Exposing Weaknesses in AI

Today, I am taking a risk. A risk of exposing weaknesses in AI and applying it to the business valuation profession. So, follow along with my experiment and let’s see what happens. First of all, you should know that I have the paid version of ChatGPT ($20/month) and I used the 4o model for my test.

Since I am a tech wizard and not a CVA, I started simple.

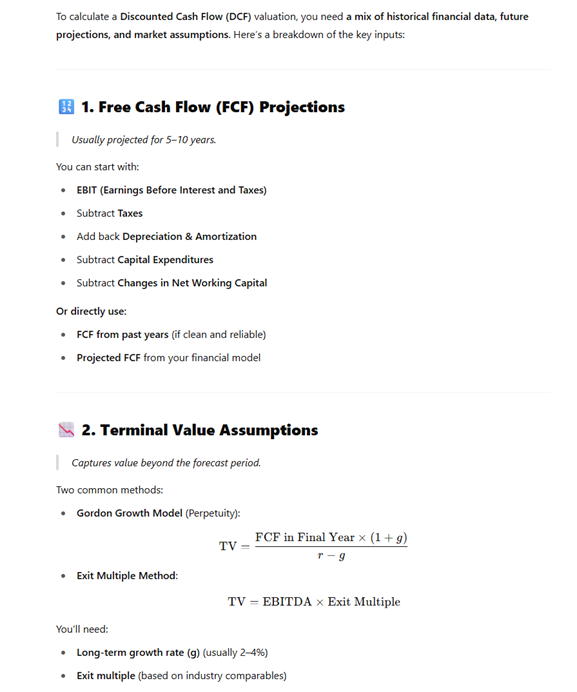

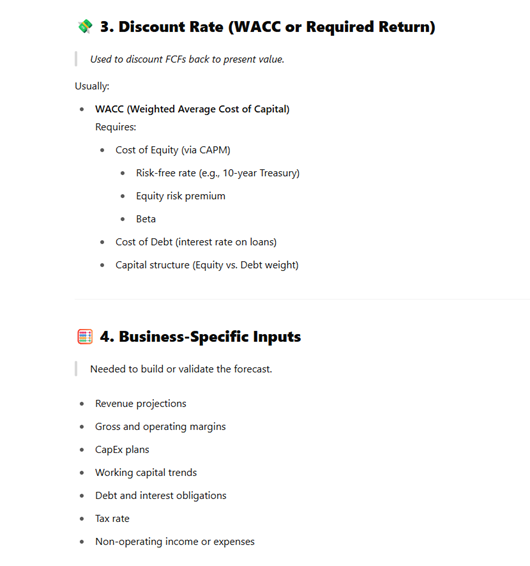

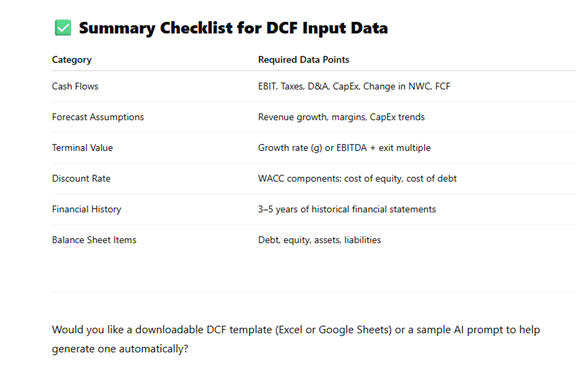

Prompt #1: What kind of data do you need to calculate DCF?

Here was the response from ChatGPT.

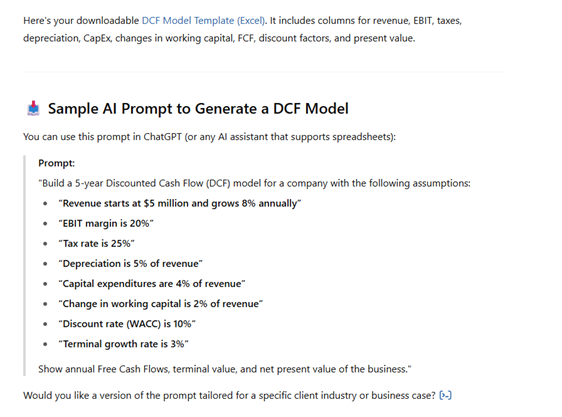

Prompt #2: Yes, could you give me a downloadable DCF template and then give me a sample prompt to help generate one automatically?

Then it gave me this.

I was able to download the template for Excel and then I used the prompt it suggested.

Prompt #3: Build a five-year discounted cash flow (DCF) model for a company with the following assumptions: revenue starts at $5 million and grows 8% annually; EBIT margin is 20%; tax rate is 25%; depreciation is 5% of revenue; capital expenditures are 4% of revenue; change in working capital is 2% of revenue; discount rate (WACC) is 10%; terminal growth rate is 3%; show annual free cash flows; terminal value; and net present value of the business.

