FAQ Interpretations

Non-Litigation #2 and Litigation #4

The NACVA’s Standards Board was formed to continually review the organizations’ standards and to ensure that the NACVA’s Professional Standards remain up to date, relevant, and relatively consistent with the standards of the other professional organizations. This article addresses the second Non-Litigation and the fourth Litigation FAQ Interpretations published by the NACVA.

[su_pullquote align=”right”]Resources:

[/su_pullquote]

Business valuation/appraisal standards are promulgated by different business appraisal organizations. The NACVA’s Standards Board was formed to continually review the organizations’ standards and to ensure that the NACVA’s Professional Standards remain up to date, relevant, and relatively consistent with the standards of the other professional organizations. This article addresses the second Non-Litigation and the fourth Litigation FAQ Interpretations published by the NACVA.

The second Non-Litigation FAQ Interpretation that has been published is as follows:

Question: Is a NACVA member required to follow USPAP?

Answer: Generally, members are not required to follow USPAP to be in compliance with NACVA Professional Standards. However, there may be instances that require USPAP to be followed as well as the NACVA Professional Standards.

Interpretation: A member of the NACVA is required to follow NACVA Professional Standards. Members should be aware of any governmental regulations and other professional standards applicable to the engagement, and the extent to which they apply. In these situations, members should follow the NACVA Professional Standards and the applicable governmental regulations and other professional standards applicable to the engagement. Members are also encouraged to review the Standards Comparison Charts here: https://www.nacva.com/standards. (Additional references: SSVS1; SBA:ii,C,1,a; CEIV Mandatory Performance Framework)

Example

Say you have earned the CVA designation and are not a CPA. However, you work in a CPA firm that is a member of the AICPA. As a non-CPA CVA working for a firm that is a member of the AICPA, then you must follow the NACVA Professional Standards and the AICPA’s SSVS, No. 1. Following the AICPA’s SSVS No.1 may still hold true if the firm is not a member of the AICPA, but the firm’s state board of accountancy follows AICPA rules and regulations.[1] While this example is not directly tied to USPAP, its framework is consistent with the interpretation of the second Non-Litigation FAQ Interpretation.

Governmental regulations and jurisdictional circumstances aside, only members of the ASA are required to adhere to USPAP. However, any valuation analyst can adhere to USPAP if he or she chooses to do so. Each business valuation is performed on a case-by-case basis and it is the member’s responsibility to seek the additional rules, regulations, and standards that may apply.

Resources

While not all-inclusive, the following two examples are definitions of qualified appraisers/sources provided by governmental agencies:

- Internal Revenue Service’s (IRS) definition of a Qualified Appraiser: an individual who (1) has earned an appraisal designation from a recognized professional appraiser organization or has otherwise met minimum education and experience requirements set forth in regulations prescribed by the Secretary, (2) regularly performs appraisals for which the individual receives compensation, and (3) meets such other requirements as may be prescribed by the Secretary in regulations or other guidance. Section 170(f)(11)(E)(iii) provides that an individual will not be treated as a qualified appraiser with respect to any specific appraisal unless that individual (1) demonstrates verifiable education and experience in valuing the type of property subject to the appraisal, and (2) has not been prohibited from practicing before the IRS by the Secretary under section 330(c) of Title 31 of the United States Code at any time during the 3-year period ending on the date of the appraisal.[2]

- Small Business Administration (SBA) definition of a Qualified Source with respect to business valuations 7(a): A “qualified source” is an individual who regularly receives compensation for business valuations and is accredited by one of the following recognized organizations:

- Accredited Senior Appraiser (ASA) accredited through the American Society of Appraisers;

- Certified Business Appraiser (CBA) accredited through the Institute of Business Appraisers;

- Accredited in Business Valuation (ABV) accredited through the American Institute of Certified Public Accountants;

- Certified Valuation Analyst (CVA) accredited through the National Association of Certified Valuation Analysts; and

- Business Certified Appraiser (BCA) accredited through the International Society of Business Appraisers.[3]

The fourth Litigation FAQ Interpretation that has been published is as follows:

Question: Does the output of an automated valuation model represent a conclusion of value or an opinion of a calculated value that can be proffered in a litigation setting?

Answer: No. The output of an automated valuation model is not, in and of itself, representative of (a)n opinion of a conclusion of value or calculated value suitable for a litigation setting. While the output of an automated valuation model may help support the basis of a member’s opinion, professional judgment must be applied by the member responsible for the determination of value and is necessary to be able to conclude or opine upon a value estimate generated by an automated valuation model.

Interpretation: The use of professional judgment is an essential component of estimating value (Section I). Moreover, the results generated by an automated valuation model are not innately or intrinsically equivalent to a conclusion of value or an opinion of a calculated value. An automated valuation model is a tool used to calculate or perform a mathematical computation.

