Reducing Bias in Business Valuation Engagements

Navigating Bias in Business Valuations

Valuation analysts are tasked with gathering information, analyzing data, summarizing findings, and communicating the results. This includes quantifying the expected cash flows and risks of the business through often conflicting and misrepresented information. This article provides an overview of bias, how it affects business valuations, and provides readers with the standards and tools they need to confidently support their opinions when challenged.

Introduction

“When the facts change, I change my mind. What do you do?” – Sir John Maynard Keynes

Our waking hours are bombarded with more information than can be absorbed. From 2009 to 2017, the amount of data that enters the human brain more than doubled from 34GB of data per day to 74GB.[1] While the brain can process 11 million bits of information per second (bps), it can only consciously handle four to five bps.[2] As a result, our minds take shortcuts to weed out irrelevant data to focus on what it determines to be important. These shortcuts are how we can hear our names in crowded rooms, yet they also contribute to bias.

Valuation analysts are tasked with gathering information, analyzing data, summarizing findings, and communicating the results. This includes quantifying the expected cash flows and risks of the business through often conflicting and misrepresented information. The potential for biased information lurks in this deluge, especially in times of uncertainty. Moreover, those who provide business valuation services—including Certified Valuation Analysts and business valuation specialists—bring their own biases to each engagement.

This article provides an overview of bias, how it affects business valuations, and provides readers with the standards and tools they need to confidently support their opinions when challenged.

Business Valuation Standards

Generally accepted valuation standards mandate bias avoidance and may require certification by the analysts. Bias is a preference or inclination that precludes an appraiser’s impartiality, independence, or objectivity in an assignment.[3] In other words, the valuator should be mindful that the “shortcuts” described above may take the valuator away from impartiality and in a direction that reflects personal bias. A survey of the leading professional standards includes the following references to objectivity and bias:

- American Institute of Certified Public Accountants (AICPA)—Statement on Standards for Valuation Services (2008)

- VS Section 100.14—“The AICPA Code of Professional Conduct requires objectivity in the performance of all professional services, including valuation engagements. Objectivity is a state of mind. The principle of objectivity imposes the obligation to be impartial, intellectually honest, disinterested, and free from conflicts of interest.”[4]

- American Society of Appraisers (ASA)—Business Valuation Standards and Principles of Appraisal Practice and Code of Ethics (2022)

- BVS-VIII (III)(A)—“Pertaining to bias. A report must contain a statement that the appraiser has no interest in the asset appraised, or other conflict that could cause a question as to the appraiser’s independence or objectivity; or, if such an interest or conflict exists, it must be disclosed.”

- PG-1 (II)(H)—“The expert witness, arbitrator, or court-appointed expert should maintain integrity, objectivity, and independence.”

- PG-1 (III)(B)—“The expert should consider key assumptions and hypothetical conditions, determining the reasonableness and appropriateness thereof. The use of unwarranted assumptions may impair the objectivity—actual or perceived—of the expert.”

- PG-1 (IV)(15)—“The use of visual aids in the body of, or appending, the expert report should be made in an objective, unbiased, and professional manner, so that they can be properly interpreted by the trier of fact and others connected with the litigation or arbitration.”

- National Association of Certified Valuators and Analysts (NACVA) Professional Standards (2023)

- Standard II(A)—“A member/credentialed designee shall remain objective, maintain professional integrity, shall not knowingly misrepresent facts, or subrogate judgment to others.”

- Standard IV(B)—“A valuation analyst must avoid bias in the development of a Conclusion of Value or a Calculated Value.”

- Standard VI(B)—“A member/credentialed designee must not allow the intended use of an assignment or a client’s objectives to cause the assignment results to be biased or advocate for a client’s objectives.”

- The Appraisal Foundation Uniform Standards of Professional Appraisal Practice (USPAP) (2024)

- Ethics Rule, Conduct: “An appraiser must perform assignments with impartiality, objectivity, and independence, and without accommodation of personal interests. An appraiser must not perform an assignment with bias.”

- Scope of Work Rule: “An appraiser must not allow the intended use of an assignment or a client’s objectives to cause the assignment results to be biased.”

In the context of litigation support, the term “independent” means the expert must provide their unbiased opinion as to the issues in dispute.[5] This means both in fact and appearance. For example, in the Cellular Telephone Partnership case, the Delaware Court of Chancery found the lead valuation partner for AT&T had a long-standing relationship with the phone giant and their personnel which influenced the outcome of the valuation.[6] This case focused on the freeze out of the minority partners in which the minority partners’ expert used AT&T’s board-approved, three-year wireless business plan to value the business, whereas AT&T’s expert conclusions based on the 10-year plan for impairment of spectrum licenses was rejected.

