The Guideline Transaction Method

Problems and solutions

The Guideline Transaction Method (GTM) remains a viable option for valuing businesses; the question is whether it is being properly applied. In this article, Eric Barr proposes that despite the recent negative press, the GTM can provide valuable insight.

The Market Approach is a generally accepted approach to valuation. It is referenced in IRS Revenue Ruling 59-60, and authoritative valuation standards. One commonly applied method under the Market Approach is the Guideline Transactions Method (GTM). Under the GTM, transaction databases are examined to identify sales of businesses/assets that are similar to the subject company. The presumption is that these transactions reflect valuation multiples that can provide an indication of the value of the subject interest. Information regarding the North American Industry Classification System (NAICS) or the Standard Industrial Classification (SIC) code; the selling price, date of sale, location of sold business, prior year revenues, gross profit, operating income, and other operating data, balance sheet amounts, and other information are all typically included in the database. It makes sense that this method should be considered if certain criteria are satisfied. What follows here is a discussion of the criteria that I believe would limit reliance on the GTM.1

The Market Approach is a generally accepted approach to valuation. It is referenced in IRS Revenue Ruling 59-60, and authoritative valuation standards. One commonly applied method under the Market Approach is the Guideline Transactions Method (GTM). Under the GTM, transaction databases are examined to identify sales of businesses/assets that are similar to the subject company. The presumption is that these transactions reflect valuation multiples that can provide an indication of the value of the subject interest. Information regarding the North American Industry Classification System (NAICS) or the Standard Industrial Classification (SIC) code; the selling price, date of sale, location of sold business, prior year revenues, gross profit, operating income, and other operating data, balance sheet amounts, and other information are all typically included in the database. It makes sense that this method should be considered if certain criteria are satisfied. What follows here is a discussion of the criteria that I believe would limit reliance on the GTM.1

Reasons for Limiting Reliance on the GTM

Facts and circumstances impact the value of a company, and no two situations are exactly alike. Accordingly, it is necessary to consider the following issues that may limit the ability of a valuation analyst to rely on the GTM:

- Number of Guideline Transactions

The valuation analyst needs to consider whether there are enough guideline transactions within the database to provide a meaningful indication of value. In an industry where a company’s gross margins, operating expenses, and other financial metrics do not materially vary by company, fewer transactions are needed. In other industries where results of operations vary significantly by entity, more transactions need to be examined. Where valuation multiples are closely aligned regardless of size of transaction, location and date, then fewer guideline transactions need to be examined (and vice versa). If the subject company’s financial performance approximates the industry, fewer transactions may be required than if the company is an outlier. These and other factors impact the minimum number of guideline transactions that must be examined. There is no one-size-fits-all situations answer to the appropriate number of relevant guideline transactions that must be examined; ultimately, it comes down to a matter of professional judgment. - Databases Do Not Contain Normalized Financial Information

For valuation purposes, the subject company data is typically “normalized.” For example, nonrecurring transactions, personal expenses, unreasonable compensation, and other adjustments that modify the reported results of operations of the subject company are considered as part of the valuation analysis. These normalization adjustments are often very substantial. Such adjustments convert the reported results of operations to an economic basis, one that is more indicative of the future economic benefits derived from owning the business.Historical financial data contained in transaction databases are not normalized. It is conceptually inconsistent to apply valuation multiples from transaction databases containing reported historical information to normalized subject company data; doing so may yield unsupportable conclusions of value.2 - Reliability of Historical Financial Data of Guideline Transaction Companies

The source of information contained in transaction databases needs to be considered, and many times the valuation analyst does not know the source of the transaction data. For example, if such data is derived from audited financial statements, then the valuation analyst may be able to rely more heavily on the data because it has been subjected to a level of independent examination. On the other hand, if such data is derived from management’s representations or internally prepared trial balances that have not been independently examined, there is less reason to rely on the data.Another issue to consider is whether the year of sale data contains transactions outside of the ordinary course of business. With an impending sale, the selling company may be more inclined to pay large bonuses to owners and key employees, especially if there is excess cash or excess working capital. Alternatively, a selling company may defer repairs, maintenance, computer purchases and other expenditures that benefit future periods. - Measuring Compensation Paid for Subject Company

