Debating the Incremental DLOM

A Nuanced Approach to Asset Valuation

Marketability refers to the ease with which an asset can be sold, and the DLOM accounts for the reduced liquidity of an asset that is not easily traded in the open market. In business valuation, the DLOM is a critical yet contentious adjustment. This article discusses the underlying issues presented in this type of valuation and uses an example to explain the incremental DLOM.

When it comes to business valuation, understanding an asset’s marketability is essential. Marketability refers to the ease with which an asset can be sold, and the discount for lack of marketability (DLOM) accounts for the reduced liquidity of an asset that is not easily traded in the open market, particularly within privately held companies. In business valuation, the DLOM is a critical yet contentious adjustment. Numerous empirical studies have supported the existence and necessity of DLOM. Research examining restricted stock transactions, pre-IPO stock studies, and other methodologies consistently shows that private shares are sold at significant discounts compared to their publicly traded counterparts. These studies provide a data-backed rationale for including DLOM in valuations.

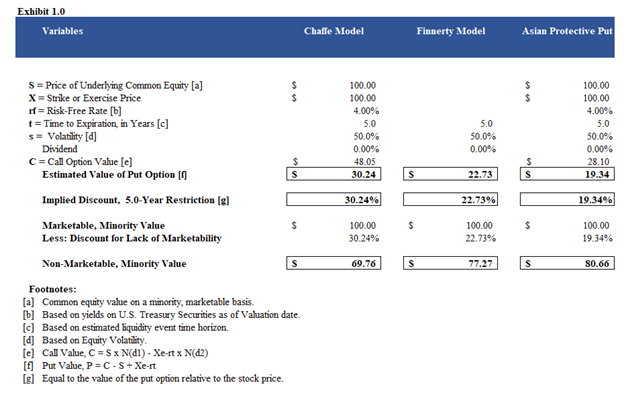

To calculate and quantify the discount for marketability of a security, the value of a protective put option is used as a proxy for the DLOM. In simple terms, the value of a protective put represents the cost of “insuring” the buyer of a non-marketable security in circumstances where they are unable to sell the security. This indicates that the buyer should ideally price the illiquid security at the value of a similar marketable security, minus the cost of the corresponding protective put option. See Exhibit 1.0 for the DLOM calculated for an LP interest using various put option models.

However, in certain situations, securities already account for the partial or complete lack of marketability, especially when the company’s internal stock transaction data (Backsolve method) is used to calculate value. This brings us to the introduction of the “incremental DLOM” in cases where one security is relatively illiquid or has no available market compared to the other, which may be sparsely traded, and a layered approach is applied. The incremental DLOM will capture and adjust for the difference between the marketability of the securities. Hence, this adjustment will result in the security with greater marketability being valued higher than the non-marketable one.

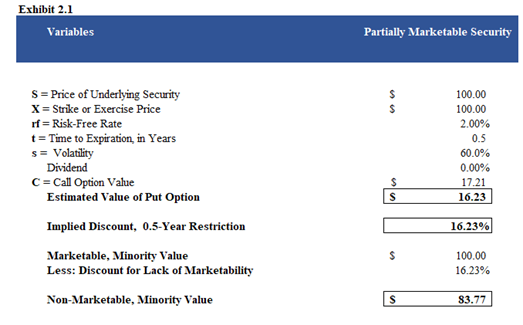

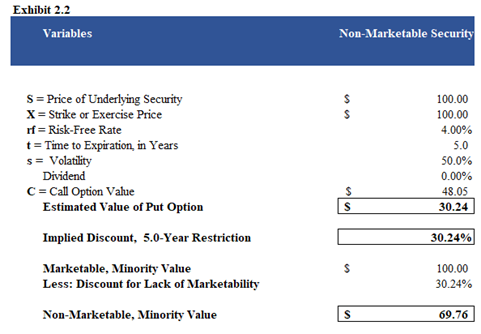

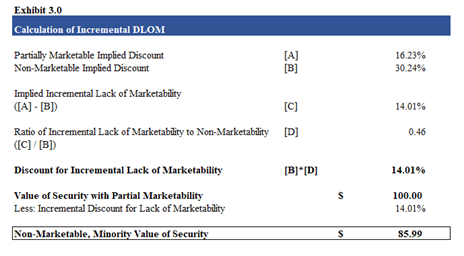

For example: One way to calculate the incremental discount would be to determine the value of two protective put options on the LP interest; one on a completely non-marketable security and one with partial marketability. The difference between these two securities would be utilized proportionally to carve out the incremental discount for a complete lack of marketability and arrive at the non-marketable value of the interest. See Exhibits 2.1, 2.2, and 3.0 below.

When we use the incremental DLOM method, we are able to quantify the over-estimation of the DLOM applied to a partially marketable security by carving out only the completely non-marketable portion. After making this adjustment, we arrive at a more accurate valuation of $85.99, using an incremental DLOM of 14.01%.

One of the most compelling arguments favoring incremental DLOM is its ability to enhance precision in valuations. Appraisers can achieve a more nuanced and realistic valuation by applying discounts based on specific factors such as the business size, industry, or growth stage. This precision is particularly beneficial in complex scenarios where a one-size-fits-all discount is insufficient. Applying an incremental discount allows appraisers to reflect a diverse set of risks associated with each security.

A few drawbacks to this method would be making a variety of assumptions with the volatilities and other inputs for each put option valuation since every input must cater to the specific nuances of the type of asset the put option is tied to; illiquid or partially liquid. A few alternative methods for completely non-marketable securities are the Longstaff model and the Average Strike Put (ASP) model, which attempt to capture the opportunity costs associated with holding certain illiquid securities for a specific period.

The complexity involved in calculating the incremental DLOM may outweigh the effort to achieve precision in deriving value. One may argue that incremental DLOM can lead to over-adjustment, where the cumulative effect of multiple layers of discounts could significantly undervalue an asset, potentially undermining its true worth and deterring potential investors. The adjustment could also overvalue an asset with greater marketability, by underestimating the incremental discount that must be applied to it.

Based on the current scenario, a handful of appraisers believe that an additional DLOM must not be applied since certain securities reflect the inherent discounted value. On the flip side, some believe that an additional DLOM must be applied even while using data derived from the company’s internal stock transactions (the Backsolve method). Ensuring that each discount is justified and appropriate is a critical challenge, especially in the context of a 409A valuation, where accuracy is paramount to uphold the credibility of the valuation process.

Source: Kam, D. Steven and Wan, Darren. “Measuring The Incremental Discount for Lack of Marketability”; Valuation Strategies–November/December 2010.

This article was previously published in Marcum LLP’s Insights (July 18, 2024) and is republished here by permission.

Sean Saari, CPA, ABV, CVA, MBA, is a partner in the Advisory Services group. He assists valuation and litigation support clients by developing credible and defensible analyses and he has testified as a financial and valuation expert numerous times. He has a practice concentrated in the areas of business valuations, litigation advisory services, domestic disputes, shareholder disputes, financial reporting, complex damages analysis and modeling, strategic planning, succession and estate planning, and mergers and acquisitions. On the business advisory side, Mr. Saari helps clients proactively manage their businesses to plan and prepare for growth while staying on top of their tax and accounting compliance requirements. He is a frequent author and speaker on valuation, litigation advisory, business management, and other financial topics.

Mr. Saari can be contacted at (440) 459-5865 or by e-mail to Sean.Saari@marcumllp.com.

Prithika Kharwar is a staff member with Marcum, LLP’s Advisory Services.

Ms. Kharwar can be contacted by e-mail to Prithika.Kharwar@Marcumllp.com.