Types of Biases in Business Valuations

Cognitive bias are systematic errors in the way individuals reason about the world due to subjective perception of reality.[7] The following are examples of cognitive biases that may affect business valuation reports:

- Anchoring Bias—The intuitive tendency to use an initial piece of predominantly insufficient and irrelevant information as an anchor in determining the final judgment. Valuators are frequently confronted with numerical estimates of a company’s value or initial pieces of information that may anchor and subsequently bias the valuator’s estimates.

- Engagement Bias—When a professional’s judgment (consciously or unconsciously) favors their client’s interests. It is driven by the need to satisfy clients in a competitive market which may jeopardize professional autonomy and unconsciously affect objective judgments.

- Blind Spot Bias—The tendency to recognize and acknowledge biases affecting other people’s judgments, while failing to recognize the potential influence of bias in one’s judgments. This may also lead to reactive devaluation when proposals or arguments are devalued due to the mere fact that they were put forward by an opposing party.

- Availability Bias—The tendency to use information that comes to mind quickly and easily when making decisions about the future. This can lead to poor or incomplete decision-making such as believing airplanes are unsafe because of highly publicized plane crashes, despite evidence to the contrary.

- Confirmation Bias—The tendency to look for and identify results that confirm what you wanted to find. This cherry-picking of information may lead to rejection of nonconforming expectations and may result in inaccurate and unfounded conclusions.

- Hindsight Bias—The tendency, upon learning an outcome of an event, to overestimate one’s ability to have foreseen the outcome. This can cause overconfidence in one’s ability to predict other future events and negatively affect future decision-making.[8] Consider again the decision in the Cellular Telephone Partnership case. Here, the court said AT&T’s argument about actual performance mirroring the 10-year plan was classic hindsight bias as the information was known or knowable as of the valuation date.

- Attribution Bias—The tendency to attribute another’s actions to their character or personality, while attributing their own behavior to external situational factors outside their control. For example, a company may attribute declining sales to poor marketing efforts while ignoring broader market trends or shifting consumer preferences.

- Over/Under Confidence Bias—The tendency to be more or less confident in one’s own abilities, including making moral judgments, than objective facts would justify. Overconfidence may cause analysts to act without proper reflection, potentially leading to mistakes, whereas under confidence may negatively affect efficiency and slow down decision-making.

Anchoring bias has been studied since the 1970s and is one of the most common biases. It has been found among professionals in various industries such as auditing, law, financial markets, etc. However, the business valuation profession had escaped this scrutiny until researchers conducted a study of experienced business appraisers. As described below, valuators were susceptible to anchoring bias, engagement bias, and blind spot bias.

Evidence for Business Valuator Bias

According to a 2020 paper in the Journal of Behavioral Finance,[9] the answer to whether business valuators are biased is a resounding yes! Researchers found robust evidence for valuator bias based on two studies.

Anchor Bias

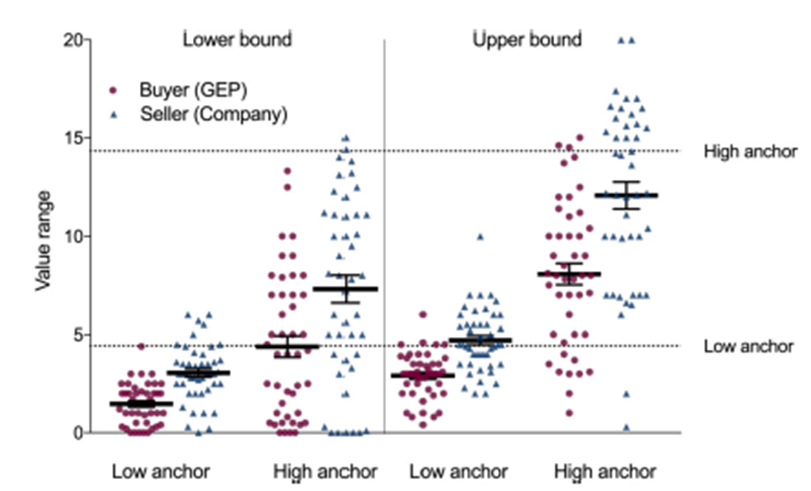

In the first study, participants were assigned to be either the buyer or seller in a hypothetical transaction, presented a high or low anchor value, and asked to review a business valuation report. This resulted in four conditions:

- Buyer – low anchor

- Buyer – high anchor

- Seller – low anchor

- Seller – high anchor

Each scenario involved a company in decline that required capital for a turnaround and a private equity (PE) firm was interested in investing. For the “Seller” group, participants received the following fact pattern:

- The PE firm had hired valuator #1 (Hypothetical) to determine value;

- Management of the company believed it was way too low (or too high);

- The company now hired valuator #2 (Participant) to review and provide a second opinion of value; and

- The assigned values were $4.4 million (low anchor group) or $14.3 million (high anchor group).

