Condition, Cause, and Outlook

Case Study on the Use of Visuals to Track Revenue, Expenses, and Process

What is CCO? How is it used? The CCO technique has no traceable origin, but its application is self-evident and imminently practical. The technique is typified by its initialism, i.e., CCO that self-describes the process: what is the condition underlying the problem(s), what is the cause of the underlying problem(s), and what is the outlook of the underlying problem? Here, the author provides an illustration of CCO and how his firm used it in an engagement.

[su_pullquote align=”right”]Resources:

Thriving in Forensics—Practice Instruction for Forensic Operators©

The Art & Science of Investigating People & Money©—Behavioral and Financial Forensics

[/su_pullquote]

Background

Everyone reading this article has experienced client requests to analyze and recommend a solution(s) to a business problem. The client expects speedy answers and results supported by convincing evidence for little cost. No problem, right?

The CCO technique, i.e., “Condition, Cause, and Outlook” mitigates such circumstances and builds and strengthens client relationships and referrals.

The Technique

The CCO technique has no traceable origin, but its application is self-evident and imminently practical. The technique is typified by its initialism,[1] i.e., CCO that self-describes the process: what is the condition underlying the problem(s), what is the cause of the underlying problem(s), and what is the outlook of the underlying problem? The outlook characterizes the problem(s) under two alternatives, i.e., whether the problem(s) is ignored or addressed.

We define each noun for our clients as follows:

- Condition—Financial condition is measured by forensic analysis[2] of its financial statements. That provides measurements to gauge performance against itself and its peer group to determine progress and/or deterioration.

- Cause—The cause(s) of conditions (above) identifies actions necessary to alleviate the condition. For example, cash was constrained, therefore a rolling cash flow (RCF) technique was implemented.

- Outlook—The entity(ies) outlook is the “prognosis” based upon the condition and cause and is used to continually gauge progress towards improvement.

We have deployed CCO in dozens of assignments over the years. The assignments range from tiny, i.e., giving off-the-cuff client advice to a barber during a lunch meeting, to multi-year projects, i.e., a request from a Fortune 500 company that spanned almost three years.

Case Study

A specialized publicly held manufacturing company requested that we “investigate” (their term) one of their subsidiaries. The subsidiary manufactured a critical part for the parent’s products, but was failing to meet quality and timeline requirements, thus affecting the parent. The circumstances existed for three to four years before our involvement and produced considerable stress between the two entities. We were tasked with advising the parent how to “fix” the problem(s) and assisted the subsidiary with implementation.

The parties agreed[3] upon our involvement and gave us no more than two weeks and a limited budget to provide answers addressing both parties. We prepped both parties by describing the CCO process and they agreed that we should proceed.

We executed the CCO process to meet their deadline. We conducted interviews of key company and subsidiary people and perused the financial, cost accounting, and operations data they provided in response to our request. Most importantly, we structured our findings into the CCO format.[4]

The results: after delivering our CCO results, both parties requested that we implement resolutions according to our prioritized findings. We worked on the assignment for the next 30 months, encountering the inevitable roadblocks and frustrations, but ultimately succeeded in improving both entities’ operations and performance, and gained several new friends among the parties.

The Specifics

Each CCO segment is illustrated and described below.

We used three software applications during the assignment: Microsoft Word and Microsoft Excel, and an iPad application titled MindMap. The Word and Excel software is familiar to virtually all readers and any number of alternatives could be used. The MindMap iPad software provided great flexibility to identify and categorize the disparate findings. However, any software with similar functionality would work just fine.

Upon completion of our two-week assignment window, we assembled our findings into a Microsoft PowerPoint slide assemblage that we used to deliver the results. Note that a detailed, lengthy, written report was purposely avoided. Neither we nor our two clients had the time or patience to read and absorb such a document.

Further, each time a status was held among the parties, we merely updated the same slide deck and updated its contents to reflect progress. This chronicled our headway and the respective clients’ results, thus providing much needed reinforcement towards execution.

This does not suggest that all went smoothly. Indeed, many sessions included vitriol and finger-pointing, but eventually the objectives were achieved. Documents key to the success are highlighted below.

