20 Questions: Getting to an Informed Assessment of Industry Risk

Here’s How a Systematic Review of Risk Can Help Valuators Assign Appropriate Discounts and Premiums

Industry risk can vary widely from company to company and industry to industry. Here are 20 questions valuation analysts can use to identify risk related to market segment; competitive position; political, environmental, and legal factors; pricing trends; profit margins, and more.

In this article, we outline 20 key questions designed to provide the valuation analyst with the information and insight needed to properly understand a company’s industry and evaluate the industry’s impact on company value. When undertaking a business valuation, the importance of industry analysis is clear. Valuation standards for both the National Association of Certified Valuators and Analysts (NACVA) and the IRS state that valuators should analyze information “necessary to accomplish the assignment including…the condition and outlook of the specific industry in particular.”1 These requirements, which are also reflected in the professional standards of the AICPA, American Society of Appraisers (ASA), and Institute of Business Appraisers (IBA), reflect the general view that the value of a company can be directly influenced by industry-specific factors.  Due to reporting requirements, virtually all business valuation reports include a section discussing the company’s industry.  Â

Two questions in particular from the ASA Candidate BV Review Report Checklist used by the ASA to evaluate business appraisals, provide excellent insight to a common problem:2

- Industry outlook—are the factors stated relevant to the value of this company (versus boilerplate)? Â

- Are specific applications to subject company stated?

These questions reflect the fact that it is relatively simple to include “boilerplate” descriptions and statistics for a given industry, but much more challenging to identify the industry-specific factors that can influence company value. In fact, the questions posed in the ASA checklist imply that many industry analyses fail in their primary goals: to identify the relevant aspects of the industry and apply them to the value of the subject company. The purpose of this article is to (1) provide a set of specific questions that help identify key industry attributes, and (2) provide a framework for evaluating an industry and identifying its value-relevant factors.   Â

The industry analysis methods we describe are well established and conservative—applications of standard methods popular in many management texts, applied to the problem of business valuation. These are frameworks for applying judgment—valuators still must apply the judgment that translates a risk assessment into a discount or premium. We will first describe these methods, then present an approach for organizing and aggregating the insights captured with these models.Â

Industry Structural Analysis Model

The challenge of analyzing an industry involves understanding significant externalities that affect the industry and understanding variation within the industry. The industry structure model is a way of organizing observations about the sector an industry participates in, the segments within the industry, and the position of strategic groups of companies within the industry. The first three of our 20 questions assess the impact of each of these elements on the subject company being valued: Â Â1.Is the outlook for interdependent industries positive or negative? Â

2. The outlook positive or negative for segments in which the subject company participates? Â

3. The subject company positioned well or poorly among its key competitors?Â

Industries are not isolated. Macroenvironmental forces affect industries, which cluster together in networks we call sectors. In the industry structure model, a sector is an interrelated group of industries. The subject industry of a valuation relies on other industries as sources of supply and complementary products. Â Risks affecting key sector partners therefore have a bearing on the risk of the subject industry. A rise in the price of steel will have ripple effects in industries that use steel, for example, and in the distribution channels that handle products using steel. Thus a rise in the commodity price of iron ore might result in margin pressures for an appliance retail business. By examining risks for related industries, the valuator adds peripheral vision to the industry risk assessment. Â Â Â

Neither are industries monolithic. The industry structure model addresses two industry substructures that have material significance for valuation purposes: market segments and strategic groups. Within an industry, different market segments (distinguishable slices of the market with distinct customer attributes and demands) may respond differently to the same externality. For example, a super-premium SUV automobile segment is negatively affected by a spike in gasoline price, while a subcompact automobile segment may be positively affected. A good industry structure analysis will establish the link between the automobile and petroleum industries and will explain how segments in the industry are differentially affected. Â Â Â

The third element of the industry structure model is the strategic group, a cluster of companies with similar business models and similar positioning. Companies within a strategic group compete more directly with each other than with companies in other groupings. Fast food hamburger chains comprise a strategic group within the restaurant industry, but do not compete directly with fine dining restaurants, and are affected differently by economic forces. Economic recession may depress fine dining business, but boost inexpensive fast food business.  Thus, to properly assess the industry influence on a subject company’s value, it is important to understand the strategic group in which the company participates.  Â