Participants were asked to indicate which elements of the valuator #1 report they believed needed to be adjusted from eight options available (EBITDA, capex, cost of capital, net working capital, etc.) and to indicate whether they would adjust the valuation upwards or downwards (measured on a 7-point Likert scale) to determine the true range of company value. The following served as the key dependent variables:

-

- Degree of adjustment

- Lower bound of range

- Upper bound of range

This fact pattern was the same for the “Buyers” group except the participants were told they were hired by management. In both scenarios, researchers found the valuators used the initial value as an anchor. For high anchors, the participant’s adjusted values were clustered around $14.3 million. Similarly, the lower anchors resulted in lower values. This is shown on the following chart:

Note the two horizontal dotted lines were the anchors provided.

Engagement Bias

In the second study, the fact pattern was replicated with new participants who were asked to assume the role as an independent valuator rather than one representing the interests of the opposing party. This was designed to measure engagement bias. The results showed that valuators still adjusted the valuation in accordance with client’s interests. The relationship with the client affected the valuator’s judgment.

Once a certain goal outcome is activated, people will subsequently interpret and analyze information in a way that is consistent with this desired outcome. This is particularly true when the situation at hand is rather ambiguous and thus allows for multiple interpretations.[10]

Combined, these data points show that participants did not so much disagree with the fact that the forecasts were too optimistic and that it needed to be adjusted downwards, but rather by how much. This appeared to be largely determined by the anchor and the interests of the client that the valuator represented.[11]

Blind Spot Bias

Researchers also found a bias blind spot existed when participants recommended whether or not their client should do the transaction at the valuation indicated in the valuator #1 report. Participants were asked whether they believed the valuator hired by the opposing party was affected in his/her judgments because of the interests of their client and whether they believed they themselves were affected in their judgment. Participants were twice as likely in both studies to say the other valuators were more biased.

Navigating Bias in Business Valuations

Biases in business valuations are plentiful and may manifest in management forecasts, discounting, compounding, and other areas. It is no surprise that forecasts prepared in conjunction with pending litigation disputes are often biased in favor of the party generating the estimates. Valuators can minimize this risk by analyzing forecasts prepared in prior periods for biased patterns and comparing them with actual results. Historically accurate forecasters are more reliable than their counterparts doing it for the first time. Valuators should also consider whether management’s plans are expectational, aspirational, or just theoretically possible.[12] This may involve preparing multiple scenarios for best case, worse case, and most likely, or use more rigorous Monte Carlo simulations. If possible, concerns should be discussed with management as they may also affect the risk via the cost of capital.

For discounting, valuators often encounter bias for discount rates that are too low. Analysts use historical compiled data to estimate true expected returns as true expected returns are not observable. If periodic returns on stocks (e.g., monthly stock returns) are not correlated, and if expected stock returns are stable through time, then the arithmetic average of historical stock returns provides an unbiased estimate of expected future stock returns. Similarly, the arithmetic average of realized risk premiums provides an unbiased estimate of expected future risk premiums (the ERP).[13]

Bias may also show up in compounding calculations. For example, the compounded future values derived from arithmetic averages will be too high in general. Studies show bias may arise in multi-period compounding when the single period estimate of expected return is subject to measurement error.[14]

Professor Aswath Damodaran gives the following examples of other biases that may be encountered in business valuations:[15]

- Selection of market multiples

- removing negative earnings per share

- Sample size too small

- Survivor bias

- Takeover valuations

There are also potential biases in the sample period and survivorship of the companies used when making calculations. While many analysts chose to use the average realized returns data, some exclude the World War II time frame or start with the Center for Research in Security Prices (CRSP) data beginning in 1963. In general, the more observations available lead to better accuracy using the arithmetic average.

How to Identify Bias and Optimize Objectivity

There is a wealth of data that demonstrates the connection between bias and performance. For example, reducing bias helps teams and organizations achieve better results. Bias can inhibit decision-making, performance, innovation, and results in the workplace.[16]

The first step to reducing bias in business valuation is to acknowledge the shortcuts in the way our brains process data. These shortcuts, or heuristics, is one of two parallel systems of decision-making.[17] System 1 is fast, intuitive, and emotional. System 2 is slower, more deliberative, and more logical. Our brains are wired to focus on avoiding threats and self-preservation, not on logical decision-making and critical thinking. Making assumptions based on incomplete or imperfect information is part of the daily routine for business valuation analysts, especially those valuing private companies. Being critically aware of this responsibility will facilitate better decision-making.

