An Analysis of Discount For Lack of Marketability Models and Studies

Calculating Discounts Accurately Depends a Lot on Company Specifics. Here’s What You Need to Know

Dennis Bingham and KC Conrad provide a thorough look at options for calculating a discount for lack of marketability (DLOM), including restricted stock studies, pre-IPO studies, theoretical and option pricing models, discounted cash flow (DCF), Mandelbaum factors, and more.

Valuation analysts frequently estimate a discount for lack of marketability (DLOM) based on one model or study. However, the current trend is to discuss the general empirical information and range of probable discounts based on multiple models or studies.

This includes discussing the strengths and weaknesses of the selected models or studies.  This article discusses a number of models and studies available for valuation analysts to utilize when estimating a DLOM for a minority interest in a closely held company. All of the models and studies discussed are based on public market data. None of the models is perfect. All of the models are sensitive to uncertain assumptions. Market data is subject to many non-DLOM influences and distortions.

Introduction

A major difference between a closely held company’s common shares and those of its publicly traded counterparts is its lack of marketability. Marketability refers to an owner’s ability to sell his interest, with nominal transaction costs, and to realize the cash proceeds of the sale in three to five business days.

A DLOM should generally be applied to the marketable value of any ownership interest that cannot be easily sold in a timely manner. Such discounts therefore are applicable to most equity investments not listed on an organized exchange or traded in an active over-the-counter market.

A DLOM is defined as:

An amount or percentage deducted from the value of an ownership interest to reflect the relative lack of marketability.1

At the present time, no direct evidence is available regarding the magnitude of a DLOM for closely held operating companies. A discount is usually estimated by analyzing public equity market data and models. The two types of models that use public equity market data as their primary sources are empirical and theoretical models. Empirical models are based on actual transactions that have occurred in the marketplace while theoretical models are based on economic formulas. Other sources include academic studies and the ‚ÄúMandelbaum Factors.‚Ä̬†

Empirical Models

There are three empirical models for estimating a DLOM: (1) restricted stock studies, (2) pre-IPO studies, and (3) flotation cost model. These models reflect a stock’s transferability and/or liquidity. Liquidity is defined as:  The ability to quickly convert property to cash or pay a liability.2 Studies of stocks listed on the New York Stock Exchange show that, while small blocks of heavily traded issues execute immediately, larger blocks and shares of lightly traded issues occur at discounts and/or are dribbled out. Moreover, the liquidity differential between heavily and  lightly traded shares has risen due to shorter Rule 144 holding periods, narrower bid-ask spreads  from decimal pricing, rising trading volume from institutional program trading, and the  availability of hedging instruments. Minority private equity interests are generally much less liquid than thinly traded New York Stock Exchange (NYSE) shares, and have benefited from none of the liquidity enhancements.

1. Restricted Stock Studies

Restricted stocks are identical in all respects to the freely traded stocks of public companies except they are restricted from trading on the open market for a certain time period.  Marketability is the only difference between a restricted stock and its freely traded counterpart. These studies have attempted to find differences in the price at which restricted stock transactions would take place compared with open market transactions in the same stock on the same date.

Restricted securities are stocks, warrants, or other securities that are acquired directly or indirectly from a public or private company or from an affiliate of the company (for example, a gift), in a transaction that is not registered by the SEC, also known as a private offering. For example, restricted stock can be acquired through corporate mergers, stock options, bonus shares, or compensation for services provided, but not through a public offering.3

Restricted stock studies have historically been the most frequently referenced source of DLOM data because some of the restricted stock studies provide detailed information on the transactions allowing comparison with companies subject to valuation. In addition, Revenue Ruling 77-287 (‚ÄúValuation of Securities Restricted from Immediate Resale‚ÄĚ) references restricted stock studies as empirical evidence to help quantify a DLOM. ¬†

