Valuing Daycare and Early Learning Centers

Common Practices in Florida, Value Enhancement Strategies, and Market Positioning

How are day care and early learning centers valued? In this article, the author shares her thoughts on how these are valued in Florida. In addition, the author shares strategies to enhance the value of the business.

“If children are the world’s greatest investment, then daycares are the blue-chip stocks of our future—steady, essential, and always in demand.”

Valuing daycares and early learning centers is a dynamic and compelling area driven by multiple factors that influence their market value. Across the country, families face limited access to childcare, making daycare centers an attractive investment opportunity for both buyers and business owners. According to the National Conference of State Legislatures, families allocate 8% to 19% of their household income to childcare expenses, with 35% relying on savings to cover costs. Additionally, 73% of center-based childcare providers have reported excess demand for available slots in recent years. The U.S. childcare market, valued at $61.7 billion in 2023, is projected to expand at a CAGR of 5.86% from 2024 to 2030, according to Grand View Research.

The resilience of the childcare industry is a key factor in its valuation, as demand remains consistent even during economic downturns. Unlike industries that experience cyclical fluctuations, the essential nature of childcare services ensures steady growth. As families continue to seek high-quality early education and childcare solutions, the industry presents strong investment potential and stable long-term opportunities.

Private daycare centers are a popular choice nationwide, offering independent owners’ full autonomy over their branding, policies, curriculum, equipment, and facility design. Unlike franchises, independent operators have the flexibility to choose their market and retain 100% of their revenue without franchise fees or royalties reducing their profits. This level of control allows independent daycare owners to tailor their services to meet local demand and differentiate themselves in the market.

On the other hand, daycare franchises provide a structured and lucrative investment opportunity, often delivering strong profit potential despite their significant upfront costs. Childcare remains an essential service for working families, ensuring steady, year-round enrollment. Many franchises position themselves as premium providers, offering high-quality early education programs and state-of-the-art facilities, which enables them to charge higher tuition rates and maintain strong profit margins. Additionally, revenue diversification through after-school programs, summer camps, and extracurricular activities helps maximize facility usage and boost overall profitability. However, success in the daycare franchise sector depends on several key factors. Location and market demand play a crucial role, as opening in a densely populated area with a high concentration of working families increases enrollment rates and potential waitlists. Operational efficiency, including staffing optimization, cost control, and capacity utilization, is essential for maximizing profitability. Additionally, competition within the industry requires franchises to stand out by offering specialized curriculums, extended hours, or unique educational approaches. Franchisor support, such as marketing assistance, training programs, and access to industry expertise, also provides franchisees with a significant competitive advantage. With strong demand, structured business models, and scalable operations, daycare franchises present a compelling investment opportunity in the growing childcare sector.

Revenue Drivers for a Daycare Business

A daycare’s revenue is primarily driven by enrollment capacity and tuition fees. The number of children a facility can accommodate depends on state regulations regarding space requirements. For instance, most industry standards recommend 35 square feet of indoor space per child, meaning a caring center for 10 children would require at least 350 square feet of play space, excluding staff rooms, bathrooms, and other non-play areas. In Florida, licensed daycare facilities must provide a minimum of 35 square feet of indoor space and 45 square feet of outdoor space per child, which directly determines enrollment capacity.

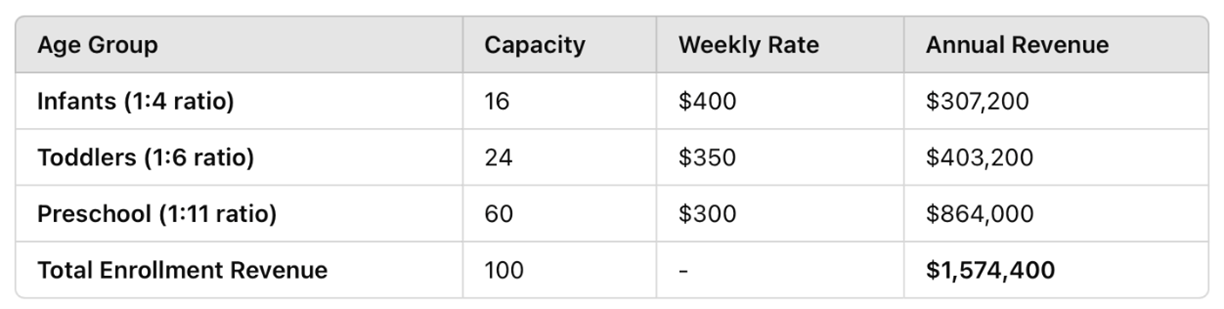

Beyond space limitations, tuition fees based on age groups are the primary revenue driver. Daycare centers typically charge higher rates for younger children due to the lower staff-to-child ratio required by licensing laws. For example, a daycare licensed to enroll 100 children could have the following fee structure and revenue potential:

This revenue model illustrates how enrollment capacity and tuition pricing impact a daycare’s financial success. By optimizing space utilization, age group distribution, and pricing strategies, daycare owners can maximize revenue potential and profitability while complying with regulatory requirements.

