Incorporating Country Risk Premium Differentials

Into the Market-Based Valuation (Part I of II)

This is a two-part article on how to incorporate country risk premium. The market-based approach to valuation is commonly used by market practitioners and is based on the relevant values and multiples from similar assets. One of the differentiators between assets is the country risk related to the operations, when the multiples are collected from various countries. This paper presents the proposed approach to incorporate country risk premium differentials into the multiples. It describes the possible ways of obtaining the country risk premium and the procedure of making the adjustment to the multiple. The theoretical reasoning is applied in a case study—the valuation of a company from an emerging market.

Abstract

This is a two-part article in how to incorporate country risk premium. The market-based approach to valuation is commonly used by market practitioners and is based on the relevant values and multiples from similar assets. One of the differentiators between assets is the country risk related to the operations, when the multiples are collected from various countries.

This paper presents the proposed approach to incorporate country risk premium differentials into the multiples. It describes the possible ways of obtaining the country risk premium and the procedure of making the adjustment to the multiple. The theoretical reasoning is applied in a case study—the valuation of a company from an emerging market.

Introduction

The market-based approach to valuation is one of the main approaches used for valuing a business, besides the income approach and asset-based approach. However, comparison to other companies and transactions is probably most widely applied in practice. As defined in European Business Valuation Standards issued by the European Group of Valuers’ Association, in the market (comparison) approach, the valuation is produced by comparing the subject business with the evidence obtained from market transactions related to similar companies, either publicly traded (comparable) or private companies, that fulfill the criteria defined by the valuer.[1]

The main assumption of this approach is that a valued entity is similar to those being subject to the transaction, whether on the public market or in the private deal. However, no two companies in the world are identical because of differentiating characteristics regarding their financial position, market positioning, growth prospects, and risks; the last two being especially crucial for the determination of the trading multiple. As some types of differences were already analyzed in the previous research with a recommendation for adjustments in the valuation process,[2] this article will focus on a difference in country risk among comparable companies.

The divergence in this risk parameter might be negligible when two companies from similar regions are put together. However, when country characteristics differ significantly, the impact on the valuation process becomes relevant and is often omitted. Even when we assume that the business risks and growth prospects are similar for comparable entities, the fact of operating under the differing regime of country risk should lead us to the conclusion that assigned multiples should differ as well. In such a situation they should not be taken mindlessly from other markets and used for valuation but need further analysis.

The Marked-based Approach to Valuation and Most Common Multiples

According to the market approach to valuation, the valued entity is compared to similar businesses and securities that have been traded on the market. The general rule is that alike assets should trade at a similar price (or multiple of some metric). The market-based approach assumes that the consideration paid in the transaction represents the fair value of an asset and can be used for the determination of prices for other assets. The price paid by the purchaser sets a base for the calculation of multiples which may be based on financial values or operational characteristics relevant for a given industry. The consideration transferred represents the nominator of the multiple, while the financial or operational attribute is taken as a denominator. However, there is a significant distinction between multiples using enterprise value (EV) and the equity value of an entity.

Equity value relates to value available only to the company’s shareholders, whereas enterprise value is the sum of equity value and interest-bearing debt less excess cash and potential non-operating assets. Enterprise value represents the total value of business operations that generate cash flows to all capital providers. As a consequence, the multiples related to equity value should be calculated on the basis of shareholder-related features like book equity value (BV), net profit or EPS (earnings per share), or dividends. On the other hand, multiples making use of enterprise value should correspond with numbers or business features suitable for the whole company, e.g., sales, earnings before interest and tax (EBIT) or earnings before interest, tax, depreciation, and amortization (EBITDA), or operational numbers like a number of vehicles, rooms, etc.

There are two steps in the valuation process according to the market approach. First, the market multiple has to be defined taking the data from the relevant transaction and data specific for the entity being a subject of the transaction. Then, in the second step, the calculated value is multiplied by the company-specific number to produce the estimate of the value, enterprise or equity, respectively. The most common multiples used in the market approach are EV/Sales, EV/EBITDA, P/E, P/BV. The source of the data can be twofold, which defines two valuation methods within the market approach. One is the comparable publicly traded company method which is based on transactions in the public securities market. The other one is the comparable transactions method which is based on deals involving the sale of entire businesses that are similar to the characteristics of the entity being valued.

Searching for similar companies usually leads to entities with the same sector exposure. This might be a satisfactory approach, subject to cases when regulations or market environment are significantly different. But even with those conditions fulfilled, one should be cautious with the simple use of multiples. Every company is unique in terms of activity, market, business segments, size, financial performance, growth, risks, etc. As a result, the valuer may have to make some adjustments to the valuation multiples obtained from market data to apply them to the subject entity. They should be considered in isolation, as every aspect may impact the valuation result positively or negatively. One of the essential differentiators among companies, except those mentioned before, is country risk.

What is Country Risk?

Country-specific factors determine the risk borne by the investors in the international markets. The risk factors in this area can be divided into three categories: political risks, economic risks, and financial risks related to the specific country. Political factors include uncertain legal situation and regime, political instability, probability of expropriation, or even restrictions on information availability. They may also include unstable and unfavorable tax laws or regulations that are restricting foreign investment. Economic factors comprise the economic vulnerability of the state, its currency risk, as well as high government debt which may occur unsustainable in the long run. At the same time, financial factors are related to restrictions in the transfer of profits or high trading costs.