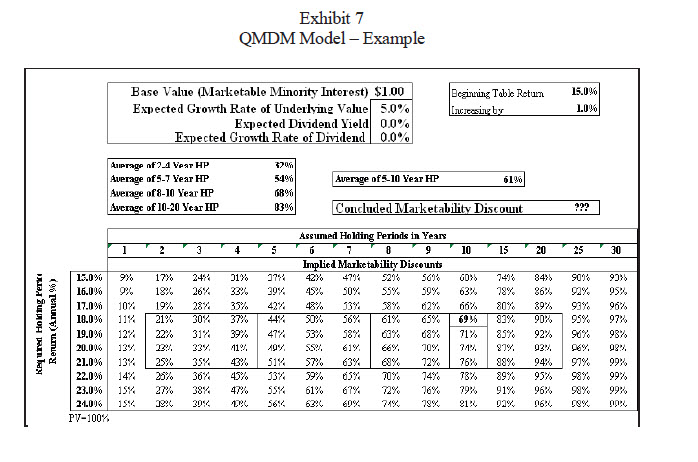

Exhibit 1 summarizes the results of twenty restricted stock studies. The restricted stock studies conducted up to 1990 varied in their methodology and sample size, but generally found transactions covering a wide range with average discounts from 13 to 35.6%.  Since 1990, average discounts have fallen into the 20s.4   This decline coincides with the decision by the Securities and Exchange Commission (SEC) to eliminate the requirement that all restricted stock transactions be registered and with the reduction of the holding period from two years to one year. Therefore, many professionals believe the earlier studies are a better indicator than the more recent studies of the discount for lack of marketability that is applicable to closely held companies.

There are four major problems associated with the restricted stock studies. First, shares analyzed in the restricted stock studies differ from shares in closely held companies in a number of important ways, including: a known limited holding period, financial reporting transparency, and the liquidity of the public market. Second, the discounts identified in the studies fell in a very wide range (for example, the Management Planning study discounts ranged from zero to 57.6%). Third, many of these studies do not provide detailed information on each of the transactions included in the study. Lastly, a number of these studies are more than 30 years old.

Aaron M. Stumpf has recently published an article in Trusts & Estates about a new restricted ¬†stock study conducted by the firm Stout Risius Ross (the ‚ÄúSSR Study‚ÄĚ) .5 ¬†The SSR Study analyzes the DLOM for a holding period of six months or less (which is shorter than the traditional restricted stock study holding period). This study found discounts covering a wide range, from a low of a negative 5.3% to a maximum 40% with a median discount of 9.3%. ¬†

Discounts are based on a comparison of the price, at which transactions were consummated, with the price one day prior to the transaction announcement date.

2. Pre-IPO Studies

Pre-IPO studies compare: 1) private transactions in a company‚Äôs stock that take place before the company goes public with 2) its market price following its Initial Public Offering (‚ÄúIPO‚ÄĚ). ¬†Emory Business Valuation, Willamette Management Associates, and Valuation Advisors are the primary organizations responsible for the development of pre-IPO data. Of these studies, only Emory provides detailed information on the transactions used in arriving at an average discount.

Pre-IPO transactions occur for a variety of reasons including: sales to investors; grants to directors, officers, employees, and lenders; issuances in acquisitions; grants for services; and debt exchanges.

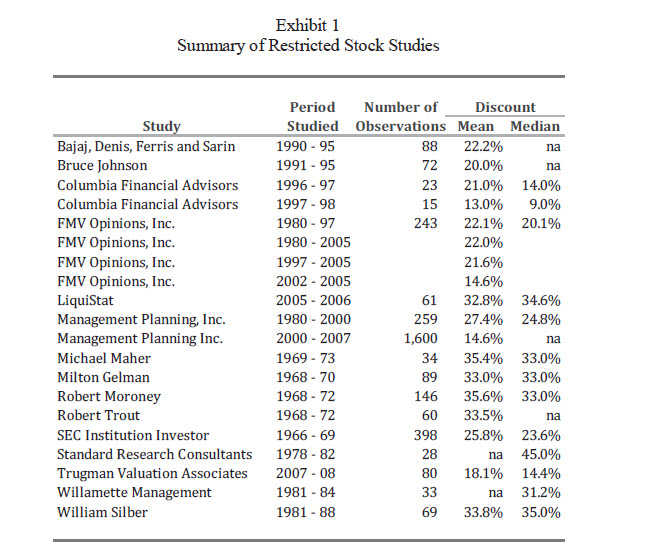

Exhibit 2 summarizes the Emory Studies. Emory compares: 1) the prices paid for private transactions occurring within five months prior to an IPO with 2) the opening price of the company’s IPO. The mean discount has generally ranged from 40 to 45%. The 1997 study was of dot.com companies and is not directly comparable to the other studies. Excluding the dot.com study, the adjusted mean discount for the remaining eight studies was 46%.

