IRS: Cheapest Obamacare Plan Will Be $20,000 Per Family —IRS Report, HuffPo, Catholic News, Yahoo! Answers, Economonitor. JofA Explains Details.

Details Found in IRS Explanation Issued Wednesday; $20,000 Figure Based on a Family of Four.

In a final regulation issued Wednesday, January 30, 2013, the Internal Revenue Service (IRS) assumed that under Obamacare the cheapest health insurance plan available in 2016 for a family will cost $20,000 for the year. Under Obamacare, Americans will be required to buy health insurance or pay a penalty to the IRS. The news was reported by Huffington Post, CNS News, Catholic News, Investment Watch, Economonitor, Naked Capitalism, Investor Village, and more.

The Journal of Accountancy offered detailed analysis of the new regulations, and NPR weighed in with a piece about how not everyone will be covered. From CNS News:

Healthcare Prices Turn Out to Be a Shock to Some

The IRS’s assumption that the cheapest plan for a family will cost $20,000 per year is found in examples the IRS gives to help people understand how to calculate the penalty they will need to pay the government if they do not buy a mandated health plan. The examples point to families of four and families of five, both of which the IRS expects in its assumptions to pay a minimum of $20,000 per year for a bronze plan. “The annual national average bronze plan premium for a family of 5 (2 adults, 3 children) is $20,000,” the regulation says.

Bronze will be the lowest tier health-insurance plan available under Obamacare–after Silver, Gold, and Platinum. Under the law, the penalty for not buying health insurance is supposed to be capped at either the annual average Bronze premium, 2.5 percent of taxable income, or $2,085.00 per family in 2016. In the new final rules published Wednesday, IRS set in law the rules for implementing the penalty Americans must pay if they fail to obey Obamacare’s mandate to buy insurance. To help illustrate these rules, the IRS presented examples of different situations families might find themselves in.

Yves Smith at Economonitor adds detail:

The cheapest type of plan in ObamaCare is a bronze plan, and bronze family plans for 4 and 5 person families are assumed to cost $20,000 in 2016.

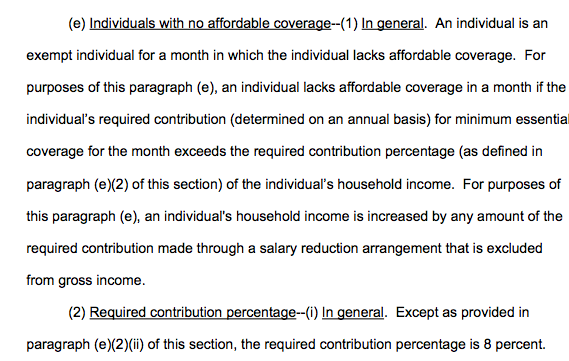

First see this section on p. 53:

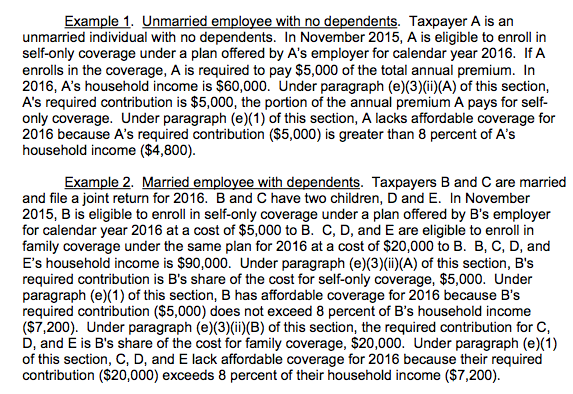

Now we see how affordable coverage thresholds relate to income in these examples, and notice the plan cost assumptions:

In a piece called “Individual Health Care Mandate Rules Under Sec. 5000A Proposed,” published today in the Journal of Accountancy, Sally P. Schreiber, JD, explains:

The proposed regulations cover the following topics:

- Maintenance of minimum essential coverage and liability for the shared-responsibility payment. Prop. Regs. Sec. 1.5000A-1 defines minimum essential coverage and liability for the shared-responsibility payment, including for dependents.

- Minimum essential coverage. Prop. Regs. Sec. 1.5000A-2 defines the different types of health plans that qualify as minimum essential coverage.

- Exempt individuals. Prop. Regs. Sec. 1.5000A-3 defines who is exempt from the payment.

- Computation of the shared-responsibility payment. Prop. Regs. Sec. 1.5000A-4 contains rules for computing the amount of the payment.

- Administration and procedure. Prop. Regs. Sec. 1.5000A-5 includes when the payment is due, the prohibition against liens or levies for nonpayment, no criminal fines, and the IRS’s authority to offset overpayments of tax to collect the payment.

Julie Appleby at National Public Radio (NPR) explains “Why Some Families Won’t Qualify For Subsidized Health Insurance.” (Ms. Kaiser’s piece earlier appeared in Kaiser Health News in collaboration with the Washington Post.) More:

Quite a few families with expensive job-based health insurance may be ineligible for federal subsidies to help them buy cheaper coverage through new online insurance markets, under final rules released Wednesday by the Internal Revenue Service.

The two rules, published by the Treasury Department here and here, uphold earlier proposals outlining what is considered affordable, employer-sponsored coverage.

Under the federal health law, low- and moderate-income workers with job-based coverage that is deemed unaffordable can opt out of it and turn to new marketplaces, called exchanges, to buy subsidized insurance. But the rule defines the standard for affordability more narrowly than most consumer groups had hoped. The threshold is defined as less than 9.5 percent of household income to cover the employee’s share of premium costs — not on what he or she must pay to cover the entire family, which is generally more expensive.

