Business Valuation in Shareholder Disputes

Addressing the Value and Professional Standards Issues in the Engagement

Resolving a shareholder dispute often requires determining the value of a shareholder’s interest in the business. This article provides a framework for the business valuation expert to discuss this issue with attorneys and clients. Headings organize the questions and issues.

Resolving a shareholder dispute often requires determining the value of a shareholder’s interest in the business. This article provides a framework for the business valuation expert to discuss this issue with attorneys and clients. Headings organize the questions and issues.

Is the Juice Worth the Squeeze?

This is the main question the attorney is asking us on the first phone call. They want to make sure they are pursuing something on their client’s behalf that is worth the effort and fees. This is tricky because we cannot answer this until we do some analysis. My suggestion is to answer these three sub-questions for the attorney:

- Is this a business or a job? If it is a business,

- Is the business producing positive cash flow (or capable of it)? If not,

- Are the assets worth more than the liabilities?

Ask the attorney about their preferences for handling discussions and documents since they may hire you as a testifying expert. The attorney may want the analysis over the phone, Zoom, or in their office and not written.

Business or Job?

This is often overlooked. It matters because a job is not an asset typically valued in a shareholder dispute. There is no bright line test but there are clues.

- Are there any workers besides the owners? If not, it could be a job because removing the owners could remove all the labor required to keep the activity going.

- Is the activity commonly purchased in an acquisition? If not, it could be a job because there is little market interest in the activity.

Examples of possible jobs include lawnmowing, childcare, and delivery routes. If we show the attorney the activity may be more of a job than a business, they may elect to stop litigation. If it is a business, we can move on to the next question.

Positive Cash Flow?

Cash flow is one of the most important numbers in business valuation and typically represents the numerator in the income approach and parameter in the market approach. Unfortunately, cash flow does not appear on the income tax returns and many financial statements. (The statement of cash flows is often omitted under allowable exceptions). Simply stated, historical cash flow often appears nowhere on the documents we receive, so it must be computed as shown below.

