Best Methods for Using Restricted Stock and Pre-IPO Databases for DLOMs

Best Practices for Estimating DLOMs

In this article, Shannon Pratt suggests that practitioners are not using effectively the DLOM databases and defending the DLOM. Dr. Pratt presents a methodology that he argues is more defensible and comprehensive.

The FMV Restricted Stock Database and the Valuation Advisor Lack of Marketability (Pre-IPO) Database are the empirical data sources most widely used by accredited business valuation practitioners to estimate discount for lack of marketability (DLOMs). And the DLOM is usually the largest (and most controversial) discount in most valuation engagements.

The FMV Restricted Stock Database and the Valuation Advisor Lack of Marketability (Pre-IPO) Database are the empirical data sources most widely used by accredited business valuation practitioners to estimate discount for lack of marketability (DLOMs). And the DLOM is usually the largest (and most controversial) discount in most valuation engagements.

Despite the data, most analysts do not utilize these databases to their greatest advantage. That is, they do not use these databases with the methodology that attains the most valid results. Consequently, their results are not as convincing to their audience (be it an interested party or a judge) as might be possible.

Select the Best Transactions

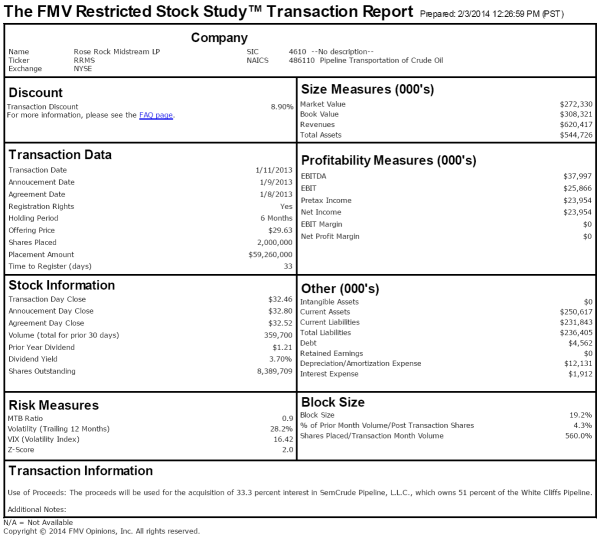

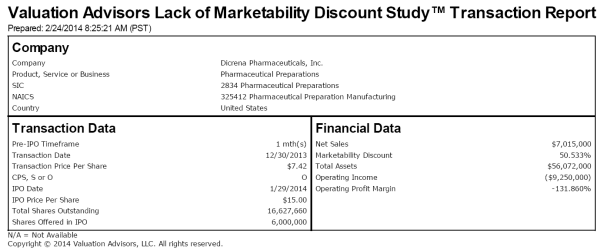

The transactions in the databases that will yield the most valid results are those in companies with characteristics closest to the characteristics of your subject company. Both databases have enough transactions and enough data points per transaction (FMV has 60 data points per transaction and Valuation Advisors has 18 data points per transaction) to select transactions with characteristics close to those of your subject company. Both databases are searchable on any combination of data points. A transaction report from the FMV database is shown as Exhibit 1, and a transaction report from the Valuation Advisors database is shown as Exhibit 2.

The first thing to do is set parameters for the searches. Sales or assets can be good measures of size. The larger the company, the lower the DLOM tends to be. Another good metric is profitability. As with sales, the larger the profits, the lower the DLOM tends to be. For profits, both the dollar size of profits and the profitability ratios can be used.

The parameters of the search should be stated in the report, and all that meet the parameters should be considered. Insiders have various relationships to the company and other stockholders. So there may be some unexplained outliers in the DLOMs that should be eliminated from the averages, and these should be disclosed. Using the medians instead of the means as the measure of central tendency also blunts the impact of outliers.

The lower the range of DLOMs, the fewer transactions are needed. If the search produces too few transactions, the parameters can be widened.

