The Value of Simple Analytics in Financial Investigations

A Case Study

In this article, the author uses a case study to explore how forensic accountants used analytics to identify discrepancies in financial records and support financial investigations.

Introduction

While we traditionally think of forensic accounting as the specialized area of accounting that focuses primarily on the investigation of financial crimes, forensic accountants are also well equipped to help companies untangle financial records when a company suspects financial records are not properly reflected due to errors. Regardless of the nature of the engagement, the use of analytics can help the forensic accounting professional identify areas to investigate and can provide an indication of the reasonableness of the financial results.

In this article, we utilized a case study to explore how forensic accountants used analytics to identify discrepancies in financial records and support financial investigations.

Transition From Accrual to Cash Basis Accounting: Impact on Revenue

We were recently retained by a firm in the professional services sector (the “Firm”) that had been advised by a third party to switch from accrual to cash basis of accounting in 2023.

The Firm’s primary source of revenue was from insurance cash settlements, which were split between the Firm, its clients, and third-party vendors. When settlements were received, the Firm recorded a liability (“Client Liability”) pending review of contract terms before recording revenue for the Firm and issuing payments to its clients and third-party vendors.

The owner of the Firm anticipated a significant decrease in revenue from 2022 to 2023 because the Firm had a one-time, outlier event (the “Outlier”) that generated USD14 million in revenue in 2022. When financial statements were prepared for 2022 and 2023, revenue for 2023 was USD2 million lower than 2022. The owner believed the change in accounting method created duplication of revenue in 2023.

We were asked to determine if the switch in accounting method led to this potential revenue overstatement.

High-Level Financial Analytics: Assessing Growth and Revenue Trends

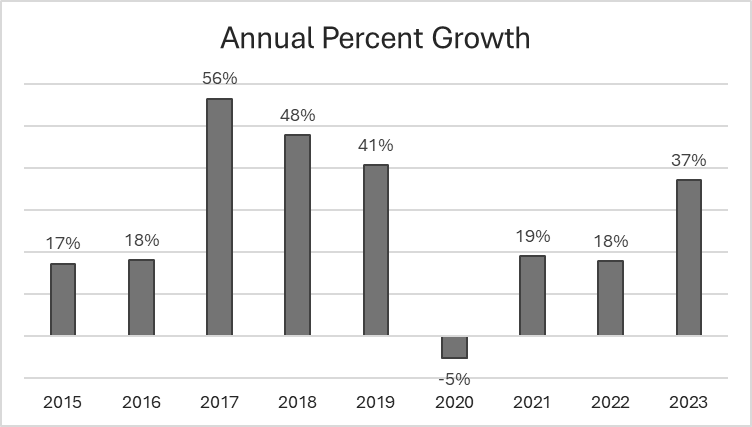

High-level analytics were a good place to start to determine if overall results were in line with expectations. According to the general ledger, the Firm experienced significant growth from 2014 to 2019, with year-over-year growth ranging from 17% to 56%. There was revenue reduction during the COVID-19 pandemic in 2020, but the Firm rebounded in 2021 with growth of 19%. Without taking into consideration the 2022 Outlier, revenue growth for 2023, as reflected in the general ledger, was approximately 37%. This growth was high compared to the 2022 growth, but not when compared to pre-pandemic growth. Financial statements for 2024 had not been finalized as of the date of this article.

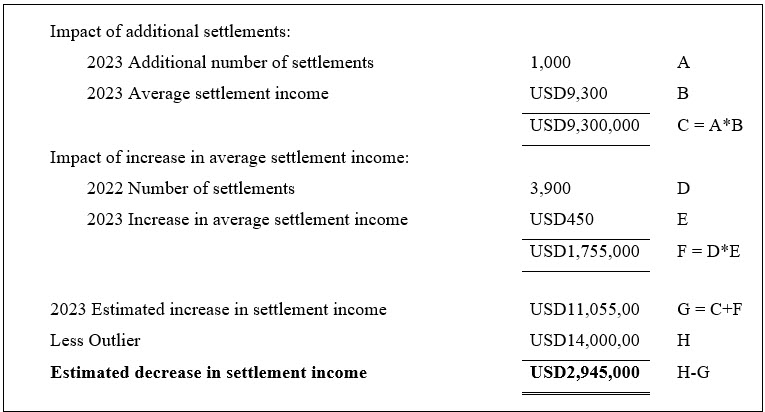

To understand if business activity could have contributed to 37% growth, we requested settlement counts for 2022 and 2023, excluding the Outlier. Settlement information indicated that the number of settlements grew by approximately 1,000 from 2022 to 2023, with an average income per client increasing from USD8,850 to USD9,300 from 2022 to 2023. The increase in both the number of settlements and the average revenue per settlement may account for an increase of approximately USD11 million in 2023 compared to 2022, offset by the Outlier of USD14 million, for an estimated net decrease in revenue of approximately USD3 million. This calculation suggests that the USD2 million decrease in revenue from 2022 to 2023, as reported, is not as unexpected as the owner suspected.