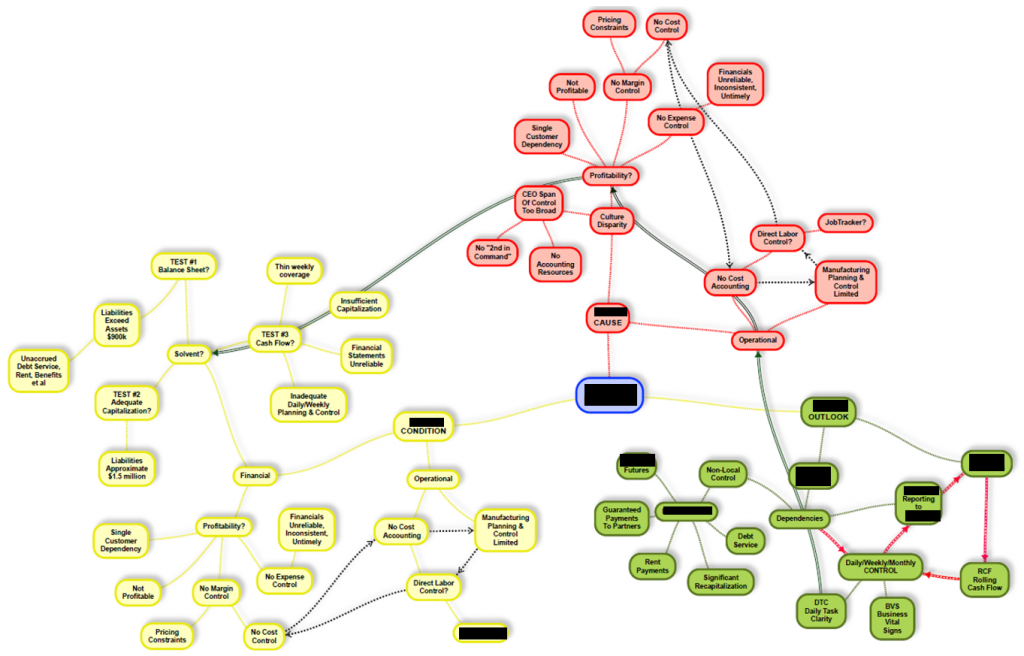

MindMap[5] for iPad was used to construct the following visual. Note that it captures all the essential findings and recommendations and illustrates their relationship to the overall problems. Also, we updated MindMap as we progressed through topic resolution so that it served as a record of our actions and results.

Such document is descriptive, interdependent, self-disclosing, and lends itself to project management supporting respective problem resolution. It is easily updated and is more easily assimilated than mundane “consultants’” reports.

We also applied the words, pictures, numbers (WPN)[6] concept for client reporting. Thus, for those who do not relate well to “pictures,” we included the following text summary structured to parallel the CCO concept.

The visual is self-explanatory, but one vital component is: “As measurement goes, so goes the behavior.” This concept is extraordinarily powerful and is exploited (as in constraints) by every company seeking to improve profitability. Its explanation is beyond the scope of this article, but remember this principle: if you want anything to improve, track and measure it.  That is, if you want revenue to increase, track it. If you want costs to decrease, track it. And so on.

