Discount Rates in a Purchase Price Allocation

Understanding the nature and risk of expected cash flow

This discussion summarizes the interrelatedness of the weighted average cost of capital and the weighted average return on assets within the context of a purchase price allocation for financial reporting purposes. Failure to understand this fundamental relationship can lead to inaccurate estimates of value for the acquired assets and, therefore, inaccurate reported asset values and amortization expense on the financial statements of the acquirer. The WACC can be viewed as a weighted average of the required rates of return for the individual assets of the acquired company. The selected intangible asset rates of return should be reviewed for reasonableness through a weighted average return on assets analysis. Understanding the nature and risk of the expected cash flow (of the enterprise and specific assets) is important to ensuring consistency throughout the analysis.

This discussion considers the interrelatedness of the weighted average cost of capital (WACC) and the weighted average return on assets (WARA) within the context of a purchase price allocation for financial reporting purposes.

It is important for the analyst performing a purchase price allocation valuation analysis to understand this concept when estimating the appropriate intangible and tangible asset rates of return.

Failure to understand this relationship can lead to inaccurate estimates of value for the acquired assets and, therefore, inaccurate reported asset values and amortization expense on the financial statements of the acquirer.

The discussion provides an overview of the financial reporting purchase price allocation guidance, Income Approach methods used to value businesses and intangible assets, discount rates applied in the Income Approach methods, and an example of a WARA analysis.

ASC 805 Overview

Financial Accounting Standards Board (FASB) Accounting Standards Codification (ASC) topic 805 provides guidance on the accounting and reporting that represent business combinations to be accounted for under the acquisition method. The acquirer is required to estimate the fair value of acquired assets. Using the appropriate valuation approaches and methods, the purchase price is allocated between:

- Identifiable assets (including financial assets, tangible assets, and identifiable intangible assets) and

- Purchased goodwill

According to ASC topic 805, intangible assets should be categorized by type and separated into two groups:

- Those with an identifiable remaining useful life

- Those with an indefinite life

Goodwill is not assigned a useful life, but it is tested (at least) annually for impairment. Intangible assets can be grouped into several categories, including marketing, customer-based, artistic, technology, and contract-based.

ASC topic 805 uses the fair value definition from ASC topic 820, which defines fair value as “the price that would be received to sell an asset or paid to transfer a liability in an orderly transaction between market participants at the measurement date.”

Income Approach

The three approaches employed in the valuation of assets (or businesses) include: the Income Approach, the Market Approach, and the Cost Approach. The focus of this discussion is on several Income Approach methods that are used in the business enterprise valuation and intangible asset valuation. This discussion also focuses on the measurement of the discount rate that is applied within the Income Approach valuation methods.1

The Income Approach is a valuation method that provides an estimate of the fair value of an asset based on the cash flows that an asset (or business) can be expected to generate over its remaining useful life.

Business Enterprise Valuation

The Income Approach may be applied through a discounted cash flow (DCF) Method. A valuation using the DCF Method is based on the present value of estimated future cash flows for the expected life of the asset (or business) discounted at a rate of return that considers the relative risk of achieving that cash flow and the time value of money. The DCF method is often used in estimating the business enterprise value of the acquired company.

Estimating the business enterprise value of the acquired company is the initial step in performing a purchase price allocation. This step is performed for several reasons, including the following:

- To validate that the purchase price is representative of fair value and that it was not a bargain purchase or overpayment

- To validate the reasonableness of the overall business cash flow projections to be relied on in applying the Income Approach to value certain intangible assets

- To validate the reasonableness of the required rates of return applied in the valuation of the intangible assets

- To validate that the estimated fair values of the assets are reasonable relative to the business enterprise value of the acquired company

When net cash flow to invested capital is used as the measure of income subject to analysis, the discount rate applied is typically the overall cost of capital, or WACC.

Intangible Asset Valuation

In the valuation of intangible assets, the Income Approach may be applied through the Multi-Period Excess Earnings Method (MEEM), the Royalty Savings Method, or some other method.

This discussion describes the MEEM and the Royalty Savings Method. The valuation of identified intangible assets relies on both:

- Expected cash flow that is attributable to the subject intangible assets and

- The discount rate that is applied to that cash flow.

