Why Bad Multiples Happen to Good Companies—McKinsey Quarterly

A Premium Multiple is Hard to Come By and Harder to Keep; Owners Should Worry More About Improving Performance

Susan Nolen Foushee, Tim Koller, and Anand Mehta make the case in McKinsey Quarterly that executives considering company value often worry too much about their company’s multiple (e.g., a P/E ratio, or EV/EBIDTA, etc.) instead of focusing on company growth.

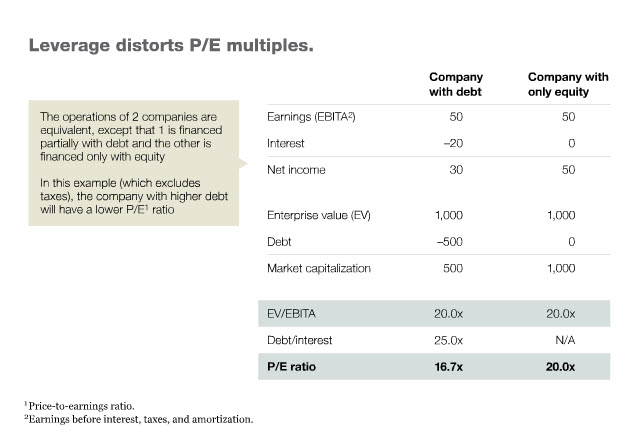

It isn’t that multiples aren’t legitimate data to consider. But multiples can vary widely if a company is comparing itself to the wrong set of competitors. Multiples legitimately vary considerably based on the leverage a company is currently using and whether its financing is largely in equity or in debt. The authors assert it makes most sense to focus on company growth and return on capital:

Earnings multiples, particularly the price-to-earnings (P/E) ratio, are a common shorthand for summarizing how the stock market values a company. The media often use them for quick comparisons between companies. Investors and analysts use them when talking about how they value companies.

That there are generally more detailed models behind the shorthand seldom makes the headlines, and this contributes to a problem: executives who worry that their multiple should be higher than the one the market currently awards them. “We have great growth plans,” they say, or “We’re the best company in the industry, so we should have a substantially higher earnings multiple.” Their logic isn’t necessarily wrong. Finance theory does suggest that companies with higher expected growth and returns on capital should have higher multiples. And the theory held true when we analyzed large samples of companies across the economy.

However, within mature industries, our analysis showed that regardless of performance, multiples vary little among true peers. Companies may occasionally outperform their competitors, but industry-wide trends show a convergence of growth and returns that is so striking as to make it difficult for investors, on average, to predict which companies will do so. As a result, a company’s multiples are largely uncontrollable. Managers would be better off focusing instead on growth and return on capital, which they can influence. Doing so will improve the company’s share price, even if it doesn’t result in a multiple higher than those of its peers.

Multiples Can Be Tricky Variables to Rely on for Assessing Value