Three Common Roles for Financial Experts

In Chapter 11 Bankruptcies, Part 1 of 2

Financial experts may be called on to provide a number of services in Chapter 11 bankruptcy cases. Common among these services is the analysis of the interest rate to be paid on secured claims, the valuing of the bankrupt business or a portion of the bankrupt estate, and the creation or analysis of cash flow projections to assist in determining the feasibility of the reorganization plan. None of these functions are exclusive to the bankruptcy courts. However, in applying commonly used techniques, an expert must be aware of the methodologies that have been accepted by bankruptcy courts and how they have been applied. In this two-part series, Dr. Allyn Needham provides an overview for those seeking to become financial experts in Chapter 11 bankruptcy and explains the four methods accepted by the courts for analyzing interest rates, commonly used methods for performing business valuations in bankruptcy situations, and the factors important to a feasibility study.

Chapter 11 of the U.S. Bankruptcy Code provides protection for businesses and certain high-income individuals while they attempt to reorganize their financial affairs. For a business to successfully move through Chapter 11, a bankruptcy court must confirm the debtorâs reorganization plan. If confirmed, the business will move out of bankruptcy and continue in operation. If the plan is not confirmed, the business will move from Chapter 11 to Chapter 7 and be liquidated. (Chapter 12 provides for the adjustment of debts for family farms and family fishing operations. Many of the expertâs roles are the same in Chapter 12 as Chapter 11)

Many parties may be involved in a bankruptcy proceeding: debtor, trustee, creditors and /or creditorsâ committee, equity holders and court appointed examiners. Any of these parties may retain a financial expert to assist them in certain areas. The requested tasks may include, but not be limited to, the following:

- Analyzing debtorâs operational problems and designing a turnaround strategy

- Developing a business plan

- Preparing special financial statements relative to the bankruptcy filing

- Preparing the monthly operating reports filed with the court after the bankruptcy is filed

- Investigating certain transactions for preferential or fraudulent activities

- Reconciling the creditorsâ proofs of claim

- Valuing the business

- Providing tax advice on debt discharge and / or the scheduled repayment of debt

- Preparing the disclosure statement to be used in soliciting acceptance of the reorganization plan

- Testifying at the hearing regarding these topics

(Weil, Lentz, Hoffman, 22.1â22.34)

For a business to move out of bankruptcy, its reorganization plan must be confirmed by the court. The bankruptcy code allows a reorganization plan to be confirmed if:

- The holder of a claim accepts the plan

- The plan provides that the holder of such claim retains the lien securing such claim and the value, as of the effective date of the plan, to be distributed under the plan on account of such claim is not less than the allowed amount of such claims or the property is surrendered to the holder of the claim. (11 U.S.C. 1129(b)2(A))

In the majority of Chapter 11 cases, the debtor and creditors agree to the reorganization plan. This occurs after negotiating of certain aspects, like the repayment schedules for the outstanding claims. However, not all cases are settled through negotiation. In some cases, one or more of the classes of creditors object to the reorganization plan. Because of this rejection, the debtor may seek a cramdown hearing asking the court to force the creditors to accept the plan.

When these disagreements arise, legal counsel for the debtor and/or the creditors may seek financial experts to provide information relative to their positions. While engagements of economic experts may cover a broad spectrum of analyses, these engagements generally fall into two areas: determining the appropriate interest rate for the repayment of a claim and the liquidation and/or fair market value of certain assets of the bankrupt estate or the business as a whole.

The following sections discuss three common tasks financial experts may be asked to perform in contested bankruptcy matters:

- Cramdown interest rates

- Business valuation

- Feasibility of reorganization plan

Cramdown Interest Rates

One of the most common topics on which economic experts are asked to opine is the appropriate interest rate to be applied to the debtorâs repayment for outstanding claims.

Plans that invoke the cram down power often provide for installment payments over a period of years rather than a single payment. In such circumstances, the amount of each installment must be calibrated to ensure that, over time, the creditor receives disbursements whose total present value equals or exceeds that of the allowed claim. (Till, 468)

Courts have accepted four methods for determining cramdown interest rates:

- Formula

- Coerced Loan

- Presumptive Contract

- Cost of Funds

The Formula Approach is based on the Build-Up Method commonly used in finance. This method is an additive model that determines the interest rate as a sum of the risk free rate plus one or more risk premia.

The Coerced Loan Approach assumes that the creditor is being forced or coerced to loan the debtor an amount equal to its claim. The cramdown interest rate is the same as the interest rate similar, non-bankrupt borrowers would be charged by other lenders in the market for the same amount of money to be repaid over the proposed repayment period.

The Presumptive Contract Approach looks to the interest rates charged by the creditor to similar, non-bankrupt borrowers. The interest rate is determined by examining the creditorâs lending practices and interest rates charged for borrowing the same amount of money to be repaid over the proposed repayment period.

