Challenges for Expert Witnesses Valuing Private Equity and Hedge Fund General Partner Interests in Divorce Matters

When You are Retained by Counsel for the Out-Spouse

Valuing private equity and hedge fund general partner interests is a complex matter. Valuing them in a divorce proceeding can be an even more complex matter. The focus of this article is to share the challenges valuators may face when engaged to value general partner interest in private equity and hedge fund businesses in divorce matters when NOT engaged by the business owner’s legal counsel.

Valuing private equity and hedge fund general partner interests is a complex matter. Valuing them in a divorce proceeding can be an even more complex matter. And, when you are retained by counsel for the non-business owner in a divorce proceeding, your job can become significantly more challenging.

While we will address valuation matters a bit, doing so in-depth is beyond the scope of this article. Our focus here is to convey to you the challenges you could face when engaged to value general partner interest in private equity and hedge fund businesses in divorce matters when you are NOT engaged by the business owner’s legal counsel. Additionally, our comments in this article are limited to our own experiences. I am sure others will have had differing experiences in doing this type of work.

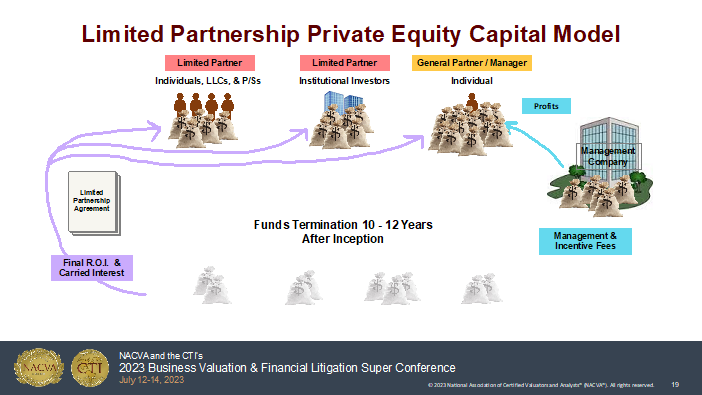

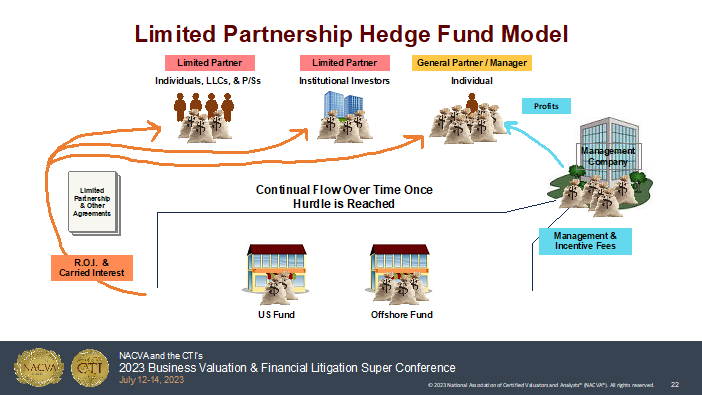

Private equity funds and hedge funds differ in their structure and operation. Private equity funds have a stated life of usually 10 to 12 years. Hedge funds are perpetual; they do not end unless the general partner closes the fund.

Private equity funds and hedge funds do have many similarities, including:

- A limited partnership is created;

- A general partnership is created, owned by the general partner(s), which can be one individual or a group of individuals;

- The general partner is usually comprised of one or more business savvy individuals;

- The limited partners are high income individuals or institutional investors;

- A management company is formed, which is owned by the general partner individuals;

- A significant amount of money is raised (say $100,000,000) for a given fund, 1% of which is raised by the general partner and 99% is raised by the limited partners;

- The fund’s capital is invested in various types of debt and equity securities;

- A guaranteed rate of return, sometimes called a hurdle rate, is provided for both the general partner and the limited partner;

- Management fees ranging from 1.5% to 2% of assets under management are paid to the management company for managing the fund’s investments;

- Incentive fees and bonuses are provided for the general partner/manager;

- Often times, “side agreements” are created to benefit the general partner/manager during the life of the fund;

- If the fund is successful and generates a rate of return greater than the guaranteed rate, the general partner is paid a carried interest of approximately 20%; and

- While the limited partners invest 99% of the capital, they only receive 80% of the profits.

