The Growth of Equity Crowdfunding Continues

Title III is the Newest Crowdfinance Option for Private Companies

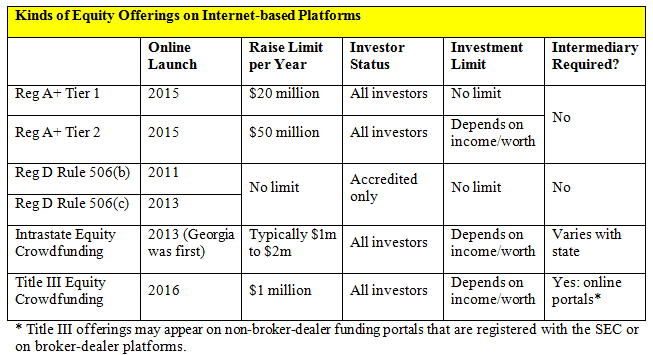

On October 30, 2015, the SEC finalized the rules for securities crowdfunding under Title III of the Jumpstart Our Business Startups (JOBS) Act of 2012. Title III lets startups raise up to $1 million per year by selling securities exclusively through registered online intermediaries known as crowdfunding portals and broker-dealer offering platforms. And it permits all Americans to invest from $2,000 to $100,000 in those offerings per year, depending on their net worth and income. Title III offerings can launch in spring 2016. This article provides an overview of recent changes impacting Title III and IV of the JOBS Act and emerging crowdfinance options.

On October 30, 2015, the SEC finalized the rules for securities crowdfunding under Title III of the Jumpstart Our Business Startups (JOBS) Act of 2012. Title III lets startups raise up to $1 million per year by selling securities exclusively through registered online intermediaries known as crowdfunding portals and broker-dealer offering platforms. And it permits all Americans to invest from $2,000 to $100,000 in those offerings per year, depending on their net worth and income. Title III offerings can launch in spring 2016.

On October 30, 2015, the SEC finalized the rules for securities crowdfunding under Title III of the Jumpstart Our Business Startups (JOBS) Act of 2012. Title III lets startups raise up to $1 million per year by selling securities exclusively through registered online intermediaries known as crowdfunding portals and broker-dealer offering platforms. And it permits all Americans to invest from $2,000 to $100,000 in those offerings per year, depending on their net worth and income. Title III offerings can launch in spring 2016.

Title III, also known as Regulation CF, will attract millions of new, non-accredited angel investors (people worth less than $1 million and with less than $200,000 in income) over the next few years. Non-accredited investors, roughly 93 percent of Americans, had essentially been locked out of the private securities market under the Securities Act of 1933.

But Title III offerings will not be a fertile ground for valuation engagements because of the $1 million raise limit. That sum hardly supports the expense of hiring a professional valuation analyst.

Title III joins two other new exemptions created by the JOBS Act that regulate securities crowdfunding, and which are more likely to generate valuation engagements: Title II, which lifted the ban on general solicitation for certain Regulation D offerings; and Title IV, known as Regulation A+ because it expanded the little-used Regulation A exemption.

As early as 2011, American startups and growing companies had already raised tens of millions of dollars online from accredited investors through equity-based offering platforms under Regulation D. The JOBS Act accelerated the growth of equity crowdfunding.

Title II—No Raise Limit

Effective in 2013, Title II of the JOBS Act lifted the ban on general solicitation for securities offerings under Regulation D, Rule 506(c), which allows equity crowdfunding platforms to advertise those offerings much more widely than before. Only accredited investors can participate in Rule 506(c) offerings, whereas up to 15 non-accredited investors can participate in the traditional off-platform Rule 506(b), where general solicitation is still banned.

The tendency among successful Regulation D platforms these days is to specialize in one kind of exemption or another. So, for example, you will see some tech-oriented crowdfunding platforms with predominantly 506(b) “quite deals.”  Consumer product companies naturally tend to gravitate to platforms that focus on 506(c) deals. You will also find platforms that focus on particular industries, such as real estate—which is the hottest sector of securities crowdfunding after peer-to-peer lending (P2P).

According to Crowdnetic’s Q2 2015 Report, in the second quarter of 2015 alone, the 17 most prominent securities offering platforms (not including P2P) in the United States recorded capital commitments totaling about $765 million—an 18 percent increase from the previous quarter. These figures represent the performance of offerings under Rule 506(c); they do not include Rule 506(b) offerings, some of which are listed on crowdfunding platforms as well. It is likely that the numbers of 506(b) offerings, and the amount of capital raised thereby, are higher than that of 506(c) offerings.

