M&A Multiples: Business Value v. Balance Sheet Value

Buyers and Sellers Need to Negotiate Delivery Targets for Working Capital and Agree on a Fair Market Value for Fixed Assets.

Valuation principles generally hold that the value of a business is largely a function of return on invested capital and growth, writes Ron Stacey, since these are the primary drivers of free cash flow. But how does this cash flow relate to the asset and liability values on the balance sheet?

Valuation principles generally hold that the value of an economic asset, a business, is a function of return on invested capital and growth, i.e., the primary drivers of free cash flow. Discounting the free cash flow by the rate most applicable to the risk, results in the value of the business. M&A price negotiations typically revolve around these principles as deals from the sell side perspective are negotiated as a function of earnings before interest, taxes, depreciation, and amortization (EBITDA) multiples. The ensuing value is the M&A enterprise value. But, how does this cash flow value relate to the asset/liability values on the balance sheet? Let’s find out.

Operating and Intangible Assets

The operating assets on the balance sheet represent the ordinary and necessary assets to produce the cash flows. Generally, these assets include accounts receivable, inventory, prepaid expenses, machinery and equipment, real estate (assuming highest and best use). Cash and long-term or interest-bearing debt, if any, are excluded hence the term a “cash free/debt free” balance sheet.

Cash is not an income-producing asset save for situations where nominal cash balances are needed to conduct the business, such as a chain of retail stores. However, if cash balances are accumulated at the expense of accounts payable, then the appropriate amount of cash or the amount of assumed payables must be adjusted, usually through a negotiation of a working capital target.Â

Debt has nothing to do with the value of the business any more than a mortgage has to do with the value of your house. In the end, debt will either be paid off by the seller from the proceeds of the sale, or assumed by the buyer and deducted from the sale price. Short term debt, accounts payable, and, in some cases, working capital lines of credit that clean up annually, as well as normal accruals are generally assumed by the buyer as part of the working capital calculation. If a working capital line of credit is a permanent liability, an asset-based revolving loan for example, then it’s included in long–term, interest-bearing debt.

The buyer is purchasing the income stream of the business plus the working capital, the fixed assets that are necessary to operate the business, and the intangible assets including goodwill, which is the excess of the purchase price over the value of the tangible and identifiable intangible assets. Identifiable intangible assets include customer relationships, assembled workforce, the value of patents and trademarks, and trade secrets. Certain intangible assets with identifiable useful lives can be amortized for tax purposes over those lives under Section 197 of the Internal Revenue Code; unidentifiable intangible assets or goodwill must be amortized over 15 years.

Non-Operating Assets

Non-operating fixed assets on the balance sheet must be identified and removed from the balance sheet (theoretically for an asset sale) or become an addition to the purchase price. Examples include assets held for investment or expansion and those related to idiosyncrasies of the seller like airplanes, yachts, golf memberships, condominiums in the Bahamas, or second homes in Palm Beach. To the extent these items remain, the buyer must buy them separate and apart from the business.Â

Case Study

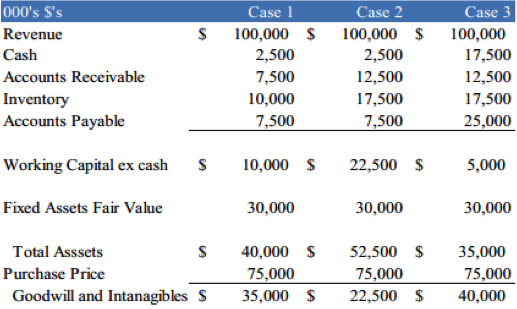

In the following example, a $100 million revenue manufacturing company with $15 million in EBITDA is being sold for a modest five times EBITDA or $75 million. The parties to the transaction must negotiate the appropriate working capital, fair value of the fixed assets, and net assets typically tied to the most recent balance sheet to be delivered at the closing subject to post-closing adjustment or “true up,” since balance sheets change on a daily basis. The table below illustrates three case scenarios for this transaction. The values for the current assets and liabilities are a function of turnover, lower values indicate high turnover, higher values lower turnover:

Case 1 illustrates a well-run business with good turnovers in receivables, inventories, and accounts payable. Working capital excluding the cash computes to $10 million. By minimizing the working capital investment, this company produces a higher return on invested capital. The parties agree that the fair value of the fixed assets is $30 million. The purchase price for the assets is thus $40 million, and the value of the goodwill and intangibles is $35 million.Â

Case 2 represents a more typical scenario with lower, but closer-to-normal, real-world turnovers. The accounts receivable are not collecting as well, the inventory turns slower than in Case 1, but the accounts payable is being kept current and happy vendors are good for a business. If the balance sheet producing these figures is the one around which the negotiations took place, the parties might agree on working capital target of $22.5 million; same scenario for the fixed assets. The assets now total $52.5 million; the value of the goodwill and intangibles is reduced to $22.5 million.Â

The Case 3 scenario is the problem child for this deal. In Case 3, the accounts receivable and inventories are turning normally (however, these can be “gamed” too), but accounts payable has been “stretched” to the limits while the company has accumulated excess cash. And yes, this does happen in real life. To get a workable deal under these circumstances, enough cash must be in the company at closing to bring the accounts payable current, or the accounts payable must be brought current prior to closing such that the working capital deliverable is $22.5 million and not $5 million. Alternatively, the excess accounts payable can be viewed as long-term debt and the purchase price reduced accordingly. In other words, $17.5 million is needed to fix the problem. One caveat, if the industry is such that the vendors actually extend 90-day terms then so be it.