Macro-Environment Analysis Model

One well known macro-environmental model is the PESTEL model. The acronym refers to the political, economic, social, technological, environmental, and legal factors that may affect an industry.  Not all industries are affected the same way by each factor; and the factors may differ significantly in their volatility, and, therefore, in their potential impact on a company’s value. For example, U.S. political campaigns often generate uncertainty about likelihood and scope of changes in industry regulation and tax rates.  Economic factors such as interest rates, GDP growth rates, and inflation rates affect an industry’s potential profitability.  Social and demographic factors such as age trends, birth rates, and educational attainment color an industry’s prospects.  Technology cycles and penetration rates of new technologies vary by industry and can dramatically affect company value.  Environmental factors such as sensitivity to costs of regulatory compliance affect an industry’s risk profile. And legal issues such as trends in consumer protection or the prospect of tort reform vary in their effects on different industries.  ÂA systematic scan of the PESTEL macro-environmental factors provides context for the valuator’s analysis of the subject industry. A version of this model called the LoNGPESTEL model3 captures local, national, and global implications of each factor. These macroenvironmental factors are the basis for the next six of our 20 questions: Â

4. Will political factors affect the subject industry positively or negatively?

5. Will economic factors affect the subject industry positively or negatively? Â

6. Will social factors affect the subject industry positively or negatively? Â

7. Will technological factors affect the subject industry positively or negatively? Â

8. Will environmental factors affect the subject industry positively or negatively?

9. Will legal factors affect the subject industry positively or negatively?Â

Table 1 provides an example LoNGPESTEL summary of the auto repair industry. Each row represents a set of influential issues associated with one of the PESTEL factors. Each column organizes the issues based on the scope of influence. Â Â

Table 1: Long PESTEL View of the Auto Repair Industry

|

PESTEL Factor |

Local |

National |

Global |

|

Political |

Local government recruiting subsidies and tax rebates |

Fleet MPG goals (encouraging fleet turnover), employee healthcare requirements |

|

|

Economic |

Disposable personal income, population growth |

Franchise and chain repair business models, shipping costs |

Currency exchange rates, steel and parts prices |

|

Social |

Consumerism versus saving ethic, preference for new product |

Organized labor and right to work, healthcare and retirement expectations |

|

|

Technological |

High-speed Internet access for networked information, required employee skills mix |

Alternative fuel vehicles, engine technology, safety technology, electronics (engine management, navigation, entertainment, service diagnostics) |

Globalized supply chain links, parts suppliers |

|

Environmental |

Inspection programs, disposal/recycling of waste material and old parts |

National auto emissions standards |

Third-world recycling |

|

Legal |

Business licenses, zoning requirements |

|

|

Â

Note that the LoNGPESTEL analysis itself is insufficient to establish a value influence on a subject company. Â The valuator must consider the position of the company within the industry to determine whether a factor has a positive or negative influence on the subject company. For instance, tougher fleet mileage requirements would tend to increase fleet turnover rates and expose repair businesses to new technologies at a faster rate. Â Economic boom times that support growth for new car sales may reduce demand for repair services, while a slow economic period that depresses new car sales would tend to increase demand for repair services for a relatively older fleet. Â Auto repair will be more affected by local than by national and global issues, while a manufacturer will be more affected by national and global issues. Â Â Â

Five Forces Model

The five forces model described by Michael Porter identifies factors that shape competition in an industry.4 A high level of any of these factors tends to reduce profitability (and therefore attractiveness) of an industry. Porter identifies the threat of new entrants, the intensity of rivalry among existing competitors, the bargaining power of buyers, the bargaining power of suppliers, and the availability of substitutes as key forces shaping the competitive profile of an industry. Essentially, these elements represent stakeholders that compete for the available industry profit—the relative strength of one class of stakeholder means less profit is available for other stakeholders. Others have noted that complementors play a key role in industry profitability. A complementor is a product or organization that complements (completes by providing a missing element) another product or organization. For example, applications are a critical complement to the smartphone industry; an extensive charging network is a missing complement needed to make all-electric automobiles practical; a robust package delivery industry is a critical complement for Amazon.com’s business model. We include complementors in our discussion here, although they are less related to the concept of industry competition and have more to do with  the generation of demand.  If complementors are inadequate, then industry demand and profitability cannot achieve their potential. ÂPorter’s five forces plus complementors form the basis for the next six of our 20 questions:

10. Are new entrants likely? Â

11. Is rivalry among incumbents intense or increasing?

12. Is bargaining power of customers high or increasing?

13. Is bargaining power of suppliers high or increasing?

14. Are current or potential substitutes a credible threat?

15. Are needed complements unavailable or scarce?Â

Table 2 provides some suggestions for judging the strength or weakness of each element. A higher risk  of new entrants, intense or increasing rivalry, increasing buyer bargaining power,  increasing supplying bargaining power,  or credible substitutes would tend to  erode profits and increase uncertainty;  and if several of these factors are highly  likely, then the attractiveness of the industry would be reduced. A robust set of complements would tend to improve the prospects for growth and profitability, while inadequate complements would tend to limit industry growth. Â

Table 2: Five Forces of Assessment Matrix

|

Five Forces Factor |

Indicators of Strength or Weakness |

|

Risk of New Entrants |

|

|

Intensity of Rivalry |

|

|

Supplier Bargaining Power |

|

|

Buyer Bargaining Power |

|

|

Availability of Substitutes |

|

|

Availability of Complements |

|

Table 3 captures some observations of the auto repair industry using the five forces model.Â

Table 3: Five Forces Analysis of Auto Repair Risk

| Risk of New Events |

Given the fragmentation of the industry (see concentration data in Industry Life Cycle |

|

Intensity of Rivalry |

Exit barriers are not a spur to rivalry in this industry—relatively modest capital is |

|

Supplier Bargaining Power |

Auto parts suppliers are relatively few in number (71, according to the 2002 Economic |

|

Buyer Bargaining Power |

While buyers are generally price-sensitive, many auto repairs are urgent, which limits |

|

Availability of Substitutes |

The substitutes for an auto repair shop are DIY repair (unfeasible for most buyers) or |

|

Availability of Complements |

Auto repair is a well established industry, and required complements are readily |

Industry Life Cycle Model

The classic life cycle model of an industry is a useful tool for analyzing industry risk because it helps explain what factors are most relevant at present and what factors may be more important in the future.5 In other words, the significance of a risk element changes as the industry moves through its life cycle. The real valuation issue is how well the subject company is equipped to manage the risk of the current and coming stages of the industry life cycle. The valuator’s challenge is first of all to identify the life cycle stage of the industry, then to compare the subject company’s positioning compared to the challenges of the life cycle stage. Changes in the industry market, concentration, price competition, profitability, and investment requirements are the focus of the last five of our 20 questions. Based on the industry life cycle:16. Will changes in market size and growth rate be positive or negative for the company?

