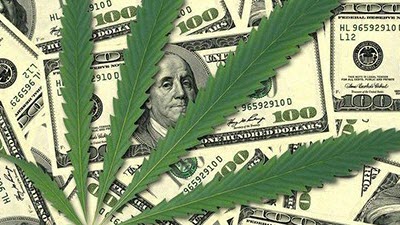

The Pot Stock Renaissance

With Colorado and Washington state legalizing casual use of marijuana, more states considering it and 20 allowing medicinal usage, at least 60 publicly traded entities have scrambled to cash in by offering pot penny stocks. Virtually none emerged through an IPO to avoid disclosure scrutiny. Real estate, marketing and even oil outfits have gotten into the game, either through reverse mergers or declaring a new line of business. Forbes magazine interviews Michael Mona, Jr., CEO of CannaVest, one of the biggest winners at the top of the pot stock bubble. The company surged 1,260 percent in 2013, the year it began. In February, CannaVest stock was valued at $160 a share, and the company made news after making a Las Vegas lawyer the first pot stock billionaire. For more information on pot stocks and their valuation, click the link below.