The CY 2016 Work Relative Value Units

The Impact on Employed Physician Groups

The CMS 2016 Hospital Outpatient Prospective Payment System and Ambulatory Surgical Center Payment System downwardly revised reimbursement for GI/endoscopy services and reduced by 0.77 percent the Physician Fee Schedule to all services because CMS failed to meet the one percent net reduction target for misvalued codes in 2016. In this article, the author discusses how the proposed CMS changes announced in July 2015 could impact gastroenterological and endoscopy group practices.

There have been significant changes to the 2016 Medicare Physician Fee Schedule resulting from the Work Relative Value Unit weightings released in July, 2015. As a result, it appears gastroenterologist will be negatively impacted. The proposed rule is currently facing scrutiny from the American College of Gastroenterology, American Gastroenterological Association, and the American Society for Gastrointestinal Endoscopy. The finalized rule is expected to be published in November of 2015, and to be enacted January 1, 2016.

There have been significant changes to the 2016 Medicare Physician Fee Schedule resulting from the Work Relative Value Unit weightings released in July, 2015. As a result, it appears gastroenterologist will be negatively impacted. The proposed rule is currently facing scrutiny from the American College of Gastroenterology, American Gastroenterological Association, and the American Society for Gastrointestinal Endoscopy. The finalized rule is expected to be published in November of 2015, and to be enacted January 1, 2016.

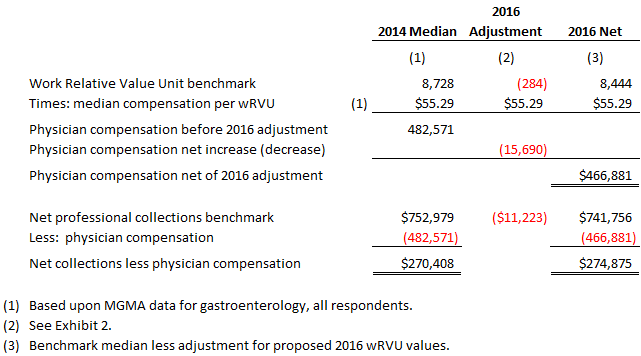

By our estimates, salaries for employed gastroenterologists paid based upon a Work Relative Value Unit compensation model may face a median reduction in pay of between three and four percent or approximately $16,000 annually (the median decrease in net collections for independent gastroenterologists is estimated at approximately $11,000). If the rule is finalized as is, it is our belief that net effect to gastroenterologists of the reduced Medicare reimbursement rates will be further impacted by declining reimbursement rates from commercial payors and overall increasing clinic operating expenses. As a result, we believe that: (a) physician groups will need to consider revising compensation models for employed gastroenterologists, and (b) more independent gastroenterologists may consider hospital employment.

Background

The Centers for Medicare and Medicaid Services (CMS) Proposed CY 2016 Physician Fee Schedule (PFS) Relative Value File was released on July 8, 2015. This file includes the Relative Value Unit (RVU) weightings assigned by CMS’ Resource Utilization Committee (RUC) used to allocate the Medicare budgeted spend for physician services for the upcoming year. The RUC assigns weightings each year by Current Procedural Terminology (CPT) code based upon the RUC’s determination of the relative inputs required to provide the service designated by each CPT code. These inputs include the following components:

- Work Relative Value Unit (wRVU): accounts for the provider’s direct input

- Practice Expense Relative Value Unit (peRVU): an estimate of the overhead required

- Malpractice Relative Value Unit (mpRVU): factors the relative complexity of the service by specialty

When evaluating physician groups, we typically rely on an analysis of wRVUs as a standardized measurement of physician activity. That is to say, wRVUs are a relative benchmark of the amount of “input” that physicians provide regardless of payer mix, contractual adjustments, or other financial indicators that may be outside of a physician’s direct control. This being the case, we often use wRVUs as a basis for determining compensation in employed physician groups since this method does not unfairly penalize physicians for providing care in a manner consistent with an employer’s mission.

While the practice of using wRVUs has been a fairly common practice for determining physician compensation in employed groups for many years, we believe it is important to proactively assess the effectiveness of wRVU-based compensation since wRVU values change from year-to-year. Although these changes are typically immaterial in the aggregate, they can materially impact specific providers or specific specialties.

