectives: structure, clarity, and quality/efficiency.

Introduction

In a litigation setting, a well-written business valuation report can position your conclusion of value as credible. When completed for tax purposes, a well-written business valuation report can help avoid an IRS challenge. In any circumstances, a well-written business valuation report can provide the business owner with ways to increase cash flow and reduce risk.

After business appraisers learn information about a business, research the economy and applicable industry(ies), analyze the financial statements, and estimate the value of the business, the work is captured in a report. In many cases, it is the business appraiser’s only work product and arguably the most important step in the appraisal process. This article will discuss report writing from three perspectives: structure, clarity, and quality/efficiency.

Structure

The structure of our reports is largely dictated by report writing standards. The report writing standards that you have to follow depend on the certification(s) that you obtain:

- A Certified Valuation Analyst (CVA) must follow the NACVA Professional Standards.

- A CPA Accredited in Business Valuation (ABV) must follow the AICPA’s Statement on Standards for Valuation Services or SSVS.

- An Accredited Senior Appraiser (ASA) must follow the Uniform Standards of Professional Appraisal Practice (USPAP).

As a practical matter, the IRS accepts reports that comply with the above standards. So, if you are a CVA, you must comply with NACVA reporting standards, and so on.

The various business valuation reporting standards are very similar and are based on Revenue Ruling 59-60, which has been around since 1959. For the purposes of this article, I will discuss the NACVA report writing standards.

Report Types

Under NACVA standards, there are three types of reports. They include detailed reports, summary reports, and calculation reports. Reports can be written or oral. We rarely prepare oral reports and I will discuss the reasons for that later in this article.

Detailed Reports

Detailed reports include all the information that would allow the reader to understand how the appraiser reached his or her conclusion of value. They can be used for any type of reporting.

The required sections of a detailed report include:

- Letter of transmittal

- Table of contents

- Introduction

- Sources of information

- A description of fundamental analysis. This section includes important qualitative and quantitative information on the company, an analysis of the industries that affect the company, and the economic conditions that affect the company. It includes all the calculations necessary to arrive at your conclusion of value.

- Assumptions and limiting conditions. A representation qualification of the appraiser and financial schedules are generally included in appendices.

Summary Reports

A summary report is a concise version of a detailed report. All of our reports of a full appraisal are summary reports. In these reports, we include all the information important to that appraisal. The Description of the Fundamental Analysis in our summary reports is broken down as follows:

- Company overview

- Financial analysis

- Economic analysis

- Industry analysis including a qualitative and quantitative analysis

- Valuation calculations

- Conclusion of value

- Assumptions and limiting conditions that are specific to the company

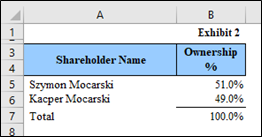

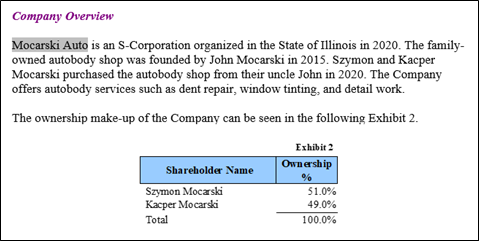

The company overview should give the reader an understanding of the business model and any other company specific factors that may have an impact on value. The financial analysis includes important company trends and an explanation of those trends. The industry analysis should include a discussion of the industry the company is in and any other industries that have a major impact on the company. The valuation calculations include all approaches used to value the company and should be supported by the company, financial, industry, and economic sections. Many of the assumptions and limiting conditions are generic; however, if an assumption is specific to a particular company, we include it in the fundamental analysis.