In today’s data-driven world, appraisers may find themselves applying more weight to the “science” portion of the valuation process rather than the “art” portion. Gone are the days of slide rules and ledger paper. While today’s proliferation of spreadsheets and software have increased business valuation work productivity, it has opened the door for the process to become overly reliant on automated mechanisms. Tools such as Excel models and business valuation software do not, in and of itself, use professional judgment. The term “professional judgment” has yet to be defined by the various valuation professional organizations, yet it is required for members providing valuation services.[4]

Definitions

Merriam Webster’s dictionary defines professional (adj.) as “relating to a job that requires special education, training, or skill; done or given by a person who works in a particular profession; characterized by or conforming to the technical or ethical standards of a profession.”[5]

Merriam Webster’s dictionary defines judgment as “an opinion or decision that is based on careful thought; the act or process of forming an opinion or making a decision after careful thought; the act of judging something or someone; the ability to make good decisions about what should be done.”[6]

When I combine these two definitions, the meaning of the word “professional judgment” would be making informed and reasonable decisions based on the special education, training, or skills of the valuation professional. Essentially, a member is not providing a valuation service if professional judgment was not applied by the professional (member). Since an automated valuation model applied in a litigation setting is not applying professional judgment in and of itself, then the indication of value reached does not represent a conclusion of value or an opinion of a calculated value that can be proffered in a litigation setting.

Importance of Professional Judgment

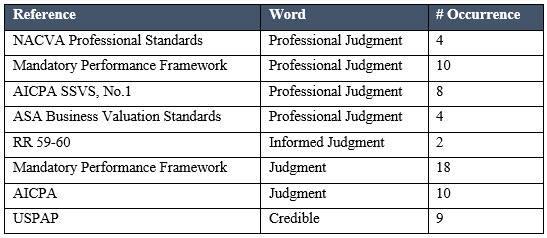

To illustrate the importance of professional judgment, I believe it is necessary to refer to the various professional organizations and readily available sources. As derived from the abundant use of the word professional judgment, or its synonym shown in the chart below, it is reasonable to conclude that professional judgment is important to the valuation profession as a whole.

Mechanical/Mathematical Computations

Although not previously addressed by the NACVA, the AICPA and USPAP provided guidance as to mechanical computations. The AICPA’s SSVS No.1 indicates that mechanical computations of value that do not apply valuation approaches and methods and do not use professional judgment are excluded from SSVS No.1. The AICPA provides examples of mechanical computations of value that do not rise to the level of an engagement to estimate value.[7]

Additionally, the 2020-2021 edition of USPAP outlines various factors that must be considered in Standards Rule 9-4 with regard to mathematical computations. Specifically, the comment to Section 9-4(d) states, “Equity interests in a business enterprise are not necessarily worth the pro-rata share of the business enterprise interest value as a whole. Also, the value of the business enterprise is not necessarily a direct mathematical extension of the value of the fractional interests. The degree of control, marketability, and/or liquidity or lack thereof depends on a broad variety of facts and circumstances that must be analyzed when applicable.” This is a great example of applying mathematical computations that do not utilize professional judgment, due professional care, or a credible result.

How Do You Know?

So how do you know if a member is using professional judgment? I generally utilize the words known and knowable to assess the use of professional judgment in a valuation. Often, we hear these words when referencing subsequent events. “… [W]hile the Court emphasized that the valuation should be based on what was known or knowable at the valuation date, and that the subsequent sale of the company was not foreseeable ….”[8]

A member could also reference professional competence within the NACVA Professional Standards. “A member shall only accept engagements the member can reasonably expect to complete with a high degree of professional competence.”[9] In my opinion, words like known, knowable, and professional competence can be combined with professional judgment.

Example

If the analyst values nonoperating assets separately in a litigation setting, it must be done so as to exclude any income generated or expenses incurred by the nonoperating assets. Related income and expenses should be valued separately from the earnings base capitalized in valuing the company’s operations.[10],[11] These statements are referenced in both the NACVA’s Business Valuations: Fundamentals, Techniques, and Theory as well as Shannon Pratt’s Valuing a Business. Therefore, if a member does not exclude any income generated or expenses incurred when valuing nonoperating assets, then in my opinion, there may be a professional judgment issue because this information was known or knowable (provided the valuation was performed after these publications were made available).

[1] NACVA’s QuickRead, “Linked Out”: A Response to a Business Valuation Standards Discussion, January 31, 2013, Ed Dupke.

[2] Internal Revenue Service (IRS), Treasury, Federal Register/Vol. 83, No. 146/Monday, July 30, 2018/ Rules and Regulations.

[3] U.S. Small Business Administration, Standard Operating Procedures, Appendix 3: Definitions, effective October 1, 2020.

[4] NACVA Professional Standards, Section I.

[5] Merriam Webster Dictionary, Definition of Professional, 2020. https://www.merriam-webster.com/dictionary/professional

[6] Merriam Webster Dictionary, Definition of Judgment, 2020. https://www.merriam-webster.com/dictionary/judgment

[7] AICPA SSVS-1, Interpretation No. 1, Illustration 8, (VS sec. 9100 par. .20-.23).

[8] Shannon P. Pratt: Valuing a Business, Fifth Edition, p. 670 referencing the Estate of Jung

[9] NACVA Professional Standards, Section II.B

[10] NACVA Business Valuations: Fundamentals, Techniques and Theory, NACVA, 2014, Chapter Three – 11

[11] Shannon P. Pratt: Valuing a Business, Fifth Edition, p. 146

Nick Mears, MBA, CVA, MAFF, is the founder and managing member of Caprock Business Consulting, LLC, a business valuation, litigation support, and consulting firm based in Lubbock, Texas. He is a Standards Board (SDB) member with the National Association of Certified Valuators and Analysts (NACVA) and focuses his expertise on valuing privately-held business interests for litigation support, acquisitions, SBA and commercial lending, and gift and estate tax purposes.

Mr. Mears can be contacted at (806) 853-7832 or by e-mail to admin@caprockbusinessconsulting.com.