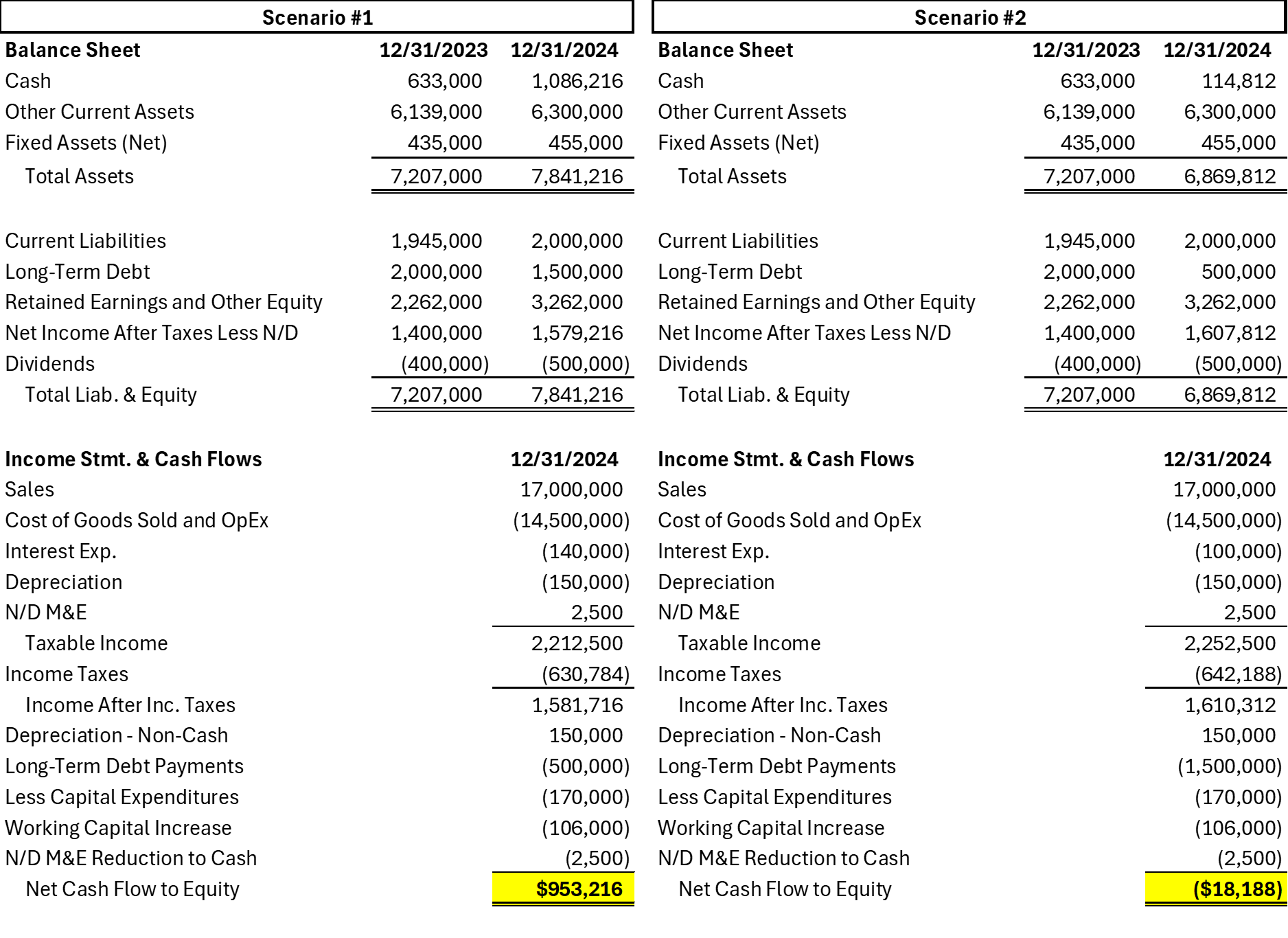

These two scenarios for the same business that made one different decision illustrate the risk of shooting from the hip when estimating cash flow. Despite an almost identical taxable income of $2.2 million, the cash flow (to equity) difference is almost $1 million and goes negative in the second scenario because long-term debt was paid down significantly. As business valuation experts, we recognize the debt payment is unlikely to continue into perpetuity but it is common for the untrained to draw incorrect conclusions from tax returns and financial statements. Business valuation is forward-looking. Historical cash flow may be materially different from where the business is headed [emphasis added]. Sales, expenses, assets, liabilities, and equity may need to be adjusted to reflect expected future changes. Pass-through entities (S corporations and partnerships) do not pay Federal (and sometimes state) income taxes directly, so income taxes may need to be imputed to account for income taxes paid by the owners. Depending on the assignment, it may be relevant that the business is not conducting activities at arm’s length such as owner wages or rent expense above or below fair market value or running personal expenses through the business. Multiple professional judgments may be necessary to estimate the amount of future cash flow. The implications of cash flow on the amount of value at stake in the shareholder dispute are huge as shown below:

- $100,000 cash flow / 15% cap. rate = $ 667,000 business value

- $500,000 cash flow / 15% cap. rate = $3,300,000 business value

The “cap.” (capitalization) rate used is only an example and you should develop your own rate for the interest you are valuing.

If the answer to this question is “no,” we should ask one more question to close the loop on whether the business has value.

Assets More than Liabilities?

Many attorneys and business owners understand the value of a business as assets less liabilities (asset approach). However, this is usually the floor value of the business or the lowest it could be. If the business is generating positive cash flow, the income and market approaches are often higher than the asset approach and represent the total value of the business, including goodwill and intangible assets. But we have reached this question because we have determined it is unlikely the business can produce positive cash flow. If the attorney requests us to use the asset approach to estimate the floor value of the business, they may need to hire asset appraisers to value equipment, real estate, and other hard assets. We could then incorporate these appraisals into a business valuation using the asset approach. (It is uncommon for a business valuation expert to be an equipment [and/or] real estate appraiser and vice versa).

If the business has little chances of future cash flow and the value of the liabilities exceeds the value of the assets, the business probably has no value. This also means the shareholder’s interest probably has no value. It rarely makes sense to proceed with litigation on the business valuation issue. My recommendation is to try to settle the dispute as soon as possible without the client incurring fees unnecessarily. On the other hand, if the business can produce cash flow and the value of the assets exceeds the liabilities, the business probably has value. How can we help the attorney estimate the value of the business before going “all in?”

Calculation for Decisions and Possible Settlement

To help the attorney make decisions based on the preliminary value of the business and estimate the potential return on investment of going to court, a suggestion is to prepare a calculation of value for settlement purposes only. The calculation is less than a conclusion of value and can still be helpful. What is a calculation engagement?