One of the best indicators for country risk is the credit rating assigned to a country by the credit agency. The assessment is based on several characteristics, usually including, among others, institutional assessment, comprising of sustainability of finances, promotion of economic growth, the transparency and accountability of data and institutions, as well as potential external and domestic security risks. Other components of evaluation include economic, fiscal, monetary, and external aspects.[3]

Developed markets with a stable political and economic situation would not pose material country risk for an investor. However, in the case of emerging markets, the aforementioned factors can become substantial and significantly influence the total risk of an investment. As a result, this should be reflected in the market valuation of an entity located in such a country compared to the valuation levels taken from developed markets, which is consequential in the market-based valuation approach. The concept of country risk premium has important practical meaning, even though it may be theoretically criticized by academics.[4] Companies operating in countries varying in country risk premium should be traded with differing multiples, ceteris paribus.

How to Measure the Country Risk Premium

First, before we implement the difference in country risk into the market multiples calculated for comparable companies, we must define how to measure the country risk premium. There are several approaches to solve that problem presented in the research papers.[5] Below are described options proposed by prof. A. Damodaran.[6]

The easiest way for determining the country risk premium is to refer to the spreads of the government bonds of a given country above the yield of the government bonds of the country perceived as risk-free. Typically, we will consider a country as risk-free when its rating would be at the top AAA-level. Naturally, both bonds should be denominated in the same currency to enable the calculation. If the analyzed country does not possess actively traded debt in a currency relevant for comparison (i.e., dollar or euro-denominated), we may find its implied spread referring to the spreads of other issuers with the analogous credit score (credit rating). As an alternative, we may apply quotes of a credit default swap (CDS) which should also represent the risk of a default by a country in the perception of the market participants.

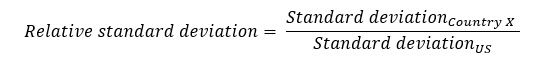

Although the above approach seems to be satisfying enough, it refers only to the default risk of the country. However, the total country risk is related to more threats than solely the default on the bond payments. We present one additional variant of the country risk premium estimate. It is based on the relative standard deviation of the equity markets between two countries measured as the proportion of the standard deviation of equity in the relevant country to the standard deviation of equity in a country risk-free state (e.g., in the U.S. market).

Then, the equity risk premium for that country is found as:

Equity risk premiumCountry X = Equity risk premiumUS x Relative standard deviation

Therefore, the country risk premium may be isolated in the following way:

Country risk premium = Equity risk premiumCountry X – Equity risk premiumUS

This method seems intuitive, as higher risk should lead to higher volatility. However, the liquidity of some markets, especially emerging markets, may prevent the prices from adjusting to changing market conditions and reduce the resulting value of standard deviation. This may lead to underestimating the country risk premium. One should be aware of this possibility. However, if the data is available, this method is a preferred one. Therefore, it will be applied in our further calculations.

The second part of this article discusses how to incorporate country risk into valuation multiples.

References

Damodaran, A. 2018, The Dark Side of Valuation. Valuing Young, Distressed and Complex Businesses, Pearson Education Inc.

Harrington J., Nunes C., International Cost of Capital: Understanding and Quantifying Country Risk, Journal of Business Valuation, 2019 edition, CBV Institute.

Kruschwitz, L., Loeffler, A. and Mandl, G., Damodaran’s Country Risk Premium: A Serious Critique (July 31, 2010). Available at SSRN: https://ssrn.com/abstract=1651466 or http://dx.doi.org/10.2139/ssrn.1651466.

Mercer, Z.C. 2013, Fundamental Adjustments to Market Capitalization Rates, reprinted from Mercer Capital’s Value Matters 2004-11. Available from Internet: https://mercercapital.com/article/fundamental-adjustments-to-market-capitalization-rates/.

Milenković, N. 2015, Market Multiples Adjustments for Differences in Risk Profile – an Airline Company Example, International Journal for Traffic and Transport Engineering, 2015, 5(1): p. 17-28. Available from Internet: http://ijtte.com/uploads/2015-02-25/935be804-f903-5243IJTTE_Vol%205(1)_3.pdf.

S&P Global Ratings, 2017, Sovereign Rating Methodology, https://www.spratings.com/documents/20184/4432051/Sovereign+Rating+Methodology/5f8c852c-108d-46d2-add1-4c20c3304725.

Country risk premiums obtained from the analysis of prof. A. Damodaran available at: http://pages.stern.nyu.edu/~adamodar/New_Home_Page/datafile/ctryprem.html.

[1] European Business Valuation Standards, TEGoVA, https://www.tegova.org/en/p5eb28f75f2df4/european-business-valuation-standards.html.

[2] See Damodaran (2018), Mercer, (2013), Milenković (2015).

[3] S&P Global Ratings, Sovereign Rating Methodology (2017).

[4] See Kruschwitz, Loeffler and Mandl (2010).

[5] Harrington, Nunes (2019)

[6] Damodaran (2018).

Tomasz Manowiec, CFA, FCCA, is a Director at Baker Tilly TPA, an audit, consulting, and advisory company, and is responsible for the Corporate Finance department. His practice includes valuation of enterprises and financial instruments, financial modeling and analysis, transaction advisory, and business planning. Before his consulting role, he was in the investment industry working as a sell-side analyst, buy-side analyst, and fund manager responsible for the equity markets.

Mr. Manowiec can be contacted at (0048) 606244697 or by e-mail to tomasz.manowiec@bakertilly-tpa.pl.