One way valuators can help identify biases is through the Implicit Association Tests (IAT). The IAT measures bias related to race, sexuality, age, religion, weight, and 15 other categories to identify attitudes and beliefs people may be unwilling or unable to report.[18] Taking the time to reflect blind spots is System 2 thinking and may reduce bias in practice.

Other areas to reduce bias include the following:

- Selective Engagement Acceptance. Performing due diligence on the case filings, the parties involved, expected deadlines, availability of staffing, and other issues, will help minimize problems down the road. The maxim “it is better to get fired than to be sued” also applies.

- Maintain Professional Autonomy. There are clients who are excessively proactive with their communications with valuators. Documenting communication, limiting interactions, and other ways to conduct procedures in an isolated manner facilitates valuator objectivity and reduces engagement bias. This includes avoiding information that is not needed to conduct the appraisal.

- Challenge the Information. The Daubert[19] challenges are riddled with experts who did not corroborate client assertions. Trusting, but not verifying, is a dangerous practice and may expose valuators to IRS accuracy-related penalties in Tax Court.[20] Seeking multiple benchmarks/industry reports will help ensure the “sufficient relevant data” threshold from the AICPA Code of Professional Conduct is met. Trade associations, magazines, and the local library may contain the jewel of information that could make the difference when the opinions are challenged.

- Poor Decisions Under Pressure. Valuation for litigation is a fast paced, exciting occupation, yet the demands are high. Knowing the discovery deadline, backwards planning the site visit, supervising staff, monitoring the report progress, using quality control reviewers, etc., helps to identify the various milestones so reports can be prepared in an orderly manner. While pressures cannot be reduced to zero, decisions are better when the valuator is proactive rather than reactive. An unsettled mind will not make good decisions.[21]

- Avoid Excessive Coherence. Similar to the anchoring bias, excessive coherence occurs when impressions are formed early in the process from the initial information received. The valuation process may be affected if subsequent information is ignored when it does not fit a preexisting story. To illustrate, valuators may focus on the large contract signed before the valuation date if learned early in the process yet minimize the risk that the key salesperson may retire next year.[22]

- Competence Breeds Confidence. Education does not stop when the valuator becomes credentialed. Staying abreast of changing valuation theory/techniques via the latest editions of learned treatises, reading industry publications/newsletters, attending training, and more, will reduce the likelihood of bias through exposure and peer perspectives. The study described above indicated that experienced valuators with strong ties to their professional affiliations may be able to resist pressure stemming from clients.[23] Professional competence is also a requirement of VS Section 100.11.[24]

- Be Actively Open-Minded. Researchers found that actively open-minded thinkers are more likely than others to make accurate forecasts.[25] Valuators would be wise to learn from other fields such as meteorology and portfolio managers where uncertainty is involved in future predictions. While there is a cost to benefit in terms of gathering additional information, confidently making estimates using intuition or templated valuation models will prove insufficient compared to actively seeking contradictory information that may change the valuator’s mind as a result.

Conclusion

Valuation standards require analysts to be objective and avoid bias, yet valuators are surrounded by it daily. Developing defensible opinions of value requires careful thought and a reasonable basis for the conclusions reached. This may differ based on the facts and circumstances of each engagement. For example, valuing startups will require a higher degree of analysis than a stable, established company with a large market capitalization.

Being impartial and intellectually honest is difficult during times of uncertainty and valuators should not look to artificial intelligence (AI) to solve or remove bias. However, tools like AI could be used or trained in a manner to look for and minimize bias. As shown above, developing a reasonable conclusion of value is a deliberate, methodical process with roots in the Prohibition era and before.[26] Actively seeking ways to check one’s work, reducing pressure, gaining perspective through independent viewpoints, and other activities will help ensure competent work products and unbiased valuation conclusions.

This article was previously published by J.S. Held Insights and is republished here by permission.

[1] Bohn, Roger and Short, James, How Much Information? 2009 Report on American Consumers, Global Information Industry Center University of California, San Diego, last update 2010. Heim S and Keil A (2017) Too Much Information, Too Little Time: How the Brain Separates Important from Unimportant Things in Our Fast-Paced Media World. Front. Young Minds. 5:23. doi: 10.3389/frym.2017.00023.

[2] Fan, Jin, An Information Theory Account of Cognitive Control, Frontiers in Human Neuroscience September 2, 2014, page 680.

