PCAOB: Asset Valuation is Most Common Big Four Audit Problem –WSJ CFO Report

The Public Company Accounting Oversight Board found 123 audit deficiencies related to fair-value estimates and asset impairments in 2010, making asset valuation the most common audit problem.

Market volatility always makes it tough to value assets fairly based on market prices.  But that doesn’t mean management forecasts—and the assumptions and methodologies of financial modeling used in corporate pricing—couldn’t benefit from additional scrutiny.

Emily Chasan reports at the Wall Street Journal’s CFO Report blog:

The Big Number:  123  That’s the number of audit deficiencies related to asset-valuation problems found among clients of the Big Four accounting firms in 2010.

Market volatility has made it hard for companies and their auditors to value assets based on market prices. They often have had to turn to outside advisers for an estimate. But overreliance on such advice has led to a sharp rise in the number of audit deficiencies cited by regulators, according to a study by business-valuation firm Acuitas Inc.

The Public Company Accounting Oversight Board found 123 audit deficiencies related to fair-value estimates and asset impairments in 2010, making asset valuation the most common audit problem, Acuitas says. The firm studied the audit watchdog’s most recent inspection reports on 250 audits and other assignments of the Big Four audit firms. They are PricewaterhouseCoopers LLP, Deloitte LLP, Ernst & Young LLP and KPMG LLP.

The PCAOB conducts annual inspections of the Big Four and reviews the audits it considers likely to be the most problematic. It flags the work as significantly deficient if it thinks the firm doesn’t have enough evidence to justify the audit; usually the firms are able to correct any problems.

Out of the 234 audit deficiencies cited in the agency’s 2010 inspection reports on the Big Four, it found 92 fair-value deficiencies and 31 deficiencies related to asset impairments.

That compares with 21 fair-value deficiencies and 17 impairment-related deficiencies out of a total of 72 deficiencies in 2009.

“The PCAOB is saying that the auditors in certain situations didn’t provide enough scrutiny in terms of management’s forecasts, or didn’t look closely enough at the assumptions and methodologies that went into some of the modeling used by corporate pricing services,” said Mark Zyla, a managing director at Acuitas.

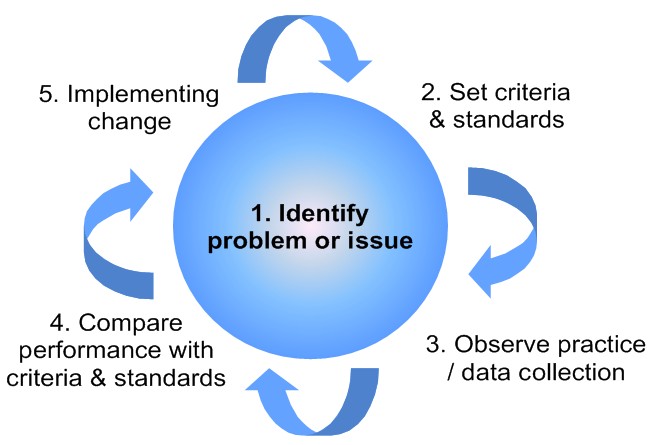

The Audit Cycle

Â