What a Matrimonial Attorney Needs From a Financial Expert

How to Maintain Independence and Professionalism in a Complex and Changing Niche

As divorce laws change, attorneys increasingly rely on financial experts such as business appraisers and forensic accountants. Â In this article, Robert D. Feder discusses the role of a financial analyst in the context of matrimonial law. Â He also covers some of the potential pitfalls of the trade.

Business appraisers and forensic accountants replaced the private investigator as the key expert in divorce cases when states changed their divorce laws from a fault based system to a no-fault system. The investigation and determination of a party’s income available to pay support and the valuation of a closely-held business or professional practice are often the most important economic issues a divorce case. The selection of the financial expert is therefore a key decision which should be made early on in the case.

The primary criteria for selecting a financial expert for a divorce case are:Â

- The knowledge, experience and credentials of the expert

- The level of experience testifying in family court

- The professional judgment and common sense of the expert

- The reputation of the expert with the bench and bar

- The reliability, accuracy, and timeliness of the expert’s work product

- The ability of the expert to communicate his findings orally and in writing especially in the expert’s written report and trial testimony

- The cost of the expert’s services and the ability to pay of the client

An expert’s experience, reputation and credentials are essential ingredients but are by no means sufficient. The expert must have sound professional judgment and common sense. Experts are often referred to as a “hired gun.”

That is an unfortunate moniker. A hired gun takes overly aggressive positions to satisfy the client despite the weak factual or legal foundation for those positions. This approach usually backfires. The client’s expectations as to the outcome of the case are inflated. When the expert is challenged by the other side, he often has to back-pedal and the client becomes disillusioned with both the expert and the attorney who hired him. An effective expert has the good judgment not to do this. Sometimes, the cost of a full-fledged financial investigation far exceeds the anticipated results for the client. Good experts exercise professional judgment in weighing the costs of the investigation against the benefits for the client and recommend a practical, cost-effective course of action based on the facts of the case.

The Role of the Financial Expert in Discovery

After hiring the expert, the matrimonial attorney needs the expert to play a major role in discovery. The expert should provide the attorney with comprehensive lists of the documents that are needed to investigate the opposing party’s income and the value of the business or professional practice. The expert needs to be able to work effectively with the opposing attorney and the opposing party to obtain the necessary discovery without intimidating them. The expert must be adept at persuading the adverse party that the expert is simply looking for the facts. It is counter-productive for the expert to be aggressive and accusatory. The expert needs to interview the opposing party, his accountant, controller or other financial advisors. The expert needs information, explanations and answers that can only be obtained from these individuals at an interview or a deposition. The overly zealous expert may cause these people to clam up which makes the discovery process more difficult, time consuming and expensive.

The financial expert plays a key role in assisting the matrimonial attorney at the deposition of the opposing party and his financial expert. The expert should draft questions for the attorney to ask at the deposition and organize the documents the attorney will need at the deposition to question the witnesses effectively. It is essential that the financial expert be an active participant at the deposition. As the witness answers questions, new ones will come to mind that the expert needs to give to the attorney to follow up on.

It is rare that a “smoking gun” is revealed at a deposition in a divorce case. After the deposition, the opposing party, his attorney and financial expert have time to regroup and reconsider any damaging evidence that came out at the deposition. Although the deponent cannot directly change his testimony, he can clarify, explain and elaborate on his answers at a later date and at trial. It is far more important for the attorney and expert to obtain the facts needed to determine the spouse’s income and the value of the business rather than trying to “score points” at the deposition.

Settlement v. Trial

In divorce cases, there is a time for settlement and a time for trial. A very large percentage of divorce cases are settled out of court. The financial expert plays an important role as an advisor to the matrimonial attorney in the negotiation process. An expert should be candid with counsel as to the strengths and weaknesses of his expert report, and the strengths and weaknesses of the opposing expert’s report. The expert should identify these issues for the attorney and discuss an appropriate compromise. If the opposing expert made a fundamental mistake, that is not an issue to be compromised. If the opposing expert refuses to acknowledge a fundamental flaw in his report that is substantial and material, then the issue will usually have to be decided in court. However, if both experts exercised sound and reasonable judgment concerning issues over which there is no single right answer, these are issues that can be compromised without going to court. The financial expert needs to sit down with the attorney and the client and identify which issues fall into this category and agree upon an acceptable compromise.

The financial expert can also play an important role assisting the financially-dependent spouse to decide whether to accept a settlement offer made by the other side. It is helpful if the expert prepares a projection of the client’s principal, income, living expenses and savings year by year based on the settlement offer. The sources of income usually include alimony, employment income, social security, interest, and dividends earned on assets received by the client in equitable distribution and other miscellaneous types of income. A long-term projection over the life expectancy of the client can give the client a level of confidence that she will have financial security and a comfortable lifestyle for the rest of her life. This is very helpful for the dependent-spouse deciding whether to accept a settlement offer. This can also assist the attorney in developing a counter-proposal.