[3] Appraisal Foundation Uniform Standards of Professional Appraisal Practice definition, 2024. See also Glossary of Diversity, Inclusion and Belonging (DIB) Terms, Harvard University Human Resources, edib.harvard.edu: “Bias is prejudice in favor of or against one thing, person, or group compared with another, usually in an unfair or negative way.”

[4] See also AICPA Code of Professional Conduct 0.300.050—Objectivity and Independence.

[5] Pratt, Shannon and ASA Educational Foundation, Pratt’s Valuing a Business, McGraw Hill, 6th Ed., 2022, page 1159.

[6] In Re Cellular Telephone Partnership Litigation., 2022 Del. Ch., C. A. 6885-VCL., March 9, 2022.

[7] Eldridge, Stephen, Cognitive Bias, Encyclopedia Britannica, March 10, 2023.

[8] Note: litigation-driven forecasts have an “untenably high’ probability of containing ‘hindsight bias and other cognitive distortions.” See Agranoff v. Miller, 791 A.2d 880, 892, Del. Ch. 2001.

[9] Broekema, Marc et. al., Are Business Valuators Biased? A Psychological Perspective on the Causes of Valuation Disputes, Journal of Behavioral Finance, 2022, Vol. 23, No. 1, 23–42.

[10] Ibid, page 26.

[11] Ibid, page 34.

[12] See Kohler v. Commissioner, T.C. Memo. 2006-152, 2006. The IRS expert weighted the aspirational operations plan four times greater than the “realistic management plan” and independently assumed assumptions about expenses rather than use those provided by management.

[13] Pratt, Shannon and Grabowski, Roger, Cost of Capital, Wiley, Fourth Edition, 2010, page 121.

[14] Blum, Michael, Unbiased Estimators of Long-Run Expected Growth Rates, Journal of American Statistical Association, September 1974.

[15] Damodaran, Aswath, Investment Valuation, Wiley, Third Edition, pages 121, 459, 508, and 724–725. Professor at the Stern School of Business at New York University.

[16] Fuller, Pamela and Murphy, Mark, The Leader’s Guide to Unconscious Bias, Simon & Schuster, 2020.

[17] Kahneman, Daniel, Thinking Fast and Slow, Princeton University, New Jersey 2011.

[18] Project Implicit, https://implicit.harvard.edu/implicit/education.html.

[19] Daubert v. Merrell Dow Pharmaceuticals, Inc., 509 U.S. 579, 113 S. Ct. 2786, 125 L.Ed.2d 469 (1993).

[20] The Omnibus Budget Reconciliation Act (OBRA) consolidated into one Internal Revenue Code section (Code §6662) several different accuracy-related taxation penalties.

[21] Cunningham, Lawrence The Essays of Warren Buffet, Eighth edition, page 119.

[22] Fans of the band Nirvana may recall the pervasive belief in Kurt Cobain’s alleged suicide from the initial reporting despite subsequent conflicting evidence.

[23] Broekema, Marc et. al., Are Business Valuators Biased? A Psychological Perspective on the Causes of Valuation Disputes, Journal of Behavioral Finance, 2022, Vol. 23, No. 1, Page 27.

[24] “A valuation analyst should possess a level of knowledge of valuation principles and theory and a level of skill in the application of such principles that will enable him or her to identify, gather, and analyze data, consider and apply appropriate valuation approaches and methods, and use professional judgment in developing the estimate of value (whether a single amount or a range).”

[25] Haran, Uriel, Ritov, Ilana, and Mellers, Barbara, The Role of Actively Open-Minded Thinking in Information Acquisition, Accuracy, and Calibration, Judgment and Decision Making, Vol. 8, No. 3, May 2013, pp. 188–201.

[26] See United States v. Fourteen Packages of Pins, 1832 U.S. Dist. LEXIS 5; 25 F. Cas. 1182; 1 Gilp 235. This was the first use of the term “fair market value.”

Jason Pierce, CPA, CMA, CFM, CVA, MAFF, is a Senior Vice President in the Economic Damages and Valuations section of J.S. Held’s Forensic Accounting / Economics / Corporate Finance practice. He specializes in forensic accounting, business valuation, and consulting engagements. He brings more than 25 years of experience in various accounting and finance-related disciplines. Mr. Pierce works with clients on disputes, transactions, fraud, damages, family law, criminal, and estate planning engagements. He has testified as an expert witness in State courts, Federal courts, and in arbitration proceedings. A regular speaker at legal and professional organizations, He also serves as a lead instructor for NACVA’s Master Analyst in Financial Forensics (MAFF) certification program and other courses.

Mr. Pierce can be contacted at (857) 216-9775 or by e-mail to JPierce@jsheld.com.