“2. Calculation Engagement: A Calculation Engagement occurs when the client and member/credentialed designee agree to specific valuation approaches, methods, and the extent of selected procedures and results in a Calculated Value.” NACVA Professional Standards III, B, 2

We agree with the client to limit the scope of what we are going to analyze and prepare in a report (written or oral). The client could be the attorney depending on the engagement. Examples could include:

- Income-based approach using the capitalization of net cash flows method or discounted net cash flows method

- Market-based approach using the guideline transaction method [and/or] guideline public company method

- Asset-based approach using the adjusted net assets method

These are only examples, and you should select the approaches and methods that will provide a reasonable and objective value or range. The attorney should understand the limitations of a calculation because you would not be doing as much work as a conclusion of value, and they should be comfortable with those limitations before proceeding with a calculation. Request that the calculation be protected from discovery if possible. This is important because you may come to a different business value if hired to prepare a conclusion of value as a full scope engagement later. You should comply with the General and Ethical Standards (Section II) in all engagements. After you provide a calculation, the attorney should be in a better position to negotiate with the other side. If negotiation fails, the attorney will likely proceed to the last question.

Expert Testimony or Not?

This is an expectation that the shareholder dispute cannot be settled without court. If we expect to testify, we should write a conclusion of value or obtain enough information that we could write a conclusion of value. The attorney may recommend we prepare a report fitting the needs of “… a court, an arbitrator, a mediator, or other facilitator, or a matter in a governmental or administrative proceeding …” We would then utilize our Litigation Engagements Reporting Standards (Section V, D) to produce the requested written or oral report. Our documentation should satisfy the following:

“For a Conclusion of Value, the member/credentialed designee must obtain and analyze applicable information, as available, to accomplish the assignment, including:

- The nature of the business and the history of the enterprise;

- The economic outlook in general and the condition and outlook of the specific industry in particular;

- The adjusted book value of the interest to be valued and the financial condition of the enterprise;

- The earning capacity of the enterprise;

- The dividend paying capacity of the enterprise;

- Whether or not the enterprise has goodwill or other intangible value;

- Prior sale of interests in the enterprise being valued;

- Size of interest to be valued and its control, liquidity and marketability characteristics;

- The market price of interests or enterprises engaged in the same or a similar line of business having interests actively traded in a free and open market;

- Hypothetical conditions appropriate for the circumstances; and

- All other information deemed by the member/credentialed designee to be relevant.” (Section IV, H)

Also see the rest of the Development Standards (Section IV) and the Reporting Standards (Section V). Our file could be requested by a court, and missing documentation could undermine our credibility or disqualify us as a testifying expert.

Calculation for Testimony?

Reference #1

“2. Calculation Engagement: A Calculation Engagement occurs when the client and member/credentialed designee agree to specific valuation approaches, methods, and the extent of selected procedures and results in a Calculated Value.” Section III, B, 2

Reference #2

“A Calculation Report should set forth the Calculated Value and should include the following information.”

“g) A general description of the calculation, including a statement similar to the following:

“This Calculation Engagement did not include all the procedures required for a Conclusion of Value. Had a Conclusion of Value been determined, the results may have been different.” Sections V, 3 and V, 3, g

First, a calculation engagement is a limited scope engagement as agreed upon by us and the attorney/client. By definition, we have done less work than a conclusion of value. Second, if we elect to use the Litigation Engagements Reporting Standards and exclude Reference #2 from a written or oral report, our professional standards can easily be obtained by any attorney. It could be a poor decision to try to defend a value in court with an agreed-upon scope limitation and explicit or implicit language that, “… the results may have been different” [from a conclusion of value]. Calculations serve a valuable purpose in settlement but risk disqualification in court. A client’s budgetary limitation for a conclusion of value may not be viewed as a valid excuse by a judge or jury and could be a disservice. If you are considering using a calculation in court, make sure you understand the risks and do everything you can to mitigate them.

Best Practices Summarized

When an attorney calls us about a shareholder dispute, we should determine if a goal is to estimate the value of their client’s interest in the business or activity. Explain the process for establishing whether the business has value and find out if the client’s budget will enable us to answer the three questions. If hired, request a retainer and send a document request. Review the files and phone the attorney with your preliminary assessment of whether the business has value. If the business has value, we should consider recommending a calculation of value. If the attorney agrees and we can provide it within the client’s budget, prepare the calculation of value in the format the attorney requested. The attorney may elect to use the calculation of value in negotiations with the opposing attorney. A settlement may be reached between the parties. If not, the attorney may contact us about proceeding to court with a conclusion of value. Throughout the process, we should make sure we understand deadlines and budget.

Josh Horn, CPA, CVA, provides business valuations for shareholder disputes, estates and gifts, and mergers and acquisitions. He has testified and has experience with companies in multiple industries. Mr. Horn served on the NACVA Standards Board from 2019 to 2022 and was Chair from 2021 to 2022. He has taught with the NACVA Current Update in Valuations instructor team since April 2022. He started working in 1997 and has been a CVA since 2008.

Mr. Horn can be contacted at (217) 649-8794 or by e-mail to josh@jhorncpa.com.