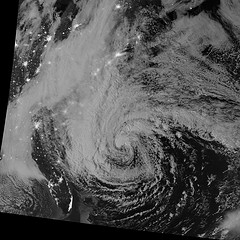

Hurricane Sandy Tax Planning—Forbes, WSJ, Accounting Today, Accounting Web

Disaster Area Declarations Have a Lot of Tax Implications. Learn Specifics.

Natural disasters, such as Hurricane Sandy, may provide certain tax opportunities and insurance recovery situations that business owners and individuals should be aware of.

Howard A. Lewis, MS, ABAR, AVA, and Former IRS Program Manager for Valuation Service offers insight:

Regarding losses, the IRS regulations allow a deduction for the amount of a casualty loss sustained. The loss is measured by the decline in value of the property destroyed, but is limited to the “adjusted basis” of that property for tax purposes. Insurance coverage for business interruption is also directly related to the effects of the disaster, and may have built-in waiting periods. The two articles in this week’s QuickRead touch on these tax and insurance issues.

In my experience of over 32 years at the IRS, you can expect real assistance with processing your tax loss claim and with an understanding that even records may be difficult to obtain. I personally worked on taxpayer relief provisions following hurricanes Katrina, Rita and Wilma.

Appraisals are critical to sustain the before and after values, and the appraisals and associated deductions are likely to be subject to examination if significant and especially if they appear to be questionable. There may be significant tax planning opportunities in allocating adjusted basis to complex properties, such as industrial plants and forests.

Peter J. Reilly at Forbes gives consultants a heads-up on issues to be aware of, contingencies to consider, and resources to mine:

If you are anywhere near the East Coast, I hope by now you are in a safe place and have a good stock of drinking water and flashlights and batteries and whatever else people who know about such things advise you to have. I’m just a tax blogger. There are already Disaster Area Declarations from Maryland to Massachusetts in place. Disaster area declarations have a lot of tax implications. Since you may have a lot of time on your hands for the next couple of days, you might want to print this out so you can spend some of that time doing disaster tax planning, after the power goes out. You need a break from the board games. I remember stories about birth spikes nine months after events like this. That is the sort of thing I don’t like to fact check, I would just as soon believe it. Even that type of activity can only take up so much time, though.

The IRS has some pretty good material on this subject so I will not try to give you a comprehensive checklist. I will just point out a couple of things that over the years, people have been surprised by when I told them.

Reilly specifically discusses Casualty Loss and Due Dates.

Read the whole piece here.

Hurricane Sandy Hit the East Coast Hard. Learn to Minimize Dollar Damages with Solid Tax Planning.

Emily Chasan at the Wall Street Journal’s CFO blog notes that “Business Interruption Costs from Sandy Seen as “Significant”:

The costs associated with the suspension of business activities due to Hurricane Sandy could rise significantly in the coming weeks, Fitch Ratings says, and that will come on top of initial insured losses that are already estimated to be around $5 to $10 billion. In a note on Tuesday, the ratings firm said it will take weeks to determine coverage for business interruption losses, particularly since coverage typically only begins after a waiting period of 72 hours or so and business interruption claims often take weeks for companies to estimate.

“There is the potential for significant business interruption (BI) and contingent business interruption (CBI) losses related to the flooding as the affected areas work to restore power and resume operations following the storm,” Fitch wrote. “The massive storm is impacting a wide variety of businesses in densely populated areas, including retail, corporate offices, transportation, manufacturing, and energy plants.”

Robert Benmosche, chief executive of insurer American International Group , expects insurance costs from Sandy will be closer to those from last year’s Hurricane Irene last year than the Japanese tsunami. Irene caused about $4.3 billion in damages, compared to the $40 billion that the Japanese tsunami disaster cost insurers, Bloomberg reports.

Other media join in to help financial consultants figure how best to help business owners manage effects of Sandy:

- About.com reports that “New York Provides Tax Relief for Hurricane Sandy.”

- Accounting Today adds that “IRS Extends Deadline After Sandy.”

- At Accounting Web, the Bonadio Group weighs in with “Frankenstorm: Post-Hurricane Accounting for Casualty Loss.”

- Tax Closure adds: “Hit by Hurricane Sandy? Here are Some Natural Disaster Relief Tips.”