Using the FMV Restricted Stock database, after a certain meaningful level, say 20 percent, the DLOM rises as the number of shares—as a percentage of the outstanding shares—goes up. Thus, a 35 percent block tends to have a higher DLOM than a 5 percent block. This occurs because of the blockage factor; that is, a large block of stock is harder to place than a smaller block. I have used this factor to successfully defend a 50 percent DLOM in court.1

Correcting for Non-Concurrent Dates Using Pre-IPO Data

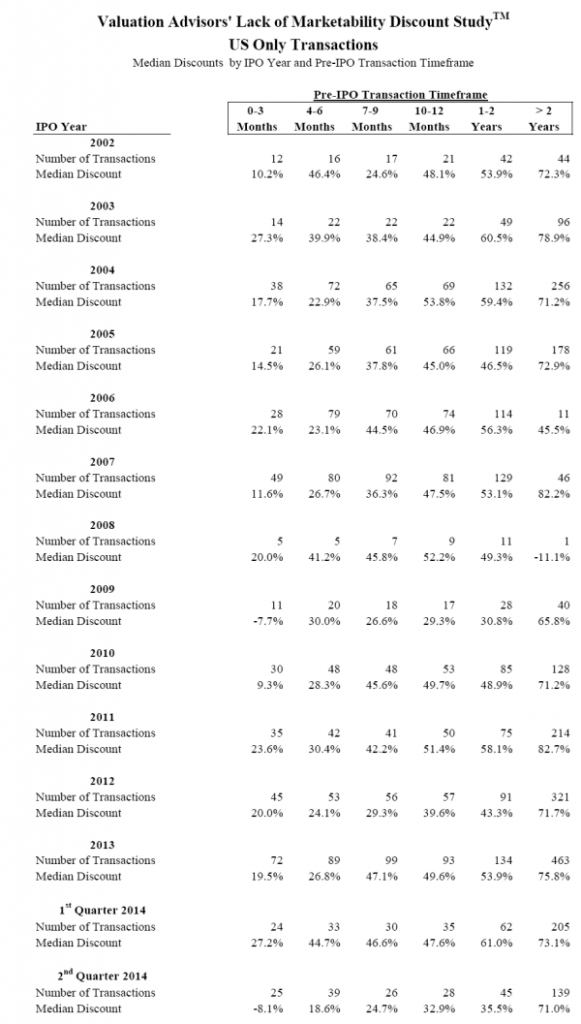

DLOMs based on pre-IPO data have come under attack in the literature and rejection in the courts for the wrong reasons. Actually, the pre-IPO data are the most relevant data for DLOMs because they measure the percentage difference in price when the company was private vs. when the same company was public. I have used pre-IPO data very successfully in court.2

In my opinion, the problem is that analysts tend to use the unadjusted figures (see Exhibit 3). But the IPO is not concurrent with the insider transaction. When a company has an IPO, the SEC requires disclosure of three years’ back financials. This enables the analyst to adjust for changes between the insider transaction and the IPO.

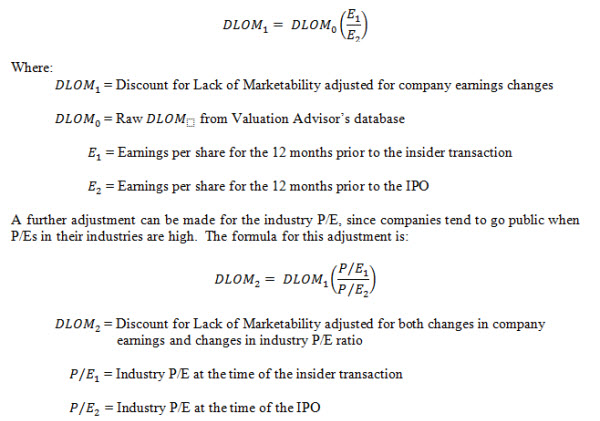

Since the IPOs are not concurrent with the insider transactions, the analyst needs to adjust for changes in the companies’ earnings between the insider transaction and the IPO. This can be done by the simple formula:

Taking the above steps can greatly enhance the validity of using the FMV database on restricted stocks and the Valuation Advisors DLOM database based on IPOs for estimating a discount for lack of marketability.

On another note, it is my opinion that industry is not very important, unless it is a utility or a financial institution; these industries tend to have lower DLOMs.

Dr. Shannon Pratt, FASA, CFA, ABAR, is founder and CEO of Shannon Pratt Valuations, Inc., a nationally recognized business valuation firm headquartered in Portland, Oregon. He holds a doctorate from Indiana University with a major in finance. He is also coauthor with Roger Grabowski of the fifth edition of Cost of Capital: Applications and Examples. Dr. Pratt can be reached at shannon@shannonpratt.com.

1 Howard v. Shay, , 1998 U.S. Dist. LEXIS 23146 (C.D. Cal.).

2 Okerlund v. United States, 365 F.3d 1044 (Fed. Cir. 2004)., and Estate of Artemus D. Davis v. Commissioner, 110 T.C. 530, 1998 U.S. Tax Ct. LEXIS 35, 110 T.C. No. 35 (1998).