Business Valuation

With respect to business valuation, the client and the matrimonial lawyer may ask for a quick, inexpensive ballpark figure for the value of the business. They often think this will reduce costs and expedite the resolution of the case. It hardly ever does. The financial expert should politely resist this request. Business valuation is an art, not a science. It is not a number crunching exercise using a calculator and the approved business valuation methodologies. There are numerous issues, factors and judgment calls that go into a quality business valuation. For example, the income capitalization approach requires determination of many variables including:

- Projected future cash flow

- Growth rate

- Risk and rate of return

- Capital expenditures and working capital needs

- Perquisites and other add-backs to reported profits

- Reasonable compensation adjustment

- Minority and marketability discounts

Industry data must be analyzed as well as the financial statements and tax returns of the business for usually five years. An on-site inspection of the business and an interview of management are essential steps. This process involves research, analysis and the exercise of professional judgment. There is no “instant coffee” version of business valuation.Â

The various market approaches to value have a similar level of complexity. Whether the expert is looking at guideline company multiples, guideline transactions or prior transactions in the stock of the business, there are various factors and issues to be considered. There are fundamental differences between privately-held and public companies. The public company multiples can vary widely from year to year. Public companies have growth rates far exceeding the growth of privately-held companies because public companies grow by acquisitions which private companies can rarely do. Public companies sometimes have multiple lines of business whereas a private company may have a niche in only one. Public companies may be national or international whereas private companies are usually regional or local. It is easy for a financial expert to calculate a Price/Earnings (P/E) ratio or a Price/Earnings Before Interest and Taxes (P/EBIT) multiple and apply them to the subject business to arrive at a figure, but that figure may bear little relation to the fair market value of the business in question.

When an expert relies too heavily on the guideline company approaches and arrives at a value that is three or four times higher than the opposing expert’s figure, that is a red flag of an inflated value. Such valuations rarely hold up in court. That is why it is essential to hire a business appraiser with sound judgment who will adjust the guideline multiples downward to reflect the realities of the subject business. It is always better to present a solid defensible business valuation even if the client and the attorney are somewhat disappointed by the figure. These are the valuations that hold up in court.

It is also important for the business appraiser to consult with the matrimonial attorney as to the accepted valuation methodologies in the particular state or jurisdiction where the divorce action is pending. Some states approve of the excess earnings method. In the greater Philadelphia area, that method is rarely used anymore. If a financial expert uses that method in a jurisdiction that has rejected it, that is a major problem.

Role of the Financial Expert in Court

A good financial expert is an individual who possesses both financial expertise and effective communications skills. The expert has to be good with numbers but also articulate, clear and persuasive on the witness stand before the family court judge. Although the concepts involved in business valuation can be mathematically complex and difficult to follow, the expert needs to be able to communicate the concepts in a way that the family court judge will understand. The expert’s goal is to persuade the Judge that his business value is reasonable and accurate. The goal is not to impress the judge about how smart the expert is. This needs to be done with confidence but not arrogance. Business valuation is not an exact science and does not lend itself to only one right answer by your expert.

The expert’s demeanor upon cross examination is also important. If it becomes clear that your expert made a mathematical mistake, he should admit it and correct it. An expert who is stubborn and inflexible on the witness stand loses credibility. The expert needs to keep in mind the difference between a minor mathematical error and a fundamental flaw in his valuation methodology. If the expert is confronted with new evidence at trial that was not made available to him previously, he should not jump to conclusions on the witness stand as to whether the evidence does or does not have an impact on his valuation. It may be that the evidence did not exist at the time the discovery phase of the case was closed by the court. There may be other evidence that contradicts the new evidence. The new evidence may not have a material impact on the business value. The evidence may relate to a time period after the valuation date. A seasoned expert evaluates the new evidence quickly, calmly and intelligently under pressure.

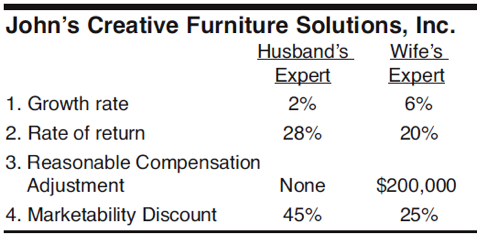

To avoid being blindsided at trial with new evidence, the expert needs to be persistent and thorough during the discovery phase to find out everything about the business. For example, if the business owner makes a casual comment that the business was considering expanding into another country but it did not pan out, the expert should not accept that at face value. In an actual case, the wife’s expert had a brochure from the business describing and trumpeting its planned expansion into Canada whereas the husband’s expert knew nothing about it. The husband’s expert used a growth rate of zero in his income capitalization approach. No expert wants to learn about this for the first time at trial. The business appraiser can play a helpful role for the Court by presenting a chart that identifies the key business valuation issues in dispute. An illustration of such appears below:

This kind of summary chart makes it much easier for the Judge to identify and resolve the business valuation disputes. Judges appreciate this roadmap from the financial expert. The expert needs to be able to explain why his figures are right and the opposing expert’s figures are wrong. The expert may be called upon by the Judge to change only one variable in the expert’s report and give the Judge the adjusted value.

Conclusion

The financial expert and the matrimonial attorney must work together as a team. The financial expert is the attorney’s “right-hand man” in a financially complex divorce case. However, the expert must maintain his professional independence and integrity throughout the divorce process. The expert needs to stand up to attorneys who pressure him to arrive at a higher or lower business value. The expert is not an advocate for the client. That is the lawyer’s role. The expert’s primary roles are to obtain and analyze financial data to arrive at an independent, objective opinion in the form of a written report and to defend his findings in court. The expert must maintain and protect his professional reputation before the bench and bar despite the pressure to satisfy a particular client or attorney in an individual case.

Robert D. Feder is a partner in the law firm, Schnader Harrison Segal & Lewis, LLP located in Philadelphia, Pennsylvania. Mr. Feder can be reached at rfeder@schnader.com or 215-751-2510.

Â