Beyond tuition fees, daycare centers can generate additional revenue through various grants, which can amount to over $100,000 annually, providing financial support for operations, facility improvements, or educational programs. However, expenses—particularly salaries and wages—constitute the largest cost driver for daycare businesses. State-mandated staff-to-child ratios determine staffing needs and directly impact labor costs. For example, in Florida, staffing requirements are as follows:

- Birth–12 months: 1 staff per 4 children

- 1–2 years: 1 staff per 6 children

- 2–3 years: 1 staff per 11 children

- 3–4 years: 1 staff per 15 children

- 4–5 years: 1 staff per 20 children

- 5 years and older: 1 staff per 25 children

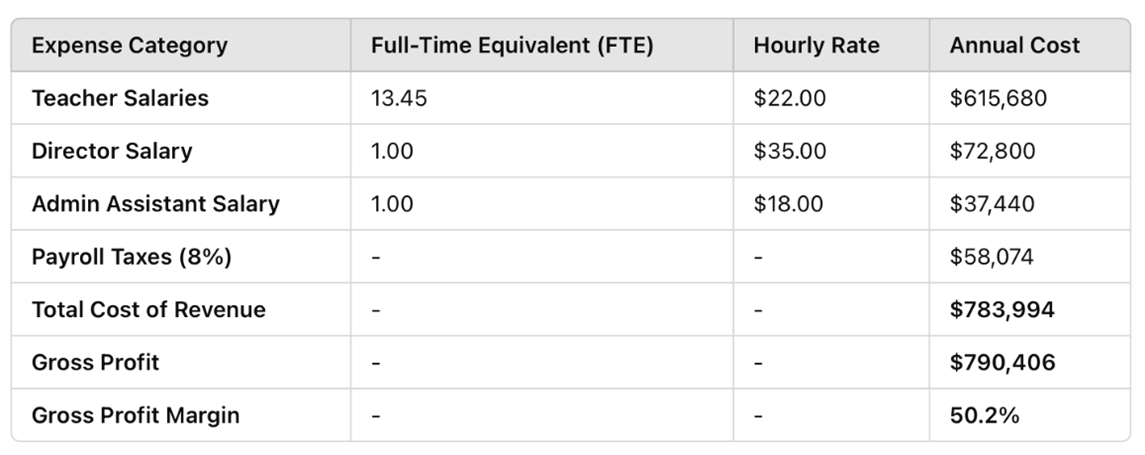

Estimated Cost of Revenue

Based on these ratios, a typical daycare’s cost structure might look like this:

While every daycare operates differently, healthy financial benchmarks for a well-run center typically include:

- Ideal occupancy: 70–90%

- Staff costs: 50–55% of revenue

- Operating costs: 11–13% of revenue

- Facility costs: 22–25% of revenue

- Administrative costs: 2–4% of revenue

- Profit margin: 15–30%

By carefully managing staffing expenses, operational efficiency, and facility costs, daycare owners can optimize profitability while maintaining a high standard of care.

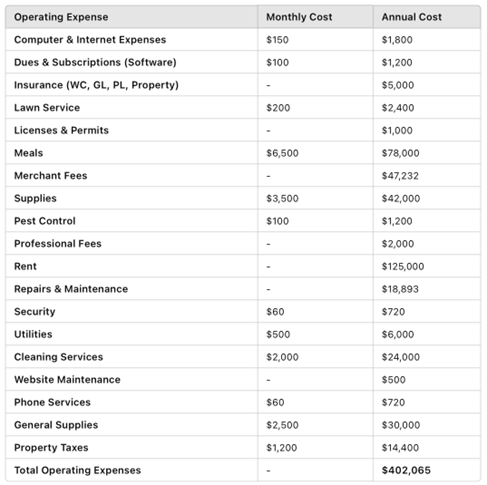

Operating Expenses and Net Income Estimation

Using a hypothetical example, we can estimate key monthly and annual expenses as follows:

After accounting for revenue, staffing costs, and operating expenses, the estimated net income for this daycare would be:

- Net income: $388,342

- Net profit margin: 25% (rounded)

This profitability margin highlights the financial viability of a well-managed daycare center, demonstrating how effective cost control and optimized enrollment capacity can result in substantial earnings.

Industry benchmarks indicate that depreciation is projected at 0.8% of revenues, based on a three-year average for Early Childhood Learning Centers in the U.S., as reported by IBISWorld. Additionally, incremental investments in working capital are essential to support business growth. The assumed net working capital requirement is estimated at 12% of annual incremental operating revenue, following industry standards for daycare and early childhood education centers.

