What is the Best Way to Balance Your Marketing Investment?

Shift Your Investment Effort

How much should a high-growth firm invest in marketing? What techniques or investments pay off more—traditional or social marketing? What should a high-growth marketing firm expect from these investments? How do results differ from firms that are not growing? How do high-growth firms differ from other firms? In this article, Dr. Frederiksen answers these and other questions.

Most firms already know they need to invest in marketing. Â The more difficult question is, exactly where should they make their marketing investments?

Most firms already know they need to invest in marketing. Â The more difficult question is, exactly where should they make their marketing investments?

Succeeding at the balancing act

[su_pullquote align=”right”]Resources:

2016 High Growth Research Study Research Summary

[/su_pullquote]

My firm recently conducted a study to understand how high-growth firms answer this question differently, especially when compared with firms that are not growing.

Our study looks at more than 525 firms and reveals several key differences in how the fast-growing firms allocate their marketing resources—in terms of both time and effort.  In a nutshell, high-growth firms have many similarities with other firms—but they also have distinct differences in strategy, marketing mix, and results.

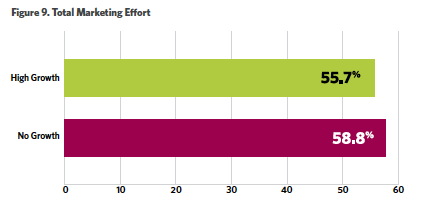

There are two major forms of marketing investment: time and money. Â We used an approach that combined these two types of investment into one concept: overall effort. Â Using this metric, the total investment made by high-growth firms in all marketing activities is actually slightly lower than that of their no-growth peers, as depicted in Figure 1.

Figure 1: Total Marketing Effort

Figure 1: Total Marketing Effort

Strategic differences

We also found that the high-growth firms have some very clear differences in their strategy when compared to their no-growth competitors.

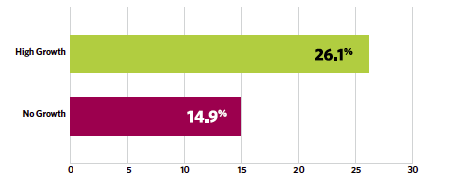

To begin with, they are far more likely to offer niche or highly specialized services. Â As Figure 2 shows, high-growth firms are 75% more likely to have a highly specialized practice.

Figure 2: Prevalence of Highly Specialized Firms

Figure 2: Prevalence of Highly Specialized Firms

High-growth firms are also far more likely to have more compelling differentiators—both in terms of sheer number (about 20% more differentiators) and in the quality of the differentiators themselves.  Their differentiators are twice as likely to be easy to prove and more relevant to potential new clients.

High-growth firms tend to shift how they balance their investment of effort—spending an average of 23% less effort on such traditional techniques as collateral, speaking engagements, partnership marketing, and conferences/tradeshows.  In fact, the only two areas of traditional marketing where high-growth firms outspent slower-growing counterparts were in telemarketing and direct mail—both of which happen to be highly targeted techniques.

Meanwhile, high-growth firms invest about 13% more effort in digital marketing—except in the area of e-mail marketing, where they actually expend somewhat less effort.  The top five digital techniques used most often by the high-growth group are:

- Marketing video

- Blogging

- Guest blogging

- Search Engine Optimization (SEO)

- Social media

That being said, high-growth firms do not neglect traditional marketing. Â Our study found the traditional marketing techniques most favored by high-growth firms are:

- Marketing collateral

- Phone marketing

- Direct mail

- Speaking engagements

- Partnership marketing

- Conferences/tradeshows

What is the real impact?

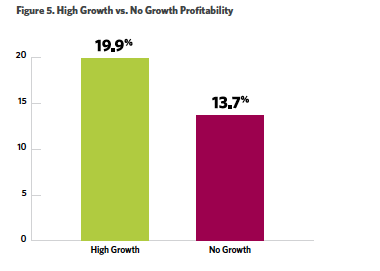

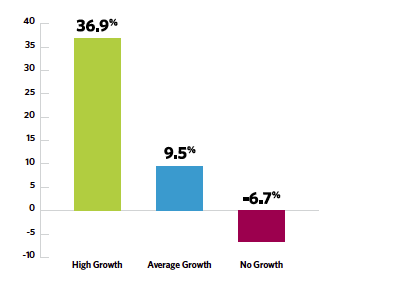

Another major difference between high-growth firms and others involves marketing results. Â We found that high-growth firms enjoy several advantages. Â As shown in Figures 3 and 4, high-growth firms are as much as 45% more profitable, and have a much higher rate of growth, than slower- or non-growing firms have.

Figure 3: Profitability of High-Growth vs. No-Growth Firms

Figure 3: Profitability of High-Growth vs. No-Growth Firms

Figure 4: Comparison of Annual Growth Rates

Figure 4: Comparison of Annual Growth Rates

High-growth firms also differ in how they measure the impact of their marketing investment; both in sheer number of metrics and in which metrics they use.  Like their slower-growing counterparts, high-growth firms track all the usual bottom-line suspects—such as number of new clients acquired and revenue growth.  But they also track variables spanning the entire marketing pipeline, including:

- Brand awareness

- Website traffic

- Social media engagement

- Lead generation

- Conversion rate

This more detailed level of insight helps firms better understand what is and what is not working—and make adjustments accordingly.  It also allows them to be more efficient and profitable, and better positioned to take advantage of growth opportunities.

Hinge is pleased to partner with NACVA on an exclusive offer to help members elevate their firms’ level of recognition: our research-driven Visible Firm® program.  Our offer includes a detailed review and benchmarking of your firm’s marketing against other firms in your industry, and lays out a detailed marketing strategy modeled on the highest performing firms.  To learn more about this proven approach to gaining recognition as a Visible Firm®, click here.

Lee W. Frederiksen, PhD, is Managing Partner at Hinge, the leading branding and marketing firm for the professional services. Hinge conducts groundbreaking research into high-growth firms and offers a complete suite of services for firms that want to become more visible and grow.

Mr. Frederiksen can be contacted at (703) 391-8870 or by e-mail to LFrederiksen@hingemarketing.com.