Building Value from the Inside-Out

Maximizing value by minimizing risk

Most private company owners are not aware of the impact of company-specific risk on the value of their businesses. When they are faced with a need to increase the value of their businesses in order to close a value gap, they typically only focus on growing sales, reducing costs, or making an acquisition. None of those strategies are the most effective initial way to increase value. Adopting measures to reduce company-specific risk is the best initial way to maximize value.

It’s a pattern that is replicated across the U.S. every day. Business owners, excited about the prospect of selling their businesses and moving on to their next phases of life, are confronted by the stark realization that their business values are nowhere near what they expected, or what they need to finance their desired future lifestyles. They face a “value gap” and, in determining how to close it, they often choose the wrong path, right from the outset.Â

Most business owners conclude that, in order to realize the value they need, their businesses must become larger and more profitable, so they turn to the only options they know about: growing sales, reducing costs, or, making an acquisition. The problem, is that none of those strategies represent the most effective initial way to maximize the value of their businesses.Â

Attempts to aggressively increase sales often come with the undesirable side effect of adding risk to the business, because the organization is not properly structured to absorb such growth.  This type of growth is not sustainable. Further, it exposes the business to increased  risk, which, in turn increases the business’s effective cost of capital, or discount rate, and that , more often than not,  results in a lower value, despite higher sales. Increased sales may also come at the expense of margin erosion, if the business’s  sales are also grown by reducing prices in a competitive environment. That, in turn, can start a downward spiral into commoditization as the business must then begin reducing costs in order to preserve margins.

Reducing costs, however, often means either eliminating positions or sacrificing the quality of some element of operations. Eliminating positions usually means adding more workload to an already thinly stretched workforce, while sacrificing quality eventually leads to inferior products or services and lost future revenue. Both outcomes reduce the business’s sustainability, increase its risk profile and effective cost of capital, and reduce its overall business value. That also may affect employee loyalty and retention.

Acquisitions present a whole other set of challenges, especially for the business that is not organizationally strong enough to manage all of the complexities of successfully integrating another business. The dilution of management’s attention alone, as it tries to focus on two different businesses and an integration process, can have the devastating effect of not only causing the acquisition to fail, but also jeopardizing its core business.

There is another way, however, to maximize business value. It’s easier, more controllable, more predictable, more sustainable, and more effective than chasing sales or margins, or making an acquisition. It doesn’t even require growth in sales, margins, or profitability, but making it even more appealing, growth in each such category typically follows as a byproduct, without reducing prices or adding more risk to the business. It’s the process of strengthening the business from the inside out by reducing its risk which, in turn, reduces its cost of capital / discount rate, and increases its value.

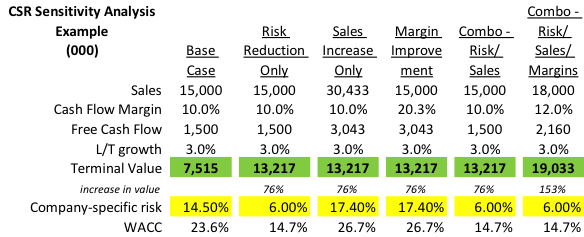

Example: To demonstrate the magnitude of the difference in approaches, assume a company has $15M in sales, $1.5M in EBITDA, and a 3 percent long-term growth rate. If its current value is $7.5M (a 5X EBITDA multiple), it very well could have a company-specific risk factor of around 14 percent embedded in its overall cost of capital / discount rate (Exhibit 1). That’s a fairly high risk level compared to, say, a public company, which might be valued as much as five times higher, with a large portion of the difference being related to the public company’s lower company-specific risk of, perhaps, only 1-2 percent.

Public companies typically have much lower company-specific risks because they are constantly under the scrutiny of external agencies such as the SEC, stock  analysts, auditors, boards of directors, etc. Such agencies collectively ensure that subject companies have all the elements in place to minimize company-specific risks, such as financial and operational transparency, well-developed growth strategies, state-of-the-art systems, disciplined processes, efficient organizational structures, robust product development programs, and continuous improvement cultures, among many other factors. Without the same external oversight, private companies lack many of those qualitative attributes.Â

If the 14 percent company-specific risk factor in the above example could be reduced to, say, 6 percent, through internal improvement initiatives (a realistic possibility), its overall value could grow to about $13M, or about a 76 percent increase in value, purely because of a reduced cost of capital (Exhibit 1). In my analysis, the lower risk is reflected in a reduction of its cost of equity and cost of debt, as well as a slight shift to a more debt-weighted capital structure, as appropriate for a lower risk enterprise. As a byproduct, it will also be easier to grow sales and margins in the future, for two reasons. First, a lower risk profile means the company will be better equipped to support sales growth because it will have a stronger infrastructure.  Secondly, the lower cost of capital, the threshold which the company’s returns must exceed in order to build incremental value, will be easier to meet, allowing the company to consider growth opportunities that were not previously attractive.

In order to achieve the same increase in value solely by increasing sales, the company might have to double its sales from $15M to $30M (Exhibit 1). In the process, it would actually increase its cost of capital because that type of sales increase on top of a weak infrastructure would add risk to the business. Increasing its risk and, therefore, its cost of capital would raise the threshold for all of its existing business, as well as new business, meaning higher profitability would be necessary in order to create new value. In a competitive environment, generating that level of new sales, at even higher than current margins, would likely be extremely difficult.

Similarly, in order to achieve the same increase in value solely by increasing margins, the company would have to double its net cash flow margins from 10 percent to 20 percent (Exhibit 1). The only ways to accomplish that objective directly, however, are to either increase prices or cut costs. The former will likely be extremely difficult in a competitive environment, while the latter could impact the company’s ability to maintain its levels of quality and customer service. Either way will also increase the company’s risk levels because they are measures that, in the long-term, are more likely to cause the company to lose business rather than gain margin.

If the necessary improvements to reduce cost of capital are implemented, and the company is successful in reducing its cost of capital to, say, the 6 percent level, and that positions the company to be able to grow sales and margins more aggressively, then the company could get the very favorable multiplier impact of lower cost of capital, combined with higher sales and higher margins. In the example above, if the company reduced its company-specific risk from 14 percent to 6 percent and was then able to increase its sales to only $18M instead of $30M and its net cash flow margins to only about 12 percent instead of 20 percent, its value could actually increase from the existing $7.5M to more than $19M (Exhibit 1).Â

So, if it’s easier, more controllable, more predictable, more sustainable, and more effective to build value from the inside out, then why don’t more business owners engage in that process? The answer is that they aren’t aware and, generally, have no knowledge or understanding of the impact of risk on their business’s value. They may also not appreciate the value that an advisory board may bring to implement and sustain initiative, but that entails being open to recommendations and disclosing confidential information. Therefore, it’s up to us, as their advisors, to educate them and help them through the process. It also means thinking about our service approach a little differently and exploring the tools available to help us improve our value propositions. If we do so, the incremental value opportunities we can create for our clients, and the incremental revenue streams we can create for our firms, are compelling.Â

Ken Sanginario is the founder of Corporate Value Metrics (www.corporatevalue.net), a Westborough, MA company, and developer of the Value Opportunity Profile® (VOP®), a cloud-based application designed to help advisors to maximize the value of their private company clients.  Ken has more than 30 years of experience developing value-creating strategies for middle market companies in transition and is a frequent speaker at national and regional conferences.