The major issues concerning the pre-IPO studies are: many of the transactions appear to be with insiders (possibly a form of compensation), and the private transactions price was not adjusted for the time value of money.

At the present time, there is no published information concerning the issue of compensation. An unscientific method of evaluating the issue of compensation is to compare the DLOM for options granted (to directors, officers, and employees, issued to lenders, and issued for services) versus sales to outsiders.

A review of the data indicates option transactions had a mean discount of 43% while sales transactions had a mean discount of 50%. The total number of transactions comprising each group was very similar (262 option transactions and 282 sale transactions). This analysis indicates the discounts associated with insider transactions are lower than sales to outsiders. A more comprehensive method of testing the insider compensation assumption is to review SEC filings to determine if the SEC required a company to make an adjustment to its financial statements for excess compensation.

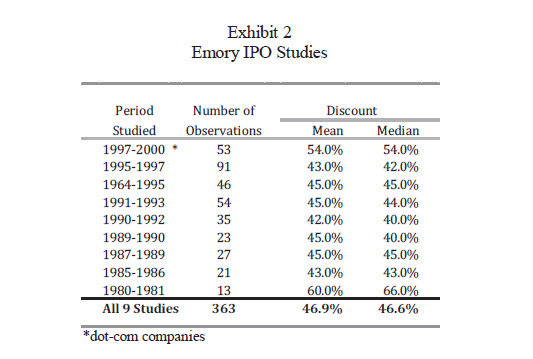

Critics suggest the size of the reported pre-IPO study discount is overstated by not adjusting the private transaction price for the time value of money. There is no published analysis of the time value of money and the DLOM. However, a review of the mean and median discounts versus the time between transactions and the IPO indicate that as the days between transaction and IPO increase the size of the discount increases (See Exhibit 3).

Another explanation for this increase in discounts may be event signaling. To correct for event  signaling, analysts have attempted to isolate the impact of an event on a publicly traded  company’s share price by using empirical analysis to study prices just before and after some  event. Stanley Feldman reviewed two studies (moving from the OTC to the NYSE, and moving from the NASDAQ to the NYSE) to estimate the impact of event signaling on discounts for closely held stocks. Based on this review, Feldman estimates a stock trading on the NYSE is at least 17% more valuable than an equivalent closely held stock. This means a closely held stock would sell at a 14.5% discount to an equivalent publicly traded stock.6

Assuming Emory’s discounts are impacted by event signaling, and then one could argue that the adjusted mean DLOM would be approximately 31.5% (46% less 14.5%).

3. Flotation Cost Model

The flotation cost model estimates a DLOM by measuring the cost of creating marketability.  Flotation costs represent the cost of going public. Flotation costs include both fixed and variable costs. The major fixed costs are audit fees, legal fees, and printing costs. The major variable costs include underwriter’s fees. Expressed as a portion of gross proceeds, costs generally increase as risks associated with the issue increase, or the size of the offering decreases. Mean discounts have ranged from 6 to 17%.

The major issue concerning flotation cost is the characteristics of the companies included in the models. These companies are significantly larger and have a higher expectancy of being a successful public company than the majority of closely held companies.

Theoretical Models

The primary sources of theoretical discount data include option-pricing models, long-term equity anticipation securities, and discounted cash flow models.

Option-pricing Models

Option-pricing models were originally developed for use in estimating the value of exchange traded stock options. An exchange-traded stock option is traded on a regulated exchange where the terms of each option are standardized by the exchange. The contract is standardized so the underlying asset, quantity, expiration date, and the strike price are known in advance.

Three frequently referenced option-pricing models are the Chaffee, Longstaff, and Finnerty models.

1. Chaffee European Put Option Model

Chaffee relies on the Black-Scholes option-pricing model to estimate a DLOM by calculating a theoretical put option price for a closely held stock. The put option price is then compared with the closely held company’s stock price to derive an estimated DLOM. A put option is:  An option contract giving the owner the right, but not the obligation, to sell a specified amount of an underlying security at a specified price within a specified time.7

The Black-Scholes model has historically been the most frequently used model to value exchange-traded options. Black-Scholes was designed to measure European-style options (options that can be exercised only on the expiration date).

