Evolving from Valuation to Value Creation

A Call to Opportunity (and Survival)

As the use of artificial intelligence (AI) tools continues to become mainstream, it is no wonder that so many professional services are becoming even more commoditized than they were pre-AI. Many professional service providers, including valuation practitioners, are feeling the combined impact of price compression from clients and higher expectations of service quality and responsiveness. For those of us who plan to continue practicing as professionals for longer than the next few years, the long view is rather disconcerting. Within the next decade, AI is expected to become one-million times more powerful than it is today. However, if market pressures force us to evolve, then perhaps our evolution will create new opportunities that are even more interesting and impactful than our existing practices.

As the use of artificial intelligence (AI) tools continues to become mainstream, it is no wonder that so many professional services are becoming even more commoditized than they were pre-AI. Many professional service providers, including valuation practitioners, are feeling the combined impact of price compression from clients and higher expectations of service quality and responsiveness.

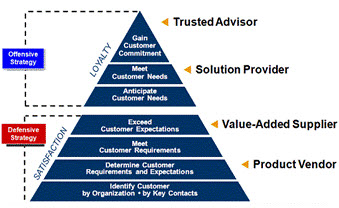

Indeed, the emergence of AI presents both a valuable resource and a curse. Yes, it can add speed and efficiency to our efforts, but consider the Customer Relationship Hierarchy below. Professional services used to be in the top half of the pyramid, with loyal clients, premium fees, and perceptions of value-added trusted advisors. However, as resources like AI continue to evolve and make our jobs easier, they will also continue to push professional services further down the pyramid and deeper into the realm of commoditization.

For those of us who plan to continue practicing as professionals for longer than the next few years, the long view is rather disconcerting. Within the next decade, AI is expected to become one-million times more powerful than it is today. However, if market pressures force us to evolve, then perhaps our evolution will create new opportunities that are even more interesting and impactful than our existing practices.

Customer Relationship Hierarchy

Enter the realm of value growth services. Imagine everything you love about your valuation practice, except that your engagements and client relationships are less transactional and more relationship-based, less retrospective and more visionary, less deadline driven and more ongoing, less compliance focused and more value-added, less commodity and more premium priced. Sounds too good to be true?

It is a relatively short step to evolve from being a business valuator to being a business value creator, a “Value Growth Advisor”. Think of it as a calculation of value engagement with ongoing services, rather than a conclusion of value engagement. Automatically, then, the standards allow more creativity by the valuator. Now, think of conducting the income approach in a much more robust manner, without conducting the market or asset approach. Just like that, you have the beginnings of a value growth advisory process. It is based on the intrinsic value of the subject company, determined by capitalized or discounted free cash flows, rather than transaction value as determined by the market approach.

The key phrase in that income approach, however, is “much more robust”. So, what does that mean? Instead of the usual somewhat superficial determination of the company-specific risk factor in building up the cap rate or discount rate, you do a deeper dive into the underlying qualitative factors that truly comprise company-specific risk. It is a more holistic approach to understanding the subject company across the entire enterprise and identifies where the strengths, weaknesses, and constraints are hiding. From there, you can build a more granular determination of company-specific risk and be able to outline a roadmap for the business owner of where they should be allocating resources to alleviate the weaknesses. Once the roadmap is outlined, you can help create an action plan for your client that is linked to the company-specific risk factor and show them what impact they could make on their business value by completing the action plan over time.

Seems like a lot of time and work? By following the calculation of value requirements and eliminating the market and asset approaches, you would spend roughly the same amount of time conducting a value growth engagement as you do on a conclusion of value engagement. However, you will have added much more value to the business owner by giving them a roadmap of how to increase their value than merely telling them what the value was at a certain point in time. Another big difference is that you will likely be asked by your client to stay involved in the process of executing the roadmap and helping them to secure whatever resources are necessary. You will become the architect and facilitator of their value growth journey.

In the process of a value growth engagement, you will have a tremendous opportunity to educate your clients about the true drivers of value. Most business owners have been led to believe that the way to maximize their business value is to grow revenue and profitability. Therefore, they treat revenue and profitability as direct drivers of value. They effectively treat revenue and profitability as inputs into the company, thinking that the company will evolve to meet the demands of the inputs and value will grow. However, that is not only backwards, but often extremely damaging to the business.

Revenue and profitability are outputs, not inputs. They are byproducts of all the underlying qualitative factors throughout the company that ultimately drive the right kind of revenue and profitability. All those underlying qualitative factors are also the same factors that comprise company-specific risk. So, as the roadmap is executed, the risk factors are reduced, and the company naturally grows top line and bottom line in a way that adds value. When revenue and profitability are treated as direct drivers of value, they very often become factors that are “chased” by the company. The company’s focus becomes diluted by chasing revenue that not only does not add value, but often erodes value. It may even be profitable and provide much needed cash flow, but it detracts the organization from building the right kind of revenue. The profit it generates is only worth the actual cash it provides. There is no multiple associated with it because it is not sustainable. So, revenue and profitability must be generated from the inside out rather than from the outside if they are to create new value.

You may be wondering: How does one go about this process? The pie chart below depicts the eight primary functional categories that every company needs to have in place, fully developed, and in balance with each other. Any functional areas that are weaker than the rest represent constraints in the organization and potential fail points as the company grows. Each of the eight functions is of equal importance, since fail points can arise anywhere in the company.

8 Primary Functions of Every Company

To properly assess the eight categories, they must be broken down into their respective subcategories. The subcategories are largely the same across industries, sizes, stages, etc. However, there are nuances for each main industry. For example, the Master General Framework presented below is the framework for a manufacturing entity. By assessing the fundamental level of development (or maturity) of each of the subcategories, a full picture of the strengths, weaknesses, and constraints can be developed. From there, the weaknesses and constraints can be individually quantified as components of company-specific risk and an improvement roadmap can be developed.

Master General Framework

Now that company-specific risk has been rigorously developed at a granular level, it is easy to contemplate improvements in the weakest areas first and to quantify the impact on overall value by rolling the impact of reducing risk through the calculations of cap and discount rates, and revaluing the cash flows.

Is this value growth process a replacement for conclusions of value engagements? Of course not. In the many situations where conclusions of value are warranted, there is no substitute. However, there are many instances where conclusions of value are not necessary, but companies could benefit immensely by understanding their current intrinsic values, what is constraining their growth, and where they should be allocating their resources to build long-term value. Adding a value growth service to your offerings opens the door to a whole new target market of companies who need your help; and your knowledge and skills are perfectly suited to help them. As the pressures to evolve our services continue to grow, adding value growth services to our offerings may be the perfect way to avoid commoditization and make us even more highly regarded than we were pre-AI.

If you would like to learn more about value growth services, feel free to contact us at CVM.

P.S.: This article was fully written without any support by AI.

Ken Sanginario is the founder of Corporate Value Metrics, developer of the Value Opportunity Profile software (VOP) and the Certified Value Growth Advisor (CVGA) education program. His perspectives come from his 35+ years background in turnaround management, M&A advisory, business valuation, and executive positions in public and private companies.

Mr. Sanginario may be contacted at (508)870-5808 or by e-mail to ksanginario@corporatevalue.net.