Strong Valuation Opinions Include Methodology Explanations

Critically Assess Underlying Data and an Appropriate Method for Value Determination

Richard Claywell regularly reviews business valuations that seem to consider the asset, market, and income approaches in forming an opinion, but that never explain or justify a weighting methodology used to arrive at a final value conclusion. Here’s why that’s a mistake. Â

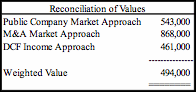

When performing a business valuation, you should always consider the Asset, Market, and Income Approaches. The various methods under the approaches need to be reconciled and explained to justify why you have selected the value conclusion. The table below shows a reconciliation I recently received.Â

Unfortunately, this is what I received except that I have rounded the numbers. You may notice that these are all called “approaches” when in fact they are “methods.”Â

There is no indication of how the valuator arrived at the conclusion of value. The reconciliation process should consider the level of confidence of the underlying data of each method. The valuator should also consider the appropriateness of each method employed and the range of the various values. In this reconciliation, the valuator has provided absolutely no information relating to the conclusion of value. The M&A Market Approach is substantially higher than the other two methods. There is no explanation as to how it is being considered in the final conclusion of value. The valuator should explain the drivers of each method and how or why they support the conclusion of value.Â

The valuator has a Weighted Value of $494,000. The valuator has not indicated how the various methods are weighted nor justified the weighting factor. If a weighting of values is used, the weights must be justified. You cannot just proclaim the weights; you must support the reconciled conclusion of value. Revenue Ruling 59-60 states:Â

“Because valuations cannot be made on the basis of a prescribed formula, there is no means whereby the various applicable factors in a particular case can be assigned mathematical weights in deriving the fair market value. For this reason, no useful purpose is served by taking an average of several factors (for example, book value, capitalized earnings and capitalized dividends) and basing the valuation on the result. Such a process excludes active consideration of other pertinent factors, and the end result cannot be supported by a realistic application of the significant facts in the case except by mere chance.”

I see weighting of values on a regular basis. The argument is that we are weighting, not averaging the values. Webster’s Dictionary defines weighting as averaging.

Richard Claywell performs business valuations and assists clients in estate management. Reach him at rclaywell@biz-valuation.com