17. Will changes in industry concentration be positive or negative for the company?

18. Will changes in price pressure be positive or negative for the company?

19. Will changes in margins be positive or negative for the company?

20. Will changes in investment patterns be positive or negative for the company?Â

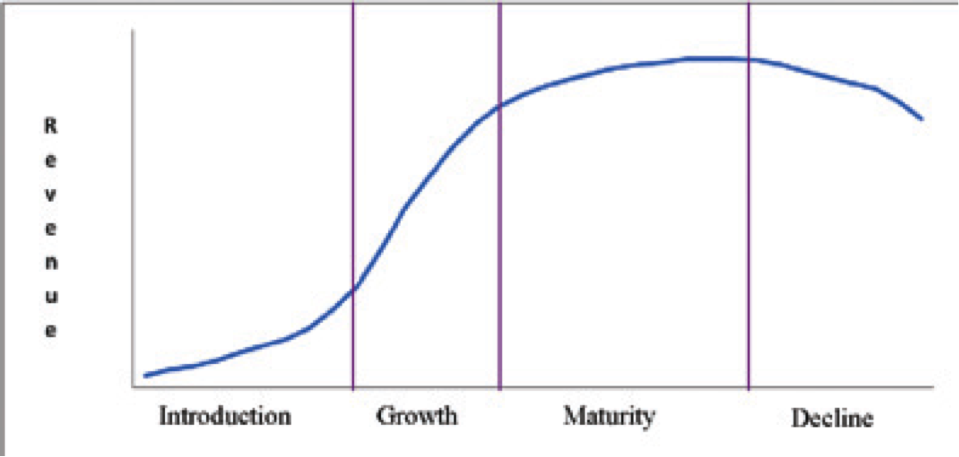

The life cycle curve is constructed by charting total industry revenue over time. Â Figure 1 is a typical illustration of an introduction stage of relatively low growth, followed by a strong growth stage, followed by a maturity stage of flattening growth, followed by a decline stage in which industry revenue shrinks.

Figure 1: Industry Life Cycle Curve

The actual shape of the curve in Figure 1—the length of each stage and the rate of revenue change—will vary with the industry, of course. The important point is that different challenges dominate different stages of the life cycle. A company heavy on innovation know-how may do well in the introductory stage of an industry, but fail in the growth stage if it doesn’t understand how to scale the business to compete effectively. Similarly, managing effectively in a growth environment requires different insights and skills than managing in a more mature, cost-driven environment.

A company’s future prospects (therefore its value) will depend on the future prospects of the industry, which are influenced by the life cycle stage, making it important for valuators to understand the life stage of the subject industry.  Sometimes it might be difficult to obtain adequate time series revenue data to construct a life cycle curve for the subject industry (consider that for an immature industry, the curve will necessarily be incomplete). If several years of data are available, valuators may plausibly infer the life cycle stage by considering multi-year trends in growth and concentration. For example, double-digit, exponential growth of the industry (increasing at an increasing rate) is suggestive of the growth stage. High industry growth that is decelerating suggests late growth or early maturity. Steadily flattening industry growth indicates maturity. Real growth―adjusting for Consumer Price Index or Producer Price Index inflation, whichever is appropriate for the industry—is a better guide than raw current dollar growth.

Analysis of trends in industry concentration provides an excellent complement to the revenue curve analysis. A state of fragmentation (many competitors with none achieving significant market share advantage) indicates introduction or growth. A consolidating trend (a few competitors gaining control of disproportionate market shares) suggests maturity or decline. Combining the growth trend and concentration trend should provide a stage estimate that is sound enough to guide the use of the tools provided here. Â

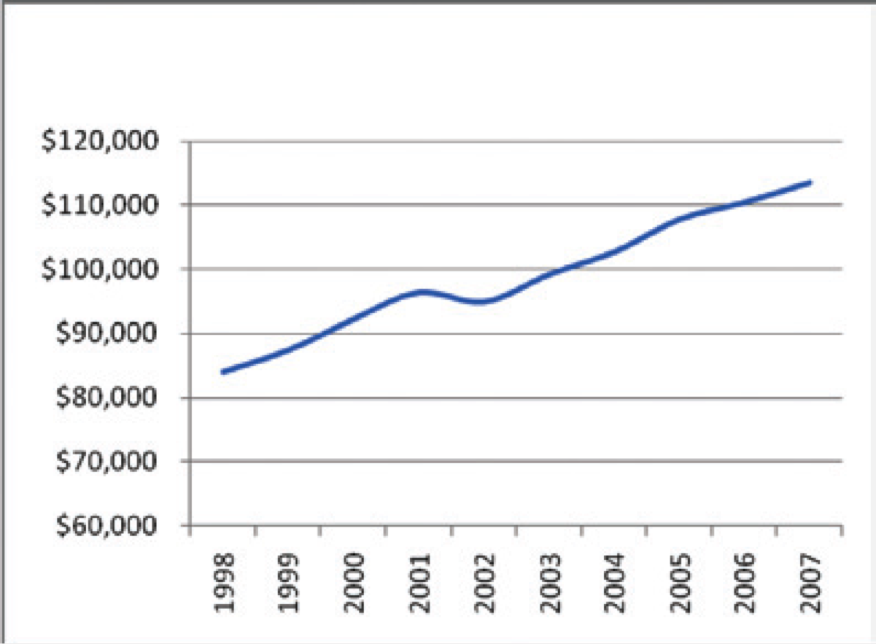

Constructing a revenue chart for the entire life of an industry can be a daunting task because of the difficulty of assembling consistent data (e.g., for many census and BEA data sets, the correspondence between SIC and NAICS industry classifications is imperfect). But if five to 10 years of data can be charted, it can be very informative. Figure 2 illustrates automotive repair industry revenue for the period 1998–2007 (charted from GDP-By-Industry Data6 ).

