The Imperative of Considering the Concept of Highest and Best Use in Healthcare Valuation (Part 2 of 2)

In this second part of a two-part series, the authors discuss why and when the highest and best use standard should apply.

In the first part of this two-part article, the authors compare and contrast the traditional valuation methodologies that analysts have relied upon to value an entity.¬† The standard of practice has included: analyzing the historical accounting and other data as predictive of future performance and value.¬† However, this may not hold true with every economy, industry, or even every enterprise within an industry, over time.¬† For example, the turbulent status of the healthcare industry over the last five decades, since the passage of Medicare in the 1960s, has introduced intervening events and circumstances that have had a dramatic effect on the revenue, expense, and subsequent net economic benefit stream of enterprises operating in the healthcare marketplace.¬† Accordingly, the ‚Äúroad map of historical performance‚ÄĚ of healthcare related enterprises becomes less predictive of future performance.¬† In this second part, the authors discuss the use and applicability of the highest and best use standard and the in-exchange standard of value for a healthcare engagement.¬†

In the first part of this two-part article, the authors compare and contrast the traditional valuation methodologies that analysts have relied upon to value an entity.¬† The standard of practice has included: analyzing the historical accounting and other data as predictive of future performance and value.¬† However, this may not hold true with every economy, industry, or even every enterprise within an industry, over time.¬† For example, the turbulent status of the healthcare industry over the last five decades, since the passage of Medicare in the 1960s, has introduced intervening events and circumstances that have had a dramatic effect on the revenue, expense, and subsequent net economic benefit stream of enterprises operating in the healthcare marketplace.¬† Accordingly, the ‚Äúroad map of historical performance‚ÄĚ of healthcare related enterprises becomes less predictive of future performance.¬† In this second part, the authors discuss the use and applicability of the highest and best use standard and the in-exchange standard of value for a healthcare engagement.¬†

Other guidance related to the concept of highest and best use can be found in the Uniform Standards of Professional Appraisal Practice (USPAP), as promulgated by The Appraisal Standards Board of The Appraisal Foundation, which is a codification of the standard practices to be utilized by within the practice of appraisal and was created for the purpose of promoting and maintaining a high level of public trust in appraisal practice by establishing requirements for appraisers.[i]

According to Standards Rule 9-3 of USPAP:

‚ÄúIn developing an appraisal of an equity interest in a business enterprise with the ability to cause liquidation, an appraiser must investigate the possibility that the business enterprise may have a higher value by liquidation of all or part of the enterprise than by continued operation as is.‚ÄĚ[ii]

This point is further elucidated in the comment to Standard 9-3:

‚ÄúThis Standards Rule requires the appraiser to recognize that the continued operation of a business is not always the best premise of value because liquidation of all or part of the enterprise may result in a higher value.‚ÄĚ

As illustrated above, the highest and best use of the invested capital in a given enterprise may not be in its continued use as a going concern but may, in fact, be in-exchange, either as an orderly disposition of the assets or in liquidation.  In either sense, it should be noted that the decision to utilize the premise of value in-exchange, in contrast to that of value in-use, does not preclude the existence of a requisite valuation of the value of intangible assets. Intangible assets may well exist and hold significant economic value in exchange.

As stated by James Zukin:

‚ÄúThe underlying asset approach considers the component parts of a business enterprise‚Ķ[and] can be [performed] on either a net liquidation basis or by using the value of the underlying assets in continued use. The former basis is normally applicable when there is a distinct possibility that the business is worth more ‚Äėdead‚Äô than ‚Äėalive.‚Äô While the latter basis is normally applicable when there is little possibility of liquidation.‚ÄĚ [iii]

Zukin goes further in clarifying the existence of intangible assets by stating:

‚Äú‚Ķthe market value [of a business enterprise] cannot be lower than the net liquidation value of the [enterprise‚Äôs underlying assets]‚Ķand [a]nother asset area requiring examination [when using the underlying asset approach] is [including the value of] the separately identifiable intangible assets.‚ÄĚ [iv]

The historical use of the assets comprising a healthcare enterprise, for example, a physician practice, should provide no binding pre-supposition about the utility to be derived by a typical purchaser from the ownership of one or more of the subject assets.  The historical inability of a particular owner to generate a positive net cash flow emanating from the subject asset(s) does not require (nor even imply) that a typical investor in a similar asset(s) would be likewise incapable of utilizing it to produce a positive stream of economic benefit.  Investors may acquire assets, such as intangible assets, under different settings and circumstances which are not beholden to the current use of the assets by the seller of the subject intangible assets, or the current owner’s difficulties in generating positive net economic benefit from the enterprise in its entirety.

