IPA Board of Directors Approves First Industry-Wide Valuation Guideline for Non-Listed REITs—Wall Street Journal

Industry Moves to Enhance Transparency of Investments Holding More Than $93 Billion in Assets

The Investment Program Association (IPA), a trade association for non-listed, direct-investment vehicles, announced recently the adoption of the IPA Practice Guideline for the valuation of publicly registered, non-listed real estate investment trusts, The Wall Street Journal reported. Here’s more from a Globe Newswire report the article cites:

“Today’s announcement is a landmark for the Investment Program Association and the direct investment industry,” said Kevin M. Hogan, President and CEO of the IPA. “Initiated by the IPA and the product of two years of industry consultation, this Guideline was developed by a broad cross-section of sponsor firms, broker-dealers, due diligence professionals and expert legal, accounting and financial advisors to bring a higher level of uniformity, consistency and transparency to the financial reporting for Non-Listed REITs.

“Today we speak with one voice about Non-Listed REIT valuation. This Guideline harmonizes different valuation approaches used by Non-Listed REIT sponsors across the industry so that investors, investment advisors, broker-dealers, and securities analysts can assess and compare more accurately Non-Listed REIT valuations and investment performance,” continued Hogan.

“We also believe the improved transparency and standardized valuation reporting arising from this Guideline will give a more compelling picture of the capacity of Non-Listed REITs to deliver attractive investment results, which in turn will enhance public confidence in our industry,” concluded Hogan.

Read more about the program on the IPA site.

The Appraisal Institute Online reports on the news here.

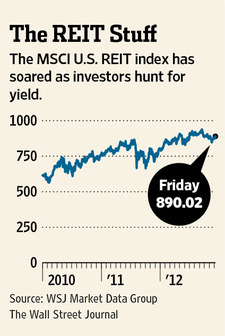

This Month, the IPA Approves New REIT Valuation Guidelines. REIT Investment Has Soared In the Last Two Years. The Graphic Above Shows Growth Through December 2012.