The basic inputs for the Black-Scholes model include: (1) stock price, (2) strike price, (3) risk free interest rate, (4) expected option life, (5) interest rate, and (6) expected volatility.

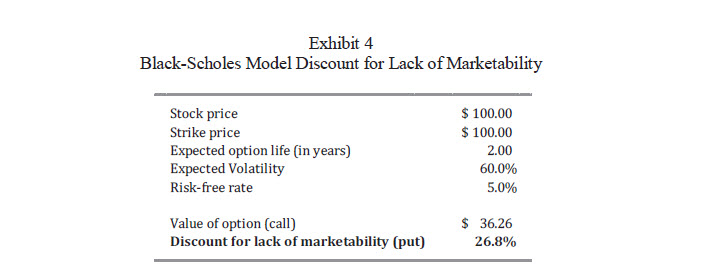

The strike price is typically set to be equal to the market value of the underlying stock as of the valuation date. The expected option life is equal to the assumed holding period, the interest rate is equal to the cost of capital, and volatility refers to the rate at which a stock’s price moves up and down. Since a closely held company’s stock does not trade it is necessary to estimate the subject stock’s volatility by using comparable publicly traded company data. Exhibit 4 presents an example of the Black-Scholes model.

Chaffee notes the use of European-style options results in lower option prices than if American-style options (options exercisable at any time) are used. The use of lower option prices results in a lower DLOM.  There are three problems associated with put option analysis. First, the Black-Scholes model assumes continuous trading of the stock. Second, hedging methods are not available for stock in closely held companies. Finally, this methodology requires the use of comparable publicly traded companies (which often do not exist) to estimate volatility.  Critics of put option analysis argue the value derived is not indicative of marketability. Rather it is an indication of the option’s intrinsic value. Intrinsic value is the positive amount by which the underlying stock price exceeds the strike price of an option.

2. Longstaff Look Back Put Option Model

Longstaff’s look back put option model was designed to derive an analytical upper bound DLOM using option-pricing theory.8 This methodology assumes an investor has perfect market timing ability, which would allow him to maximize the value of his portfolio.

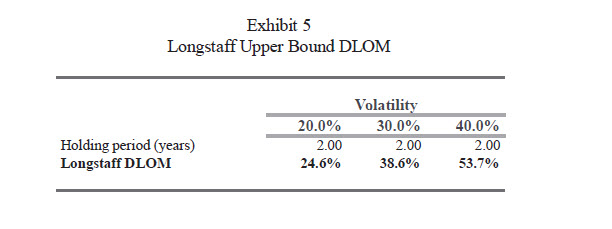

Exhibit 5 presents an example of a DLOM analysis using Longstaff’s model. The illustrated range of volatility was based on typical stock return volatilities. The estimated DLOM ranges from 24.6 to 53.7% for a two-year restricted holding period. The holding period represents the time required to sell the stock.

The primary problems with Longstaff’s study are that the methodology assumes investors have perfect market timing, and the selection of the variables (volatility and holding period).