A substantial portion of the consideration paid for the business entity may not be reported in the transaction database purchase price. For example, medical practice acquisitions often include a substantial portion of the purchase price in the form of greater physician compensation than that previously earned. Other forms of transaction-related compensation are covenants not to compete and above-market rental payments for seller-owned property (tangible and intangible). Such transactions are often structured for tax savings efficiency. In order to properly analyze transaction database pricing multiples, all forms of compensation must be considered. - Operating Trends

Two companies with identical results of operations in the latest year may be valued very differently, especially if revenues, profitability, and other financial metrics are trending in opposite directions. A multi-period comparison of financial information can also provide guidance on nonrecurring transactions requiring normalization. Most transaction databases do not provide such multi-period information, limiting financial and pricing analyses to a single period. - Risk Factors

The valuation analyst needs to perform an analysis of the subject company’s risk factors when performing a conclusion of value. Such risk factors can include dependence on a single or small group of (a) customers, (b) product lines, (c) vendor relationships, (d) technologies, (e) employees, (d) lenders, and many other factors. These risk factors will impact the subject company’s strengths, weaknesses, opportunities, and threats. It will dictate whether the subject company is more or less risky than other companies in its NAICS or SIC grouping. This information can often be obtained through substantive interviews of management.Information concerning the risk factors of guideline transaction companies is not available to the valuation analyst―it is not provided in the transaction database and selling company management is not available to be interviewed. The inability to access risk factor information of transaction database companies limits the utility of the GTM. - Comparability of Guideline Transactions and Industry Data to Subject Company

When comparing the financial performance of the subject company to (a) industry data, and (b) database transaction companies, it is important to understand the reasons for substantial variances. Are the variances due to classification differences or performance issues? Can a guideline transaction provide a meaningful indication of value if the sold company’s revenues, gross profit, operating income, earnings before interest and taxes (EBIT), earnings before interest, taxes, depreciation, and amortization (EBITDA), or other financial measures are 1,000 times (or one-one thousandth) the size of the subject company? Maybe not. Companies that are substantially larger or smaller may have different depth of management, risk factors, cost structures, and other factors than the subject company.When analyzing the pricing multiples of database transactions, some companies have multiples that are substantially different than other entities. Depending on facts and circumstances, the valuation analyst may decide to exclude these pricing multiple outliers. The valuation analyst should be prepared to justify their decision for including or excluding the valuation multiples of any guideline transaction under the GTM. - Location of Subject Company

In real estate, there is an adage that “location, location, and location” are the three most important factors impacting value. Location also matters in many other businesses.For example, consider a family owned hardware store operating in a mature, high-income, densely populated suburban community approximately 35 miles outside of a major city. The store has no local competition within 10 miles and does not expect future competition. How comparable are this store’s risk factors to an identically sized hardware store located in:(a) An inner-city, crime ridden neighborhood

(b) A similar community where there is also a Home Depot

(c) A low income rural area that is sparsely populatedStated differently, local issues may yield different performance results and different values. Just because the subject company and the guideline transaction companies are located in the same general geographic region of the United States does not necessarily mean that the local markets are the same. This negatively impacts the reliability of GTM results. - Year of Transaction

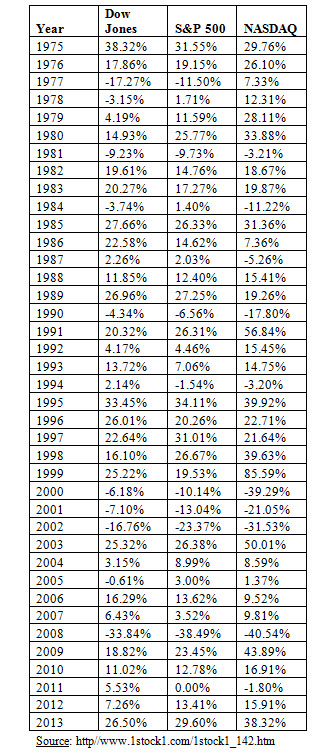

As shown in Table 1, the Dow Jones Industrial Average, Standard & Poor’s 500, and NASDAQ have all experienced substantial yearly changes in annual returns during the years 1975 through 2013.Table 1 Annual Returns -

