Developing Supportable Attrition Rates in Customer Relationship Valuations

Valuation of the Customer Base

The value of the customer base is a function of attribution. Measuring percentage attribution requires access to internal data, and this data is often missing. Where it is available, the valuation professional can use the Constant Revenue or Revenue Decline Model. This article explains how these models are developed.

In a battle of attrition, one side attempts to win by wearing its opponent down through continuous losses over time. The word “attrition” actually comes from the Latin root atterere, which means to “grind down.” Battles of attrition are long, ugly, and costly.

In a battle of attrition, one side attempts to win by wearing its opponent down through continuous losses over time. The word “attrition” actually comes from the Latin root atterere, which means to “grind down.” Battles of attrition are long, ugly, and costly.

While auditors, valuation experts, and management can sometimes battle over the value of intangible assets in purchase price allocations, none of the parties involved want anything close to a battle of attrition. Long, ugly, and costly are three words that no client wants to hear when dealing with a service provider. The only attrition that anyone wants to see in a purchase price allocation relates to customer attrition estimates used in the valuation of customer relationships, so it is important to develop supportable customer attrition rates to avoid battles with auditors during the review process

How Does Attrition Factor Into the Valuation of Customer Relationships?

Customer relationships are often valued using the Multi-Period Excess Earnings Method (MPEEM). One of the key inputs to the MPEEM is the customer attrition rate, which reflects the rate at which customers (and the revenue they generate) are lost over time. Because only the customers in place at the time of acquisition can be considered in the valuation of customer relationships in a purchase price allocation, the attrition rate utilized plays a significant role in determining the value and useful life of acquired customer relationships.

Factors Affecting Attrition Rates

While there are numerous factors that can affect a company’s customer attrition rate, some of the most impactful include the following:Â

- Length of customer relationship. Longer relationships are typically less likely to be lost.

- Product differentiation. Superior products can translate to customers being less likely to switch.

- Lower competition will generally result in lower attrition.

- Switching costs. Higher switching costs will typically lower the attrition experienced.

- Individual customers vs. business customers. Individual customers are more likely to leave/switch than business customers.

- More customers within close range of the company will generally decrease attrition.

Key Considerations in Estimating Attrition

The list below includes a summary of key considerations that should be kept in mind when estimating attrition rates:

- Gather as much available data as possible because the more years of historical attrition data analyzed, the stronger and more supportable the analysis.

- Determine if segmentation of the customer population is necessary/appropriate (if a certain segment of customers is more “sticky” than another, segmentation of the customer base in calculating attrition may more accurately reflect economic reality).

- Look at the financial statement footnotes for any guideline public companies identified and look at the useful lives assigned to customer relationships in any acquisitions (attrition rates can be estimated from the useful lives).

- Determine 1) the period of time that must elapse without any sales, or 2) the percent of current sales levels to which revenue must decline before a customer is considered “lost” (in certain industries, customers may only need to make purchases every few years rather than on an annual basis, so a few years without a purchase may not indicate a “lost” customer).

Methods to Estimate Attrition

There are multiple methods that valuation experts can use to estimate customer attrition:

- Management Estimate. The simplest method in arriving at an attrition rate is to rely on a qualitative management-developed estimate. While this is the simplest method, it is also the least supportable to auditors, who may have difficulty relying on the estimate without a corroborating quantitative analysis (unless such quantitative data is not available).

- Analysis of Guideline Public Company Customer Relationship Lives. If any of the guideline public companies analyzed have made acquisitions, they will need to disclose the useful lives assigned to the acquired customer relationships. It is possible to back into an attrition rate by referring to the useful life assigned by comparable public companies (oftentimes, the useful life of a company’s customer relationships is estimated to be equal to the period of time from the acquisition until the cumulative discounted cash flows capture 90‒95 percent of the total projected discounted cash flows for the acquired customers).

- Analysis of Historical Customer Attrition. Historical attrition rates are often used to estimate future customer attrition.  This method is often the most supportable, but also the most time-consuming, of those relied upon to estimate a company’s customer attrition when valuing acquired customer relationships. This application of this method, however, is predicated on the company having kept detailed historical sales data.

How to Prepare an Analysis of Historical Customer Attrition

Before preparing a historical attrition analysis, first, determine whether attrition will be measured by either revenue or customer count. Customer count-based attrition is typically only appropriate if all customers generate a similar amount of revenue (such as for subscription-based companies). Therefore, it is much more common to see revenue-based attrition analyses. It has become a best practice to calculate revenue-based attrition rates without growth factored into them (also known as “adjusted revenue-based attrition”), particularly when historical growth is larger than attrition.