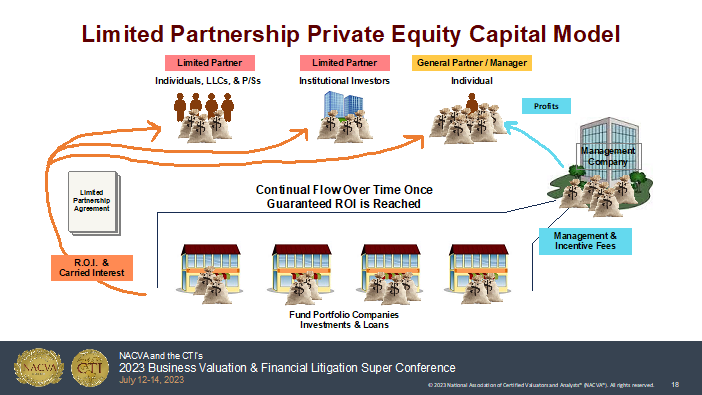

Below is a graph of how money flows in a typical private equity fund structure taken from our presentation in Salt Lake City, UT in July 2023 at the NACVA and the CTI’s Business Valuation and Financial Litigation Super Conference.

While the carried interest is not paid until late in the game in a private equity fund, it is paid continually over time in a hedge fund as shown in the graph below.

When a valuator is initially approached to value a general partner interest in a private equity fund or hedge fund, it is important to first determine whether you are qualified to do it or can get qualified as required by the professional standards governing your work and Rule 702 (either the federal rule or the state rule of your case jurisdiction). The applicable professional standards will depend on what credential(s) you own. Text resources are widely available as are webinars and training courses. The American Institute of CPAs (AICPA) published the AICPA Accounting & Valuation Guide: Valuation of Privately-Held-Company Equity Securities Issued as Compensation, which includes relevant guidance within SSVS No. 1 that is useful in valuing private equity fund general partner interests. Vladimir Korobov presented in 2019 at a NACVA conference that is very helpful when valuing hedge fund interests.

One of the best sources for achieving competence when doing something for the first time can come from your network of professional contacts. Valuators can become competent by consulting with someone else in doing their work and preparing the report. For this reason, I have made it a priority to attend the annual NACVA conference in-person and other national conferences. Through my attendance at these annual events, I have built a network of highly competent professional friends who are only a text, phone call, or e-mail away, and they have helped me greatly over the years when I need reassurance about the work I am doing.

When valuing private equity and hedge fund interest, valuators need a lot of documents. For the fund itself, valuators will need the audited financial statements for several years, SEC filings, the limited partisanship agreement, and amendments thereto, side agreements, fee waiver agreements, organization charts, capital contributions, capital calls, rate of return projections, and others. For the general partnership and management company, you will need articles of incorporation and bylaws, organization charts, unaudited financial statements and tax returns for several years, operating agreements and amendments thereto, any and all other agreements, and general ledgers for the years being reviewed. You will also need the general partner/manager’s personal tax returns.

One of the biggest problems we have seen in our work in this area is the difficulty in getting the documents that you need. We are limited to what retaining counsel can do to help us get what we need. Obstacles we have encountered include:

- Refusal by the individual GP to produce requested documents;

- Refusal by the business entity to produce requested documents;

- Hide and Seek (burying important documents in unrelated multi-page pdfs);

- “We already gave it to you” arguments;

- Multi-thousand page pdfs;

- Motions to quash;

- Motions to compel (sometimes in other states too);

- Multi-state issues on subpoenas;

- Appeal after appeal after appeal;

- Drowning one side in discovery requests;

- Drowning one side in unhelpful documents;

- Manipulating document production;

- Requirement for protective orders;

- Form of data (printouts, doctored files);

- Third-party practice in lawsuits (LPs/other involvement);

- “Does not exist” arguments; and

- “Not authorized to provide” arguments.

In one matter, we encountered a general partner who bifurcated the LLC ownership interest, sold the equity interests to newly formed entities domiciled in Delaware that he controlled, yet claiming that he no longer owned the interests.

We have also encountered fraud schemes that were implemented to hide or conceal the truth, including:

- Incomplete general ledgers;

- General ledgers with just one cash account while many existed;

- No revenue and expense detail in the general ledgers;

- Condensed capital accounts so you cannot see the capital accounts activities for the partner interest being valued;

- General ledger exports without explanatory descriptions;

- Fabricated financial statements;

- Financial statements that have the inscription “audited” but are not actually audited by a CPA firm;

- Trusts formed in asset protection states and owner interests transferred there (Alaska is the No. 1 most restrictive asset protection state, Nevada is another, there are about eight more); treaties among states sometimes make it possible to break out-of-state trusts but this is not easy; and

- Be aware of the Uniform Voidable Transactions Act (federal and state statutes) if you encounter ownership interest transfers to asset protection states.