3. Finnerty Average-Strike Put Option Marketability Discount Model

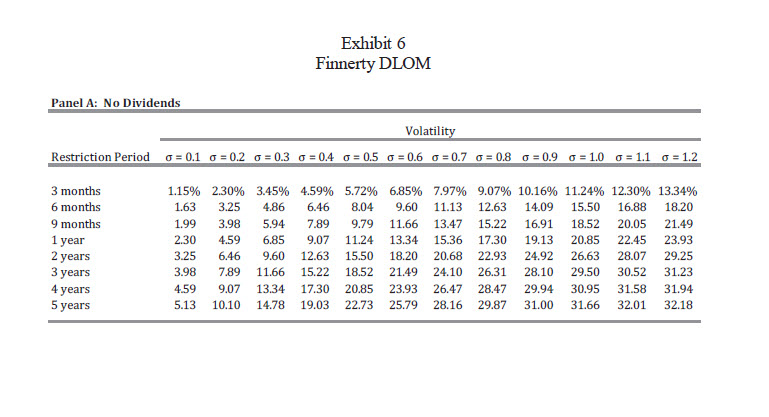

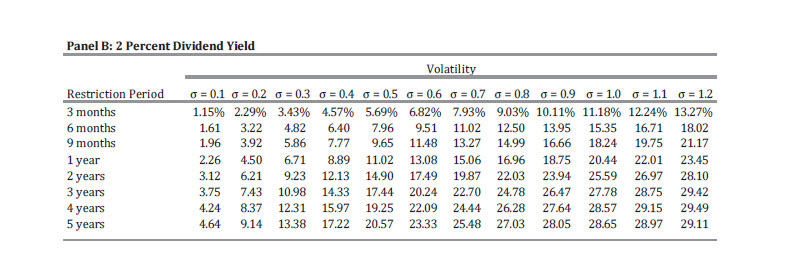

This model9 estimates marketability discount as the value of an average-strike put option.¬† The investor is not assumed to have any special market-timing ability; instead, Mr. Finnerty assumes that the investor would, in the absence of any transfer restrictions, be equally likely to sell the shares any time during the restriction period.¬†¬† The cost of transfer restrictions can be priced as the value of an average-strike put option.¬† The average-strike put option model fits empirically observed discounts better than the look back put option model, which substantially overstates the discount, according Finnerty.¬† Exhibit 6 presents the sensitivity of the DLOM to the length of the restriction period and the stock‚Äôs volatility (ŌÉ). Panel A assumes no dividends are paid while panel B assumes a dividend yield of 2%. Mr. Finnerty assumes a 2% dividend yield based on the 15-year average dividend yield of the Standard & Poor‚Äôs 500 portfolio of stocks.¬†

Assuming no dividends (Panel A), a one-year restriction period and a ŌÉ between 10 and 120% the DLOM varies between 2.3 and 23.9% . Assuming a two-year holding period the DLOM varies between 3.2 and 29.2%. A somewhat lower discount applies to dividend paying stocks (Panel B)

Long-Term Equity Anticipation Securities (LEAPS)

LEAPS are identical in all respects to short-term options except they have a later expiration date (positions can be maintained up to three years). According to the Options Clearing Corporation, these exchange-listed options grant ‚Äúthe buyer (holder) the right, but not the obligation, to buy, in the case of a call, or to sell, in the case of a put, a specified amount of the underlying asset at a predetermined price on or before a given date.‚ÄĚ LEAPS can provide a hedge against stock price declines in underlying equities (cost of insurance). This cost of insurance represents a minimum DLOM that is required. The cost of insurance is calculated as the option put price divided by the strike price of the option (for example, the DLOM for a stock with an option price of $1.13 and a strike price of $3.75 is 30.1%).¬†

The most recent LEAPS study is ‚ÄúMinimum Marketability Discounts‚Äď4th Edition‚ÄĚ by Ronald Seaman. The Seaman study sorted 1,036 LEAPS by revenue and book value size using the prices of 2008 LEAPS. The study showed that as company size decreased (either in terms of revenue or book value), the size of the required discount increased. The average discount for all 1,036 companies was 36.4%. As revenue size decreased, the average DLOM increased from 30.9 to 50.7%.¬† As book value decreased, the average DLOM increased from 32.4 to 45.7%.¬†

This study indicates that for a company with revenues of less than $100 million, the average DLOM would be approximately 50.7%. In addition, Seaman notes that as a company’s beta increases, the cost of protection increases. The cost of protection is from 30 to 50%, with a beta range of 0.66 to 1.83.

The major results of this study were: discounts change over time and are not consistent in size; discounts vary by industry; company size has a clear and major affect on discounts; and company risk has a major affect on discounts.

There are three problems associated with LEAPS. First, not all publicly traded companies trade LEAPS. Second, it is difficult to find LEAPS generally similar to the closely held company being valued (either in terms of business or industry type). Third, companies having LEAPS are generally larger than nearly all closely held businesses.

Discounted Cash Flow Model

Discounted cash flow models are based on the underlying premise that an investment in a business is worth the present value of all the future benefits it will produce for the owner(s).

The Quantitative Marketability Discount Model (QMDM) by Christopher Mercer is the most frequently referenced discount cash flow model for estimating DLOM.10 QMDM is based on quantitative analysis and estimates DLOM for marketable minority interest values.