Figure 2: Automotive Repair Revenue ($M)

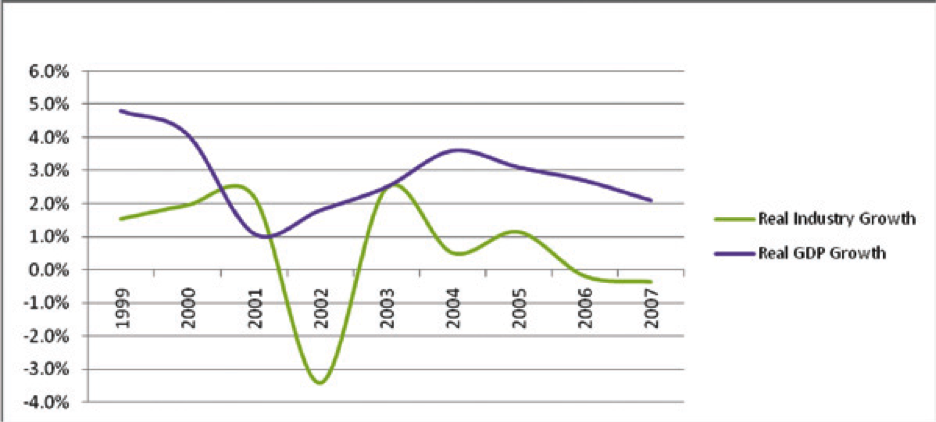

Figure 3: Automotive Repair v. GDP (Adjusted for CPI Inflation)

Industry revenues are clearly growing at a steady, but slow rate: 10-year current dollar CAGR of 3.38 percent. Adjusting for CPI inflation7 and comparing real industry growth to real GDP growth8 provides further insights: industry real growth is slowing and is significantly slower than real GDP growth, even losing ground to CPI inflation in 2006-2007. This industry appears to be in a mature stage based on the revenue curve analysis.

What does a look at industry concentration reveal? Economic census data show a fragmented industry. Over 97% of firms in the industry operate a single establishment location. These single-unit firms account for 89% of industry establishments that harvest 80 % of industry revenue. Consider Table 4, which compares 1997 and 2002 concentration figures from economic census reports.9 By the end of the five-year review period,  there is some slight increased concentration of market share in the top 50 largest firms, but the top 20 firms actually lost a  point of market share during the five-year  period, reinforcing the fragmented state of  the auto repair industry.

Table 4: Automotive Repair Firm Concentration

|

NAICS 8111 |

1997 |

2002 |

|

4 largest firms |

2.3% |

1.8% |

|

8 largest firms |

3.2% |

2.8% |

|

20 largest firms |

4.7% |

4.6% |

|

50 largest firms |

6.2% |

6.5% |

1997 & 2002 Economic Census Data

The economic census data also provide a segmented view of industry revenue by establishment size (a firm may operate multiple establishments). Calculating the segment shares of revenue and comparing the 1997 and 2002 industries yields two interesting insights (see Table 5): First, the lion’s share of industry revenue is taken by mid-size establishments. Second, while concentration is not happening in the sense of fewer large players controlling more revenue, revenue is shifting toward segments with larger establishments. This suggests an increase in the minimum efficient scale of operation in the industry, which may create conditions more favorable for consolidation—a future management challenge for an automotive repair business.