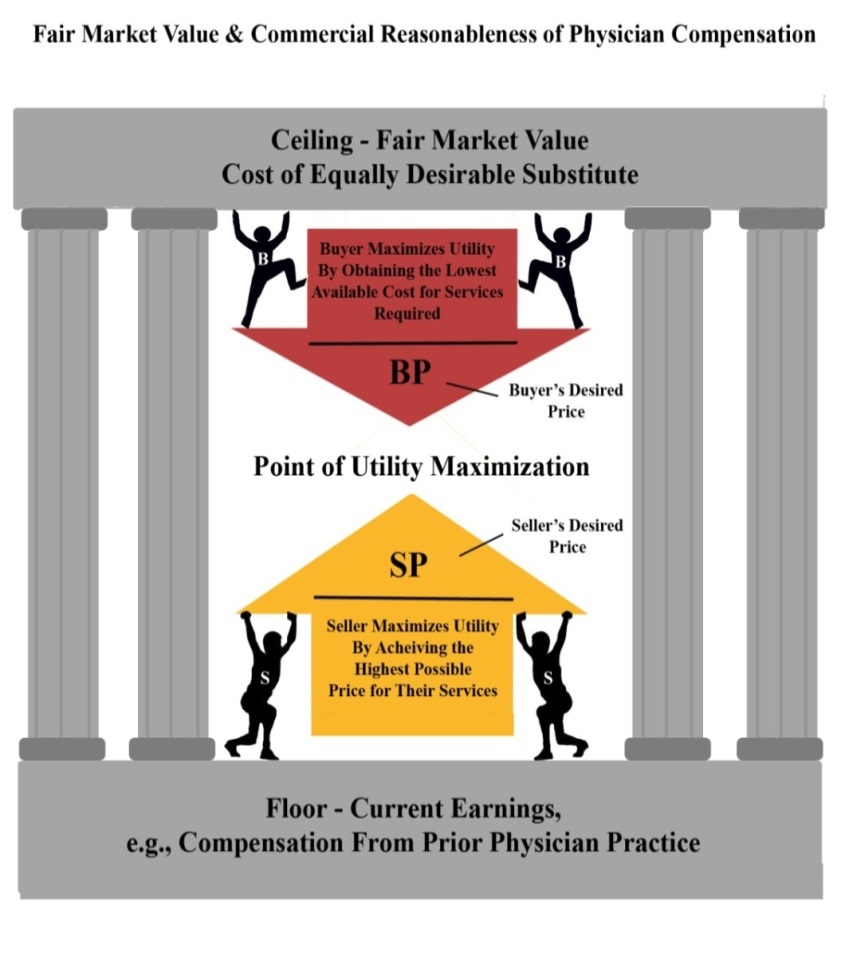

The diversity in uses for assets among purchasers and sellers is an economic fact which gives rise to the difference in anticipated benefit to be derived from the ownership of the subject asset and the opportunity of the participants in a transaction to generate gains from trade. In fact, it is the existence of these differences in value, that is, the aggregate expected economic benefit accruing to the owner of a particular asset, which underpins the concept of ‚Äúwilling buyer‚ÄĚ and ‚Äúwilling seller‚ÄĚ, as illustrated in Exhibit 3 below. [v]

Exhibit 3: Point of Utility Maximization between Willing Buyer and Willing Seller

The expected future economic benefit accruing to the purchaser of a subject asset will tend to put a ceiling on the price the acquirer would be willing to pay.  Likewise, the expected future economic benefit accruing to the seller of an asset will tend to put a floor on the price the seller would be willing to accept.  Within the gap between the expected future economic benefits of the buyer and seller lies the gains of trade, which may be distributed between the market participants to arrive at the agreed upon transaction price for the subject asset.

According to the theory of utility maximization, rational market participants tend to make decisions in order to maximize their own expected personal utility,[vi]  with further assumptions pertaining to each participant’s decision making criterion, to wit:

- Perfect rationality (e.g., in that they prefer more benefit to less) [vii]

- Perfect self-interest (i.e., the decisions people make are based solely on the consequences to themselves) [viii]

- Perfect information (i.e., an equivalency of knowledge between the parties of all information pertinent to the transaction, which is a key criterion in definition of Fair Market Value) [ix]

This concept of utility maximization was described by Jeremy Bentham (regarded as the founder of modern utilitarianism), as being based on the premise that utility derived from an object is its ability to:

‚Äú‚Ķproduce benefit, advantage, pleasure, good, or happiness or prevent the happening of mischief, pain, evil, or unhappiness to the party whose interest is considered‚ÄĚ[x]

As previously discussed, in those instances when using an income approach to value a healthcare enterprise, where the adjustment made to reflect the Fair Market Value compensation for the services to be provided by the sellers post transaction reduces the cash flow of the enterprise in its entirety to a level that is insufficient to support the tangible assets of the business, the resulting highest and best use may not be in use as a going concern. However, the practice may still have distinct intangible assets that provide economic benefit to their owner, and therefore have economic value, which can be ascertained through use of an asset/cost approach, under the premise of: (1) the value in-exchange as an orderly disposition of an assemblage of assets in place; (2) the value in-exchange as an orderly disposition of assets, with no assemblage in place; or, (3) forced liquidation.