The Cost of Funds Approach sets the interest rate based on the creditorâs cost for funds. The interest rate would be determined by the interest rate the creditor has been charged to replace the amount of money equal to the claim against the debtor.

In the Till decision, the U.S. Supreme Court selected the formula approach for determining the cramdown interest rate for a secured claim in a Chapter 13 bankruptcy matter. The court set the range of one to three percent greater than the current prime lending rate as the standard for interest rates on secured claims in Chapter 13 bankruptcies. (Till, 480) As an example, with a prime lending rate of 3.25 percent, the range for Chapter 13 cramdown interest rates would be between 4.25 and 6.25 percent.

Most bankruptcy and appellate courts have found the Till decision to be âinstructive and informativeâ in guiding experts and the courts in determining cram down interest rates in Chapter 11 matters. (See, In Re: Mirant Corp., In Re: Northwest Timberline Enterprises, Inc., In Re: Texas Grand Prairie Hotel Realty, LLC)

Till was a splintered decision whose precedential value is limited even in the Chapter 13 context. While many courts have chosen to apply the Till pluralityâs formula method under Chapter 11, they have done so because they were persuaded by the pluralityâs reasoning, not because they considered Till binding. Ultimately, the pluralityâs suggestion that its analysis also governs in the Chapter 11 context â which would be dictum even in a majority opinion â is not âcontrollingâŚprecedent.â (In Re: Texas Grand Prairie Hotel Realty, LLC, 14)

The Till decision addresses interest rates for secured claims in personal bankruptcy cases. The prime lending rate represents the base from which many secured personal loans are based. Therefore, there is some logic in basing the interest rate to be paid on a personal bankruptcy claim on the prime lending rate.

The majority of Chapter 11 bankruptcy cases are business related. Many of these bankrupt firms are corporations. While their borrowing rates may be compared to the prime lending rate, most business loans are based on the lenderâs cost of funds or the risk free rate. (i.e., the yield on U.S. Treasury securities over the same time period as the payout. These securities are assumed to be free from the risk of default; therefore, they are called risk free.) Most bankruptcy courts have preferred to begin their determination of cramdown interest rates in Chapter 11 matters by using the risk free rate.

The risk premia applied to the risk free rate will vary based on the facts of each bankruptcy. âThe appropriate size of the risk adjustments depends, of course, on such factors as the circumstances of the estate, the nature of the security, and the duration and feasibility of the reorganization plan.â (Till, 479) The circumstance of the estate includes not only the fact that the business is in bankruptcy but whether it is still operating and generating cash flow or no longer a going concern. The nature of the security will examine the collateral for a specific claim, its condition, and liquidation value. The duration and feasibility of the reorganization plan is a study of the repayment plan, how long it will last, and the ability of the debtor to make the payments as offered.

The Fifth Circuit Court of Appeals provided additional factors affecting these risk adjustments in its Texas Grand Prairie Hotel Realty decision.

[C]ourts typically select a rate on the basis of a holistic assessment of the risk of the debtorâs default on its restructured obligations, evaluating factors including the quality of the debtorâs management, the commitment of the debtorâs owners, the health and future prospects of the debtorâs business, the quality of the lenderâs collateral, and the feasibility and duration of the plan. (In Re: Texas Grand Prairie Hotel Realty, LLC, 20)

This is not an all-inclusive list. But, it does provide the broad factors any expert will need to consider in assessing a cramdown interest rate.

Courts have accepted several different ways of applying the formula method. Some experts have applied the prime plus risk factors discussed in Till. Others have followed other court decisions and provided a cram down interest rate based on the risk free rate (the yield on U.S. Treasury securities) plus assumed risk factors. (In re: SJT Ventures, LLC)

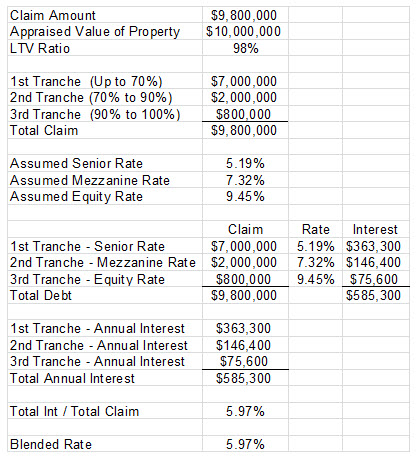

In commercial real estate claims with loan to value ratios near 100 percent, courts and experts have applied an investment band (blended rate) approach using up to three tranches of risk (senior debt, mezzanine and equity). (In re: North Valley Mall, LLC, In re: Village at Camp Bowie I, LP)

The following is an example of the method used in determining the blended rate with the investment band approach:

A more detailed explanation of various methods accepted by bankruptcy courts under the formula approach can be found in Commercial Real Estate, Chapter 11 Bankruptcy, & Cram-Down Interest Rates. (Needham, Schroeder)

Any expert hired to address a Chapter 11 cramdown interest rate should become familiar with the opinions on cramdown interest rates and the preferred analysis method(s) for that specific Federal district. In addition, any analysis should include an assessment of the risk factors discussed in Till before determining the recommended interest rate.