Table 5: Automotive Repair Market Share by Establishment Size

|

Establishment Size (Revenue $) |

1997 % of Revenue |

2002 % of Revenue |

1997 Aggregate Segments (%) |

2002 Aggregate Segments (5) |

|

Less than 10,000 |

0.001 |

0.001 |

1.96 |

1.31 |

|

10,000 to 24,999 |

0.030 |

0.025 |

|

|

|

25,000 to 49,999 |

0.25 |

0.16 |

|

|

|

50,000 to 99,999 |

1.7 |

1.1 |

|

|

|

100,000 to 249,999 |

13.1 |

9.4 |

87.85 |

83.05 |

|

250,000 to 499,999 |

24.9 |

20.8 |

|

|

|

500,000 to 999,999 |

27.5 |

27.2 |

|

|

|

1,000,000 to 2,499,999 |

22.3 |

25.6 |

|

|

|

2,500,000 to 4,999,999 |

6.5 |

9.2 |

10.19 |

15.64 |

|

5,000,000 to 9,999,999 |

2.2 |

3.6 |

|

|

|

10,000,000 or more |

1.5 |

2.8 |

|

|

Derived from 1997 & 2002 Economic Census Data

Generally, when an industry emerges, the key challenge will be innovation, the critical function will be R&D, and a company will need an excellent product design process. As the industry grows, market development becomes critical and marketing and sales acquire increased importance. As the industry matures, the key challenge becomes cost management, production assumes key strategic importance, and a company needs excellence in process design. In a declining industry, the key challenge is how to transition to the next industry, requiring financial finesse and ability to assess opportunities in other industries and the transfer value of current company assets. In other words, management challenges are dynamic based on life cycle stage. Having identified the likely life cycle stage of the industry, the valuator’s attention should turn to the challenges typically posed by that stage. Table 6 summarizes some of the key factors that change as an industry evolves.

Table 6: Implications of the Industry Life Cycle

|

Stage Factor |

Introduction |

Growth |

Maturity |

Decline |

|

Key challenge |

Innovation challenge Product design |

Growth challenge Market development |

Cost challenge Process design |

Transition challenge Harvest or exit? |

|

Market Implications |

High risk Small size Few segments

|

High growth rate Increasing size Increasing segmentation

|

Flattening growth rate Large, stable size Many segments

|

Declining size |

|

Competition Implications |

Low competition |

Increasing competition |

Intense competition Price pressure |

Declining competition |

|

Financial Implications |

Poor margins (high cost) Invest in R&D |

Good margins Invest in advertising, expansion |

Tighter margins Invest in process improvement |

Tight margins Invest in transition |

Adapted from Dess, Lumpkin, and Eisner, 2010 (see footnote 5), pg. 181

While understanding the industry is important, the valuator’s real challenge is judging how the subject company is equipped to handle the industry’s current and future stages.  At this point the valuator must consider the valuation implications of future change. Is the subject company well prepared to handle the changes implied by the future state of the industry?

• Change in market characteristics (size, growth rate, degree of segmentation)? Increasing growth rates ahead mean good times, but for how long?  Slowing growth rates suggest an impending change in the intensity of competition. Is the company positioned to handle greater volume? Can the company gracefully address increased segmentation with targeted products and marketing? Does management understand the emerging challenges? If not, does management understand that it needs to bring different talent on board to deal with the emerging challenges?

• Change in competitor concentration and price competition? If growth and profits are good, a company can expect to see more competitors. When growth flattens, price competition will intensify and put pressure on margins. Eventually, weaker competitors will falter and consolidation or concentration will occur. Is the company positioned to become stronger in response to these developments, or is it likely to become a target for stronger competitors?

• Change in profit margins and investment patterns? Costs are relatively high and margins relatively low in the early stages of an industry as companies struggle to fund development of initial products and establish capacity to deliver products. As the new market becomes established, growth in volume creates economies of scale and improved margins—until too many competitors jump in and drive margins down with price competition. Is the company positioned (with management knowledge, operating flexibility, and financial capability) to adapt to future industry conditions?

Identifying the subject industry’s probable life cycle stage can highlight factors that may materially affect the forecast years of the valuation analysis. This will be a function not only of the prospects for the industry per se, but also of how well the subject company and its management is prepared to address future industry conditions.

Aggregating the Judgments

Our article describes a method for systematic review of potential industry risk factors, helping to ensure that important risk factors are not overlooked in the valuation. The method does not programmatically calculate industry risk—the valuator must judge the significance of each risk factor for the subject company and translate that judgment into a risk discount or premium. A direct and easily understood method to aggregate these judgements is simply to assign a risk discount/premium to each of the evaluated factors. The net of the individual discounts/premia is the aggregate industry risk discount/premium.