The Legal Side

This specific valuation work is document-intensive, analysis-intensive, and application of law intensive. In hedge funds and private equity interests, even more so than “regular” divorce valuations, the stakes are high, the access to information is coveted, and the number of roadblocks are plentiful. It is important for the valuation expert to have a close working relationship with the attorney and regular meetings to ensure all avenues of value are properly vetted during the process instead of at the end. The roadblocks mentioned can be addressed with constructively drafted confidentiality agreements and court protective orders. In the role of an expert, valuators have probably encountered or drafted plenty of “good” orders. Sharing this information with your attorney can speed up gathering the much-needed information. For example, a good order may allow counsel for the out-spouse to interview the general partner and limited partners without the need for a formal deposition. This can lead to a more relaxed conversation that allows the expert to gain better insight into the workings of the funds and the involvement of the owner-spouse.

Another strategy that both expedites information gathering and streamlines the process is suggesting arbitration to the attorneys. Arbitration entails many advantages:

- Protection of information. The process is confidential and not open to the public. The document records and proceedings, while recorded, are not available to the public. The ultimate valuation result can also remain protected from the prying eyes of competitors.

- Streamlining the process. Arbitration allows parties, experts, witnesses, and even the “hired judge” to work on personal schedules instead of the whim of the courthouse, and without being subject to other cases being on the calendar. The arbitrator has specific availability that is blocked off in advance, and typically the arbitrator’s schedule is more readily available than the court system. The nature of the proceedings is in someone’s office instead of in the open-forum courtroom. The ability to “come-and-go” as you please is more readily available. Often, many conference rooms are reserved for breakout sessions in the event of potential settlement or side-bar discussions. Finally, the technology available at someone’s office is more likely to be advanced versus the courthouse.

- Bringing more certainty to the result. The nature of arbitration is essentially picking your own judge. The courthouse has limited choices due to the election or appointment of judges, many of whom may never have engaged in a business valuation, much less have knowledge of hedge funds and private equity interests. The attorneys and valuation experts can select a person with specialized knowledge of the issues at hand, either as an individual arbitrator or a panel of arbitrators. This provides a potentially higher quality decision-maker, and it avoids a situation where a new judge presides over the case due to elections/appointments given the time it may take to get to trial. Finally, the arbitrators may also employ referees for specific issues that involve even greater specialized knowledge, such as patents, trusts, or other complex assets.

While there are many challenges to valuation work, the newest, most dangerous, and easiest to create is fabrication of information. All noses must be on high alert for the “smell test.” PDF documents are easy to manipulate, change, and create data without anyone’s knowledge whether it be bank accounts, tax returns, P&Ls, or other signed agreements. AI’s rise has made the creation of content as simple as a one-sentence request to a web platform. For example, ChatGPT can generate large paragraphs of information on a whim. Dall-E can create images based on short, directive words input in the engine. Holly+ shows the ability to fabricate someone’s voice based on a recording. The ever-present ability for bad actors to modify QuickBooks and other platform data is worse only because of owner’s knowledge of the importance of such information in developing cash flows. Valuation work cannot simply rely on “1s and 0s”. It must involve scrutiny regarding non-mathematical concepts that impact the final value. Educating business valuation experts (and attorneys) on what means exist to manipulate data has become imperative. The term “garbage in, garbage out” has never had greater meaning than today. Be vigilant!

Greg Reagan, CPA, CFF, ABV, CFE, CVA, is the managing director of Reagan FVL, LLC, a Charlotte, NC forensic accounting firm providing services in the southeastern U.S. As a NACVA member since 1997, he has served on NACVA’s Ethics Oversight Board and has 40-years’ experience in “Big Four,” regional, and local CPA firms performing audit, tax, and consulting services. Today, Mr. Reagan provides forensic accounting, business valuation, damages determination, and fraud investigation services, and testifies in family, civil, and criminal courts of law as an expert witness for both defendants and plaintiffs. He is an advocate for unbiased, objective, ethical professional services performed in conformity to applicable professional standards.

Mr. Reagan can be contacted at (704) 376-3399 or by e-mail to greg@ReaganFVL.com.

Ketan Soni, Esq., is the co-founding partner of Soni Brendle, PLLC, a Charlotte-based law firm focus on divorce and business litigation. He frequently mediates and arbitrates for other attorneys who understand the potential lack of control and predictability in the court system. Mr. Soni is 2022–2023 Chair of the North Carolina Bar Association Family Law Section, a NC Business Legal Elite category winner in 2022 for Family Law, a top 25 Superlawyer in Charlotte, a top 100 Superlawyer in NC, and an NC Dispute Resolution Commissioner from 2020 through 2023.

Mr. Soni can be contacted at (706) 686-7300 or by e-mail to Ketan@NCLawattorneys.com.