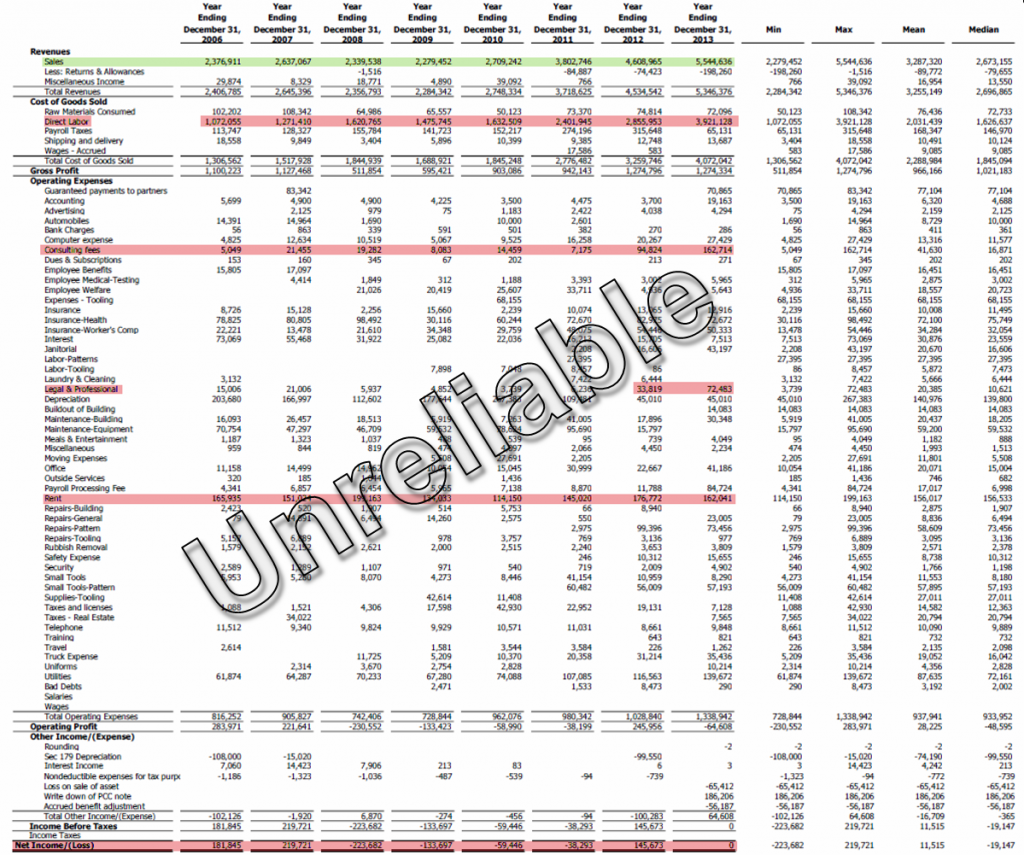

Finally, we included certain requisite financial documents to meet anticipated pushback from the CFO. An extract is reproduced below, noting the “Unreliable” label.  Further, the green and red highlights draw attention to positive results, i.e., revenue compared to negative results, i.e., direct labor, respectively.

Conclusion

The CCO technique can be used for virtually any type or size assignment. It saves time and money by avoiding labor intensive actions, such as report writing, and increases communication effectiveness.

[1] A set of initials representing a name, organization, or the like, with each letter pronounced separately, as FBI for Federal Bureau of Investigation, http://www.dictionary.com/browse/initialism, June 10, 2018.

[2] “The art & science of investigating people & money©”, financialforensics®, circa 1993.

[3] The parent company initiated our involvement.

[5] Several different vendors provide similar tools.

[6] WPN, i.e,. “Weapon,” National Litigation Consultants’ Review, (Litigation Consultants, LLC – Vol. 4 Issue 4, September 2004).

Darrell D. Dorrell, CPA, MBA, ASA, CVA, CMA, ABV, CFF, is principal at financialforensics®, a Lake Oswego, OR firm. He is a forensic operator specializing in the determination, investigation, restatement, analysis, interpretation, forecasting, feasibility, translation, and visualization of complex financial and operational data.

He is nationally recognized within his profession as a speaker and author, and has delivered more than 100 addresses to many national bodies on financial topics including the Federal Bureau of Investigation (FBI), United States Department of Justice (USDOJ), Bankruptcy Bar Association, American Institute of Certified Public Accountants (AICPA), National Association of Certified Valuation Analysts (NACVA), the Oregon and Washington bars, PriceWaterhouse Coopers, Institute of Management Accountants, SEAK, CPAA International, Inc., AGN, Inc., the National Litigation Support Services Association (NLSSA), Turnaround Management Association, and the California, New York, Oregon, Pennsylvania, and Washington Society of CPAs, among others.

Mr. Dorrell can be contacted at (503) 636-7999 or by e-mail to DarrellD@financialforensics.com.