In certain recession years, the price of financial assets decreased substantially (i.e., 2000‒2002 and 2008); in the immediate years post-recession the price of financial assets often increased substantially (i.e., 2003 and 2009). Asset pricing and return on investment (ROI) are impacted by the (a) availability of capital, (b) decreases in financial asset prices, (c) the state of the U.S. and/or world economies, (d) government actions, and (e) many other factors.It is not unreasonable to assume that such ROI volatility also impacts the prices realized by privately held companies. Accordingly, the price realized in a sale transaction may be affected by whether the sale occurred before, during or after a recession. For some industries, certain regions of the U.S. recovered more quickly than other regions (for example, the residential real estate market in Manhattan versus Las Vegas). The date that a guideline transaction occurred may significantly impact the price realized. Valuation analysts must be mindful of the potential impact of the date of the guideline transaction when assessing the transaction’s reliability under the GTM.

In certain recession years, the price of financial assets decreased substantially (i.e., 2000‒2002 and 2008); in the immediate years post-recession the price of financial assets often increased substantially (i.e., 2003 and 2009). Asset pricing and return on investment (ROI) are impacted by the (a) availability of capital, (b) decreases in financial asset prices, (c) the state of the U.S. and/or world economies, (d) government actions, and (e) many other factors.It is not unreasonable to assume that such ROI volatility also impacts the prices realized by privately held companies. Accordingly, the price realized in a sale transaction may be affected by whether the sale occurred before, during or after a recession. For some industries, certain regions of the U.S. recovered more quickly than other regions (for example, the residential real estate market in Manhattan versus Las Vegas). The date that a guideline transaction occurred may significantly impact the price realized. Valuation analysts must be mindful of the potential impact of the date of the guideline transaction when assessing the transaction’s reliability under the GTM. - Asset Sale or Stock Sale

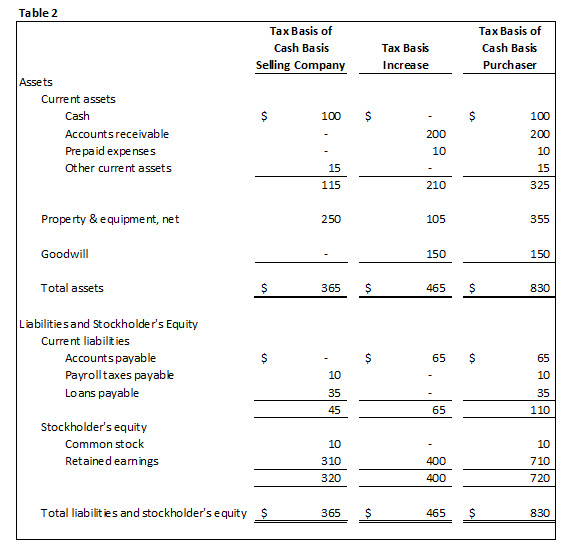

Transactions are typically structured as either asset or equity purchases. Where assets are purchased, the acquirer often buys only those business assets (net of liabilities) that it desires to purchase. By purchasing assets, the buyer has a positive tax result because the cost basis of each asset is separately calculated and (where applicable) increased for income tax reporting purposes. Using a hypothetical example, Table 2 illustrates this increase in basis.

In the above example, when $200 of accounts receivable are collected post-transaction by the cash basis purchaser, there is no recognition of taxable income. Depreciation expense on fixed assets is based on its appraised value as of the transaction date ($355, not $250). Goodwill is recorded for federal income tax purposes and amortized on a straight-line basis over a fifteen year period ($10 per year). For the buyer, these are all very positive results from a tax planning perspective.When a buyer purchases the equity of an S Corporation or a C Corporation, the buyer’s tax basis in the acquired entity is increased (outside basis), but their inside basis (the basis of each acquired asset within the entity) remains unchanged. So in the above example, the acquirer’s basis in each asset and liability would be the same as the selling company’s basis if the transaction was structured as an equity purchase.3 The income tax benefit of the stepped-up outside basis is deferred until the buyer ultimately sells the company. This can create a significant current income tax cost to the buyer. Another disadvantage of purchasing equity is that any contingent liabilities and commitments of the target company are assumed by the buyer. This assumption of risk is avoided when purchasing assets.

