Determining the Price for One

When All You Have is the Price for Many (Patents)

It is rare for all patents included in portfolio license or sale agreements to have equal value. In a patent infringement case, the individual values of the patents are needed. So, when only a small subset of patents are at issue, how can we estimate their worth? This article provides insight as to how value can be adduced.

It is rare for all patents included in portfolio license or sale agreements to have equal value. When only a small subset of patents are at issue, how can we estimate their worth?

Patent infringement litigation often requires determining the value of an individual patent or a small subset of patents that have been bundled together with dozens, or even hundreds, of other patents in a portfolio license or sale agreement. While the price paid for the entire portfolio may be known, how much of that price is attributable to individual patents in the portfolio is not.

The value of any individual patent, or of a subset of patents, rarely, if ever, can be calculated simply by dividing the price paid for the portfolio by the number of patents included in the agreement. The value of each patent in a portfolio is based on its unique characteristics, such as its technical advantages over other technologies, the marketplace demand for these advantages, the relative contribution of the patent to the overall product, and the patent’s legal strength, among other things.

Because these characteristics can vary widely, it is no surprise that patent values can also vary across the portfolio. As illustrated in Figure 1, we know from well-established research that the distributions of patent values across a portfolio are highly skewed. Some patents may be worth a lot, but most are worth very little.

While we know that a disproportionate share of a portfolio’s value is concentrated in relatively few patents, knowing how much of the total price paid for the portfolio to apportion to specific patents is the question. How, then, may we determine the price for any of the component patents when all we have is the price for the entire portfolio?

Using Research on Patent Value Distributions to Determine Individual Patent Values

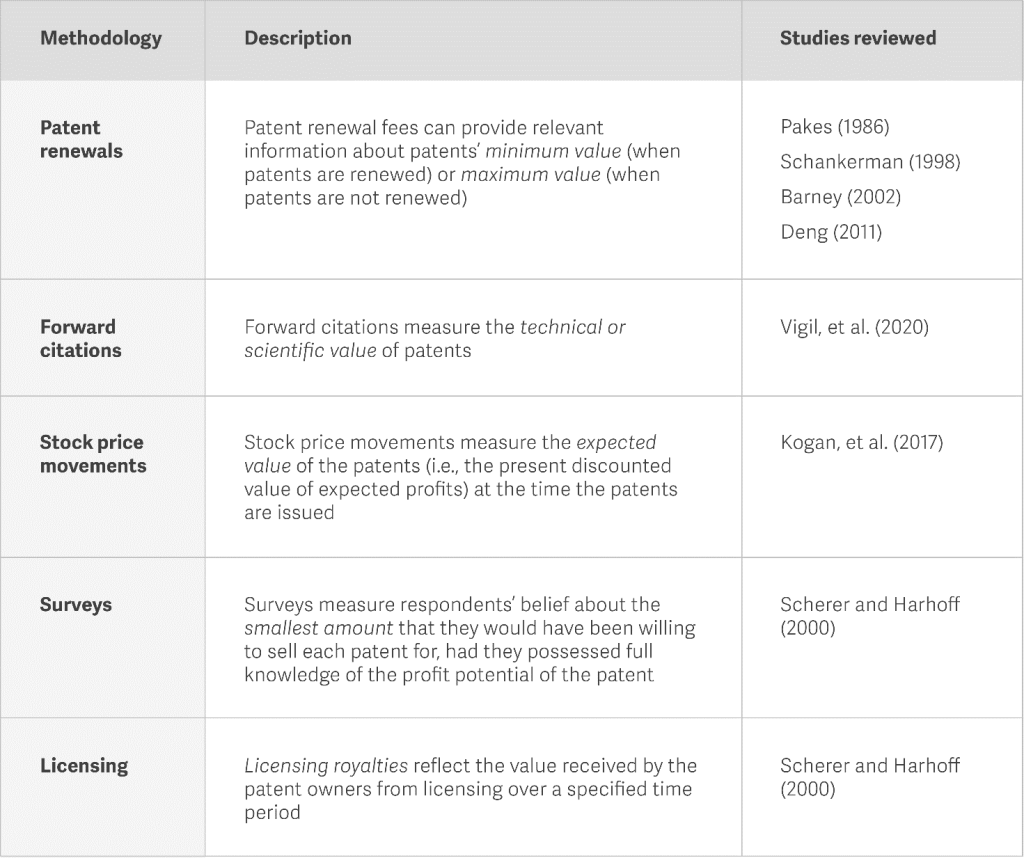

One method that may be used to answer this question relies upon academic research regarding the distribution of patent values for different groups of patents spanning different time periods, geographies, and technologies. This research utilizes several methodologies, including patent renewals, forward citations, stock price movements, surveys, and licensing. (See Table 1.)

Table 1: Patent Value Distribution Research

Though the data and methodology used in these studies are different, their results generally corroborate the conclusion that a patent portfolio’s value typically is concentrated in only a small percentage of patents. (See Table 2.)

Table 2: Study Results for Proportion of Value in Top 10% of Distribution

Note: Values are rounded

While the degree of disproportionality of patent values indicated by these studies varies, the differences reflect, in part, the fact that each methodology is measuring different things or looking at value in different ways.

Making the Most of the Information Available for Patent Valuation

We have found that the results from these studies may be generalizable to a broader set of facts and circumstances than those underlying the individual studies. Among other things, findings from this research show that patent value distributions:

- Are not materially different for different subsets of a broader category of technology;

- Have been relatively stable over time for a given technology; and

- May not be materially different across countries for a given technology.

Our research suggests that, in certain circumstances, the results from these patent value distribution studies can be combined with information about the unique characteristics of the patent being valued to determine what proportion of the total portfolio price may be attributable to the patent of interest. How relevant the results from a given study are will depend upon the facts and circumstances of the case and how the patent value distributions will be used.

The methodologies for the individual studies discussed here are rooted in rigorous economic research and have been accepted by the courts. Depending upon the facts of the case, they may provide a reliable framework for determining the value of individual patents that are part of a larger portfolio when all you have is the price for the entire portfolio. As a result, these methodologies make it possible to utilize potentially relevant information from these portfolio license and sale agreements that often went unused in the past.

This article, which is based on work originally published in the January 2021 edition of les Nouvelles, was previously published by Analysis Group, Inc., in June 2022, and is republished here by permission.

Robert L. Vigil is a Principal at Analysis Group, Inc. He has extensive experience estimating damages and unjust enrichment in intellectual property (IP), breach of contract, and false advertising cases, and has served as an expert witness on litigation matters in a variety of industries.

Dr. Vigil can be contacted at (202) 530-3996 or by e-mail to Robert.Vigil@analysisgroup.com.

Xiao Zhang is an Associate at Analysis Group. Inc.

Dr. Zhang can be contacted at (202) 530-2053 or by e-mail to Xiao.Zhang@analysisgroup.com.