Objectively Supporting Discounts for Lack of Marketability

Using the Empirical Method

Business appraisers around the country have historically used comparisons to the averages found in restricted stock studies to determine a discount for lack of marketability in their valuations of a privately held, noncontrolling interest in a business. While the average discounts from restricted stock studies are useful and indicate that discounts for lack of marketability do occur in arm’s length transactions, more analysis is needed to apply the underlying data to the valuation of privately held minority interests. In this article, the author illustrates his views developing the DLOM.

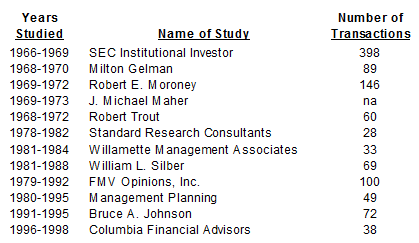

Business appraisers around the country have historically used comparisons to the averages found in restricted stock studies to determine a discount for lack of marketability in their valuations of a privately held, noncontrolling interest in a business. While the average discounts from restricted stock studies are useful and indicate that discounts for lack of marketability do occur in arm’s length transactions, more analysis is needed to apply the underlying data to the valuation of privately held minority interests. The following table shows a list of restricted stock studies that have been commonly used in these types of business appraisals.

[su_pullquote align=”right”]Resources:

How to Objectively Support Discounts for Lack of Marketability—The Empirical Method

Why a -75% DLOM May be Too Low and How to Defend It!

How Probability Affects Discounts For Lack Of Marketability

Advanced Valuation: Applications And Models Workshop

[/su_pullquote]

Upon a closer examination of the above restricted stock studies, it is evident that the reported discounts are not grouped in a bell-shaped curve around the average. Rather, they are widely distributed and range from premiums of 10% to discounts as high as 90%.

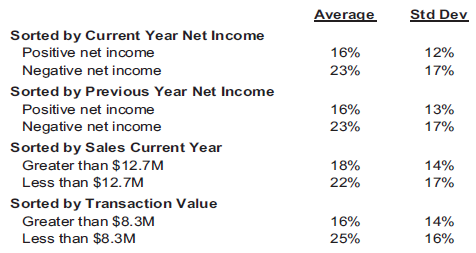

An analysis of why the discounts occur in the restricted stock transactions can lead appraisers to a reasonable conclusion on how to calculate discounts for lack of marketability. For example, in the Johnson Study performed on data from 1991–1995, the underlying financial information on each company involved in the restricted stock transactions was obtained from the 10K annual reports and compared to the discounts based on profitability, size (measured by sales), and transaction size.  As shown below, the discount for lack of marketability was lower for companies that had higher profitability, larger (as measured by sales) when the transactions were larger.

This indicates that the discount is lower for investments with less risk. While this is a generally accepted financial theory, it is important to understand that it is observed in restricted stock data. Discounts for lack of marketability occur in third party transactions because investors recognize that the lack of marketability of an interest increases the risk of an investment in the interest. Accordingly, an investor purchases the interest at a discount to increase the return on their investment. This increased rate of return offsets the additional risk caused by the lack of marketability of the investment.

Generally, when appraisers are determining the fair market value of an interest, the calculation is performed in stages including a determination of the value on a noncontrolling, marketable basis followed by the application of a discount for lack of marketability to determine the value on a noncontrolling, nonmarketable basis. At the stage when a discount for lack of marketability should be considered, the practitioner should ask the following primary question:

How much more of a return is required to compensate for the lack of marketability of the subject investment because of the increased risk?

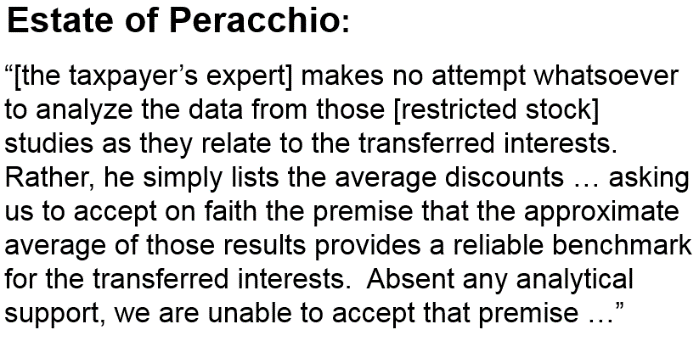

Restricted stock studies and their modern counterparts, restricted stock databases, are an invaluable look at arm’s lengths transactions. They illustrate that in third-party transactions, discounts for lack of marketability do occur.  However, simply applying the averages from the restricted stock studies have not been well received in tax court for several reasons.  This is evident in the following excerpt from the tax court case in the Estate of Peracchio:

The application of the discount for lack of marketability increases the effective return on investment to compensate the owner of the interest for the risks associated with the ownership of a nonmarketable interest. Rather than applying an average discount from a restricted stock study, it would stand to reason that a discount for lack of marketability should be calculated based on how much it increases the rate of return of the subject interest that is being valued. The process of calculating a discount for lack of marketability using its impact on rate of return is known as the Empirical Method.