Another form of high-level analysis performed was a review of the financial statements. While we were engaged to determine if the change in accounting method caused revenue to be overstated, a review of the financial statements showed accrued expenses totaling more than USD1 million for 2023 in the balance sheets for accrued payroll related expenses. These accruals are not consistent with the cash basis of accounting.

Identifying Key Areas of Focus

High-level analytics were a helpful starting point; however, a deep dive was still needed to determine if there were areas in the financial records that required further review. Whether sifting through thousands or hundreds of thousands of records, analytics can help identify areas of focus. In this case, since the owner was concerned that settlement revenue had been duplicated, revenue was our starting point. A series of simple pivots that were tied to revenue by year in the general ledger helped us determine areas to request additional documentation.

- Large client revenue. Pivot tables for revenue by client and year, with client name in the rows, sorted from largest to lowest revenue helped us select settlements with high revenue values. Sample selections revealed that in the early days of 2023, revenue for multiple clients was combined into a single revenue entry. For example, on January 31, 2023, revenue for 81 clients was recorded against one client. A review of documentation for a sample of clients within the 81 clients confirmed revenue for those sample clients had not been duplicated by recording the individual revenue in addition to the combined revenue.[1]

- Client revenue in multiple years. To identify if revenue was recorded for the same client across multiple years, and thus potentially duplicating revenue, we created a pivot table for revenue by client, with client name in the rows and years in the columns. We added a count to the right of each client (row) to easily identify clients with revenue across multiple years. After reviewing documentation for a sample of clients with revenue across multiple years, our analysis showed revenue was the result of separate revenue activity and therefore no duplication of revenue.

- Multiple client revenue incidences within the same year. To identify if multiple revenue was recorded for the same client within a year, and thus potentially duplicating revenue, we created pivot tables for revenue by client, with client name in the rows. Rather than using a “sum” of values to calculate revenue per client, we used a “count” of values to determine the number of times revenue had been booked against each client. After reviewing documentation for a sample of clients with multiple revenue entries in the same year (i.e., count higher than 1), our analysis showed revenue was either the result of separate revenue activity, or revenue from members of the same family and therefore no duplication of revenue.

- Manual adjustments. Manual adjustments were clearly identifiable in the pivot tables by a “NULL” value instead of a client name. These lines represented journal entries booked against the general ledger. We reviewed these journal entries for the years 2022, 2023, and 2024.

- 2022: Journal entries booked in 2022, when the Firm was still using the accrual method of accounting, were mainly monthly adjustments to reconcile balance sheet accounts, including monthly accruals.

- 2023: Journal entries booked in 2023 were mainly a series of entries to record revenue from settlements received in 2023, but for which revenue was not recorded until 2024. These entries were appropriate under cash method of accounting as revenue is recognized with the cash received. We also noted an accrual entry to estimate revenue from settlements for which cash had not been received as of December 31, 2023. This entry was not consistent with cash basis of accounting.

- 2024: Journal entries booked in 2024 were mainly reversals of the 2023 year-end entries, which is appropriate under cash method of accounting, as the revenue recorded in 2024 had already been recognized in 2023. We noted no journal entries to reclassify revenue from cash received in 2024, as the 2024 financial statements had not been finalized.

Findings and Recommendations

Review of the general ledger (and based on the growth the firm had experienced) indicated that revenue would likely not see the decrease the owner was anticipating.

Our review of settlements and journal entries indicated the finance staff had been performing detailed reviews of settlements to ensure revenue is captured in the proper period. Our greatest area of concern was that there appeared to be little to no management review to ensure the balance sheet had been accurately reflected since 2022.

Our recommendations included adding a controller to the finance team to perform substantial monthly reviews and analysis of the financial statements. We also recommended the reversal of any accrual journal entries in the period they were recorded, as these entries were not consistent with cash basis of accounting. Finally, we recommended creating a dashboard of key indicators to give the owner quick visibility of the Firm’s performance.

Conclusion

Analytics alone are not always sufficient when conducting financial investigations. Interviewing personnel and stakeholders provide much needed context, even when malfeasance is not suspected. An inquisitive mindset, understanding transaction flows, and strong knowledge of accounting and auditing are critical aspects of forensic accounting. In addition, supporting documentation is necessary to verify assertions. However, in this era of large data, knowing where to start can make a tremendous difference in the effectiveness of an investigation. Analytics provide a quick way to determine if results are in line with expectations and can highlight areas of focus that serve as a launching pad for the investigation.

This article was previously published in J.S. Held Insights and is republished here by permission.

[1] Settlement count provided by the Firm was obtained from a source different from the general ledger and thus did not skew settlement per client calculations.

Pamela Hefner, CPA, CFE, is a vice president in J.S. Held’s Economic Damages and Valuations practice. She specializes in litigation consulting, utilizing financial analysis to provide business, financial, and accounting advice to attorneys and their clients throughout the commercial litigation and investigation process. As a certified public accountant (CPA) and certified fraud examiner (CFE), Ms. Hefner has provided expert support across multiple industries, including retail, manufacturing, food and beverage, and local government. She provides expert witness and consulting services in accounting, investigations, and litigation, with specific expertise in damages calculations, class certifications, and fraud examinations.

Ms. Hefner can be contacted at (229) 337-4067 or by e-mail to pamela.hefner@jsheld.com.