Multi-period Excess Earnings Method

The MEEM is a method under the Income Approach used to estimate the value of certain intangible assets, typically existing customer relationships. The starting point for the MEEM is generally financial information (e.g., revenue, profit margin, etc.) derived from the cash flow projections used in the DCF Method.

Intangible assets often do not produce profits and cash flow without the use of other tangible and intangible assets. Through the application of the MEEM, the cash flows of the subject intangible asset can be isolated from the group of assets.

The expected earnings of the subject intangible asset, or excess earnings, are isolated from the earnings of the group of assets by identifying and deducting portions of the total earnings that are attributable to contributory assets.

The identification of earnings attributable to the contributory assets is based on the application of a contributory asset charges (CAC), which represent an economic charge for the use of the contributory assets. The resulting excess earnings (the residual earnings after subtraction of the CAC) are the earnings attributable to the subject intangible asset.

The after-tax excess earnings of the subject intangible asset should be discounted to present value at an appropriate rate of return.

Royalty Savings Method

The Royalty Savings Method, also known as the Relief From Royalty Method, is another method considered an Income Approach Method. This method is often used to estimate the value of certain intellectual property, typically trade names. In the Royalty Savings Method, the value of the intangible asset is estimated to be the present value of the royalties saved because the company owns the intangible asset.

Viewed another way, the owner of the subject intangible asset realizes a benefit from owning the asset as opposed to paying royalties for the use of the subject intangible asset. By acquiring the asset, the owner is relieved from making royalty payments.

The after-tax royalty savings of the subject intangible asset should be discounted to the present value at an appropriate rate of return. Refer to Valuation for Financial Reporting for further description and an example of the Royalty Savings Method.2

DISCOUNT RATES

The cost of capital can be viewed from three different perspectives, as discussed in the following quotations:

On the asset side of a firm’s balance sheet, it is the rate that should be used to discount to a present value the future expected cash flows.

On the liability side, it is the economic cost to the business of attracting and retaining capital in a competitive environment, in which investors (capital providers) carefully analyze and compare all return-generating opportunities.

On the investor’s side, it is the return one expects and requires from an investment in a business’s debt or equity. While each of these perspectives might view the cost of capital differently, they are all dealing with the same number.3

Considering these different perspectives of the cost of capital allows for the analyst to understand the interrelatedness of the WACC and the WARA.

Rates of Return

The estimation of an overall rate of return for the acquired company is required before determining the stratification of the rates of return for the acquired assets. The comparison of the WACC to the WARA allows the analyst to reconcile the rates of return required by providers of capital with the rates of return earned by the acquired assets.

Weighted Average Cost of Capital

The overall cost of capital is commonly referred to as the WACC. The WACC is calculated as the return on the investment in the acquired company by a market participant.

The WACC is comprised of a required rate of return on equity which is estimated by a rate building process (e.g., Capital Asset Pricing Model, the Build-Up Model, etc.) and an after-tax rate of return on debt capital.

Further, an analysis of an appropriate long-term market participant capital structure for the acquired company is required. Using an estimated required rate of return on equity capital, an estimated after-tax cost of debt capital, and a market participant capital structure, the WACC of the acquired com¬pany can be estimated.

Asset Rate of Return Selection

In general, the risk profile of each asset category should be considered when estimating the appropriate rates of return. The analyst should consider the liquidity of the assets on the balance sheet on a spectrum from working capital (most liquid) to the intangible assets (least liquid). In addition, the analyst can consider the assets based on their ability to be financed by debt or equity.

The Appraisal Foundation notes that “the risk profile of an entity’s assets generally increases as you move down the balance sheet and, accordingly, the type of financing available for these assets shifts from debt to equity as the risk profile increases.”4

Given these concepts, it is typical to select a rate of return for working capital at or near the cost of debt (depending on the available debt financing estimated when considering the market participant capital structure and the purchase price paid) and a rate of return consistent with the estimated cost of equity for the acquired company’s intangible assets.

