The Future of the Business Valuation Profession

(Part V)

To look to the future of the BV profession, we must explore the relevant dynamics within the industry. That starts with looking to our past to see what events and milestones brought us to where we are today, followed by ascertaining the economic and demographic trends leading us into the future, and culminating with identifying those trends which will have the greatest impact upon the profession. NACVA set upon drafting a white paper that would provide valuable insight to the future of the business valuation profession, with Chris Mercer taking the lead who is known by nearly every person in the valuation industry.

Consolidation in Valuation and Related Spaces

Representation of the Business Valuation Profession

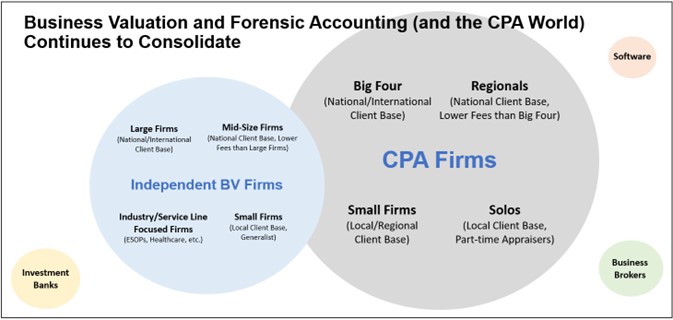

The following graphic depicts the players in the business valuation (BV) profession and the current state of the profession. There are many independent business valuation firms and there are also firms/companies who provide business valuation services in addition to their core services, such as CPA firms, investment bankers, business brokers, and even some software providers.

Throughout the nation there are many CPA and non-CPA business valuators choosing to solely focus on providing business valuation services, working either within a CPA firm or independently. The state of consolidation in the accounting profession is instructive and pertinent to the business valuation profession.

Consolidation in Accounting Profession and Relevance to Business Valuation Profession

The accounting profession is in a consolidation phase that will have a significant impact on the valuation space. For many years there has been consolidation among the smaller CPA firms of $10 million in revenue or less, but in the last couple years there has been a dramatic shift towards consolidation among the larger CPA firms.

According to Alan Koltin, a consultant who has advised on many of the largest transactions in the accounting industry, there are three major drivers of this continuing consolidation:

- The succession component. Many firms with aging senior partners have not planned well for ownership succession and have looked to being acquired as a vehicle to assure succession—and some payout for their efforts building their firms.

- Strategic change from compliance to consulting. Advancing technology is causing a reduction of compliance services (accounting and tax) and an accompanying compression in fees. Compliance services could decline on the order of 50 percent over the next several years. Many firms are attempting to shift their services mix from a majority in areas of compliance to a majority in areas of consulting. Some firms have waited too long to begin to shift and are forced to sell—most likely not on the best of terms.

- Desire for growth. To grow practices at desired rates of growth, larger and mid-sized firms must engage in M&A as a growth strategy because organic growth alone will not achieve growth objectives.

Because of these dynamics, larger CPA firms are refining their acquisition targets, thus changing the nature of the acquisitions they have historically been making. Koltin says there are four levels of acquisitions for the larger CPA firms. In order of their attractiveness, they are:

- Level 1: Wealth Management and Cyber Technology. Many accounting firms have established small wealth management subsidiaries over the last decade or more. Most firms have not grown significantly, but they have added an element of recurring revenue to their base. Larger firms are now looking to acquire more established wealth management firms and are joining the fray with many banks that are also looking for similar acquisitions to generate significant incremental fee income. Cybertechnology consulting is also of great interest in that it is seen as high value-added at its nature.

- Level 2: Consulting, Advisory, Outsourcing, and Industry Specializations. These acquisitions are designed to provide strategic growth in areas of consulting to diminish the relative importance of compliance work. Business valuation services fit squarely into Level 2. Most mid-sized valuation firms have been approached by potential acquirers, according to Koltin.

- Level 3: Tax Planning with Value Added Components. This level is referring to firms that provide sophisticated tax planning advice and not to firms that provide significant tax compliance services.

- Level 4: Compliance Work. Koltin refers to substantial compliance customer bases as depreciating assets. The lowest relative acquisition prices will typically occur at this level.

To put this in perspective, business valuation services as a target would be considered slightly below wealth management and cybertechnology but rising to the top of Level 2.

There has been interest in the business valuation space for a number of years. Orix Corp. acquired about 70% of the equity of Houlihan Lokey Howard & Zukin (now HLHZ) in 2005. HLHZ’s market capitalization of equity is $6.5 billion as of February of 2023.

Duff & Phelps was an early acquiror, purchasing Valumetrics, Inc. in 2005, and has been active since then. It has acquired a number of companies, including Kroll, Inc. in 2018 for $1.75 billion. Duff & Phelps was purchased in April 2020 by Stonepoint Capital and Further Global, both private equity firms, with a valuation of $4.2 billion. Duff & Phelps was rebranded as Kroll in 2021Â

Private Equity’s Role

Koltin predicts that within a short time, private equity money will gain control of some CPA firms with a goal of building middle-market national consulting firms. There are several examples of acquisitions in the broader business valuation space. Two noteworthy mentions are:

- J.S. Held is the global leader in providing specialized consulting services to address complex high value insurance claims and construction-related matters. J.S. Held grew through 2019 (before it was acquired by Kelso & Company in 2020, a significant private equity firm) through 18 acquisitions and had expanded to over 600 professionals in more than 60 offices across the U.S., Canada, Latin America, Europe, and the Middle East. Today, under the Kelso umbrella, J.S. Held has 1,100 professionals and has continued to grow through acquisition. One of the areas of keen acquisition interest for this private equity backed enterprise is business valuation.

- On August 5, 2021, Citizens Financial Group (CFG), the 22nd largest banking organization in the United States, announced the acquisition of Willamette Management Associates. The closing was completed in 2021. CFG is interested in business valuation as a vehicle to increase non-interest income, or service fees. Willamette is one of the leading mid-sized valuation firms in the nation. The owners of Willamette were at ages where they were ready for an ownership transition.[1]

The author has developed a list of acquisition and transition activity in the business valuation space which includes all the examples above except J.S. Held, which has not yet made a significant acquisition in the business valuation space (though future acquisitions are likely on the horizon). Click here to see that list (and more on consolidation in the Valuation and Financial Forensics space).

What you will see is there has been investment interest in the business valuation space since at least 2005, and the pace of acquisitions and other transition-related transactions is increasing.

Predictions—Consolidation

- The valuation profession resides both in independent firms and within many CPA firms. All the above trends, together with aging leadership in need of ownership and management succession, will lead to further consolidation within the business valuation space over the next five or more years.

- The COVID-19 pandemic will also result in additional “consolidation.” We have learned that valuation professionals do not need to be tethered to desks in offices. There will be movement of seasoned professionals from smaller to larger firms over the next few years. Whether they work from home or from small offices, these professionals can tap into the marketing and support resources of larger firms and the firms can maintain appropriate command and control of remote professionals.

To learn more about the future of the business valuation profession and Chris Mercer’s final overall predictions for the shape of things to come, click here.

[1] Mercer Capital has been approached by a number of potential acquirers. We have elected to complete the transition of ownership internally through Mercer Capital’s ESOP. One way or another, those of us who started firms 30 or more years ago will transition ownership.