Therefore, while value is a forward looking concept, market participants will vary in their opinions as to the utility to be derived from ownership or control of an asset.  The job of the valuation analyst is to consider each of the appropriate concepts that provide insight and guidance to value, which, in addition to the appropriate standard of value, includes the consideration of the highest and best use of the assets of the enterprise, which informs the valuation analyst’s selection of an appropriate premise of value.

Robert James Cimasi, MHA, ASA, MCBA, FRICS, CVA, CM&AA, serves as Chief Executive Officer of HEALTH CAPITAL CONSULTANTS (HCC), a nationally recognized healthcare financial and economic consulting firm headquartered in St. Louis, MO, serving clients in 49 states since 1993. Mr. Cimasi has over thirty years of experience in serving clients, with a professional focus on the financial and economic aspects of healthcare service sector entities. He is the author of several books the most recent book, entitled “Healthcare Valuation: The Financial Appraisal of Enterprises, Assets, and Services” was published by John Wiley & Sons in March of 2014. Mr. Cimasi can be reached at (314) 994-7641 or by e-mail at RCimasi@healthcapital.com.

Todd A. Zigrang, MBA, MHA, FACHE, ASA, is the President of HEALTH CAPITAL CONSULTANTS (HCC), where he focuses on the areas of valuation and financial analysis for hospitals, physician practices, and other healthcare enterprises. Mr. Zigrang has over 20 years of experience providing valuation, financial, transaction and strategic advisory services nationwide. He is the author of ‚ÄúAdviser‚Äôs Guide to Healthcare ‚Äď 2nd Edition‚ÄĚ (AICPA, 2014). . Mr. Zigrnang can be reached at (313) 994-7641 or by e-mail at TZigrang@healthcapital.com.

Matthew J. Wagner, MBA, CFA, s Senior Vice President of HEALTH CAPITAL CONSULTANTS (HCC), where he focuses on the areas of valuation and financial analysis. Mr. Wagner has provided valuation services regarding various healthcare related enterprises, assets and services. Mr. Wagner can be reached at (313) 994-7641 or by e-mail at MWagner@healthcapital.com.

Notes

[i] ¬†¬†¬†¬†¬†¬†¬†¬†¬† Preamble to the 2014 ‚Äď 2015 Uniform Standards of Professional Appraisal Practice published by the Appraisal Standards Board of the Appraisal Foundation, p. U-5.

[ii] ¬†¬†¬†¬†¬†¬†¬†¬† Standard 9 of the 2014 ‚Äď 2015 Uniform Standards of Professional Appraisal Practice published by the Appraisal Standards Board of the Appraisal Foundation, p. U-62.

[iii] ¬†¬†¬†¬†¬†¬†¬† ‚ÄúFinancial Valuation: Businesses and Business Interests‚ÄĚ By James H. Zukin, New York, NY: Maxwell MacMillan, 1990, ¬∂ 2.10., p. 42-44.

[iv] ¬†¬†¬†¬†¬†¬†¬† ‚ÄúFinancial Valuation: Businesses and Business Interests‚ÄĚ By James H. Zukin, New York, NY: Maxwell MacMillan, 1990, ¬∂ 2.10., p. 42-44.

[v] ¬†¬†¬†¬†¬†¬†¬†¬† ‚ÄúHealthcare Valuation: The Financial Appraisal of Enterprises, Assets, and Services‚ÄĚ by Robert James Cimasi, Volume II, Hoboken, NJ: John Wiley & Sons, 2014, p. 884-888.

[vi] ¬†¬†¬†¬†¬†¬†¬† ‚ÄúThe Theory of Political Economy‚ÄĚ by William Jevons, 3rd edition, original work published by Macmillan and Co., London, 1888, electronic version from Library of Economics and Liberty utilized, http://www.econlib.org/library/YPDBooks/Jevons/jvnPE3.html#Chapter3 (Accessed 9/13/2012), Ch. 3, p. 2.

[vii] ¬†¬†¬†¬†¬†¬† ‚ÄúEssays on Some Unsettled Questions of Political Economy‚ÄĚ by John Stuart Mill, Library of Economics and Liberty, 1874, electronic version: http://www.econlib.org/library/Mill/mlUQP5.html (Accessed 12/18/2014), .

[viii] ¬†¬†¬†¬†¬† ‚ÄúIntroduction to the Principles of Morals and Legislation‚ÄĚ by Jeremy Bentham, Oxford: Clarendon Press (1907) Chapter I.4.

[ix] ¬†¬†¬†¬†¬†¬†¬† ‚ÄúThe Behavioral Finance Perspective‚ÄĚ by Michael M. Pompian, CFA Institute, 2013.

[x] ¬†¬†¬†¬†¬†¬†¬†¬† ‚ÄúIntroduction to the Principles of Morals and Legislation‚ÄĚ by Jeremy Bentham, Oxford: Clarendon Press (1907) Chapter I.4.

Image courtesy of Vichaya Kiatying-Angsulee/FreeDigitalPhotos.net