Changes in wRVU Values for 2016

Although the proposed wRVU weightings are not finalized as of yet, changes in wRVU values from 2015 to 2016 are summarized as follows:

- We’ve identified 58 CPT codes are expected to have reduced wRVU values

- Of these codes, wRVU values are expected to decrease by 10% or more for 31 codes

- The average wRVU reduction for all 58 codes is 13.5%

- We have also found 17 CPT codes are expected to have increased wRVU values

- The average increase for these codes is 35.8%

A complete listing of the proposed changes in wRVU values appears in Exhibit 1 to this report.

The Specific Impact to Employed Gastroenterologist

The most significant impact to the changes in wRVU values for 2016 is expected to be to the gastroenterology CPT codes. Of the 71 total CPT codes that we have determined are proposed to change from 2015 to 2016, 37 of these codes are specific to gastroenterology (nearly 50%). Of the 58 total CPT codes expected to have reduced wRVU values in 2016, 34 CPT codes are specific to gastroenterology (over 58%).

Although these changes will certainly impact individual providers differently, we have estimated the net impact for a 1.0 Full-Time-Equivalent (FTE) gastroenterologist based upon Medical Group Management Association (MGMA) benchmark data. Specifically, we have relied upon CPT code utilization data published by MGMA and have adjusted median benchmark net professional collections and total annual wRVUs by the 2016 net decrease in wRVU values and PFS facility reimbursement. A summary of the results appears in the table below.

As a result of the decreased 2016 wRVU values proposed, we have imputed a median decrease in physician compensation for gastroenterologists of approximately $16,000 annually, as well as a median decrease in net professional collections of approximately $11,000. Our detailed analysis appears in Exhibit 2 to this report.

Other Potential Side Effects

In addition to the direct impact to those employed physician groups that utilize wRVU-based compensation models, independent gastroenterologists will likewise feel the effect of the reduced reimbursement rates for the impacted services. As a result, we believe there will be increased inquiries for employment of independent gastroenterologists, consolidation of gastroenterology practices, sales of ambulatory surgery centers, or other efforts to financially integrate physicians into health systems nationwide in 2016.

Summary

Although it is not uncommon for there to be minor changes in wRVU weightings from year-to-year, changes that materially impact a specific specialty occur less frequently. The analysis included in this report and exhibits only consider the impact to those services provided to Medicare beneficiaries. It is unclear whether other payors will follow suit with Medicare’s revisions. If so, the impact to revenue will be greater than the estimated $11,000 per FTE as shown in Exhibit 1; however if the proposed rule stands, the estimated decrease in wRVU values of approximately 13.5% will likely impact all gastroenterologist paid on a wRVU basis.

As a result, it is our recommendation all physician groups that employ gastroenterologists review their current employment arrangements to measure the potential impact to compensation in 2016. In fact, we highly recommend this exercise for all specialties at least every year as part of the budgetary and strategic planning process.

Article Update from CMS Website:

The CY 2016 PFS final rule with comment period was placed on display at the Federal Register on October 30, 2015. In addition to policies affecting the calculation of payment rates, this final rule identifies potentially misvalued codes, adds procedures to the telehealth list, and finalizes a number of new policies, including several that are a result of recently enacted legislation. The rule also finalizes changes to several of the quality reporting initiatives associated with PFS payments, including the Physician Quality Reporting System (PQRS), the Physician Value-Based Payment Modifier (Value Modifier), and the Medicare Electronic Health Record (EHR) Incentive Program, as well as changes to the Physician Compare website on Medicare.gov. This is the first PFS final rule since the repeal of the Sustainable Growth Rate (SGR) formula by the Medicare Access and CHIP Reauthorization Act of 2015 (MACRA). The calendar year 2016 PFS final rule is one of several final rules reflecting a broader Administration-wide strategy to create a health care system that results in better care, smarter spending, and healthier people.

Jeffry Moffatt, CPA, ABV, CITP, CVA is a member of Blue & Co.’s Healthcare Consulting team and based in the firm’s Indianapolis, IN office.

If you’d like to know more about how Blue can assist with reviewing employment arragngemets and other financial, operational, and strategic initiatives within your employed physician group, please contact: Jeff Moffatt at (317) 275-7405 or e-mail jmoffatt@blueandco.com.