In order to determine the discount for lack of marketability, a practitioner must first know how much the rate of return should be increased. Discounts for lack of marketability in the real world are not fixed and are not linear. They depend on the specific characteristics of the privately held interest. In order to calculate a discount for lack of marketability using the Empirical Method, there are two basic steps that an appraiser ought to consider:

- After a value has been determined on a noncontrolling, marketable basis, the effective rate of return that an investor would expect to receive prior to the discount for lack of marketability should be calculated. This calculation is relatively simple, with the effective rate of return being determined using the average annual yield or the IRR function in MS Excel based on the noncontrolling, marketable value and the forecast of net cash flow that was derived from the Income Approach. The result of this calculation provides the base rate of return for determining the magnitude of the discount for lack of marketability.

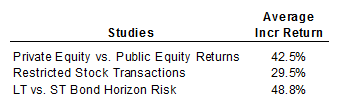

There are three studies published annually by Partnership Profiles, Inc. in their report titled Discount for Lack of Marketability Study that provides a basis for the increase in the rate of return.[1]Â The studies measure the increased return demanded by investors between:

- Private Equity vs. Public Equity Investments,

- Restricted Stock vs. Publicly Traded Stock, and

- Horizon Risk (as measured by Long Term vs. Short Term Bond Returns).

Based on these three studies, investors demanded approximately a 30% to 45% higher rate of return for the additional risk of holding an illiquid investment as compared to the same or comparable investment that is liquid.[2]

For more information on each study, a full explanation and examples are included in the Discount for Lack of Marketability Study report.

- The next step is to apply a discount for lack of marketability that increases the subject interest’s rate of return to a level that achieves the 30% to 45% increase in the rate of return. This is accomplished by applying a discount and calculating the resulting rate of return, again using the same methodology used to calculate the rate of return before the application of the discount for lack of marketability. By doing so, the practitioner is able to calculate the increase that occurred in the rate of return and adjust the discount for lack of marketability in order to achieve the increase that is required to compensate the investor appropriately for the lack of marketability of the subject interest.

For example, let’s say we are appraising a minority interest in a privately held national trucking company and have determined the noncontrolling, marketable value to be $60 per share. To complete the appraisal of the minority interest, we must determine the discount for lack of marketability.

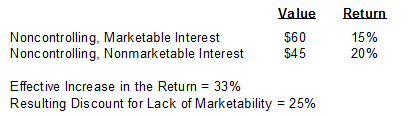

Our first step in converting the $60 value to a noncontrolling, nonmarketable value would be to calculate the effective return that a price of $60 would yield to an investor based on the forecast of net cash flow from the Income Approach. For this example, let’s assume the noncontrolling, marketable value of $60 resulted in a return of 15%. Our next step would be to examine the empirical studies, which indicate that an investor would require a 30% to 45% higher return for investing in this interest if it were not liquid. This would mean an investor would pay an amount less than $60 per share to increase the return from 15% to 20% [a 33% increase = (20%/15% – 1)]. Accordingly, an investor would discount the $60 per share by 25% ,which would result in a noncontrolling, nonmarketable value of $45 per share.

To summarize, the purpose of the discount for lack of marketability is to recognize and quantify the effect on value attributable to the inability to convert a privately held interest into liquid funds as quickly as a publicly traded security. Revenue Ruling 77-287 recognizes the lack of marketability for an interest in a privately held business.

Whether the shares are privately held or publicly traded affects the worth of the shares to the holder. Securities traded on a public market generally are worth more to investors than those that are not traded on a public market.

The inability to readily sell a privately held interest increases an investor’s exposure to changing market conditions and increases the risk of ownership. Because of the lack of liquidity and the resulting increased risk, an investor typically demands a higher return in comparison to a similar but publicly traded interest. Consequently, a privately held interest trades at a discount or a value less than it would if it were publicly traded. As presented, the amount of this discount is based on the required increase in return. A reasonable increase in the rate of return appears to approximate 30% to 45% as determined by studies published by Partnership Profiles of third party transactions.

By quantifying the discount for lack of marketability using the expected future benefits of the specific interest being appraised, the size of the discount can be determined using a more meaningful relationship to rate of return expectations as opposed to average discounts obtained from historical studies. Using the Empirical Method enables appraisers to more accurately and objectively determine and justify the discount for lack of marketability.

[1] 2016 Discount for Lack of Marketability Study, www.PartnershipProfiles.com.

[2] Spencer Jefferies, et. al., Comprehensive Guide for the Valuation of Family Limited Partnerships, 4th ed., (Dallas, TX: Partnership Profiles, Inc., 2011), 127-129.

Bruce A. Johnson, ASA is a partner in the firm of Munroe, Park & Johnson, Inc. He holds a degree in Engineering and MBA from Texas A&M University. Mr. Johnson is an Accredited Senior Appraiser of the American Society of Appraisers and has been published on a wide range of valuation topics in several periodicals. He has spoken at numerous seminars, conferences, and webinars for the NACVA, Business Valuation Resources, AICPA, Partnership Profiles, and ASA. He was the expert witness for the taxpayer in two landmark tax cases—Estate of Elsie J. Church and Estate of Emily Klauss.

Mr. Johnson can be reached at (210) 545-7335 or by e-mail to Bruce@mpjonline.com.