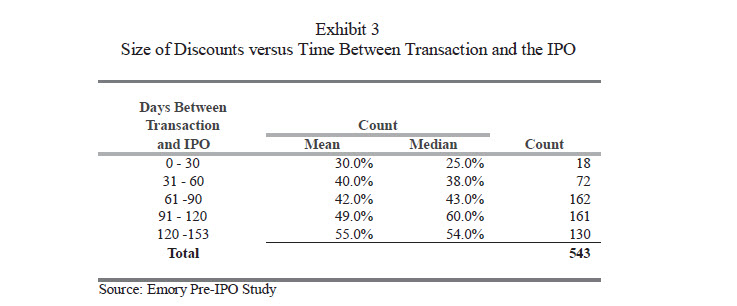

The application of this model requires a determination of the following elements: (1) expected growth rate in value; (2) expected dividend yield; (3) expected growth rate in the dividend; (4) expected holding period; and (5) required holding period return. Exhibit 7 presents an example of a DLOM analysis using QMDM.

The two major criticisms of this model center on the selection of the holding period. The first criticism is that the holding period cannot be determined with any degree of assurance. As can¬† been seen in Exhibit 7, by assuming an 18%¬† required rate of return and a two- to four-year¬† holding period, the indicated DLOM varies from 21 to 37% . The second criticism is ‚Äútheoretically the value of the entity should not change whether you have a short or long holding period. This is because the terminal value incorporates the present value of all future cash flows.‚ÄĚ11

At the present time, while many business valuation professionals are using QMDM, the tax court has generally not accepted this methodology as empirical evidence to quantify a DLOM.

Academic Studies

There have been three academic research studies that have attempted to determine marketability discounts related to minority interest values. These studies are ‚ÄúEquity Ownership Concentration and Firm Value: Evidence from Private Equity Financing‚ÄĚ12 by Karen Wruck; ‚ÄúMarket Discounts and Shareholder Gains for Placing Private Equity‚ÄĚ13 ¬†by Michael Hertzel and Richard¬† Smith; and ‚ÄúFirm Value and Marketability Discounts‚ÄĚ14 ¬†by Mukesh Bajaj, David Denis, Stephen¬† Ferris, and Atulya Sarin‚Äēreferred to as the private placement study in this article.¬†

To determine an indication of a DLOM, Wruck studied the difference in the price between unregistered and registered shares. This difference is assumed to be due to the lack of marketability. Wruck’s study indicated the announcement of private transactions was associated with significant positive abnormal returns (similar to event signaling). The mean discount of Wruck’s study was 17.6%.

The Hertzel/Smith study attempted to determine the underlying reason for the discounts observed in private placements. In this study, the authors identified 106 transactions involving private placements from 1980 to 1987. The mean discount was 20.1%. The authors then performed a multivariate regression to control for possible non-marketability factors involved in private placement discounts. The calculated difference between registered and unregistered shares was 13.5%.

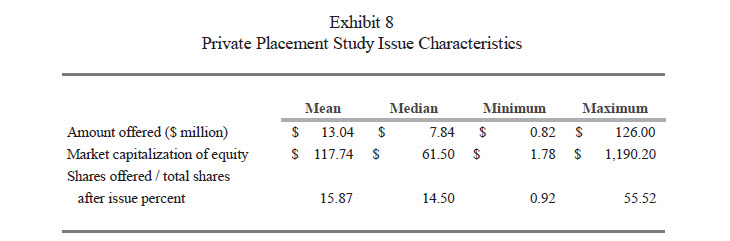

The private placement study sampled 88 private placements from 1990 to 1995. The majority of companies traded over-the-counter, with an average placement size of $13 million, and an average market capitalization of $118 million. The number of shares offered as a percent of total shares after issue was 15.87%. Exhibit 8 presents summary information concerning the characteristics of the private placements included in the private placement study (Source: “Firm Value and Marketability Discounts).