Significantly for the valuation profession, the types of securities offerings that received capital commitments were: equity (69%), convertible debt (20%), straight debt (9%), and other (2%). The capital structure of crowdfunding offerings “remains relatively consistent with previous quarters,” says Crowdnetic.

Title IV—$50 Million Raise Limit

Effective in June 2015, Title IV of the JOBS Act allows an unlimited number of accredited and non-accredited investors to invest in “Regulation A+ offerings.”  The Title IV exemption is structured primarily for growth- and later-stage companies that want to file “mini-IPOs,” not ideal for seed-stage startups since compliance costs alone may overwhelm the amount of capital being sought in a smaller offering.

Under Title IV, the moribund Regulation A exemption was expanded from a $5 million raise limit to a $50 million limit, and for raises above $20 million (Tier 2 offerings) it preempts blue sky review (i.e., no need for approval by every state in which the offering is made). Blue sky review is still required for offerings under $20 million in Tier 1.

Some Regulation A+ offerings will be listed through online offering platforms. Such platforms may be dedicated to Reg A+ offerings, or they may feature a mix of Regulation D and Regulation A+ offerings. Neither Reg D nor Reg A+ offerings are required to go through intermediaries, though.

Before the JOBS Act, Regulation A issuers could sell unrestricted securities to non-accredited, as well as accredited investors. The expanded Reg A+ still lets non-accredited investors participate, but it limits their annual investment in offerings above the $20 million threshold to 10 percent of their income or net worth, whichever is greater. All investors can invest an unlimited amount in Tier 1 offerings up to $20 million.

Professionals in the securities industry are calling Reg A+ offerings “mini-IPOs,” as issuers are required to go through a scaled-down registration process and file a prospectus-like document called an “offering circular” with the SEC. The benefits of Reg A+ for seed-stage and startup companies seem limited mainly because offerings up to $20 million still require blue sky review and compliance, which can be costly and time-consuming. Time will tell whether seed-stage and startup companies try to take advantage of Reg A+ rather than (or in addition to) Reg D, intrastate, or (starting in April 2016) Title III equity crowdfunding.

According to the SEC, as of October 28 2015, 34 companies have applied to file Reg A+ offerings and only three have been qualified by the SEC so far.

Other Crowdfinance Options

Another form of equity crowdfunding is the intrastate securities exemption, under Section 3(a)(11) of the Securities Act of 1933, where issuers with headquarters in a particular state may sell securities to all investors (non-accredited as well as accredited) who live in that state. At this moment, at least 22 states and the District of Columbia have such exemptions in place, and at least one more is awaiting the governor’s signature. Some of these exemptions are variations of Title III of the JOBS Act, in terms of the dollar limits on raises and investment limits for non-accredited investors.

Securities crowdfunding also includes peer-to-peer lending (P2P), more recently known as marketplace lending because true peers (individuals) are being overwhelmed by institutional lenders. Debt-based crowdfunding is a hot sector of the securities markets in the USA and some other countries, including China.

Accredited Investors Predominate

Because Reg A+ is brand-new and intrastate securities crowdfunding is slow to emerge, the equity crowdfunding world is still occupied mainly by accredited investors under Reg D. This might be comforting to some regulators and investor protection groups, and maybe to some accredited investors who don’t want the world to change. But thanks to the launch of Title III, the world will change.

“We are still at the first pitch in the first inning of the equity crowdfunding ballgame,” says Madelyn Young, content development manager at EarlyShares, a Reg D platform based in Miami. Over the next few years we will see how the various JOBS Act financing schemes really work, what kinds of companies use which exemptions, and how investors perceive value in each new opportunity.

David M. Freedman, a financial and legal journalist since 1978, has served on the editorial staff of The Value Examiner since 2005. Mr. Freedman is a coauthor (with Matthew R. Nutting, a corporate lawyer in Fresno, CA) of Equity Crowdfunding for Investors: A Guide to Risks, Returns, Regulations, Funding Portals, Due Diligence, and Deal Terms, (Wiley & Sons, June 2015). Website: www.ec4i.com.

Mr. Freedman can be contacted at: (847) 204-6868 or e-mail to: dave@freedman-chicago.com.