Sub-100M Revenue Companies are Having More Successful IPOs than Big-ledger Counterparts —IPO Dashboards

73% of Tech IPOs Aren’t Profitable When They Go Public, But Smaller Companies (e.g., Zillow, Bazaarvoice, Jive Software) Fare Better Post IPO

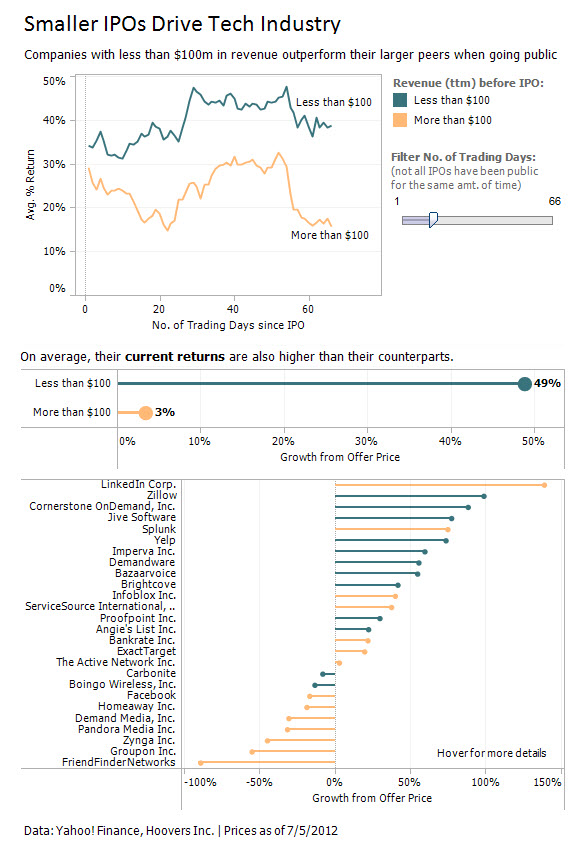

Bigger isn’t always better, at least when it comes to initial public offerings, GeekWire reports. A new report out from Tableau Software’s Daniel Hom, editor of the IPO Dashboards blog, finds that smaller tech companies, described as having fewer than $100 million in revenue, performed far better on Wall Street following their initial public offerings:

According to the research, those companies showed gains of 49 percent. That compares to a meager three percent return for the big dogs, weighed down by lackluster performances by companies such as Facebook, Zynga, Pandora and Groupon.

However, one very large company still claims the top slot. LinkedIn, with revenue of $243 million prior to the IPO, is up 141 percent since its public offering. However, as you can see in the visualization below, just two of the top 10 tech IPOs had revenues over $100 million. (Splunk was the other).

Seattle’s Zillow is the prototypical example of a smaller company making positive waves. It went public last July at $20 per share, and has since nearly doubled its stock price. However, it had just $36.4 million in revenue before its IPO, leading some to believe the company was just too small to make it on Wall Street.

The report is a follow-up to Hom’s research from last week in which he found that 73 percent of tech IPOs aren’t profitable when they go public. Here’s a look at his latest findings.

Small Tech Firms Outpace Larger Counterparts in Post-IPO Growth