Consumer groups had hoped to sway the IRS to base the affordability threshold on the cost of a family plan, saying the rules could prevent some children and spouses from getting coverage. A July report from the Government Accountability Office estimated that a small percentage of uninsured children — 6.6 percent of the total, or at least 460,000 — may be shut out because of how the government proposed to define affordable coverage.

Econometrix adds: “Some of the backers of the ACA are finding it to be less of a deal than they had anticipated. Exconometrix then proceeds to quote the Wall Street Journal “(hat tip Tyler Cowen).”

In a piece called “Some Unions Grow Wary of Health Law They Backed,” Janet Adamy and Melanie Trottman of the Wall Street Journal report:

Labor unions enthusiastically backed the Obama administration’s health-care overhaul when it was up for debate. Now that the law is rolling out, some are turning sour.

Union leaders say many of the law’s requirements will drive up the costs for their health-care plans and make unionized workers less competitive. Among other things, the law eliminates the caps on medical benefits and prescription drugs used as cost-containment measures in many health-care plans. It also allows children to stay on their parents’ plans until they turn 26.

To offset that, the nation’s largest labor groups want their lower-paid members to be able to get federal insurance subsidies while remaining on their plans. In the law, these subsidies were designed only for low-income workers without employer coverage as a way to help them buy private insurance.

Mixed Opinion.

The news strikes people who have different assumptions and views quite differently. In an opinion piece in the Wall Street Journal yesterday (1/31), Daniel P. Kessler, a professor of business and law at Stanford University and a senior fellow at the Hoover Institution, opines in a piece called “ObamaCare’s Broken Promises:” that “every one of the main claims made for the law is turning out to be false.” Kessler specifically cites:

• Lower health-care costs.

• Smaller deficits.

• Preservation of existing insurance.

• Increased productivity.

And in “The Doctors Office as Union Shop,” Dr. Leffell, a practicing physician, former CEO of the Yale Medical Group and a professor at the Yale School of Medicine asserted separately in the Wall Street Journal on Wednesday [1/29]:

The net effect is that in 2012 approximately half of physicians already were employed by large health-care entities. Some industry observers estimate that, over the next few years, health systems will employ close to 80% of all doctors.

The shift will be important for many reasons. The migration of physicians into large, regulated entities is essential if the practice of medicine is going to be transformed into the corporatist-government model that is the only way health-care costs can be controlled. The number of failed cost-control experiments in this country—remember the HMO experiment?—is dizzying. None has worked.

The change in the nature of physician employment will have effects never before experienced in America. As the effects of the Affordable Care Act come into focus, it becomes clear that when the majority of physicians are no longer self-employed—and barring any legislation to the contrary—their new employed status will provide doctors with the right to collective bargaining.

But that doesn’t mean the entire world is in agreement.

As noted in an earlier QuickReadBuzz.com post this week, a number of other observers are quite happy with the new healthcare law.

In a piece that appeared last Sunday in the New York Times op/ed section (1/24) called “Carrots for Doctors,” Bill Keller, former Executive Editor of the New York Times wrote that he did — and still does — largely favor the law “mainly for extending the basic safety net to millions of Americans,” although he concedes that as currently structured, he doesn’t believe the “Pay for Performance” incentives built into the program will work at all as currently structured.

And in The New Republic, in a piece titled “Obamacare Sticker Shock: Not Very Shocking,” Jonathan Cohn argues that the Affordable Care Act was never about making health insurance more affordable, and that the American people should know that.

see also:

- A Cruel Blow to American Families —New York Times [02/02]

- IRS Anticipates Cheapest ObamaCare Family Plan Will be $20,000 in 2016 —Economonitor [02/01]

- IRS: Cheapest Obamacare Plan Will Be $20,000 Per Family —Catholic News Consortium [02/01]

- Will “Pay for Performance Work in Healthcare?” Times Editor has Doubts. Here’s Why. —NY Times QuickReadBuzz [1/31]

- Individual health Care Mandate Rules Under Sec. 5000A Proposed —Journal of Accountancy [02/01]

- IRS: Cheapest Obamacare Plan Will Be $20,000 Per Family —Catholic News Consortium [02/01]

- Opinion: Obamacare’s Broken Promises: Every One of the Main Claims Made for the Law is Turning Out to Be False —Wall Street Journal

- Some Unions Grow Wary of Healthcare Law They Backed —Wall Street Journal [1/30]

- Why Some Families Won’t Qualify For Subsidized Health Insurance —National Public Radio & Washington Post [1/30]

- Labor Unions Finally Read Obamacare Fine Print, Realize Costs Set To Spike, “Turn Sour” On Obama —Zero Hedge [1/30]

- David J. Leffell: The Doctor’s Office as Union Shop —Wall Street Journal [1/29]

- Obamacare Sticker Shock: Not Very Shocking —New Republic [1/29]

- To Outsmart Obamacare, Go Protean: Don’t Fire Staff. Make them Corporations. —Wall Street Journal [1/28]

- Carrots for Doctors —New York Times [1/24]

- Health Care Costs To Exceed A Record $20,000 Per Year For Families With Insurance, Study Says —Huffington Post [05/16/2012]

Questions? Comments? Critiques?

Interested in contributing on an alternate topic?

Write editor Dave Dix.