Conclusion

NACVA, AICPA, ASA, and IBA all point out the important role of industry analysis in providing a well founded business valuation. It is important that the industry analysis be relevant to the subject company and not simply a boilerplate analysis, because the same elements in an industry may affect the value of companies within the industry differently. Put another way, industry risk cannot be completely divorced from the company-specific risk. For example, factors such as how a company has positioned itself within the industry, its scope of operation, and characteristics of its management affect its exposure to industry risk. We have described an approach to analyzing an industry based on well established models of industry structural analysis, macro-environmental analysis, competitive forces analysis, and industry life cycle analysis. The results of the analysis can be captured as answers to 20 questions yielding an aggregated view of industry risk as applied to the subject company. We also presented an illustrative example of how to aggregate the scores on a scale ranging from high probability of negative impact to high probability of positive impact.

The art of valuation lies in assigning an appropriate discount or premium once the risk has been assessed. A systematic review of the industry from multiple perspectives reduces the possibility that an important influence factor will be overlooked. The method of industry analysis we have described provides the valuator a reasoned and defensible basis for the industry risk discount or premium, relying on well established models.

This article was originally published in the May/June 2011 issue of The Value Examiner.

Dennis R. Balch, PhD, is an assistant professor of management at the University of North Alabama. He has 24 years of experience with two Fortune 500 companies in the computer technology industry, including 14 years in executive management. Balch specializes in management strategy and leadership, teaching upper division and graduate courses.Â

Keith Sellers, PhD, CPA/ABV, CVA, is the LaGrange Eminent Scholar of Business Valuation and Director of the Center for Business Valuation Research and  Education at the University of North Alabama. He is the president of Financial Valuation Services, Inc., and cofounder of Derivative Valuation Services, LLC. Sellers is a member of  The Value Examiner’s Editorial Board.

Santanu Borah, PhD, is a professor in the Department of Management at the University of North Alabama. He has been teaching primarily in the areas of strategic management and international business.

Footnotes:

1. IRS Business Valuation Guidelines, Sec. 4.48.4.2.3; NACVA Professional Standards, accessed 11/19/2010:Â www.nacva.com/PDF/NACVA_Standards.pdf.

2. ASA Candidate BV Report Review Checklist of Basic Report Requirements and General Report Quality (2010), American Society of Appraisers, accessed 11/19/2010: www.asabv.org/userfiles/files/ Website%20Content/BVCandidateChecklist.pdf.

3. Andrew Gillespie, “PESTEL Analysis of the Macro-environment,” Foundations of Economics: Additional Chapter on Business Strategy, Oxford University Press, 2007. Accessed 9/7/2008: www.oup.com/ uk/orc/bin/9780199296378/01student/additional/ page_12.htm.  Â

4. Michael Porter, Competitive Strategy, Free Press, New York, 1980; “How Competitive Forces Shape Strategy,” Harvard Business Review (1979) 57.2, 137-145.

5. Porter, ibid. Also Gregory G. Dess, G.T. Lumpkin, and Alan B. Eisner, (2010). Strategic Management:Â Creating Competitive Advantages, Fifth Edition, McGraw-Hill Irwin, Boston, 2020.

6. GDP-By-Industry Data, Bureau of Economic Analysis, Industry Economic Accounts. Accessed 2/15/2010: www.bea.gov/industry/gdpbyind_data.htm. Â

7. Charted from Consumer Price Index History Table, Bureau of Labor Statistics, Consumer Price Index. Accessed 2/15/2010: www.bls.gov/ cpi/#tables.

8.  Charted from Gross Domestic Product.  Bureau of Economic Analysis, National Economic Accounts. Accessed 2/15/2010: www.bea.gov/ national/index.htm.

9.  Concentration by Largest Firms Subject to Federal Income Tax: 1997 (2000), U.S. Census Bureau, Accessed 2/15/2010: www.census.gov/epcd/ www/concentration.html; Establishment and Firm Size: 1997 (Including Legal Form of Organization): 1997 Economic Census Other Services (Except Public Administration), 2000, U.S. Census Bureau, accessed 2/15/2010: www.census.gov/epcd/www/ concentration.html.