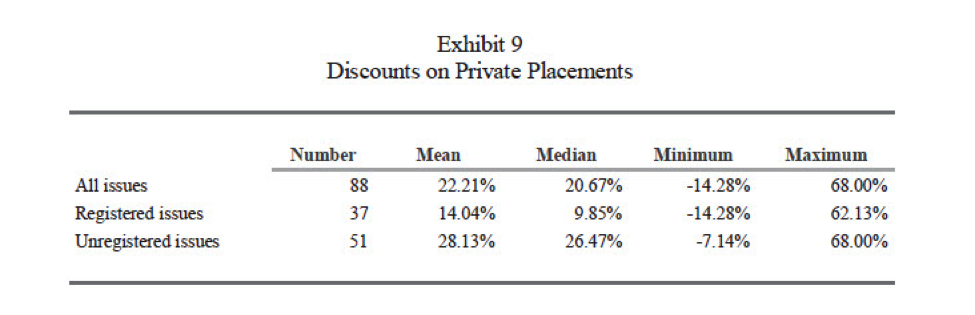

Exhibit 9 summarizes the discounts on private placements. The discounts covered a very wide range (from a negative 14.3% to 68%) with an average of 22.2% compared to the firm’s publicly traded shares. The mean discount for the registered shares was 14% and 28.1% for unregistered shares (also referred to as restricted shares).

The private placement study indicates these discounts include factors other than marketability (such as, fraction of total shares offered in the private placement, business risk, financial distress, and total proceeds from the placement). Excluding these other factors, the average DLOM is 7.2%.

The 7.2% discount is not directly comparable to the results obtained in the restricted stock and pre-IPO studies for two reasons. First, the restricted stock and pre-IPO studies measured a lack of marketability while the private placement study measures a lack of liquidity.

Marketability denotes the right to sell an asset in an established and efficient public capital market, within a reasonable time, with relatively low transaction costs, and with minimal effect on that security’s public market price.

Liquidity denotes the ability to convert an asset into cash without diminishing its value. Liquidity is a spectrum. A block with high liquidity will have low transaction costs, a short liquidation period and minimal discounts (e.g., bid-ask spread). A block with low liquidity will have opposite characteristics.15

Second, the discounts reported in the restricted stock and pre-IPO studies related to minority interests in operating companies. This is not the case in the private placement study. According to the authors of the private placement study:

In our opinion, when valuing an operating company that is privately held (or its securities), the appropriate benchmark for discounts is provided by the total private placement discount or the discount observed in the acquisition approach. This is because, whether it is marketability restriction per se or other factors, the relevant analysis aims to determine the total valuation discount. However, when it is appropriate to only consider the effect of marketability restrictions, as is the case in valuation of non-controlling interests in a non-operating partnership, which holds assets of known value (e.g., a family limited partnership), the distinction between the total valuation discount and liquidity discount is key. In such cases, the applicable discount is only for the lack of liquidity.16

Therefore, for most business valuations of minority interests in privately held companies, the appropriate DLOM starting point is 22.2% based on this study. The average discount would be 28.1% if only the unregistered shares were considered.

There are two problems associated with the academic studies. First, since the transaction data has never been published, the data is not verifiable, and there is no good method for comparing specific companies with those used in this study. Second, there is a wide range of discounts identified in these studies.

Mandelbaum Factors

Arguably the ‚ÄúMandelbaum Factors‚ÄĚ are not an observed study or model. In¬† Bernard¬† Mandelbaum v. Commissioner, the Tax Court used nine factors in determining a DLOM amount,¬† now known as the Mandelbaum Factors. These benchmarks are:¬†

-  Financial statement analysis

- Company’s dividend policy

- The nature of the company, its history, its position in the industry, and its economic outlook

- Company’s management

- Amount of control in transferred shares

- Restrictions on transferability of stock

- Holding period for stock

- Company’s redemption policy

- Costs associated with making a public offering

There are two problems associated with these factors. First, several of these factors (e.g., financial statement analysis, nature of the company, company’s management) are typically included in the selection of discount and capitalization rates or market multiples. Therefore, these factors should have no impact on the size of the DLOM or there may be a problem with double counting. Second, some of the factors are subjective (e.g., there are no studies indicating a range of possible discounts or even a direction in the discount) and thus are open to an individual’s interpretation.

Conclusions

A DLOM is ultimately a valuation analyst’s opinion; an opinion that should be supported by discussing the methodologies used and the strengths and weaknesses of each of the methodologies.