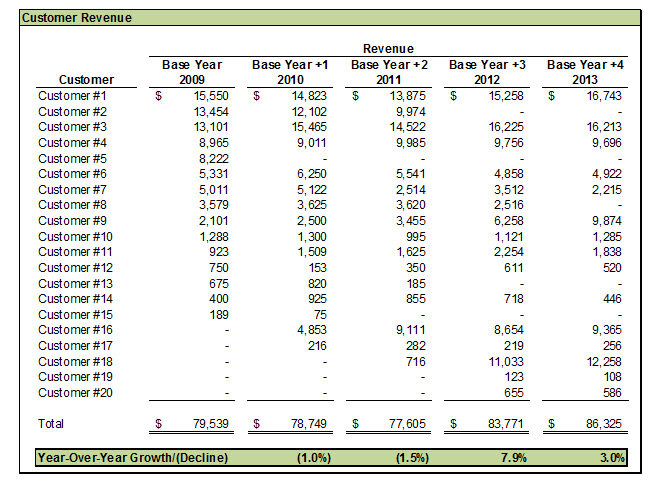

The following set of customer revenue data will serve as the foundation for examples of two commonly used methodologies to calculate customer attrition:

There are two methods that are often used in calculating adjusted revenue-based attrition:

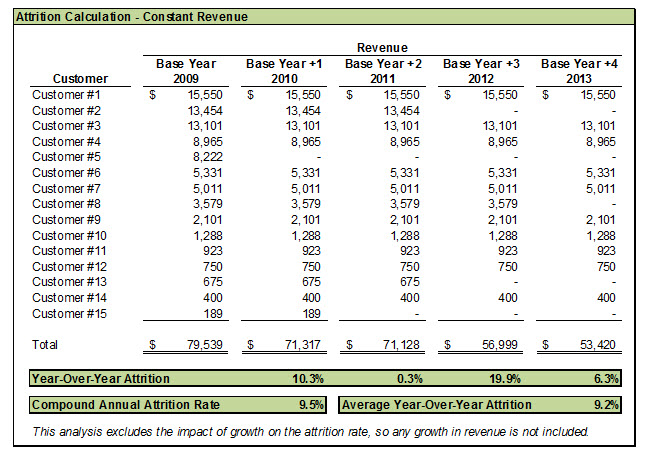

- Constant Revenue. Using this methodology, a base year is chosen to be the date from which customer attrition will be measured. The same revenue in the base year (the starting point) is shown in each future year until the customer is lost. When a customer is lost, revenue for that year and all future years is reduced to zero. Attrition can then be calculated on an annual and compound annual basis. A basic example of how this method is applied is presented below:

- Revenue Decline Permitted. Using this methodology, the revenue in the base year (the starting point) is the maximum amount that can be shown in any future year, but declines in revenue are permitted. Therefore, if a customer represented $2 million of revenue in the base year, $1 million in the next year and then $0 in the following year, this method would take into account the decline in revenue to $1 million in Year 2 before the customer was lost in Year 3. This is different from the constant revenue method discussed above, which would use $2 million as the revenue for that customer in each year of the attrition analysis until the customer is lost. Note that in practice, some valuation experts will allow for recovery of revenue after a period of decline (but not higher than the base year revenue amount). Similar to the constant revenue method, attrition can be calculated on an annual and compound annual basis. Unlike the constant revenue method, however, this methodology reflects the impact of changes in customer buying patterns in addition to customer turnover. A basic example of how this method is applied is presented below:

Valuation analysts will often attempt to obtain customer sales data for the five years preceding the valuation date, but the number of years analyzed in each engagement will vary based on the availability of data and the characteristics of the company’s customers. If historical customer sales data for multiple years is available, attrition rates can be calculated using each year as its own base year. For example, if five years of sales data is available, an analyst could prepare a five-year analysis, four-year analysis, three-year analysis, and two-year analysis all using the same data. Looking at attrition for customers in place over these multiple time periods provides additional data points for consideration and also allows for the analysis of any potential trends in a company’s customer attrition rate over time.

Developing a Supportable Attrition Estimate

When developing attrition estimates, it is often helpful to have multiple data points supporting the concluded attrition rate. Therefore, multiple attrition calculations are often prepared (such as both the “Constant Revenue” and “Revenue Decline Permitted” methods discussed above over multiple time periods), possibly corroborated by management’s attrition estimate and/or the implied attrition rates of the guideline public companies. Like developing a discount rate, arriving at an exact attrition figure is not necessary to pass auditor review, but you need to have support for why the selected attrition rate is reasonable and appropriate.

Other Resources for Estimating Attrition Rates

Two of the most helpful resources for developing supportable attrition rates, both of which were relied upon to develop this article, are the ASA BV 302 course and “The Valuation of Customer-Related Assets” whitepaper issued by The Appraisal Foundation. Both contain in-depth analysis on the issue of calculating customer attrition and provide additional examples of the quantitative methodologies for doing so.

Conclusion

Attrition rates are one of the key inputs valuing customer relationships. Auditors understand this and are requiring more documentation and support for how customer attrition estimates are developed. Therefore, it is important that valuation experts have a full array of both quantitative and qualitative data to support their attrition estimates to avoid “battles of attrition” with auditors over this issue.Â

Sean R. Saari, CPA.ABV, CVA, MBA, is principal at Skoda Minotti CPAs, Business & Financial Advisors in Mayfield Village, Ohio. Mr. Saari can be reached at (440) 605-7221 or ssaari@skodaminotti.com.