In the above example, when $200 of accounts receivable are collected post-transaction by the cash basis purchaser, there is no recognition of taxable income. Depreciation expense on fixed assets is based on its appraised value as of the transaction date ($355, not $250). Goodwill is recorded for federal income tax purposes and amortized on a straight-line basis over a fifteen year period ($10 per year). For the buyer, these are all very positive results from a tax planning perspective.When a buyer purchases the equity of an S Corporation or a C Corporation, the buyer’s tax basis in the acquired entity is increased (outside basis), but their inside basis (the basis of each acquired asset within the entity) remains unchanged. So in the above example, the acquirer’s basis in each asset and liability would be the same as the selling company’s basis if the transaction was structured as an equity purchase.3 The income tax benefit of the stepped-up outside basis is deferred until the buyer ultimately sells the company. This can create a significant current income tax cost to the buyer. Another disadvantage of purchasing equity is that any contingent liabilities and commitments of the target company are assumed by the buyer. This assumption of risk is avoided when purchasing assets.

Overcoming GTM Reliance Issues

Given all of the issues noted above, it would appear that the GTM would hardly ever be applied. This is not the case. For many companies, the GTM is a very relevant indicator of value when the following facts are present:

- Large Number of Guideline Transactions

Certain NAICS and SIC codes have large numbers (hundreds) of transactions, with many occurring within a similar geographic area as the subject company, of similar size to the subject company, and occurring within a relatively recent period of time of the valuation date. In these situations, assuming that the range of relevant pricing multiples is within a relatively narrow range, meaningful valuation multiples can be developed for the target company. Having a large number of guideline transactions mitigates the risk of numbered items one through nine above. - Industry Performance Data Approximates Guideline Transaction Data and Subject Company Data

Where the subject company’s normalized results of operations are comparable to industry data and guideline company transaction data, the concerns expressed in numbered items two, three, five, eight, and nine above are greatly reduced. - Consider Valuation Impact Of Asset vs. Stock Sale

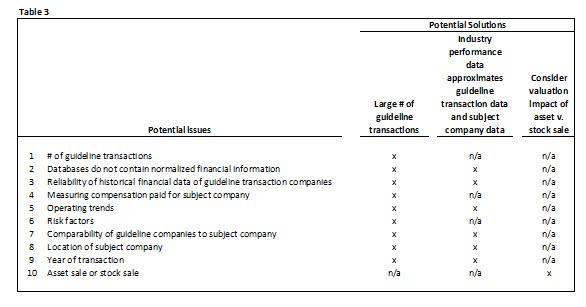

A typical trade-off when negotiating a transaction is price versus terms. If a buyer finds it tax advantageous to purchase assets and not equity, they may be willing to pay more. If a C Corporation seller realizes more after-tax from the sale of a business by selling equity than by selling assets, they may be willing to accept a lower selling price if the transaction is structured as an equity sale.The business valuation analyst needs to be mindful of the guideline transaction’s deal structure and consider the impact and relevance of an asset purchase when valuing the subject company’s equity. The valuation analyst also needs to consider the valuation impact of deriving a GTM pricing multiple from an equity transaction where there are appreciated, excess or non-operating assets which could inflate valuation multiples.Table 3 summarizes the issues associated with utilizing the GTM, and the way in which each of these issues can be addressed:

Conclusion

The GTM is an often-used method of developing an indication of value. However, business valuation analysts need to be aware of the many potential limitations of this method. By thoughtfully considering the limitations and solutions described in this article, the valuation analyst should be able to make informed decisions regarding the reliability of valuation conclusions developed under the GTM.

—

Eric Barr, CPA/ABV, CVA, CFE, is co-founder and co-managing member of Fischer Barr & Wissinger, LLC, a Morris County, New Jersey, firm. Mr., Barr serves as director of the firm’s Business Valuation and Accounting and Assurances Services departments. Mr. Barr has over 40 years of public accounting experience specializing in litigation support, consulting, and traditional accounting and auditing services. Mr. Barr can be reached at (973) 267-1400 or via e-mail at ebarr@fbwcpas.com.

1 This article does not address the statistical analysis required to derive appropriate valuation multiples under the GTM.

2 This may not be an issue if the price-to-revenues multiple is being applied.

3 If the equity of a partnership or limited liability company is purchased, the buyer has the option of making an IRC Section 754 election to increase the basis of acquired assets. The federal income tax result would be similar to what would occur assuming an asset purchase.