In the second part of this two-part series article, we discuss valuation issues.

Allyn Needham, PhD, CEA, is a principal at Shipp, Needham & Durham, LLC (Fort Worth, Texas). For the past 17 years, he has worked in the area of litigation support. Prior to that, he worked for more than 20 years in the area of banking and risk management. Dr. Needham has also been an adjunct professor of economics at Texas Christian University and Weatherford College. As an expert, Dr. Needham has testified on various matters relating to commercial damages, personal damages, business bankruptcy, and business valuation. He has been retained by attorneys representing plaintiffs and defendants, debtors and creditors. Dr. Needham has given expert testimony in state and federal courts. Dr. Needham can be reached at aneedham@shippneedham.com and (817) 348-0213.

Sources

Baldiga, Nancy, âPractice Opportunities in Chapter 11,â CPA Journal, May 1998, The New York State Society of CPAs, www.nysscpa.org/cpajournal/1998/0598.

Feasibility Study, Definition, Investopedia, www.investopedia.com .

Internal Revenue Service, Revenue Ruling 59-60.

Kenter, Doron, âAlways Sunny In Adelphia â Bankruptcy Court Rejects DCF with Unreliable Projections, Drops Some Valuation Knowledge,â Weil Bankruptcy Blog, May 28, 2014.

Needham, Allyn, and Schroeder, Kristin, âCommercial Real Estate, Chapter 11 Bankruptcy, & Cram Down Interest Rates,â The Earnings Analyst, Vol. 13, 2013, pages 1-12.

Ratner, Ian, Stein, Grant, and Weitnauer, John, Business Valuation and Bankruptcy, John Wiley & Sons, Inc., 2009.

Schwartz, Michael, and Bryan, David, âCampbell, Iridium, and the Future of Valuation Litigation,â The Business Lawyer, Vol. 67, August 2012, pages 939-955.

Sontchi, Christopher, âValuation Methodologies: A Judgeâs View,â ABI Law Review, Vol. 20:1, 2012, pages 1-16.

Stopford, Martin, Maritime Economics, 3rd Edition, Routledge, 2009.

Suker, Kathleen, âFeasibility Opinions in Bankruptcy Plan Approvals,â Marcum LLP Website, www.marcumllp.com, 2014.

Weil, Roman, Lentz, Daniel, and Hoffman, David, Litigation Services Handbook, 5th Edition, The Role of the Financial Expert, 2012, John Wiley & Sons, Inc.

11 U.S.C. 363 (b)

11 U.S.C. 1129 (b) 2 (A)

11 U.S.C. 1129 (a) 7 (A) (ii)

Cases

In re: Adelphia Communications et. al.; Adelphia Recovery Trust v FLP Group, Inc. et. al., 2012 U. S. Dist. LEXIS 10864, 15, 2012 WL 264180, 5, (S.D. N.Y. 1/30/2012)

Consolidated Rock Products Co. v Du Bois, 312 U.S. 510, 525-526 (1941)

In re: Iridium Operating, LLC, 373 B.R. 283 (Bankr. S.D. N.Y. 2007)

In re: Genco Shipping & Trade, Ltd., 2014 Bankr. LEXIS 2854, (Bankr. S.D.N.Y. 2014)

In re: Mirant Corp., 334 B.R. 800, (Bankr. N.D. Tex 2005)

In re: North Valley Mall, LLC, 2010, Bankr. LEXIS 1927, *; 53 Bankr. Ct. Dec. 109

In re: Northwest Timberline Enterprises, Inc., 348 B.R. 412, (Bankr. N.D. Tex. 2006)

In re: SJT Ventures, LLC, 441 B.R. 248 (Bankr. N.D. Tex. 2010)

In re: Texas Grand Prairie Hotel Realty, LLC, 710 F.3d; 2013 U.S. App. LEXIS 4514; 57 Bankr. Ct. Dec. 177

Lee Till and Amy Till v SCS Credit Corp., 541 U.S. 465, 479-80, 124 S, Ct. 1951, 158 L/ Ed. 2d 787 (2004)

U.S. Bank, N.A. v Verizon Communications, Inc., 2013 U.S. Dist. LEXIS 8521 (N.D. Tex. 2013)

VFB LLC v Campbell Soup Co., 482 F. 3d 624 (3rd Cir. 2007)

In re: Village at Camp Bowie I, LP, 454 B.R. 702, (N.D., Tex. 2011)