Judge Laro stated, during the Second Annual Business Valuation & Tax Conference (2009), that valuation reports should address the weaknesses of each study, not just the positive aspects of the DLOM studies. Judges need to know these weaknesses to better understand the full breadth in rendering a decision. Judge Laro went on to say, ‚ÄúOne better show all directions to arrive at a [marketability] conclusion.‚Ä̬† The use of a simple average from a single study is not appropriate. More than one model should be used (for example: a restricted stock study and an option-pricing model, or QMDM) when selecting an initial estimate of a DLOM. Then adjustments should be considered to recognize the unique circumstances of each individual situation, because the factors causing an extremely high or low discount may or may not be present in the subject company.

End Notes:

- The International Glossary of Business Valuation Terms

- Ibid

- Fidelity.com

- The mean and median discounts for the studies from 1966 through 1992 were approximately 31%  and 33% , respectively. The mean and median discounts for the period from 1991 to 1998 were approximately 21%  and 17% , respectively.

- Aaron M. Stumpf, ‚ÄúShould Substantial Discounts Apply to Very Short Holding Periods?‚ÄĚ Trusts & Estates: The Journal of Wealth Management for Estate Planning Professionals, Issue Date July 1, 2011.¬†

- Stanley J. Feldman, ‚ÄúRevisiting the Liquidity Discount Controversy: Establishing a Plausible Range,‚ÄĚ www.axiomvaluation.com, published October 2004.¬†

- www.investopedia.com

- Francis A. Longstaff, ‚ÄúHow Much Can Marketability Affect Security Values,‚ÄĚ Journal of Finance, 50, pp. 1767- 1774.¬†

- John Finnerty, ‚ÄúAn Average-Strike Put Option Model of the Marketability Discount‚ÄĚ (Unpublished paper as of this writing July 22, 2011. Paper to be published in second half of 2011, according to John Finnerty).¬†

-  Z. Christopher Mercer, Quantifying Marketability Discounts. (Memphis: Peabody Publishing, 1997).

- ¬†Lance Hall, ‚ÄúIs There a ‚ÄėBest‚Äô Lack of Marketability Discount?‚ÄĚ www.bvmarketdata.com/pdf.¬†

- ¬†Karen H. Wruck, ‚ÄúEquity Ownership Concentration and Firm Value: Evidence from Private Equity Financings,‚ÄĚ Journal of Financial Economics, 23, pp. 3-28.¬†

- ¬†Michael Hertzel & Richard L. Smith, ‚ÄúMarket Discounts and Shareholder Gains from Placing Private Equity,‚ÄĚ Journal of Finance, 48, pp. 459-485.¬†

- ¬†Mukesh Bajaj, David J. Denis, Stephen P. Ferris, and Atulya Sarin, ‚ÄúFirm Value and Marketability Discounts,‚ÄĚ Journal of Corporation Law, 27, pp. 89-115.¬†

- ¬†Ashok B. Abbott, ‚ÄúDiscounts and Premiums,‚ÄĚ Presented at the American Society of Appraisers, Hollywood, CA,¬† July 17, 2007.

-  Bajaj, et. al, supra, p. 114.  Dennis Bingham, MCBA, BVAL is President of Corporate Appraisal.

Dennis Bingham, MCBA, BVAL is President of Corporate Appraisal. Dennis has over 37 years experience in business appraisals, accounting, financial analysis, and merger and acquisition activities. Dennis is an instructor and course author for The Institute of Business Appraisers and has served on the Qualifications Review Committee for IBA.  Dennis has been a speaker at the National Conference of the IBA and has been published in the Journal of Business Appraisal Practice, Family Law, and Valuation Viewpoint.  Dennis can be reached at dennisbingham@me.com.

KC Conrad, CBA, CMEA, ABAR, ASA is a principal in American Business Appraisers, a firm located in metro Phoenix, AZ. He performs valuations for a variety of purposes; estate and gift tax, buy-sell transactions, lender financing, partnership, and corporate disputes. KC has authored numerous courses relating to business valuation and is a course instructor for the Institute of Business Appraisers, NEBB/SBA Institute, Consultant’s Training Institute/National Association of Certified Valuators and Analysts (NACVA), American Society of Appraisers and the Arizona Business Brokers  Association. He is currently a member of IBA’s Qualification Review Committee and Board of Governors. KC can be contacted at kc@abavalue.com.

This piece was originally published in Business Appraisal Practice (BAP), 3rd Quarter, 2011.  Visit www.go-iba.org for more information.