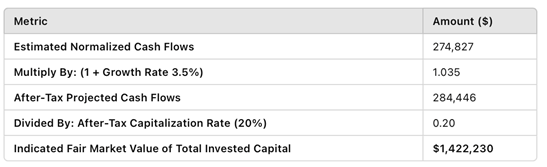

Using these assumptions, the financial estimates are as follows:

With an estimated EBITDA of $388,342, subtracting depreciation of $12,595 results in an EBIT of $375,747. Applying an effective tax rate of 25.35%, the after-tax cash flow amounts to $280,495. After cash flow adjustments, the normalized cash flow base is calculated at $280,495. These projections provide a clear financial outlook, incorporating industry-driven assumptions for depreciation and working capital cash flow adjustments. The breakdown is as follows:

Using the capitalization of earnings method, with a 20% cap rate, the indicated business value is $1,422,230. This valuation approach highlights the company’s earnings potential, emphasizing sustainable cash flow as a key driver of business worth. The calculation is as follows:

Market Multiples for Daycare Centers in Florida

These market multiples provide a secondary valuation reference, allowing for a comprehensive assessment of the business’s fair market value. Recent market transactions in Florida provide comparative valuation benchmarks for early learning centers:

- Revenue multiples:

- Average: 0.60x

- Median: 0.56x

- Seller’s discretionary earnings multiples:

- Average: 2.69x

- Median: 2.66x

- EBITDA multiples:

- Average: 4.77x

- Median: 3.77x

Source: BVR DealStat’s Transactional Database

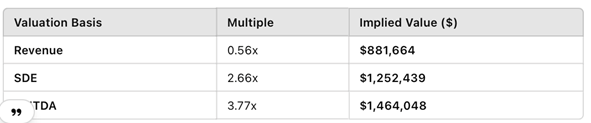

Applying the median multiples to the subject company’s financials:

These figures highlight the market-driven valuation range, with implied business values varying based on revenue, seller’s discretionary earnings, and EBITDA profitability metrics.

It should also be noted that many daycare centers benefit from state and federal funding programs, including grants, subsidies, and food assistance programs, which significantly impact financial stability. Additionally, centers with accreditations such as the Gold Seal designation often command higher enrollment rates and stronger reputations, leading to higher valuations.

Profitability and Cost Management

While the industry profit margin stands at 14.7% (source: IBISWorld), rising labor costs, staff shortages, and wage inflation present significant operational challenges. Competitive wages and benefits, such as health insurance and professional development, are crucial in reducing staff turnover; a key factor in maintaining operational efficiency and service quality. Additionally, leveraging technology solutions can enhance operational productivity, further supporting profitability.

Competitive and Real Estate Considerations

The highly competitive nature of the childcare sector, coupled with relatively low barriers to entry, results in price-based competition that may compress profit margins. Many daycare valuations are tied to the underlying real estate where the business operates, and transactions often include both the business entity and the property.

With Florida’s growing population and strong demand for childcare services, there is significant investment potential in the daycare sector. Businesses with diverse revenue streams, strong reputations, and scalable operations achieve higher valuation multiples, whereas smaller, tuition-dependent centers may experience greater financial volatility.

Key Strategies for Enhancing Valuation and Market Positioning

Some of the best practices include: (1) adhere to recognized educational frameworks and ensure staff receive continuous training; (2) seek additional accreditations to enhance credibility and attract higher enrollment; (3) implement efficient cost management strategies to maintain healthy margins; (4) leverage technology solutions to improve administrative and operational workflows; (5) offer competitive salaries, benefits, and professional growth opportunities to reduce turnover; and (6) maintain a positive work environment, as satisfied staff leads to better service quality and customer retention.

For investors and business owners, carefully assessing revenue sustainability, cost structures, and long-term demand trends will be critical in making informed investment decisions in this evolving industry.

Nataliya Kalava, CVA, ABV, MAFF, CMEA, is an expert in the fields of business valuation and finance, with about 15 years of experience. She has led and contributed to numerous valuations for diverse purposes, including gift and estate tax planning, management planning, M&A transactions, SBA valuations, financial reporting, and litigation support. Ms. Kalava’s passion lies in helping business owners navigate ownership transitions, guiding them through challenges, and uncovering opportunities for growth. Her expertise is honed through a rich career journey, having worked with renowned organizations such as Equinix Inc., Humana Inc., BDO LLP, Sigma Valuation Consulting Inc., and PwC. Ms. Kalava’s dedication to her profession extends to education and community engagement. She has been an Adjunct Finance faculty member at the University of Tampa, imparting her knowledge to undergraduate students on corporate finance and investment. Furthermore, she organizes Continuing Legal Education (CLE) courses on business valuation topics accredited by the Florida Bar.

Ms. Kalava can be contacted at (813) 999-1144 or by e-mail to nkalava@one10firm.com.