Nonetheless, such terms are not trade financing, but long-term debt subject to purchase price reduction. Note also, that a $5 million working capital position, if accepted, results in $40 million of goodwill and intangibles for all the wrong reasons.Â

Timing

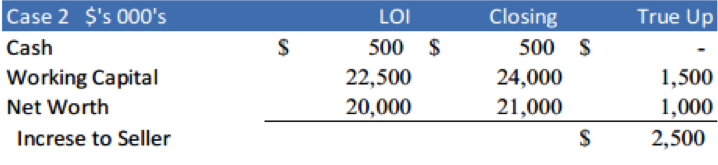

As illustrated in the above example, three time points are germane to the negotiation. The first is the balance sheet date around which the letter of intent (LOI) is negotiated. The second one is the date on which the transaction is settled, and the third is the post closing or “true up” date, usually 30 to 45 days later, at which time, the balance sheet delivered at closing is adjusted to the negotiated balance sheet as reflected in the LOI. Adjustments to purchase price either up or down are made at the true up date. Definitive agreements provide dispute resolution procedures in the event a disagreement occurs over the calculation of the true up.

Balance Sheet Deliverables

The balance sheet changes on a daily basis as business is transacted, accounts receivable are billed and collected, inventories change, and cash balances fluctuate. The balance sheet is also affected by profits or losses over any given period. This dynamic characteristic of the balance sheet means that on closing or settlement, the balance sheet will likely be different than the one negotiated for the LOI. Since the buyer receives working capital, fixed assets and the intangibles, the parties to the transaction must set targets for these items to be delivered at closing.Â

The working capital target is an agreed-upon value that may represent the LOI balance sheet value, or can be set as an average of the working capital over the last twelve months or alternatively set as a percentage of sales. If cash is included in the deal, the parties must agree on the amount of cash to be delivered at closing.

A net assets or net worth test is typically included to account for changes in fixed assets or long term debt to be assumed by the buyer. The formula is working capital plus fixed tangible assets less debt. All things being equal, and absent any changes in fixed assets or long term debt, any profits or losses incurred during the time interval between the LOI and the closing will be reflected in the working capital or a change in cash. For example, if a company earns money, the profits manifest either in an increase in working capital or an increase in cash. The converse is true for losses. Until the deal closes and ownership transfers, profits and losses accrue to the seller. The following is an example of a true up calculation.

The benefit to the seller is a $2.5 million increase in purchase price suggesting a $2.5 million profit over the period split between a working capital asset increase and a debt reduction.

Normalization

Unlike the income statement, balance sheets rarely need normalizing. Once the working capital target is set and an agreement reached on the value of the fixed assets, nothing on the balance sheet should require normalizing with some exceptions. Any change to the carrying value in the working capital components that impact the cash flows affects the deal pricing. An example is a write down in accounts receivable or inventory that has not been through the income statement or the discovery of additional accounts payable not yet expensed to the income statement. A corollary to the working capital caution, if fixed assets require major capital expenditures post closing, this expense must be incorporated into future cash flows and pricing adjusted accordingly. Any non-operating assets need to be priced accordingly or removed from the balance sheet; an alternative treatment in an asset sale is to create a proforma opening balance sheet for the new entity and simply ignore non-operating assets that are not part of the sale.

Summary and Conclusion

M&A enterprise value is determined as function of discount rates and free cash flows and expressed in terms of multiples of EBITDA by a sell side investment banker. While the business is valued and sold in this fashion, the buyer gets the cash-free, debt-free balance sheet negotiated at the time of the LOI, and delivered at closing subject to a true up, including the ordinary and necessary working capital, fixed assets, and intangible assets that produce the cash flows. In that the balance sheet is constantly changing, the parties to a transaction must negotiate delivery targets for working capital, agree on a fair value for the fixed assets, and set a target for net assets or net worth at closing. It’s highly important, particularly for the buyer, that the working capital target be determined correctly. Final true up of the delivered balance sheets results in an adjustment, either up or down, to the selling price.Â

In conclusion, we trust that this article proves to be a useful tool toward a better understanding of the value of a business and the value of its balance sheet assets.

Ronald L. Stacey, MBA, CMA, AVA, CBI, CMAP, is founder and managing director of Legacy Advisors. He is a senior level corporate finance and operating executive with a broad range of experience over a wide variety of industries. A creative problem solver with a unique ability to effectively close complex transactions, his professional history includes work with world-class national and international financial services companies as well as privately held businesses. He can be reached at (214) 750-1112 or via e-mail at rstacey@legacyadvisors.org.