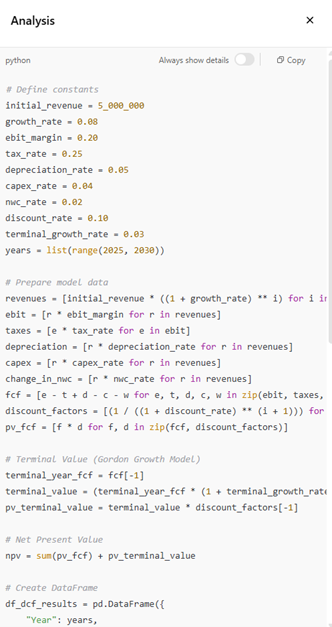

Here is what I got back.

It showed me how it did its analysis.

(Note: There was more to this, I just could not fit it on a single screen.)

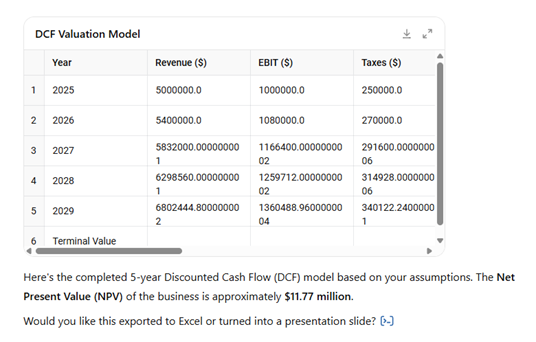

I exported this sample data to Excel and then used an AI prompt from NACVA’s AI Data University.

Prompt #4: You are an AI designed to perform discounted cash flow (DCF) analysis. Your task is to estimate the present value of a company’s future cash flows and determine the company’s intrinsic value. Use the projected cash flows and discount rate provided. 1. Read the projected cash flow data and extract the information. 2. Calculate the present value of each projected cash flow using the given discount rate. 3. Sum the present values to determine the company’s intrinsic value. 4. Provide a summary of the DCF analysis results.

Example output: present value of cash flows: $500,000 – intrinsic value of the company: $550,000. Summary: based on the DCF analysis, the company’s intrinsic value is estimated at $550,000, indicating potential for future growth.

Then I pasted the sample forecast data I obtained from ChatGPT.

Year Revenue ($) EBIT ($) Taxes ($) Depreciation ($) CapEx ($) Change in NWC ($) Free Cash Flow ($) Discount Factor Present Value of FCF ($) 2025 5000000 1000000 250000 250000 200000 100000 700000 0.909090909 636363.6364 2026 5400000 1080000 270000 270000 216000 108000 756000 0.826446281 624793.3884 2027 5832000 1166400 291600 291600 233280 116640 816480 0.751314801 613433.5086 2028 6298560 1259712 314928 314928 251942.4 125971.2 881798.4 0.683013455 602280.1721 2029 6802444.8 1360488.96 340122.24 340122.24 272097.792 136048.896 952342.272 0.620921323 591329.6235 Terminal Value 14013036.29 0.620921323 8700993.032

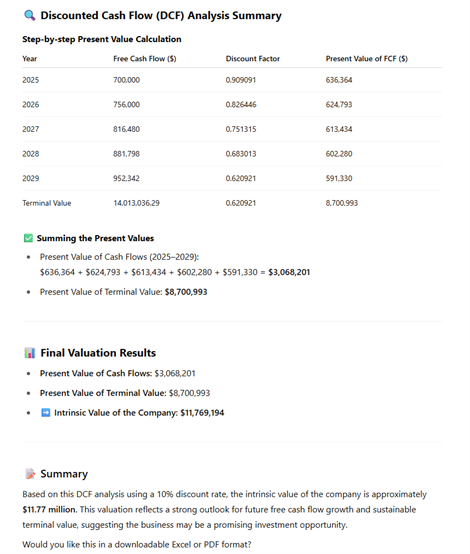

Then I let ChatGPT do its thing and this is what came back.

Wow! In just four simple prompts I was able to:

- Learn what data I needed to make a DCF calculation

- Create sample data I could use to test

- Calculated the DCF for the sample data

Here is where you come in: your professional judgement. Sure, someone can take the steps I demonstrated here but is it correct? Did I use the right assumptions?

AI is cool and does amazing things faster than any human, but you cannot take everything it spits out and use it in a report until you have vetted the inputs and the outputs. There will always be a need for CVAs and your expertise.

But now it is your turn. Verify the calculations, test out these sample prompts for yourself, and see what happens.

If you want to learn more about AI prompting, I am holding a course on May 28, 2025, for NACVA’s AI Webinar Series. My session is titled: “AI Prompt Engineering: How to Get Better Results from AI for Your Consulting Practice”. It will be fun!

Register at: https://www.nacva.com/ev_calendar_day.asp?date=5/28/2025&eventid=2739

Colin Brown is the founder and CTO for Syncnet.com and has been working with NACVA since 1996.

Mr. Brown can be contacted by e-mail to cto@syncnet.com.