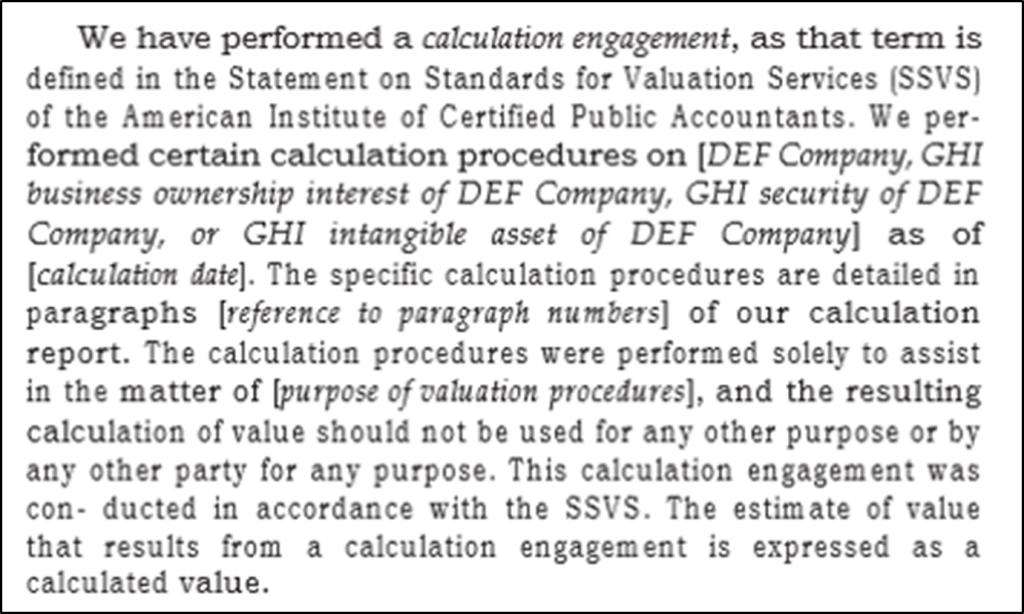

Calculation Reports

The scope of calculation reports is agreed upon between the client and the appraiser. The report must clearly state that had a full appraisal been done, the estimated value may have been different.

This type of report can be used where an estimate of value is needed for estate planning, for facilitating a settlement in litigation prior to trial, and for providing a business owner with an estimated value for purposes of negotiating a sale of the company.

Written vs. Oral Reports

A business valuation report can be written or oral. The concern I have with oral reports is that you lose a check on the quality of your assumptions … it is not unusual for me to change an assumption when I am writing a report because I am not satisfied with it when I try to explain it in writing. I am also concerned that the audience may not understand or may forget important aspects of the information conveyed in an oral report. As a result, we rarely use them.

Litigation Reports

Reports prepared for litigation are exempt from NACVA reporting standards. We include an executive summary in our litigation reports. This is where you can tell a story about the company; is it in decline, is it thriving, is future cash flow subject to significant risks? This summary can help you prepare for testimony.

More detail on NACVA reporting requirements can be found at c.

Clarity

Most of the users of our reports include attorneys, business owners, judges, and other non-financial people. Write the report for your audience. We use several guidelines geared toward improving the clarity of our reports.

Be Objective

We use objective sources as the basis for many of our assumptions. For example, we frequently use the inflation and GDP forecasts issued by the Philadelphia Federal Reserve (Livingston Survey) and IBIS World industry forecasts when developing our assumptions.

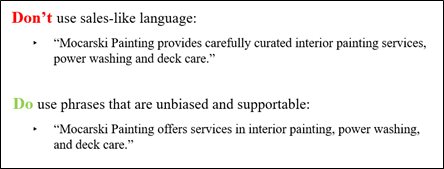

A business valuation report is not the place to sell a company. Avoid using verbiage directly from the company website. As shown in the following example:

Keep it Simple

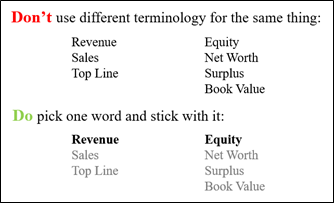

Avoid using different technical terms for the same reason. As shown in the following example:

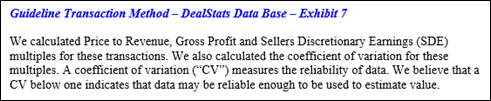

Do not explain complex formulas and the like to the audience. Just tell them what it is used for. The following example illustrates how we handle using the coefficient of variation in the Guideline Transaction Method:

Establish a Foundation

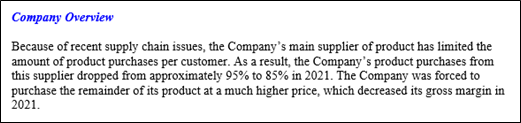

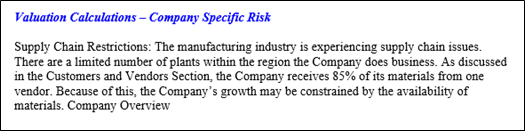

Key valuation assumptions should have strong support in the company specific assumptions and limiting conditions, company overview, financial analysis, and economic and industry analysis. For example:

Use Visual Aids

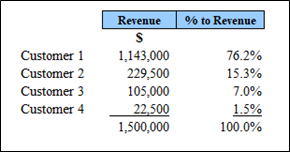

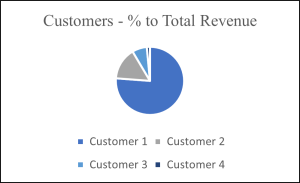

Use visual aids such as line, bar, and pie charts to communicate. For example, the following schedule can be illustrated in a pie chart to more clearly communicate that the company has a very large customer:

Quality/Efficiency

A strong report writing process can help your organization produce reports more efficiently and help to decrease the errors in your reports. We use boilerplate and mechanize for the report writing process to achieve these goals. And, of course, carefully proofread every time you make a change!

Boilerplate

The effective use of boilerplate can help to speed up your report writing. Boilerplate is any text that is consistent from report to report or is consistent among reports using the same methods. It can be your own, or in some cases, boilerplate can be obtained from reporting standards. The following boilerplate that we use is taken from the SSVS:

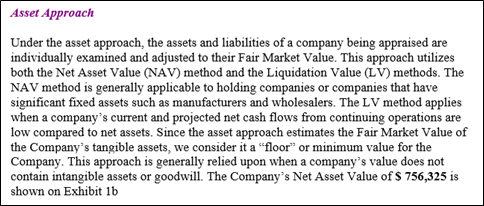

The introduction of an approach or a method in a report can be boilerplate. The following boilerplate is what we have developed to introduce the Asset Approach:

Wherever possible, try to make it easy for the non-financial person to understand it. For example, we never use formulas in our boilerplate.

Mechanization

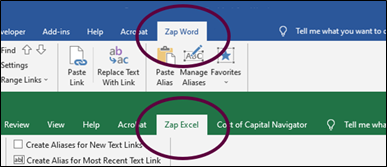

Early in my business valuation career, I tried to tie Microsoft Excel and Word together and crashed my computer. A lot has changed since then. ValuSource has just introduced the ZapReport Builder which provides the functionality to connect our Excel schedules to our Word documents. My firm has just begun using this product and we are very excited about the things that we can do with it. Â

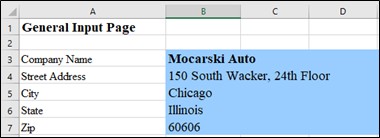

The program allows you to link cells on your Excel model to your Word document in multiple ways. Once you download ZapReport Builder, it is added to your Microsoft ribbon on Excel and Word.

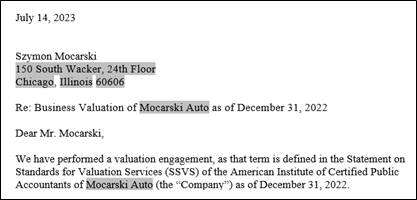

Through the ribbon, you can create links to specific Excel cells, ranges, and charts, and paste those links into multiple places on your Word document.

Auto-updating pictures of Excel exhibits can be placed in your Word documents as shown below:Â

Conclusion

I would like to leave readers with a few things to remember. Obviously, you must follow report writing standards … that is a given. The users of your reports are, for the most part, going to be non-financial people, so write your reports for them. If you must describe some technical term or metric, tell the reader what it is used for, not how to build it. Do not sell the company. Include enough information so the reader can understand the business model and important valuation considerations, such as the risk associated with having a large customer. Do not use financial terms interchangeably; pick a term and stick with it. Establish a foundation for your valuation calculations before you get to them. Base your work on authoritative sources wherever possible. Use boilerplate and mechanize where possible.

Katherine Puffer, MBA, CPA, ABV, is the founder and managing director of VH Valuations. Her firm is located in Chicago and specializes in business appraisals and damage estimates for litigation and taxes. She is a CPA and is Accredited in Business Valuation by the American Institute of Certified Public Accountants. She holds an MBA from the University of Chicago and has completed the banking program at the University of Wisconsin.

Ms. Puffer can be contacted at (312) 235-2866 or by e-mail to kpuffer@vhvaluations.com.