The selected asset rates of return have three uses in the MEEM within the purchase price allocation analysis. These are as follows:

- The application of CACs

- The returns on asset categories in the calculation of the WARA

- The discount rate used to derive the present value of the expected subject intangible asset cash flows

Weighted Average Return on Assets

The WARA should result in the same overall cost of capital as the WACC. This is because the WACC can be viewed as a weighted average of the required rates of return for the individual assets of the acquired company. Said another way, the operations of the acquired company are considered fundamentally equivalent to the combined assets of the acquired company. A WARA that is significantly different from the estimated WACC may require a reassessment of both the estimated asset values and the assumed returns assigned to those assets to determine if they represent market participant assumptions.

In part, the WACC reflects required rates of return for less risky assets, such as net working capital and tangible assets, as well as the required rates of return for riskier assets such as intangible assets.

The comparison of the WACC to the WARA allows the analyst to reconcile the rates of return required by providers of capital with the rates of return earned by the various classes of assets. Thus, the WARA calculation assists in assessing the reasonableness of the asset-specific returns for identified intangible assets and the implied (or calculated) return on goodwill.

For financial reporting purposes, goodwill is a residual value and the rate of return on goodwill is calculated as an implied rate of return. Within the context of the WARA, the rate of return on goodwill can be implied by reconciling the weighted average rates of return of all the identified assets to the WACC of the acquired company as demonstrated in the following example.

WARA Analysis Example

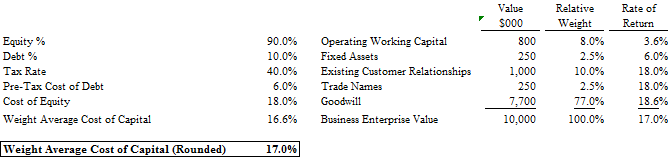

This example demonstrates how the WARA calculation can be used to assist the analyst in assessing the reasonableness of the selected asset-specific returns for the tangible assets, identified intangible assets and the implied return on unidentified intangible assets or goodwill. The sample company has an estimated business enterprise value of $10 million and a WACC of 17.0 percent.

Table 1

WARA Example

In the example above, the selected rates of return for each asset are based on the methodology discussed earlier. Given the business enterprise value of $10 million and that 10 percent of the capital structure is debt; the sample company has $1 million of debt. Since the operating net working capital is $800,000, the sample company can fully finance the operating working capital with debt and the after-tax cost of debt was selected as the rate of return. The selected rate of return for fixed assets was based on a blended after-tax cost of debt and cost of equity given the debt remaining to finance the fixed assets after financing working capital, or $200,000. The selected rates of return for existing customer relationships and trade names were equal to the cost of equity consistent with the risk profile of these assets.

The WARA is calculated as the sum of the required rates of return for operating working capital, fixed assets, and intangible assets, weighted by each asset’s proportionate share of the total business enterprise value. The goodwill rate of return is the return that causes the business enterprise value rate of return to equal the WACC of 17.0 percent. The implied rate of return on goodwill based on the selected rates of return for each asset and the WACC is higher than any other asset. This result is consistent with the concept that goodwill is the riskiest asset and should require the highest rate of return.

Summary

The interrelatedness of the WACC and the WARA within the context of a purchase price allocation is an important concept for the analyst performing a purchase price allocation valuation analysis. The failure to understand this relationship can lead to inaccurate estimates of value for the acquired assets.

The selected intangible asset rates of return utilized in the valuation of the subject intangible asset and the application of CACs should be reviewed for reasonableness through a WARA analysis.

Understanding the nature and risk of the expected cash flow (of the enterprise and specific assets) is important to ensuring consistency throughout the analysis.

This article originally appeared in the Fourth Quarter edition of the Business Appraisal Practice and was a contribution of Willamette Management Associates.

Notes:

- The market approach and cost approach do not require the estimation of a discount rate in an intangible asset valuation. However, a rate of return would need to be applied to each intangible asset for the application of capital asset charges in the multiperiod excess earnings method.

- Mard, Michael J., Hitchner, James R., Hyden, Steven D. Valuation for Financial Reporting (New York: John Wiley & Sons, Inc., 2011), 101-104.

- Ibbotson SBBI 2012 Valuation Yearbook (Chicago: Morningstar, 2012), 21.

- Â Best Practices for Valuation in Financial Reporting: Intangible Asset Workgroup. The Identification of Contributory Assets and the Calculation of Economics Rents (Washington, DC: The Appraisal Foundation, 2009).